Global Hardware In The Loop Market

Market Size in USD Billion

CAGR :

%

USD

1.10 Billion

USD

2.46 Billion

2024

2032

USD

1.10 Billion

USD

2.46 Billion

2024

2032

| 2025 –2032 | |

| USD 1.10 Billion | |

| USD 2.46 Billion | |

|

|

|

|

Hardware in the Loop Market Size

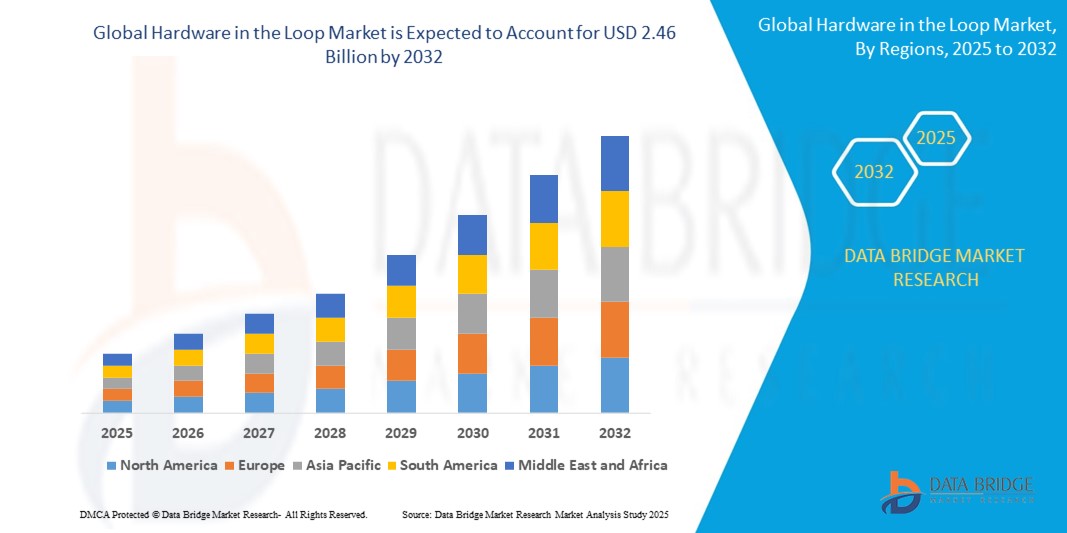

- The global hardware in the loop market size was valued at USD 1.1 billion in 2024 and is expected to reach USD 2.46 billion by 2032, at a CAGR of 10.6% during the forecast period

- The market growth is significantly driven by the increasing demand for advanced and rigorous testing of complex embedded systems, particularly in the automotive and aerospace industries, where safety, reliability, and regulatory compliance are paramount

- Rising advancements in technology, especially in the development of sophisticated simulation tools and the increasing complexity of electronic control units (ECUs) and software in vehicles, aircraft, and industrial equipment, necessitate the use of HIL testing for effective validation and verification in a cost-efficient and real-time environment. The growing adoption of electric vehicles, autonomous driving technologies, and automation across various sectors further fuels the demand for HIL testing solutions

Hardware in the Loop Market Analysis

- Hardware in the loop (HIL) involves a testing methodology where real-time simulations of complex systems are integrated with physical hardware to test embedded control systems. This approach has become increasingly vital in today's engineering environment due to the rising complexity of mechatronic systems across industries such as automotive, aerospace, and industrial automation

- The expanding adoption of HIL testing is mainly attributable to the growing acknowledgment of the limitations and costs associated with traditional physical prototyping and testing, an increasing focus on identifying and resolving design flaws early in the development cycle, and a rising understanding of the long-term benefits associated with improved product quality, reduced development time, and enhanced safety through comprehensive and repeatable testing in a virtual environment

- North America dominates the hardware in the loop market with a share of 34.1% in 2024 due to presence of major automotive and aerospace companies and increasing investments in advanced product development and validation technologies

- Asia-Pacific is expected to be the fastest growing region in the hardware in the loop market during the forecast period due to growing automotive production, expanding electronics sectors, and increased investment in infrastructure and automation

- Closed loop HIL segment is expected to dominate the market with a market share of 55.9% in 2024 due to its ability to simulate real-time feedback between physical and virtual components, which is essential for validating complex, safety-critical systems.

Report Scope and Hardware in the Loop Market Segmentation

|

Attributes |

Hardware in the Loop Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Hardware in the Loop Market Trends

“Increasing Adoption of HIL in Automotive”

- A prominent and rapidly expanding trend in the global Hardware in the Loop (HIL) market is the increasing adoption of this technology within the automotive industry. This growing emphasis is driven by the rising complexity of vehicle systems, the advent of electric and autonomous vehicles, and stringent safety and regulatory requirements

- For instance, major automotive manufacturers such as BMW and Toyota, as well as Tier 1 suppliers such as Bosch and Continental, are heavily investing in and utilizing HIL testing. These companies employ HIL systems to validate and verify the functionality and safety of various electronic control units (ECUs) and software responsible for critical functions such as powertrain control, advanced driver-assistance systems (ADAS), and autonomous driving

- This heightened adoption of HIL in automotive enables the creation of more reliable and safer vehicles by allowing for extensive testing in simulated real-world conditions without the need for physical prototypes or extensive on-road testing. It helps identify and resolve potential issues early in the development cycle, reducing development time and costs. Moreover, HIL testing is crucial for validating the increasing number of software-driven features and ensuring compliance with stringent automotive safety standards

- The growing recognition among automotive companies of the limitations of traditional testing methods and the potential of HIL to provide comprehensive and repeatable validation for complex electronic systems further fuels the importance of this trend as a critical component of modern automotive engineering and development strategies

- Organizations across the automotive sector are increasingly acknowledging the potential of HIL to accelerate innovation, enhance vehicle quality, and ensure the safety and reliability of next-generation vehicles. This trend towards greater adoption of HIL is driving significant advancements and investments in this area

- The demand for robust and efficient testing solutions is growing rapidly within the automotive industry, encouraging manufacturers to increasingly rely on HIL technology to validate the intricate electronic systems that power modern and future vehicles, ultimately boosting the effectiveness and safety of automobiles.

Hardware in the Loop Market Dynamics

Driver

“Increasing Complexity of Embedded Systems”

- The increasing recognition of the profound impact of advanced technology is a significant driver for the heightened demand for Hardware in the Loop (HIL) testing solutions. The rising complexity of embedded systems across various industries, including automotive, aerospace, robotics, and industrial automation, necessitates sophisticated testing methodologies to ensure their proper functionality, reliability, and safety

- For instance, leading technology and engineering companies, such as National Instruments (NI) and dSPACE, provide comprehensive HIL testing platforms that enable engineers to effectively manage the intricate software and hardware interactions within complex embedded systems. In the automotive sector, the increasing number of ECUs and sensors in modern vehicles, especially with the advent of electric and autonomous features, exemplifies this growing complexity. Similarly, in aerospace, the sophisticated control systems in aircraft require rigorous testing, often facilitated by HIL

- As the sophistication of these embedded systems grows, traditional testing methods become inadequate for verifying the multitude of potential scenarios and interactions. HIL testing offers a virtual environment where these complex systems can be subjected to a wide range of simulated conditions, allowing for thorough validation of control algorithms, software integration, and overall system behavior. This ensures that potential flaws or safety hazards are identified and rectified early in the development process, saving time, cost, and improving the final product quality

- Organizations across various industries are increasingly acknowledging the essential role of HIL testing in handling the intricacies of modern embedded systems, leading to increased investment and adoption of these technologies

- The demand for robust and efficient testing solutions is growing rapidly as the complexity of technological systems continues to escalate, encouraging industries to rely on HIL testing to ensure the reliable and safe operation of their increasingly sophisticated products

Restraint/Challenge

“Diverse systems and components”

- The wide array of diverse systems and components that need to be integrated and tested presents a significant challenge in the Hardware in the Loop (HIL) market. The lack of standardization across different industries and manufacturers leads to complexities in creating unified HIL testing environments that can effectively simulate the interactions between various hardware and software elements

- For instance, companies such as National Instruments (NI) and dSPACE offer HIL platforms that aim to be versatile, but the integration of specific ECUs, sensors, and actuators from different automotive suppliers, aerospace companies, or industrial automation vendors often requires custom interface development and configuration. This heterogeneity can lead to increased development time and cost for creating and maintaining comprehensive HIL test benches

- Addressing this challenge requires significant effort in developing adaptable simulation models, creating custom hardware interfaces, and ensuring compatibility across a wide range of protocols and communication standards. The complexity increases further with the integration of software from different sources and the need for real-time synchronization across diverse components

- While the ability of HIL testing to validate the interaction of diverse systems and components is its strength, the sheer variety and lack of standardization can make the initial setup and ongoing maintenance a complex and resource-intensive process, potentially hindering wider adoption, especially for smaller organizations with limited resources

- Overcoming these challenges involves continuous development of more open and interoperable HIL platforms, the creation of standardized interfaces and simulation models, and fostering greater collaboration across industries to promote more unified testing approaches. This will be vital for making HIL testing more accessible and efficient for a broader range of users dealing with diverse system and component integrations

Hardware in the Loop Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the market is segmented into open loop HIL and closed loop HIL. The closed loop HIL segment dominates with the largest market revenue share of 55.9% in 2024, driven by its ability to simulate real-time feedback between physical and virtual components, which is essential for validating complex, safety-critical systems. Industries such as automotive, aerospace, and power electronics rely heavily on closed loop HIL setups to ensure performance, reliability, and compliance with stringent safety standards.

The open loop HIL segment is expected to witness the fastest CAGR of 11.9% from 2025 to 2032, driven by its cost-effectiveness and suitability for early-stage development and academic research. Open loop systems, while lacking real-time feedback, are easier to implement and maintain, making them attractive to SMEs and organizations entering HIL testing for the first time. The rise of digital prototyping, growing demand in emerging economies, and wider adoption in low-to-mid complexity applications further drive its rapid growth trajectory.

- By Application

On the basis of application, the market is segmented into automotive, aerospace & defense, electronics and semiconductor, industrial equipment, research and education, energy and power, and others. The automotive segment dominates the largest market revenue share in 2024, driven by rapid advancement and complexity of modern vehicle systems such as advanced driver-assistance systems (ADAS), electric powertrains, and autonomous driving technologies. HIL testing enables real-time simulation of these systems, allowing manufacturers to reduce development time, enhance safety validation, and meet regulatory standards.

The aerospace & defense segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing reliance on mission-critical systems that demand extensive simulation and validation. Aerospace and defense applications involve highly complex avionics, control systems, and autonomous technologies where failure is not an option. The sector’s growing investment in unmanned aerial vehicles (UAVs), satellite systems, and defense automation further accelerates the adoption of HIL solutions for ensuring performance, safety, and compliance with strict regulatory frameworks.

Hardware in the Loop Market Regional Analysis

- North America dominates the hardware in the loop market with the largest revenue share of 34.1% in 2024, driven by the presence of major automotive and aerospace companies and increasing investments in advanced product development and validation technologies

- The region's focus on enhancing system efficiency and safety, especially in the automotive and defense sectors, fuels the adoption of HIL systems for real-time simulation and testing

- North America's robust R&D infrastructure, coupled with stringent regulatory standards and growing demand for electric and autonomous vehicles, is propelling the integration of HIL platforms in product design cycles

U.S. Hardware in the Loop Market Insight

U.S. hardware in the loop market held a dominant share of 87.7% in the North America market in 2024, largely due to strong government funding in aerospace and defense and rapid advancements in automotive testing. The country’s mature technology ecosystem, supported by key players such as National Instruments and dSPACE, is facilitating widespread deployment of HIL solutions in automotive ECUs, powertrain systems, and avionics. Furthermore, the growing focus on reducing development time and enhancing prototype accuracy continues to drive HIL adoption across industrial applications.

Europe Hardware in the Loop Market Insight

Europe hardware in the loop market is projected to register a solid CAGR over the forecast period, propelled by stringent vehicle safety norms and the transition toward electric mobility. Regulatory frameworks such as Euro NCAP and UN ECE standards are encouraging automakers to implement hardware in the loop testing to validate safety-critical functions. In addition, the growing shift towards Industry 4.0 and smart manufacturing practices is accelerating the deployment of hardware in the loop systems in both automotive and industrial automation sectors.

U.K. Hardware in the Loop Market Insight

U.K. hardware in the loop market is anticipated to grow significantly during the forecast period, supported by strong academic-industry collaboration and a robust automotive R&D environment. Key initiatives focused on electric and autonomous vehicle testing, coupled with support from government programs, are boosting demand for real-time simulation and validation technologies. U.K.'s emphasis on system innovation and reduced time-to-market is further contributing to the rising adoption of hardware in the loop platforms.

Germany Hardware in the Loop Market Insight

Germany’s hardware in the loop market is set to expand steadily, driven by the country’s leadership in automotive engineering and industrial automation. Leading OEMs and Tier 1 suppliers are increasingly using hardware in the loop systems to streamline the testing of embedded software in next-generation vehicles. In addition, the integration of hardware in the loop in renewable energy and rail systems highlights the versatility and strategic importance of these platforms in Germany’s technology landscape.

Asia-Pacific Hardware in the Loop Market Insight

Asia-Pacific is expected to witness the fastest CAGR of 12.1% in 2024, driven by growing automotive production, expanding electronics sectors, and increased investment in infrastructure and automation in countries such as China, Japan, and India. The region’s accelerating transition to electric vehicles and the development of smart cities are major catalysts for the adoption of HIL technologies. The rise of local HIL solution providers and cost-effective testing platforms is also enabling broader market penetration across industries.

Japan Hardware in the Loop Market Insight

Japan’s hardware in the loop market is gaining traction, particularly in automotive, robotics, and semiconductor applications. The country's focus on precision and safety in vehicle electronics and factory automation is encouraging the integration of real-time testing systems. With a strong inclination toward innovation and miniaturization, Japanese firms are deploying hardware in the loop solutions to ensure optimal performance and regulatory compliance of embedded control systems.

China Hardware in the Loop Market Insight

China accounted for the largest share of the Asia-Pacific hardware in the loop market in 2024, fueled by its rapid adoption of electric and autonomous vehicles and a booming industrial automation sector. The country’s push towards smart manufacturing and government-supported R&D initiatives are driving demand for scalable, efficient testing environments. Local technological advancements and the presence of domestic automotive giants are solidifying China's position as a key hardware in the loop market in the region.

Hardware in the Loop Market Share

The hardware in the loop industry is primarily led by well-established companies, including:

- dSPACE GmbH (Germany)

- NATIONAL INSTRUMENTS CORP (U.S.)

- Vector Informatik GmbH (Germany)

- Cognata (Israel)

- Siemens (Germany)

- MicroNova AG (Germany)

- Opal-RT Technologies (Canada)

- LHP Engineering Solutions (U.S.)

- IPG Automotive GmbH (Germany)

- Typhoon HIL (U.S.)

- Speedgoat GmbH (Switzerland)

- Eontronix (China)

- Wineman Technology (U.S.)

- Modeling Tech (U.S.)

- Robert Bosch GmbH (Germany)

Latest Developments in Global Hardware in the Loop Market

- In January 2024, dSPACE GmbH partnered with Spirent to advance real-time positioning scenarios for Autonomous Driving Hardware-in-the-Loop (AD-HIL) test systems. The collaboration integrates dSPACE’s AD-HIL platform with Spirent’s high-precision GNSS simulator, offering a comprehensive, turnkey solution for developers. By using real satellite signals, this partnership enhances the accuracy and safety of autonomous vehicle development

- In January 2024, Cognata announced a strategic partnership with Microsoft to incorporate its high-fidelity AI simulation technology into Microsoft’s Software-Defined Vehicle (SDV) development ecosystem. This integration enables OEMs to accelerate the validation and deployment of automated driving functions, leveraging Cognata’s simulation tools and Hardware-in-the-Loop testing capabilities within Microsoft's SDV Cloud Infrastructure

- In October 2022, National Instruments Corp unveiled a unified test system architecture tailored for advanced driver-assistance systems (ADAS) and autonomous driving (AD). This innovative solution facilitates seamless transitions between data replay and Hardware-in-the-Loop testing, using real-world or simulated data to validate ADAS ECUs. The system enhances testing efficiency, reduces capital equipment costs, and shortens time to market. National Instruments further strengthened its offering through collaborations with industry leaders such as ZF Mobility Solutions and Konrad Technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hardware In The Loop Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hardware In The Loop Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hardware In The Loop Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.