Global H2 Receptor Antagonist Market

Market Size in USD Billion

CAGR :

%

USD

3.44 Billion

USD

6.13 Billion

2024

2032

USD

3.44 Billion

USD

6.13 Billion

2024

2032

| 2025 –2032 | |

| USD 3.44 Billion | |

| USD 6.13 Billion | |

|

|

|

|

H2 Receptor Antagonist Market Size

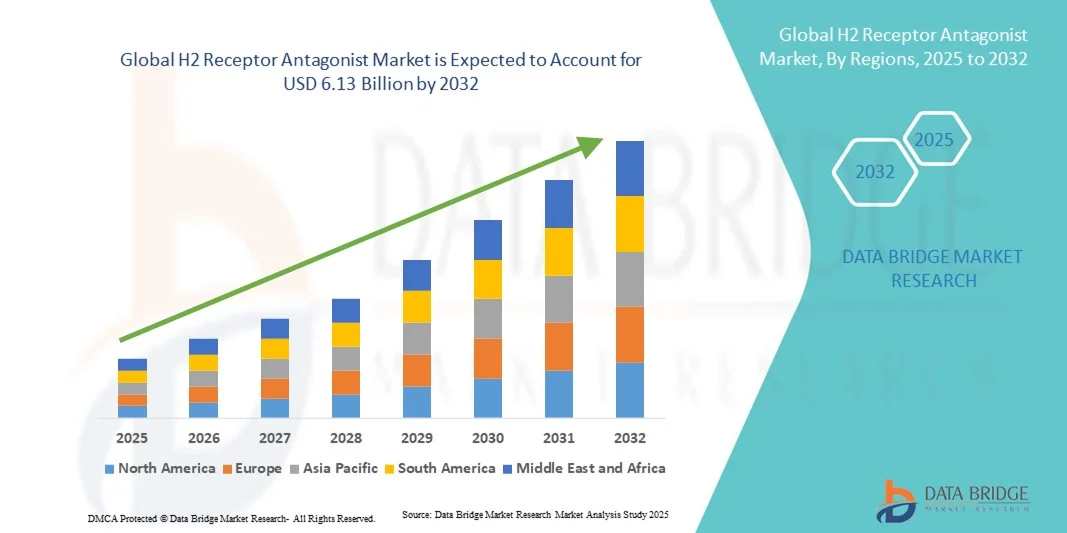

- The global H2 receptor antagonist market size was valued at USD 3.44 billion in 2024 and is expected to reach USD 6.13 billion by 2032, at a CAGR of 7.49% during the forecast period

- The market growth is largely fueled by the increasing prevalence of gastrointestinal disorders such as gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome, driving the demand for effective acid-suppressing therapies

- Furthermore, rising awareness among patients and healthcare providers regarding the benefits of H2 receptor antagonists, along with their favorable safety profile and cost-effectiveness compared to alternative treatments, is positioning these drugs as a preferred therapy for acid-related conditions. These factors are collectively accelerating the adoption of H2 receptor antagonists, thereby significantly boosting the market's growth

H2 Receptor Antagonist Market Analysis

- H2 receptor antagonists, functioning as acid-suppressing agents by blocking histamine H2 receptors in the stomach lining, are increasingly vital in the management of gastrointestinal disorders such as GERD, peptic ulcers, and Zollinger-Ellison syndrome due to their efficacy, safety profile, and ease of administration

- The escalating demand for H2 receptor antagonists is primarily fueled by the rising prevalence of acid-related disorders, increasing awareness among patients and healthcare providers, and a growing preference for cost-effective and well-tolerated therapeutic options compared to proton pump inhibitors in certain patient populations

- North America dominated the H2 receptor antagonist market with the largest revenue share of 39.8% in 2024, characterized by high prevalence of gastrointestinal disorders, well-established healthcare infrastructure, and the presence of leading pharmaceutical companies, with the U.S. experiencing substantial growth driven by generic drug availability and ongoing clinical research enhancing treatment guidelines

- Asia-Pacific is expected to be the fastest growing region in the H2 receptor antagonist market during the forecast period due to increasing healthcare access, rising awareness of gastrointestinal health, and expanding urban populations with lifestyle-related digestive disorders

- Tablet segment dominated the H2 receptor antagonist market with a market share of 47.2% in 2024, driven by patient convenience, widespread physician preference, and compatibility with chronic management of acid-related conditions

Report Scope and H2 Receptor Antagonist Market Segmentation

|

Attributes |

H2 Receptor Antagonist Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

H2 Receptor Antagonist Market Trends

Shift Towards Extended-Release and Combination Therapies

- A significant and accelerating trend in the global H2 receptor antagonist market is the development of extended-release formulations and combination therapies with other gastrointestinal drugs, enhancing patient adherence and treatment efficacy

- For instance, ranitidine-magnesium combination tablets are designed to provide prolonged acid suppression, reducing dosing frequency and improving patient convenience in chronic GERD management

- Extended-release H2 receptor antagonists allow for once-daily dosing, improving compliance among patients with long-term acid-related disorders, while combination therapies address multiple pathophysiological mechanisms in a single regimen

- The integration of H2 receptor antagonists with complementary agents such as prokinetics facilitates more comprehensive management of gastrointestinal symptoms, reducing the need for multiple separate medications

- This trend towards more patient-friendly, effective, and convenient therapies is fundamentally reshaping treatment strategies for acid-related disorders, prompting pharmaceutical companies to focus on innovative drug delivery systems

- The demand for advanced H2 receptor antagonist formulations is growing rapidly across both developed and emerging markets, as patients and healthcare providers prioritize convenience, efficacy, and safety in long-term treatment plans

H2 Receptor Antagonist Market Dynamics

Driver

Increasing Prevalence of Gastrointestinal Disorders and Awareness

- The rising prevalence of GERD, peptic ulcers, and other acid-related disorders, along with growing awareness of available treatments, is a significant driver for the heightened demand for H2 receptor antagonists

- For instance, the U.S. FDA approval of new H2 receptor antagonist formulations with improved safety profiles has contributed to higher adoption among patients and healthcare providers

- As more individuals experience gastrointestinal symptoms due to lifestyle factors, diet, and aging populations, H2 receptor antagonists offer effective acid suppression and symptom relief, positioning them as preferred therapeutic options

- Furthermore, increasing awareness campaigns by pharmaceutical companies and healthcare organizations are educating patients about early diagnosis and management of acid-related disorders, boosting market demand

- The availability of over-the-counter H2 receptor antagonists also drives adoption by providing easy access for self-management of mild to moderate conditions, supplementing prescription-based use

- The combination of rising disease prevalence, patient awareness, and accessibility is propelling the adoption of H2 receptor antagonists across both developed and emerging markets

Restraint/Challenge

Drug Interactions and Regulatory Limitations

- Concerns regarding potential drug interactions, side effects, and strict regulatory requirements pose significant challenges to broader market penetration of H2 receptor antagonists

- For instance, reports of interactions between cimetidine and common medications such as anticoagulants or antiepileptics have led some physicians to prefer alternative therapies, limiting prescription growth

- Adverse effects such as headache, dizziness, and rare liver function disturbances can reduce patient compliance and hinder long-term usage in chronic conditions

- In addition, regulatory hurdles in emerging markets, including stringent clinical trial requirements and pricing controls, slow the introduction of new H2 receptor antagonist formulations

- While generic options are expanding accessibility, ongoing safety concerns and stringent regulatory scrutiny continue to restrict rapid market expansion in certain regions

- Overcoming these challenges through rigorous safety monitoring, physician education, and regulatory compliance will be vital for sustained growth of the H2 receptor antagonist market

H2 Receptor Antagonist Market Scope

The market is segmented on the basis of type, dosage form, application, and distribution channel.

- By Type

On the basis of type, the H2 receptor antagonist market is segmented into famotidine, cimetidine, ranitidine, and nizatidine. The famotidine segment dominated the market with the largest revenue share in 2024, driven by its well-established efficacy in treating GERD, peptic ulcers, and Zollinger-Ellison syndrome. Famotidine is preferred by healthcare providers for its strong safety profile, minimal drug interactions, and availability in both prescription and over-the-counter forms. Its popularity is further enhanced by patient familiarity, long-term clinical usage, and cost-effective generic options, making it a preferred choice in both developed and emerging markets. In addition, famotidine's availability in multiple dosage forms such as tablets, suspension, and injectable forms supports wider patient compliance. The segment also benefits from consistent demand in chronic and acute gastrointestinal conditions, positioning it as the most dominant type in the global H2 receptor antagonist market.

The nizatidine segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its introduction in newer formulations and increasing use in combination therapies for complex acid-related disorders. Nizatidine offers advantages such as fewer side effects and better tolerance in patients with comorbidities, which is driving its adoption. Emerging markets are showing growing awareness of newer H2 receptor antagonist types, creating demand for alternatives such as nizatidine. Pharmaceutical companies are focusing on expanding its accessibility through generic and extended-release formulations. Nizatidine’s compatibility with modern treatment regimens, including OTC and hospital prescriptions, is enhancing its market penetration. The segment’s growth is further supported by clinical studies demonstrating comparable efficacy to established drugs with improved patient adherence.

- By Dosage Form

On the basis of dosage form, the H2 receptor antagonist market is segmented into tablet, powder/suspension, syrup, injectable, and others. The tablet segment dominated the market in 2024 with a market share of 47.2%, owing to its convenience, affordability, and widespread physician preference for chronic and acute management of acid-related disorders. Tablets provide precise dosing, ease of storage, and compatibility with long-term treatment plans. The segment also benefits from extensive availability of generic and branded formulations, increasing accessibility for patients across different regions. Tablets are suitable for both adult and pediatric populations in controlled doses, reinforcing their dominance. Healthcare providers often prefer tablets due to patient familiarity and predictable pharmacokinetics.

The injectable segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand in hospital settings for rapid symptom control in acute conditions such as severe GERD, stress ulcers, and Zollinger-Ellison syndrome. Injectable H2 receptor antagonists provide immediate therapeutic effects, which is crucial in critical care and emergency situations. Hospitals and specialty clinics are increasingly adopting injectable forms for inpatient management. Innovations in formulation for enhanced bioavailability and reduced side effects are further supporting the segment's growth. Rising awareness among healthcare professionals about injectable H2 receptor antagonists’ efficacy in complex cases is boosting adoption.

- By Application

On the basis of application, the H2 receptor antagonist market is segmented into gastritis, peptic ulcers, Zollinger-Ellison syndrome, allergies, and others. The peptic ulcer segment dominated the market in 2024 due to the high prevalence of ulcer-related gastrointestinal conditions globally. H2 receptor antagonists are widely prescribed to manage ulcer healing, prevent recurrence, and reduce gastric acid secretion. The segment benefits from extensive clinical validation and long-standing physician trust in these drugs. Patient adherence is high due to the drugs’ well-established safety and efficacy profiles. OTC availability in many regions also contributes to its dominance.

The gastritis segment is anticipated to witness the fastest growth from 2025 to 2032, driven by rising lifestyle-related gastrointestinal disorders, increasing awareness, and early treatment interventions. Growing consumption of spicy and processed foods, alcohol, and rising stress levels contribute to gastritis prevalence. H2 receptor antagonists are increasingly recommended for symptom relief and acid control in gastritis cases. Rising awareness campaigns and patient education are promoting early adoption. The segment growth is further supported by convenient dosage forms such as tablets and suspensions that enhance patient compliance.

- By Distribution Channel

On the basis of distribution channel, the H2 receptor antagonist market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. The retail pharmacy segment dominated the market in 2024, owing to wide accessibility, ease of purchase, and the availability of both prescription and OTC H2 receptor antagonist products. Retail pharmacies serve as a primary touchpoint for chronic patients managing acid-related disorders. They also provide convenient refill options and consultations with pharmacists. The segment benefits from extensive network coverage in urban and semi-urban areas, facilitating sustained demand.

The online pharmacy segment is expected to witness the fastest growth from 2025 to 2032, driven by rising e-commerce penetration, digital healthcare adoption, and patient preference for home delivery of medications. Online platforms offer convenience, privacy, and subscription-based refill services for chronic therapy. Telemedicine consultations increasingly support prescriptions through online channels, boosting adoption. The segment is particularly gaining traction in urban markets and regions with limited physical pharmacy access. Growing awareness about safe online purchases and competitive pricing further enhances growth prospects.

H2 Receptor Antagonist Market Regional Analysis

- North America dominated the H2 receptor antagonist market with the largest revenue share of 39.8% in 2024, characterized by high prevalence of gastrointestinal disorders, well-established healthcare infrastructure, and the presence of leading pharmaceutical companies

- Patients and healthcare providers in the region prioritize effective and safe treatment options for GERD, peptic ulcers, and Zollinger-Ellison syndrome, supporting widespread adoption of H2 receptor antagonists

- This strong market position is further reinforced by the availability of both prescription and over-the-counter formulations, generic options, and ongoing clinical research, making H2 receptor antagonists a preferred choice for managing gastrointestinal conditions in both outpatient and inpatient settings

U.S. H2 Receptor Antagonist Market Insight

The U.S. H2 receptor antagonist market captured the largest revenue share of 36% in 2024 within North America, fueled by the high prevalence of GERD, peptic ulcers, and other acid-related disorders. Patients and healthcare providers increasingly prioritize safe, effective, and convenient treatment options, including both prescription and over-the-counter formulations. The growing awareness of early diagnosis and management of gastrointestinal conditions, combined with the availability of generic H2 receptor antagonists, further propels market growth. Moreover, ongoing clinical research and advancements in extended-release formulations are significantly contributing to the expansion of the U.S. market.

Europe H2 Receptor Antagonist Market Insight

The Europe H2 receptor antagonist market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing prevalence of gastrointestinal disorders and growing patient awareness regarding acid-related conditions. The region benefits from well-established healthcare infrastructure and widespread access to pharmacies, supporting H2 receptor antagonist adoption. European patients and physicians are increasingly favoring cost-effective and safe therapies, with the market growing across outpatient and inpatient settings. In addition, the expansion of OTC availability and awareness campaigns is fostering broader usage in both chronic and acute cases.

U.K. H2 Receptor Antagonist Market Insight

The U.K. H2 receptor antagonist market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising incidences of GERD and peptic ulcers and increasing awareness of acid-related disorder management. The adoption of both prescription and OTC H2 receptor antagonist drugs is being fueled by patient preference for safe, effective, and convenient treatment options. In addition, the U.K.’s robust healthcare system, increasing physician awareness, and patient accessibility to generic formulations are expected to continue stimulating market growth.

Germany H2 Receptor Antagonist Market Insight

The Germany H2 receptor antagonist market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing prevalence of acid-related gastrointestinal disorders and the rising adoption of modern therapies. Germany’s well-developed healthcare infrastructure, combined with high awareness among patients and physicians about early intervention, promotes H2 receptor antagonist usage. The preference for safe, cost-effective, and clinically validated treatments supports sustained demand. The market is also benefiting from hospital and pharmacy networks ensuring accessibility of both prescription and OTC options across the country.

Asia-Pacific H2 Receptor Antagonist Market Insight

The Asia-Pacific H2 receptor antagonist market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising incidences of gastrointestinal disorders, increasing healthcare access, and expanding urban populations in countries such as China, Japan, and India. Growing awareness regarding acid-related conditions and the availability of generic and affordable treatment options are driving adoption. Furthermore, government healthcare initiatives and the expansion of hospital and pharmacy networks are facilitating easier access to H2 receptor antagonists across the region.

Japan H2 Receptor Antagonist Market Insight

The Japan H2 receptor antagonist market is gaining momentum due to rising prevalence of GERD, peptic ulcers, and lifestyle-related gastrointestinal disorders. Japanese patients and healthcare providers place significant emphasis on treatment efficacy, safety, and convenience, supporting widespread adoption. The integration of H2 receptor antagonists into both outpatient and inpatient care, along with OTC availability, is fueling growth. Moreover, Japan’s aging population increases demand for chronic management of acid-related disorders, driving market expansion in both residential and hospital settings.

India H2 Receptor Antagonist Market Insight

The India H2 receptor antagonist market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising gastrointestinal disorder prevalence, increasing healthcare access, and growing awareness among patients. India’s expanding urban population, rising disposable incomes, and high adoption of generic medications support strong market growth. The availability of affordable H2 receptor antagonist options through retail and online pharmacies, alongside government healthcare initiatives, is further propelling market expansion in both urban and semi-urban regions.

H2 Receptor Antagonist Market Share

The H2 Receptor Antagonist industry is primarily led by well-established companies, including:

- Merck & Co., Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- AstraZeneca (U.K.)

- GSK plc (U.K.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Abbott (U.S.)

- Novartis AG (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Lilly USA, LLC. (U.S.)

- Teva Pharmaceutical Industries Limited (Israel)

- Boehringer Ingelheim International GmbH (Germany)

- Sun Pharmaceutical Industries Limited (India)

- Apotex Inc. (Canada)

- Aurobindo Pharma Limited (India)

- Dr. Reddy's Laboratories Limited (India)

- Cipla (India)

- Hikma Pharmaceuticals plc (U.K.)

- Zydus Lifesciences Limited (India)

What are the Recent Developments in Global H2 Receptor Antagonist Market?

- In September 2025, Zydus Lifesciences announced that its oncology injectable manufacturing facility at SEZ-1 in Ahmedabad received an Establishment Inspection Report (EIR) from the U.S. Food and Drug Administration (USFDA). This signifies that the plant has successfully completed a regulatory inspection by the USFDA, ensuring compliance with manufacturing standards

- In January 2024, a study highlighted the potential of H2 receptor antagonists as radioprotective agents. The research suggested that these medications might offer partial protection against radiation-induced injuries, opening avenues for their use in oncology settings to mitigate side effects of radiation therapy

- In August 2023, Upsher-Smith Laboratories announced the launch of Famotidine for Oral Suspension, USP. This product is therapeutically equivalent to the Reference Listed Drug (RLD), Pepcid® Oral Suspension. The launch was made possible through a strategic partnership with Appco Pharma LLC, a New Jersey-based generic drug development and manufacturing company. The oral suspension formulation offers an alternative for patients who have difficulty swallowing tablets, expanding the accessibility of H2RA therapy

- In October 2022, A study published in a leading medical journal supported the removal of H2 antagonists from standard paclitaxel premedication regimens, suggesting they did not reduce the incidence of hypersensitivity reactions in cancer patients. This finding, motivated in part by the ranitidine withdrawal, has led to a potential change in clinical protocol for a non-GI use of H2RAs

- In June 2022, Zydus Lifesciences received final approval from the U.S. Food and Drug Administration (FDA) to market Famotidine Tablets in the U.S. market. Famotidine tablets are used to treat conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. This approval enables Zydus to expand its presence in the U.S. market and provide a cost-effective alternative to branded famotidine products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.