Global Hacksaw Blades Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.35 Billion

2024

2032

USD

1.70 Billion

USD

2.35 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.35 Billion | |

|

|

|

|

Hacksaw Blades Market Size

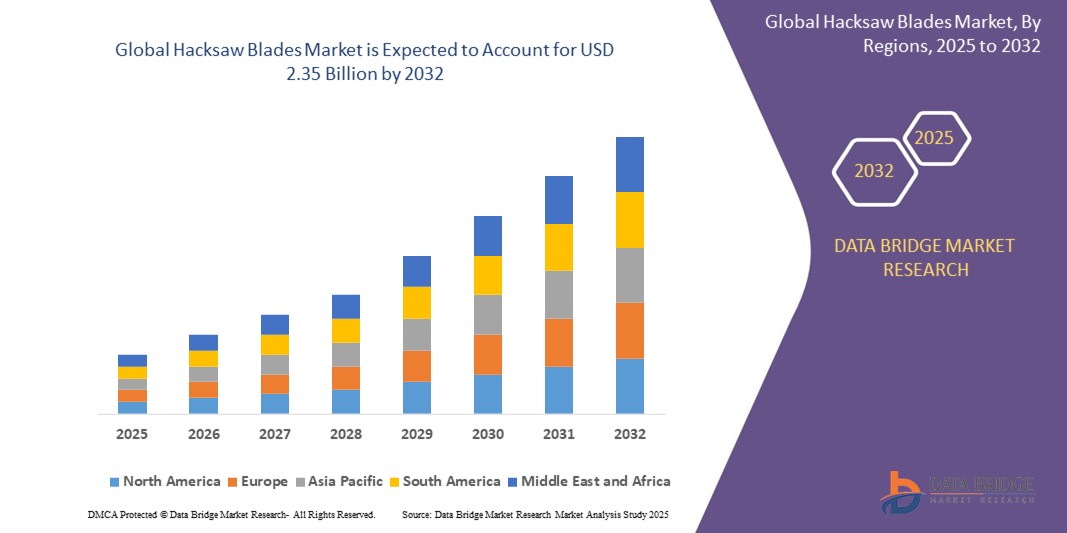

- The global Hacksaw Blades market was valued at USD 1.7 billion in 2024 and is expected to reach USD 2.35 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.15 %, primarily driven by the increasing demand for efficient and durable cutting tools in various industries

- This growth is driven by factors such as the rising adoption of hacksaw blades in industrial applications, advancements in material technology leading to longer-lasting blades, and the growing preference for cost-effective cutting solutions

Hacksaw Blades Market Analysis

- The global hacksaw blades market is currently experiencing steady growth, driven by their widespread use in industries requiring precise and durable cutting tools. Hacksaw blades are essential in sectors such as manufacturing, automotive, and construction, where high-quality cutting is crucial for various materials, including metal, plastic, and wood

- The market has seen an increased demand for advanced materials used in the production of hacksaw blades, such as high-carbon steel and bi-metal, which enhance blade durability and performance. These materials allow blades to handle tougher tasks, increasing their appeal to industries with rigorous cutting needs

- Technological advancements in blade manufacturing have improved cutting efficiency, contributing to higher demand. Innovations such as coated blades and new tooth designs are providing better performance, offering smoother and faster cuts, which are particularly attractive to professionals in industries such as metalworking and automotive

- The increasing focus on automation and precision cutting techniques is further boosting the market for hacksaw blades. Manufacturers are now looking for tools that can ensure greater accuracy and reduce operational downtime, thus contributing to market growth

- For instance, companies such as Stanley Black & Decker are focusing on producing high-quality hacksaw blades that cater to both DIY enthusiasts and professional users, ensuring that they meet the evolving demands of diverse markets while maintaining competitive pricing

Report Scope and Hacksaw Blades Market Segmentation

|

Attributes |

Hacksaw Blades Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hacksaw Blades Market Trends

Increasing Adoption of Bi-Metal and High-Performance Blades

- Bi-metal blades, which combine high-speed steel teeth with a flexible steel back, offer superior performance, longer life, and greater resistance to wear and breakage compared to traditional carbon steel blades

- These blades are gaining popularity in industries such as automotive, metalworking, and construction, where heavy-duty cutting tasks require tools that can withstand high stresses and offer consistent performance

- For instance, LENOX, a major manufacturer of cutting tools, has introduced bi-metal hacksaw blades that provide faster and smoother cuts in tough materials such as stainless steel, reinforcing their appeal among professionals who require high precision and performance in their tools

- In addition, manufacturers are focusing on developing blades with advanced coatings, such as titanium and carbide, to increase their durability and resistance to corrosion, further boosting their adoption in industries with demanding cutting requirements

- As industries continue to prioritize productivity and efficiency, the demand for high-performance hacksaw blades is expected to rise, driving innovation and development in blade technology and materials

- The trend toward bi-metal and high-performance hacksaw blades is expected to continue, with more companies focusing on providing products that offer superior performance, longer lifespan, and better value for industrial applications

Hacksaw Blades Market Dynamics

Driver

Rising Demand for Durable and Efficient Cutting Tools

- The increasing demand for durable and efficient cutting tools is one of the primary drivers of growth in the global hacksaw blades market

- As industries such as manufacturing, automotive, and construction require precise and reliable tools for cutting through a variety of materials, the need for high-quality hacksaw blades has grown significantly

- Companies are focusing on developing blades that offer enhanced durability, longer life, and smoother cutting experiences to meet the high expectations of industrial users

- For instance, Stanley Black & Decker, a leading player in the tools market, has developed hacksaw blades made of bi-metal and high-carbon steel, which provide greater strength and resistance to wear and tear, thereby improving the performance and longevity of the blade

- Additionally, innovations in the design of hacksaw blades, such as improved tooth geometry and coatings, are further contributing to the demand for these tools, as they offer better cutting efficiency and increased precision

- The rising use of automated systems and robotic cutting techniques in manufacturing plants is also increasing the demand for high-performance cutting tools, including hacksaw blades, which can provide the necessary accuracy and speed for industrial production lines

Opportunity

Expansion of Industrialization in Emerging Markets

- The rapid industrialization of emerging markets presents a significant opportunity for growth in the global hacksaw blades market

- Countries in Asia-Pacific, particularly China and India, are experiencing rapid urbanization, increased construction activity, and the growth of the manufacturing and automotive sectors, all of which require high-quality cutting tools such as hacksaw blades

- As these markets continue to develop, the demand for tools that can provide precise and durable cutting solutions will increase, opening new revenue streams for global hacksaw blade manufacturers

- For Instance, China’s automotive sector is growing rapidly, and the demand for reliable cutting tools in metalworking and fabrication processes is on the rise. This has created an opportunity for global brands to expand their market presence in these regions and cater to the growing industrial needs

- Furthermore, e-commerce platforms have expanded the reach of hacksaw blades to new customers, particularly in emerging markets where online purchasing is gaining popularity. This accessibility to a broader customer base offers an additional opportunity for companies to grow their market share

- As industries in these regions continue to expand, there is an opportunity for hacksaw blade manufacturers to tap into this increasing demand by offering affordable, high-performance products that meet the unique needs of these markets

Restraint/Challenge

Fluctuations in Raw Material Costs and Supply Chain Issues

- The production of hacksaw blades requires materials such as high-carbon steel, bi-metal, and alloyed metals, and price volatility in these raw materials can significantly affect production costs and profit margins for manufacturers

- For instance, during the COVID-19 pandemic, several manufacturing industries, including tools and machinery, faced severe supply chain disruptions, leading to delays in the production and distribution of hacksaw blades. These disruptions resulted in price hikes and product shortages, impacting market growth and consumer access to tools

- In addition, global transportation issues and the rising cost of logistics are further complicating the supply chain, causing delays in the delivery of raw materials and finished products. This can lead to increased costs for manufacturers and affect their ability to meet market demand on time

- Companies such as Stanley Black & Decker have also acknowledged the impact of material cost increases and supply chain bottlenecks on their overall operations. This has led them to explore ways to optimize their production processes, including using alternative materials and localizing supply chains to mitigate risks

- To address these challenges, hacksaw blade manufacturers will need to adapt by finding ways to stabilize raw material costs, streamline supply chains, and diversify their sourcing strategies to ensure a steady flow of production

Hacksaw Blades Market Scope

The market is segmented on the basis of blade type, teeth per inch, material type, mechanism type, product, consumer type, and application

|

Segmentation |

Sub-Segmentation |

|

By Blade Type |

|

|

By Teeth Per Inch |

|

|

By Material Type |

|

|

By Mechanism Type |

|

|

By Product |

|

|

By Consumer Type |

|

|

By Application |

|

Hacksaw Blades Market Regional Analysis

North America is the Dominant Region in the Hacksaw Blades Market

- North America currently holds the dominant position in the global hacksaw blades market due to the strong industrial presence in countries such as the United States and Canada

- The region has a well-established manufacturing sector, particularly in automotive, aerospace, and construction industries, where hacksaw blades are frequently used for precise cutting

- North America is home to several leading players in the hacksaw blades market, such as Stanley Black & Decker and Milwaukee Tool, which contributes to the region's dominant market share

- The demand for high-quality and durable tools in North America is fueled by the need for efficient and accurate cutting in heavy industries

- Increased investment in infrastructure and construction projects also drives the demand for cutting tools, as these industries often require reliable and efficient cutting solutions for various materials

Asia-Pacific is Projected to Register the Highest Growth Rate

- Rapid industrialization and urbanization in countries such as China, India, and Japan are significant contributors to the growth in this region

- The demand for hacksaw blades is rising as these countries are heavily investing in manufacturing, construction, and infrastructure projects, creating a need for efficient cutting tools

- The expansion of the automotive and metalworking industries in the Asia-Pacific region is particularly driving the demand for high-performance hacksaw blades

- For instance, China’s ongoing investments in the automotive and construction industries are creating increased demand for tools such as hacksaw blades

- Additionally, the growing middle class in countries such as India is driving the demand for DIY projects, further contributing to market expansion

- The region's growth is also attributed to increasing technological advancements in blade manufacturing and the growing availability of high-quality products at competitive prices

Hacksaw Blades Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IRWIN Tools (U.S.)

- FACOM (France)

- Stanley Black & Decker, Inc (U.S.)

- LENOX (U.S.)

- Stanley Black & Decker, Inc. (U.S.)

- Milwaukee Tool (U.S.)

- DEWALT (U.S.)

- Disston Company (U.S.)

- Apex Tool Group, LLC (U.S.)

- C. & E. Fein GmbH (Germany)

- Klein Tools, Inc. (U.S.)

- Texas Tool Traders (U.S.)

- Starrett (U.S.)

- Bipico (India)

- Snap-on Incorporated (U.S.)

- ABM Tools (India)

Latest Developments in Global Hacksaw Blades Market

- In April 2025, DEWALT introduced Power Hacksaw Blades with advanced carbide tips. These new blades are designed for superior cutting performance in industrial settings, providing longer blade life and better precision when cutting through hard and abrasive materials such as metal and composites

- In March 2025, Milwaukee introduced Titanium-coated hacksaw blades. The titanium coating helps the blade remain sharper for a longer time, offering better resistance to wear and corrosion. This launch aims to meet the needs of professionals who require high-performance blades for heavy-duty cutting tasks

- In February 2025, LENOX unveiled a new range of wavy tooth hacksaw blades, specifically designed for smoother cuts and reduced vibration during use. These blades are ideal for metalworking applications, offering improved performance for professionals when cutting tough materials such as aluminum and steel

- In January 2025, Stanley launched a new line of bi-metal hacksaw blades designed to enhance durability and provide longer cutting life. These blades feature a high-speed steel cutting edge fused with a flexible steel back, catering to industries such as construction and automotive for cutting tougher materials such as stainless steel

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.