Global Health And Wellness Food Market

Market Size in USD Billion

CAGR :

%

USD

962.32 Billion

USD

1,989.01 Billion

2024

2032

USD

962.32 Billion

USD

1,989.01 Billion

2024

2032

| 2025 –2032 | |

| USD 962.32 Billion | |

| USD 1,989.01 Billion | |

|

|

|

|

Health and Wellness Food Market Size

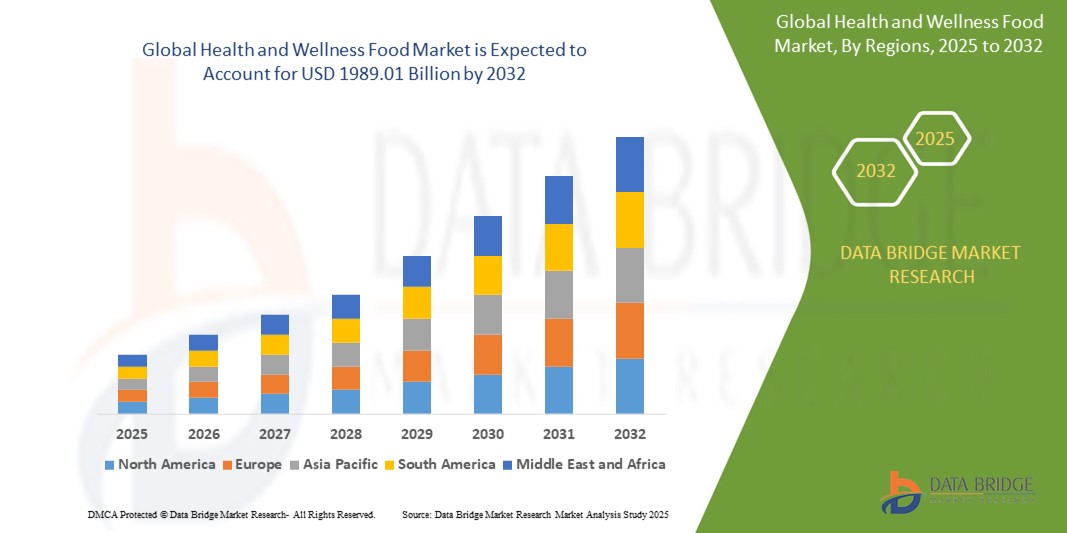

- The global health and wellness food market was valued at USD 962.32 billion in 2024 and is expected to reach USD 1989.01 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.50%, primarily driven by rising consumer awareness about healthy lifestyles

- This growth is driven by increasing demand for natural and organic products and a growing focus on preventive healthcare

Health and Wellness Food Market Analysis

- The health and wellness food market is witnessing remarkable growth fueled by increasing health consciousness, rising incidences of lifestyle-related diseases, and greater emphasis on preventive healthcare. Consumers are increasingly opting for organic, functional, and clean-label products, encouraging manufacturers to innovate with nutrient-rich and fortified foods. In addition, partnerships between food brands and health-tech companies are leading to personalized nutrition solutions, further enhancing consumer engagement and expanding the market footprint

- The surge in e-commerce and digital grocery platforms is accelerating the availability and accessibility of health and wellness food products. Busy urban lifestyles, combined with the growing influence of fitness and wellness trends on social media, are shifting purchasing patterns towards healthier options. Innovations such as plant-based alternatives, gut health supplements, and low-sugar snacks are gaining popularity, while investments in eco-friendly packaging and sustainable sourcing are helping brands appeal to environmentally conscious consumers

- For instance, in February 2025, PepsiCo announced a strategic pivot towards healthier options, relaunching its Simply line and expanding better-for-you brands such as Siete and Sabra, aligning with consumer demand for clean, nutritious products and strengthening its presence in the Health and Wellness Food sector

- Globally, the health and wellness food industry is rapidly evolving to meet the demand for transparency, sustainability, and functionality. Technological advancements such as AI-driven dietary recommendations, biowearable devices tracking nutrition metrics, and innovations in food fortification are reshaping the market. Combined with supportive government regulations and growing investments in wellness-focused startups, these trends are positioning health and wellness food as a vital and enduring segment of the global food economy

Report Scope and Health and Wellness Food Market Segmentation

|

Attributes |

Health and Wellness Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Health and Wellness Food Market Trends

“Integration of Functional Ingredients for Enhanced Health Benefits”

- Consumers are increasingly looking for foods that offer specific functional health benefits, such as improved gut health, immunity boosting, cognitive support, and stress reduction. This trend is fueling demand for products enriched with probiotics, prebiotics, adaptogens, superfoods, and omega-3 fatty acids

- Health and Wellness Food brands are innovating by fortifying everyday foods such as snacks, beverages, and ready meals with natural functional ingredients derived from herbs, spices, botanicals, and marine sources to meet consumer preferences for holistic well-being

- Marketing strategies are increasingly focused on clean labels, ingredient transparency, and scientific backing to build consumer trust and differentiate products in a competitive marketplace

For instance,

- In 2024, Danone introduced a new range of probiotic yogurts and plant-based smoothies under its “Activia+” line, targeting digestive and immune health through clinically tested strains

- Nestlé launched “Mindful Mix,” a snack range infused with ashwagandha and L-theanine to promote relaxation and mental wellness, especially targeting busy professionals and students

- PepsiCo expanded its functional beverage portfolio with the launch of “Soulboost,” a sparkling water drink fortified with ginseng and L-theanine to cater to the growing demand for mood-enhancing drinks

- As consumer awareness around preventive health and wellness rises, the integration of functional ingredients will become a cornerstone strategy for brands, helping the Health and Wellness Food market to drive deeper consumer loyalty and premiumization

Health and Wellness Food Market Dynamics

Driver

“Growing Consumer Focus on Clean Labels and Natural Ingredients”

- Rising consumer awareness about the impact of food ingredients on health is a major driver for the health and wellness food market, with clean labels and natural formulations gaining strong traction. Shoppers are increasingly demanding transparency, looking for products that are free from artificial colors, flavors, preservatives, and genetically modified organisms (GMOs)

- Brands are responding by reformulating products with simpler ingredient lists, using organic, non-GMO, and minimally processed ingredients. This shift is helping companies build trust, enhance brand loyalty, and cater to the growing segment of health-conscious consumers seeking authenticity and quality in their food choices

- Regulatory bodies and health advocacy groups are also encouraging clean labeling practices, making it a competitive necessity for food manufacturers aiming to capture and retain market share

For instance,

- In 2024, Danone expanded its “One Planet. One Health” initiative by launching a new range of organic dairy and plant-based products featuring clean labels in Europe and North America.

- The Simply Good Foods Company reported a 12% sales growth in 2024, driven by its strategic focus on clean-label, low-sugar snacks under the Atkins and Quest brands.

- Mondelez International, through its SnackFutures innovation hub, introduced a line of plant-based, clean-label snacks in early 2025, catering to evolving consumer demands for transparency and wellness

- As health-conscious lifestyles become mainstream and consumers continue scrutinizing product labels, the emphasis on clean-label and natural ingredient formulations is expected to shape the future trajectory of the health and wellness food market, promoting sustained innovation and growth

Opportunity

“Growing Popularity of Plant-Based and Functional Foods”

- The surging demand for plant-based diets and functional food products presents a significant opportunity for health and wellness food providers. Consumers are increasingly turning to plant-based proteins, dairy alternatives, and superfoods that offer health benefits such as improved immunity, better digestion, and enhanced mental well-being, creating new avenues for innovation and product development

- Food manufacturers are investing heavily in R&D to create flavorful, nutrient-dense plant-based offerings and fortified foods containing probiotics, prebiotics, vitamins, and adaptogens. This trend is further supported by the rise of flexitarian diets, where consumers consciously reduce meat consumption without fully committing to vegetarianism or veganism

- Supportive government policies, increasing vegan advocacy, and greater availability of plant-based ingredients are fueling rapid expansion across supermarkets, specialty stores, and foodservice outlets globally

For instance,

- In 2024, Nestlé expanded its Garden Gourmet range across Europe, offering plant-based meat and dairy alternatives fortified with essential nutrients to meet rising demand

- Beyond Meat partnered with several quick service restaurant chains in 2023 to introduce plant-based menu options targeting health-conscious consumers worldwide

- Danone North America launched a new line of fortified plant-based yogurts in early 2025, combining probiotics and high protein content to cater to functional food seekers

- As consumers increasingly prioritize preventive healthcare and ethical consumption, the health and wellness food market stands to benefit immensely from the growth of plant-based and functional foods, driving continuous innovation and market expansion

Restraint/Challenge

“High Costs of Sourcing Organic and Premium Ingredients”

- The rising costs of sourcing organic, non-GMO, and sustainably produced ingredients are a major challenge for health and wellness food providers. Strict quality standards, limited supply chain scalability, and unpredictable agricultural yields make premium ingredients significantly more expensive compared to conventional alternatives.

- Price volatility in organic farming, increased transportation costs, and the need for third-party certifications (such as USDA Organic or Fairtrade) add further financial burdens. These higher input costs often translate to more expensive end-products, which can limit consumer accessibility and shrink potential market segments

- Small and mid-sized businesses, in particular, find it difficult to compete with larger players who have established supply chain networks and bargaining power, leading to market consolidation and reduced diversity in product offerings

For instance,

- In 2024, multiple organic food brands in Europe, including Alnatura and Bio Company, reported a 15–20% increase in procurement costs due to supply chain disruptions and climate-related farming challenges

- Whole Foods Market announced selective price hikes on organic produce and specialty wellness foods in 2023, citing global inflation and supply shortages

- The Organic Trade Association (U.S.) highlighted in its 2024 annual report that organic certification costs remained a significant barrier for small farmers, impacting supply chain expansion

- As ingredient sourcing challenges persist, health and wellness food providers must explore innovative solutions such as vertical farming, local sourcing partnerships, and regenerative agriculture practices to stabilize costs and maintain competitive advantage in a price-sensitive market

Health and Wellness Food Market Scope

The market is segmented on the basis of type, calorie content, nature, fat content, category, free from category, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Calorie Content |

|

|

By Nature |

|

|

By Fat Content |

|

|

By Category |

|

|

By Free From Category |

|

|

By Distribution Channel |

|

Health and Wellness Food Market Regional Analysis

“North America is the Dominant Region in the Health and Wellness Food Market”

- Strong consumer awareness about health benefits and a proactive approach to preventive healthcare are driving the demand for health and wellness food across North America

- Government initiatives promoting organic farming and clean-label products are further boosting market growth in the region

- Leading food brands are heavily investing in product innovation, introducing plant-based, gluten-free, and functional foods tailored to health-conscious consumers

- These factors solidify North America’s dominance in the global health and wellness food market, ensuring continued leadership throughout the forecast period

“Asia-Pacific is projected to register the Highest Growth Rate”

- Rising disposable incomes and increasing health awareness among consumers are fueling demand for health and wellness food products across Asia-Pacific

- Government initiatives promoting healthy eating habits and the development of organic farming practices are further accelerating market growth in the region

- Rapid urbanization, along with the expansion of modern retail formats and e-commerce platforms, is making health and wellness products more accessible to a wider population

- These factors are expected to drive significant growth in Asia-Pacific’s health and wellness food market over the forecast period

Health and Wellness Food Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Danone (France)

- PepsiCo (U.S.)

- Mondelez International (U.S.)

- General Mills Inc. (U.S.)

- Kashi LLC (U.S.)

- The Quaker Oats Company (U.S.)

- Mars, Incorporated (U.S.)

- Abbott (U.S.)

- Huel Limited (U.K.)

- Green Valley Dairies (New Zealand)

- LIBERTÉ (Canada)

- Chobani, LLC (U.S.)

- Stonyfield Farm, Inc. (U.S.)

- Forager Project (U.S.)

- Kite Hill Store (U.S.)

- LAVVA (Israel)

- Enjoy Life (Kentucky, U.S.)

- Barrel LLC (U.S.)

- The Simply Good Foods Company (Georgia, U.S.)

- Alter Eco Foods (U.S.)

- Lake Champlain Chocolates (U.S.)

- Maspex (Poland)

- Kellanova (U.S.)

- Nestlé (Switzerland)

- Yakult Honsha Co., Ltd (Japan)

- GSK plc. (U.K.)

Latest Developments in Global Health and Wellness Food Market

- In February 2025, PepsiCo announced a strategic shift towards healthier product offerings, focusing on value and better-for-you options by relaunching its Simply line and expanding brands such as Siete and Sabra, while emphasizing its goal to reduce sodium and artificial ingredients to appeal to health-conscious consumers, concluding its commitment to driving a healthier product portfolio

- In February 2025, Mars revealed its plan to acquire Kellanova, aiming to strengthen its position in the snacking category by expanding its range of healthier options, concluding its strategy to boost growth in the health and wellness food segment

- In February 2025, Danone reported a return to volume/mix growth for fiscal-year 2024, fueled by rising demand for health and wellness products, especially in gut health and high-protein categories, concluding its successful alignment with evolving consumer health trends

- In February 2025, Quaker Oats experienced a product recall of its pancake mix due to the presence of undeclared milk, which was classified as the highest risk level by the FDA, concluding its need for strengthened quality control measures

- In January 2025, Abbott was honored with an innovation award for Lingo, a consumer biowearable device designed to monitor glucose levels and promote personal health management, concluding its advancement in supporting wellness through technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Health And Wellness Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Health And Wellness Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Health And Wellness Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.