Global Hard Candy Market

Market Size in USD Billion

CAGR :

%

USD

290.59 Billion

USD

403.86 Billion

2024

2032

USD

290.59 Billion

USD

403.86 Billion

2024

2032

| 2025 –2032 | |

| USD 290.59 Billion | |

| USD 403.86 Billion | |

|

|

|

|

Hard Candy Market Size

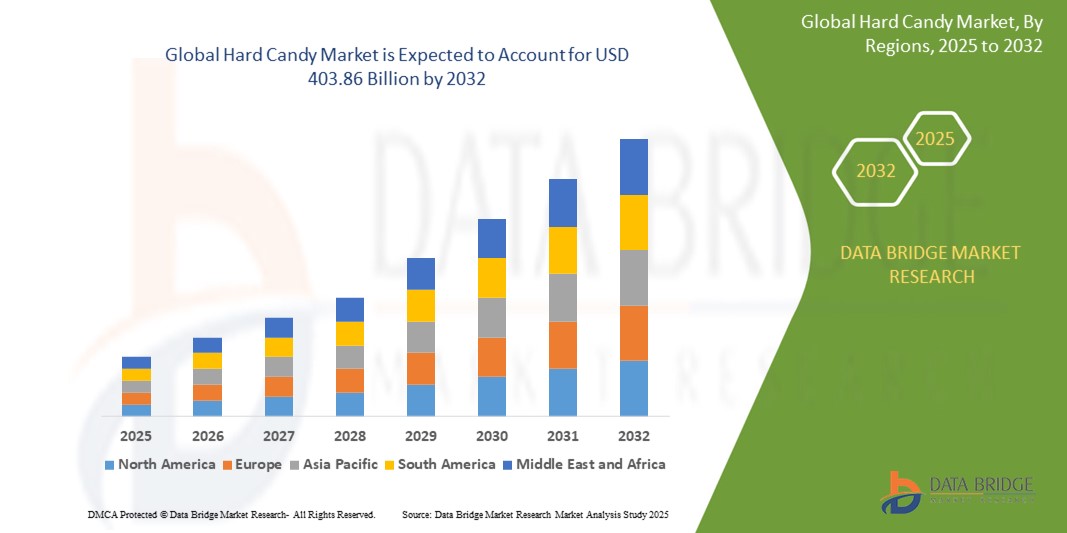

- The global hard candy market size was valued at USD 290.59 billion in 2024 and is expected to reach USD 403.86 billion by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is primarily driven by increasing consumer preference for convenient, portable, and indulgent confectionery products, coupled with innovations in flavors and packaging

- Rising demand for nostalgic and premium hard candy products, along with growing popularity among younger demographics, is further propelling market expansion

Hard Candy Market Analysis

- Hard candies, known for their long shelf life and diverse flavor profiles, are a staple in the global confectionery industry, catering to both children and adults across various retail channels

- The surge in demand is fueled by increasing consumer interest in unique and exotic flavors, sugar-free options, and the convenience of on-the-go snacking

- Asia-Pacific dominated the hard candy market with the largest revenue share of 42.5% in 2024, driven by high consumption in countries such as China and India, a strong cultural affinity for confectionery, and the presence of major manufacturers

- North America is expected to be the fastest-growing region during the forecast period, attributed to rising demand for premium and artisanal hard candies, increasing health-conscious consumer preferences for sugar-free options, and strong retail distribution networks

- The fruit hard candy segment dominated the largest market revenue share of 38.5% in 2024, driven by its widespread appeal across diverse consumer groups, vibrant taste profiles, and natural flavor innovations

Report Scope and Hard Candy Market Segmentation

|

Attributes |

Hard Candy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hard Candy Market Trends

“Increasing Integration of Health-Conscious and Innovative Flavors”

- The global hard candy market is experiencing a notable trend toward integrating health-conscious ingredients and innovative flavor profiles to meet evolving consumer preferences

- Manufacturers are leveraging natural and organic ingredients, such as fruit extracts and plant-based sweeteners, to cater to health-conscious consumers seeking low-sugar or sugar-free options

- Advanced flavor development techniques enable the creation of exotic and gourmet profiles, such as tropical fruits, spicy blends, and floral infusions, enhancing sensory appeal

- For instances, companies are introducing sugar-free hard candies sweetened with stevia or isomalt, and brands such as Jolly Ranchers have launched tropical mix flavors, including golden pineapple and mango, to captivate diverse consumer palates

- This trend enhances the appeal of hard candies, making them more attractive to health-focused individuals and those seeking unique taste experiences

- Data analytics is being used to study consumer preferences, enabling manufacturers to tailor flavors and textures, such as sour or multi-layered lollipops, to specific demographics and regional tastes

Hard Candy Market Dynamics

Driver

“Rising Demand for Nostalgic and Premium Confectionery Products”

- Increasing consumer demand for nostalgic treats, such as traditional lollipops and candy canes, alongside premium and artisanal hard candies, is a major driver for the global hard candy market

- Hard candies enhance consumer experiences by offering vibrant flavors, long shelf life, and a satisfying crunch, making them popular for indulgence and gifting during festive seasons such as Halloween and Christmas

- Regional preferences and cultural influences, particularly in Asia-Pacific, which dominates the market due to its large population of children and young consumers, are boosting demand for diverse flavors and innovative packaging

- The proliferation of e-commerce and advanced distribution channels, such as hypermarkets and supermarkets, which held a 39% market share in 2024, facilitates greater accessibility and impulse purchases

- Manufacturers are increasingly offering premium hard candies with high-quality ingredients and elegant packaging as standard or specialty products to meet consumer expectations for unique confectionery experiences

Restraint/Challenge

“High Sugar Content Concerns and Regulatory Restrictions”

- Increasing consumer demand for nostalgic treats, such as traditional lollipops and candy canes, alongside premium and artisanal hard candies, is a major driver for the global hard candy market

- Hard candies enhance consumer experiences by offering vibrant flavors, long shelf life, and a satisfying crunch, making them popular for indulgence and gifting during festive seasons such as Halloween and Christmas

- Regional preferences and cultural influences, particularly in Asia-Pacific, which dominates the market due to its large population of children and young consumers, are boosting demand for diverse flavors and innovative packaging

- The proliferation of e-commerce and advanced distribution channels, such as hypermarkets and supermarkets, which held a 39% market share in 2024, facilitates greater accessibility and impulse purchases

- Manufacturers are increasingly offering premium hard candies with high-quality ingredients and elegant packaging as standard or specialty products to meet consumer expectations for unique confectionery experiences

Hard Candy market Scope

The market is segmented on the basis of flavor, type, and applications.

- By Flavor

On the basis of flavor, the global hard candy market is segmented into mint hard candy, caramel hard candy, butterscotch hard candy, fruit hard candy, chocolate hard candy, and others. The fruit hard candy segment dominated the largest market revenue share of 38.5% in 2024, driven by its widespread appeal across diverse consumer groups, vibrant taste profiles, and natural flavor innovations. Rising consumer preference for fruity, refreshing candies has boosted its dominance, particularly in the Asia-Pacific region, which leads the global market.

The chocolate hard candy segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in North America, the fastest-growing region. Increasing demand for indulgent, premium chocolate-based candies, coupled with innovations in flavor combinations and sugar-free options, is driving this segment’s growth.

- By Type

On the basis of type, the global hard candy market is segmented into pop rocks, lollipop, and traditional. The lollipop segment dominated the market with a revenue share of 45.5% in 2024, attributed to its popularity among children and adults alike, ease of consumption, and widespread availability in diverse flavors and designs. The Asia-Pacific region significantly contributes to this segment’s dominance due to high consumption and innovative product offerings.

The pop rocks segment is anticipated to experience the fastest growth rate of 18.2% from 2025 to 2032. The unique sensory experience of popping candies, coupled with growing demand for novelty and interactive confectionery products, particularly in North America, is expected to drive this segment’s rapid expansion.

- By Applications

On the basis of applications, the global hard candy market is segmented into hypermarkets and supermarkets, drug stores, specialty stores, and retail stores. The hypermarkets and supermarkets segment accounted for the largest market revenue share of 52.5% in 2024, driven by their extensive distribution networks, diverse product offerings, and consumer preference for convenient one-stop shopping. The Asia-Pacific region’s robust retail infrastructure further strengthens this segment’s dominance.

The specialty stores segment is projected to witness significant growth from 2025 to 2032, fueled by increasing consumer demand for premium and artisanal hard candies. North America’s rising focus on high-quality, unique confectionery products and the growth of boutique candy stores are key drivers for this segment’s expansion.

Hard Candy Market Regional Analysis

- Asia-Pacific dominated the hard candy market with the largest revenue share of 42.5% in 2024, driven by high consumption in countries such as China and India, a strong cultural affinity for confectionery, and the presence of major manufacturers

- Consumers prioritize hard candies for their long-lasting taste, portability, and variety in flavors such as mint, caramel, butterscotch, fruit, and chocolate, catering to diverse taste preferences across regions

- Growth is supported by advancements in candy production technology, including sugar-free and natural ingredient formulations, alongside rising demand in both hypermarkets/supermarkets and specialty retail channels

U.S. Hard Candy Market Insight

The U.S. hard candy market is expected to witness significant growth, fueled by strong demand in retail stores and growing consumer interest in nostalgic and innovative candy flavors. The trend toward premium and artisanal candies, coupled with increasing health-conscious options such as sugar-free varieties, boosts market expansion. The popularity of lollipops and traditional hard candies in drug stores and supermarkets complements the growing e-commerce sales, creating a diverse market ecosystem.

Europe Hard Candy Market Insight

The European hard candy market is expected to witness significant growth, supported by consumer demand for premium and natural-ingredient candies. Shoppers seek candies that offer unique flavors such as mint and fruit while aligning with health trends, such as low-sugar options. Growth is prominent in both hypermarkets and specialty stores, with countries such as Germany and France showing significant uptake due to rising demand for organic and artisanal products.

U.K. Hard Candy Market Insight

The U.K. market for hard candies is expected to witness rapid growth, driven by demand for nostalgic flavors such as butterscotch and innovative products such as pop rocks in urban and suburban retail settings. Increased interest in premium candies and growing awareness of sugar-free options encourage adoption. Evolving regulations on sugar content influence consumer choices, balancing indulgence with health-conscious preferences.

Germany Hard Candy Market Insight

Germany is expected to witness strong growth in the hard candy market, attributed to its advanced confectionery sector and high consumer focus on quality and innovative flavors. German consumers prefer candies with natural ingredients and unique textures, such as lollipops and fruit-flavored options, which contribute to sustained market growth. The integration of these products in premium retail and specialty stores supports market expansion.

Asia-Pacific Hard Candy Market Insight

The Asia-Pacific region dominates the global hard candy market, driven by expanding confectionery production and rising disposable incomes in countries such as China, India, and Japan. Increasing demand for diverse flavors such as caramel, chocolate, and fruit, along with convenient packaging, boosts market growth. Government initiatives promoting food safety and quality standards further encourage the adoption of advanced hard candy formulations.

Japan Hard Candy Market Insight

Japan’s hard candy market is expected to witness significant growth due to strong consumer preference for high-quality, innovative candies that offer unique flavors and textures. The presence of major confectionery manufacturers and the integration of hard candies in specialty stores accelerate market penetration. Rising interest in pop rocks and lollipops in retail channels also contributes to growth.

China Hard Candy Market Insight

China holds the largest share of the Asia-Pacific hard candy market, propelled by rapid urbanization, rising consumer spending, and increasing demand for diverse candy flavors. The country’s growing middle class and focus on convenience foods support the adoption of hard candies in hypermarkets, supermarkets, and drug stores. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Hard Candy Market Share

The hard candy industry is primarily led by well-established companies, including:

- Perfetti Van Melle (Netherlands)

- Arcor (Argentina)

- THE HERSHEY COMPANY. (U.S.)

- Strauss Group (Israel)

- TIGER BRANDS (South Africa)

- LOTTE (South Korea)

- Storck USA, L.P. (U.S.)

- Nestlé (Switzerland)

- Mars, Incorporated (U.S.)

- Ferrero (Italy)

- Mondelez International. (U.S.)

- Meiji Holdings Co., Ltd. (Japan)

- DS Group. (India)

- UHA Mikakuto Co.,Ltd. (Japan)

- Yum Earth, Inc. (U.S.)

- Dum Dums (U.S.)

- Tootsie Roll Inc. (U.S.)

- Ferrara Candy Company. (U.S.)

What are the Recent Developments in Global Hard Candy Market?

- In June 2025, Jolly Rancher Hard Candy and other related products manufactured by The Hershey Company in Canada were recalled in the UK by Food Standards Scotland (FSS) and the Food Standards Agency (FSA). The recall was prompted by the detection of mineral oil aromatic hydrocarbons (MOAH) and mineral oil saturated hydrocarbons (MOSH)—substances not permitted in UK food products due to potential health risks. This action underscores the stringent regulatory oversight in the UK and the challenges faced by global confectionery brands in meeting diverse international food safety standards

- In September 2024, Morinaga America Inc. launched FI-BEING™, a new brand dedicated to creating better-for-you hard candies. Each serving delivers 11 grams of dietary fiber, meeting approximately 39% of the daily recommended intake, while containing just 4 grams of sugar and zero sugar alcohol. Available in flavors such as Passionfruit and Elderberry, FI-BEING™ offers a flavorful, functional treat that supports digestive health without compromising on taste. This launch reflects a growing consumer demand for functional confections that align with wellness goals and clean-label preferences

- In April 2024, Jolly Rancher expanded its flavor lineup with the launch of a Tropical Mix hard candy assortment, designed to satisfy adventurous palates and evolving consumer preferences. This vibrant mix features bold, fruity flavors including fruit punch, golden pineapple, lime, and mango, delivering a sweet escape to the tropics with every piece. The individually wrapped candies are perfect for on-the-go snacking, party favors, or simply brightening up your candy dish with a splash of island-inspired color and taste

- In October 2023, World of Sweets unveiled the Zed Candy Screamers range, a bold new entry into the sour candy market. The lineup featured the innovative "Shake & Spray" product, which mimics a spray can with a twist-to-open design and includes three Blue Razz bubblegum balls that create a fun shake effect. Available in Blue Razz and Purple Razz, this novelty candy was designed to captivate younger consumers with its interactive format and eye-catching packaging. The launch also included two additional products—Big Lick and Dip & Lick—broadening the brand’s appeal in the sour segment

- In September 2023, the candy industry saw a notable surge in product innovations featuring natural ingredients and alternative sweeteners such as stevia, erythritol, agave nectar, and coconut sugar. These developments were especially prominent in premium and functional candy segments, where brands aimed to meet the rising demand for clean-label, low-sugar, and health-conscious treats. Many of these new offerings emphasized organic sourcing, plant-based formulations, and reduced glycemic impact, appealing to consumers seeking indulgence without compromising wellness goals. This shift reflects a broader movement toward transparency and sustainability in confectionery production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hard Candy Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hard Candy Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hard Candy Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.