Global Hammertoe Market

Market Size in USD Million

CAGR :

%

USD

320.48 Million

USD

741.24 Million

2024

2032

USD

320.48 Million

USD

741.24 Million

2024

2032

| 2025 –2032 | |

| USD 320.48 Million | |

| USD 741.24 Million | |

|

|

|

|

Hammertoe Market Size

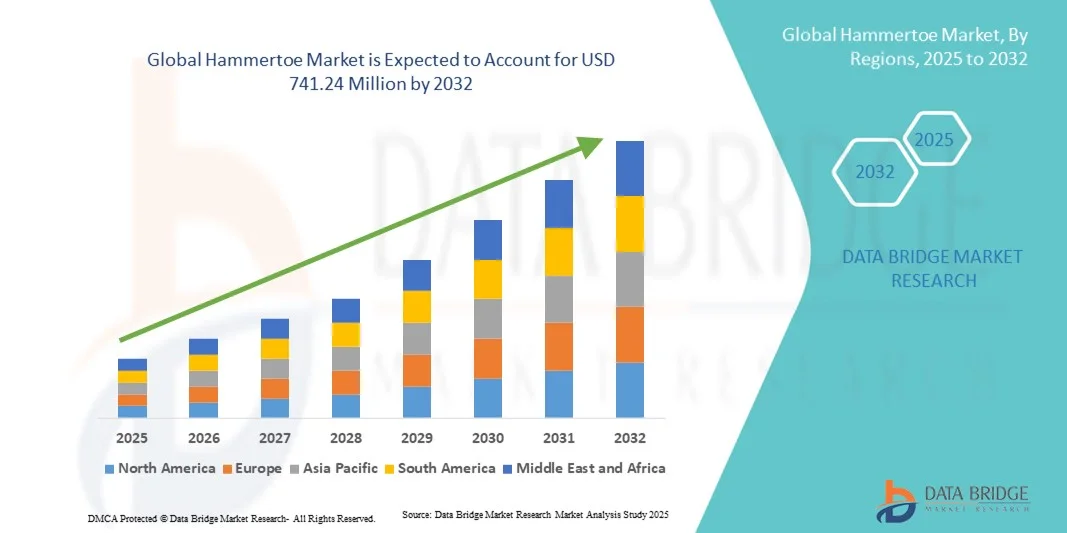

- The global hammertoe market size was valued at USD 320.48 million in 2024 and is expected to reach USD 741.24 million by 2032, at a CAGR of 11.05% during the forecast period

- The market growth is largely fueled by the increasing prevalence of foot deformities, particularly among the aging population, and advancements in surgical and non-surgical treatment options

- Furthermore, rising consumer demand for effective and minimally invasive solutions for foot health is establishing hammertoe correction as a preferred choice. These converging factors are accelerating the uptake of hammertoe correction solutions, thereby significantly boosting the industry's growth

Hammertoe Market Analysis

- Hammertoe correction solutions, including surgical, orthotic, and pharmacological treatments, are increasingly vital components of foot care management in both hospitals and clinics due to their effectiveness in alleviating pain, restoring toe function, and improving patient mobility

- The escalating demand for hammertoe correction is primarily fueled by the increasing prevalence of foot deformities, particularly among the aging population, growing awareness of foot health, and advancements in minimally invasive treatment options

- North America dominated the hammertoe market with the largest revenue share of 40.5% in 2024, characterized by advanced healthcare infrastructure, high awareness levels, and the presence of key industry players, with the U.S. experiencing substantial growth in both surgical and orthotic treatments

- Asia-Pacific is expected to be the fastest-growing region in the hammertoe market during the forecast period due to increasing urbanization, rising disposable incomes, and a growing geriatric population seeking effective foot care solutions

- Surgery segment dominated the hammertoe market in 2024 with a market share of 50.5%, driven by its proven effectiveness in correcting severe rigid hammertoe cases, while orthotic devices and implants are gaining traction for flexible hammertoe management due to their minimally invasive nature and ease of use

Report Scope and Hammertoe Market Segmentation

|

Attributes |

Hammertoe Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hammertoe Market Trends

Rising Demand for Minimally Invasive and Patient-Friendly Treatments

- A significant and accelerating trend in the global hammertoe market is the growing adoption of minimally invasive surgical techniques and orthotic devices that improve patient comfort and reduce recovery time. These innovations are transforming the treatment landscape for both flexible and rigid hammertoe cases

- For instance, flexible hammertoe correction often utilizes custom orthotic devices and implants to realign the toes without extensive surgery, while new surgical techniques for rigid hammertoe allow for smaller incisions, reduced pain, and faster rehabilitation

- Advanced treatment solutions are also incorporating digital planning tools and imaging technologies to enhance precision, enabling surgeons to customize procedures based on individual patient anatomy. This trend supports improved outcomes and fewer complications

- The integration of rehabilitation-focused physiotherapy and postoperative monitoring with orthotic solutions further enhances recovery, allowing patients to regain mobility more quickly. This combination of treatments provides a comprehensive, patient-centric approach that is gaining popularity across clinics and hospitals

- The increasing emphasis on patient comfort, minimally invasive procedures, and holistic treatment approaches is reshaping expectations for foot care. Consequently, companies are developing innovative implants, orthotic devices, and combined therapy solutions to meet this demand

- The adoption of these patient-friendly solutions is growing rapidly across both hospitals and specialized clinics, as consumers increasingly prioritize faster recovery, lower risk, and effective long-term management of hammertoe conditions

Hammertoe Market Dynamics

Driver

Rising Prevalence of Foot Deformities and Aging Population

- The increasing prevalence of hammertoe deformities, particularly among older adults, combined with heightened awareness of foot health, is a significant driver of market growth

- For instance, the growing number of patients seeking treatment for chronic foot pain and mobility issues is fueling demand for both surgical and non-surgical interventions

- As consumers become more aware of available treatment options, hospitals and clinics are increasingly adopting advanced orthotic devices, implants, and minimally invasive procedures to address patient needs

- Furthermore, the integration of rehabilitation programs and postoperative care with treatment plans is enhancing patient outcomes and encouraging broader adoption of advanced hammertoe correction methods

- The increasing incidence of hammertoe, particularly among the elderly and people with diabetes or arthritis, is driving demand for corrective treatments. Patients are seeking effective solutions, including surgical interventions, orthotic devices, and minimally invasive procedures, to improve mobility and reduce chronic pain

- The convenience and effectiveness of modern surgical techniques, orthotic devices, and combined therapy approaches are key factors propelling the market, particularly in urbanized regions with established healthcare infrastructure

Restraint/Challenge

High Treatment Costs and Limited Awareness in Emerging Markets

- The relatively high cost of surgical procedures, implants, and advanced orthotic devices poses a challenge to wider adoption, particularly among price-sensitive patients in developing regions

- In addition, limited awareness about early diagnosis and treatment options in some emerging markets leads to delayed care and higher prevalence of severe deformities requiring complex procedures

- Addressing these challenges through patient education, cost-effective solutions, and increased availability of minimally invasive treatments is crucial for expanding market reach

- Moreover, ensuring proper clinical expertise, infrastructure, and regulatory compliance for surgical procedures and devices is essential to build trust among patients and healthcare providers

- Surgical correction, implants, and advanced orthotic devices can be expensive, and insurance coverage may be limited, particularly in developing countries, which restricts patient access to treatment

- Overcoming these barriers through awareness campaigns, affordable treatment options, and partnerships with healthcare providers will be vital for sustained market growth

Hammertoe Market Scope

The market is segmented on the basis of type, diagnosis, treatment, and end user.

- By Type

On the basis of type, the hammertoe market is segmented into flexible hammertoe and rigid hammertoe. The flexible hammertoe segment dominated the market with the largest revenue share of 55% in 2024, driven by its higher prevalence and the effectiveness of non-surgical treatments such as orthotic devices and physiotherapy. Patients with flexible hammertoe often seek early intervention to prevent progression, which has increased demand for minimally invasive corrective solutions. The segment benefits from the accessibility of outpatient care, allowing clinics and hospitals to treat cases without extensive surgical infrastructure. Custom orthotic devices and splints further strengthen the dominance of this segment by providing patient-friendly solutions that ensure quicker recovery. Early diagnosis through routine physical exams also supports the frequent treatment of flexible hammertoe, increasing the market share.

The rigid hammertoe segment is anticipated to witness the fastest growth rate of 8.5% from 2025 to 2032, fueled by increasing awareness of corrective surgical options and technological advancements in minimally invasive procedures. Severe deformities often require surgical intervention, which has gained traction due to improved patient outcomes and shorter recovery times. Rising geriatric populations, particularly in developed regions, are more prone to rigid deformities, supporting the growth of this segment. Innovative implants, fixation devices, and precision surgical techniques are expanding the treatment possibilities for rigid hammertoe. Hospitals and specialty orthopedic centers are increasingly adopting these solutions, driving market expansion. In addition, patient preference for permanent correction of severe deformities contributes to the rapid adoption of rigid hammertoe treatments.

- By Diagnosis

On the basis of diagnosis, the hammertoe market is segmented into physical exam, X-rays, and others. The physical exam segment dominated the market with a revenue share of 60% in 2024, as it is the most widely used and cost-effective method for identifying hammertoe deformities. Clinicians rely on visual inspection and manual evaluation to determine deformity severity and type, enabling early intervention. Its non-invasive nature and minimal equipment requirements make it highly accessible across hospitals, clinics, and physiotherapy centers. Early detection through physical exams facilitates the use of conservative treatments such as orthotic devices. The reliability and speed of physical exams strengthen their dominant position. This method is especially prevalent in emerging markets where advanced imaging may be less accessible.

The X-ray segment is expected to witness the fastest growth at a CAGR of 9.2% from 2025 to 2032, driven by increasing use of imaging technologies for precise evaluation of bone alignment and deformity severity. X-rays are particularly critical for planning surgical procedures and assessing rigid hammertoe cases. Technological improvements in digital radiography, faster image processing, and reduced radiation exposure have enhanced adoption. Hospitals and specialized clinics increasingly use X-rays to improve surgical accuracy and patient outcomes. Rising patient awareness about diagnostic precision supports the growth of this segment. X-ray adoption is expected to expand further as healthcare facilities in developing regions modernize their diagnostic capabilities.

- By Treatment

On the basis of treatment, the hammertoe market is segmented into drugs, orthotic devices, implants, surgery, and others. The surgery segment dominated the market with a share of 50.5% in 2024, as it is the most effective solution for severe or rigid deformities. Surgical interventions restore toe functionality, alleviate chronic pain, and provide long-term correction, making them the preferred choice in hospitals and specialty clinics. Innovations in minimally invasive techniques and post-surgical rehabilitation programs further strengthen its market dominance. Patients increasingly prefer surgery for permanent correction of severe cases, boosting adoption. Advanced fixation devices and implants enhance the success rate and recovery time. Hospitals with skilled orthopedic surgeons play a key role in sustaining the dominance of the surgical segment.

The orthotic devices segment is anticipated to witness the fastest growth rate of 10% from 2025 to 2032, fueled by increasing patient preference for non-invasive and conservative treatments. Custom orthoses, splints, and footwear modifications provide pain relief and functional support, particularly for flexible hammertoe cases. Rising awareness about preventive care and early-stage intervention contributes to the rapid adoption of orthotic solutions. Physiotherapy and orthopedic centers are integrating orthotic therapy with rehabilitation programs to improve patient outcomes. Growth is also supported by technological advancements in materials and customization methods, which enhance comfort and efficacy. The demand for home-based orthotic solutions is further expanding this segment’s reach.

- By End User

On the basis of end user, the hammertoe market is segmented into hospitals, clinics, physiotherapy and orthopedic centers, and others. The hospital segment dominated the market with a revenue share of 45% in 2024, driven by the availability of advanced surgical facilities, skilled orthopedic surgeons, and comprehensive postoperative care programs. Hospitals handle severe rigid hammertoe cases and complex corrective procedures, solidifying their dominant position. Access to advanced imaging and diagnostic technologies further supports hospital dominance. Hospitals also offer multidisciplinary care, integrating surgery with physiotherapy and rehabilitation. Patients often prefer hospital-based treatment for severe deformities due to perceived higher quality and safety. Hospital networks in developed regions continue to invest in new treatment technologies, maintaining market leadership.

Physiotherapy and orthopedic centers are expected to witness the fastest growth at a CAGR of 11% from 2025 to 2032, due to rising demand for conservative treatments, rehabilitation, and follow-up care for patients recovering from surgeries or using orthotic devices. These centers are increasingly integrating customized exercise programs, splinting, and patient education, enhancing treatment outcomes and patient satisfaction. The growing focus on outpatient care and minimally invasive solutions contributes to the rapid expansion. Rising awareness about preventive and early-stage treatment further supports this segment. Partnerships with hospitals and clinics are increasing access to specialized therapies. The expansion of physiotherapy and orthopedic networks in urban and semi-urban areas fuels accelerated adoption of these services.

Hammertoe Market Regional Analysis

- North America dominated the hammertoe market with the largest revenue share of 40.5% in 2024, characterized by advanced healthcare infrastructure, high awareness levels, and the presence of key industry players, with the U.S. experiencing substantial growth in both surgical and orthotic treatments

- Patients in the region highly value access to skilled orthopedic surgeons, advanced surgical techniques, and comprehensive postoperative care programs, which ensure effective treatment and faster recovery

- The widespread adoption of minimally invasive procedures, orthotic devices, and implants is further supported by high healthcare spending, a well-established network of hospitals and clinics, and strong insurance coverage, establishing North America as a key market for both flexible and rigid hammertoe treatments

U.S. Hammertoe Market Insight

The U.S. hammertoe market captured the largest revenue share of 81% in 2024 within North America, driven by advanced healthcare infrastructure, high awareness of foot health, and the widespread availability of skilled orthopedic surgeons. Patients increasingly prioritize effective treatment options, including minimally invasive surgery, implants, and orthotic devices, to restore mobility and reduce chronic pain. The growing trend of early diagnosis and preventive care is fueling demand for both flexible and rigid hammertoe treatments. In addition, hospitals and specialized clinics are integrating rehabilitation and physiotherapy programs, enhancing recovery and patient satisfaction. Rising adoption of outpatient care for less severe cases further supports market growth. Overall, the combination of technological advancement, patient-centric care, and high healthcare spending is propelling the U.S. market.

Europe Hammertoe Market Insight

The Europe hammertoe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising awareness of foot health, an increasing geriatric population, and the demand for advanced corrective treatments. Countries in Europe are witnessing growth across hospitals, clinics, and orthopedic centers, with a focus on both surgical and non-surgical interventions. Patients increasingly seek comprehensive treatment options that include orthotic devices, implants, and rehabilitation programs. Urbanization and higher healthcare spending are fostering the adoption of advanced diagnostic and treatment technologies. Preventive care initiatives and early-stage intervention programs are also supporting market expansion. The European emphasis on quality healthcare and patient outcomes continues to drive market development.

U.K. Hammertoe Market Insight

The U.K. hammertoe market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of foot deformities and the need for effective treatment solutions. Increasing prevalence of hammertoe among aging populations and active adults has accelerated demand for surgical correction, orthotic devices, and conservative therapies. Hospitals and clinics are adopting advanced imaging and minimally invasive techniques to improve treatment outcomes. The growing preference for outpatient care and physiotherapy programs is further boosting adoption. The U.K.’s strong healthcare infrastructure and insurance coverage facilitate access to corrective procedures, while preventive care initiatives are encouraging early diagnosis. Combined, these factors support steady market growth in the region.

Germany Hammertoe Market Insight

The Germany hammertoe market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of foot health, a rising geriatric population, and increasing adoption of advanced surgical and non-surgical treatments. German hospitals and specialized orthopedic centers are emphasizing precision corrective procedures, minimally invasive surgeries, and post-treatment rehabilitation programs. Patients are showing a preference for high-quality, effective interventions that reduce recovery time and improve mobility. Urbanization and healthcare infrastructure development further support market growth. In addition, Germany’s focus on preventive care and patient education is increasing early detection and treatment adoption. These factors collectively drive the country’s market expansion.

Asia-Pacific Hammertoe Market Insight

The Asia-Pacific hammertoe market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing awareness of foot health in countries such as China, Japan, and India. The region is witnessing higher adoption of both surgical and conservative treatment options, supported by expanding healthcare infrastructure and availability of skilled orthopedic professionals. Government initiatives promoting health awareness and accessibility to outpatient care are accelerating market growth. The rising geriatric population and active lifestyle trends are creating higher demand for corrective and preventive treatments. Furthermore, the expansion of clinics, hospitals, and physiotherapy centers in urban and semi-urban areas enhances treatment accessibility, contributing to rapid growth.

Japan Hammertoe Market Insight

The Japan hammertoe market is gaining momentum due to the country’s aging population, high awareness of foot health, and strong healthcare infrastructure. Patients increasingly seek minimally invasive surgical solutions, implants, and orthotic devices to maintain mobility and quality of life. Integration of rehabilitation and physiotherapy programs with corrective treatments is enhancing outcomes and patient satisfaction. The growing number of outpatient facilities and specialized orthopedic centers is improving treatment accessibility. Technological adoption in surgical procedures and post-treatment care is also driving growth. Combined with preventive care awareness, these factors are stimulating market expansion across both residential and commercial healthcare settings.

India Hammertoe Market Insight

The India hammertoe market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising disposable incomes, and increased awareness of foot health. Patients are increasingly opting for surgical corrections, orthotic devices, and physiotherapy-based treatments for both flexible and rigid hammertoe cases. Expansion of hospitals, clinics, and orthopedic centers, along with government initiatives promoting health awareness, is driving market growth. Affordability of treatments and availability of skilled orthopedic professionals are further encouraging adoption. Rising focus on preventive care and early diagnosis is contributing to higher treatment rates. The growing middle class and improving healthcare infrastructure continue to support the market’s rapid expansion.

Hammertoe Market Share

The Hammertoe industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Smith+Nephew (U.K.)

- Zimmer Biomet (U.S.)

- Extremity Medical (U.S.)

- Orthofix Medical Inc. (U.S.)

- BioPro, Inc. (U.S.)

- Paragon 28, Inc. (U.S.)

- Acumed LLC (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Össur (Iceland)

- Anika Therapeutics, Inc. (U.S.)

- Arrowhead Medical Device Technologies LLC (U.S.)

- Arthrex, Inc. (U.S.)

- Solvay (Belgium)

- OsteoMed (U.S.)

- Centric Medical LLC (U.S.)

- Instratek (U.S.)

- Horizon Consulting Group (U.S.)

What are the Recent Developments in Global Hammertoe Market?

- In September 2024, Tyber Medical's PEEK ToeGrip Hammertoe implant family received Medical Device Regulation (MDR) certification from TÜV Rheinland. This certification, along with prior FDA 510(k) clearance, positions the implant as one of the first to achieve both regulatory approvals, enhancing its availability in European markets

- In July 2025, LMD Podiatry reported the use of Botox injections as a non-surgical treatment for hammertoe. Injecting Botox into the toe's muscles helps relax the tendons, allowing the toe to realign over time. This approach is particularly beneficial for patients with early-stage or flexible hammertoe deformities

- In March 2025, Podiatry Hotline highlighted the adoption of new minimal incision approaches in hammertoe surgery. These techniques involve smaller incisions and advanced instrumentation, leading to reduced scarring, quicker recovery times, and improved patient outcomes compared to traditional surgical methods

- In September 2023, Forma Medical announced the launch of OptimalHT, the world's first instrumented minimally invasive surgery (MIS) procedure for hammertoe correction. This FDA-approved technique utilizes a specialized instrument to straighten the toe through small incisions, offering reduced recovery times and minimal scarring. Over 50 procedures have been successfully performed since its introduction

- In July 2023, Toetal Solutions, a leading innovator in the medical industry, has partnered with Ghost Medical, a renowned medical illustration company, to unveil the ZipToe Hammertoe System. This collaboration combines Toetal's innovative design with Ghost Medical's expertise in medical visualization to create a cutting-edge solution for the treatment of rigid hammertoe deformities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.