Global Healthcare Additive Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

10.92 Billion

USD

51.87 Billion

2024

2032

USD

10.92 Billion

USD

51.87 Billion

2024

2032

| 2025 –2032 | |

| USD 10.92 Billion | |

| USD 51.87 Billion | |

|

|

|

|

Healthcare Additive Manufacturing Market Size

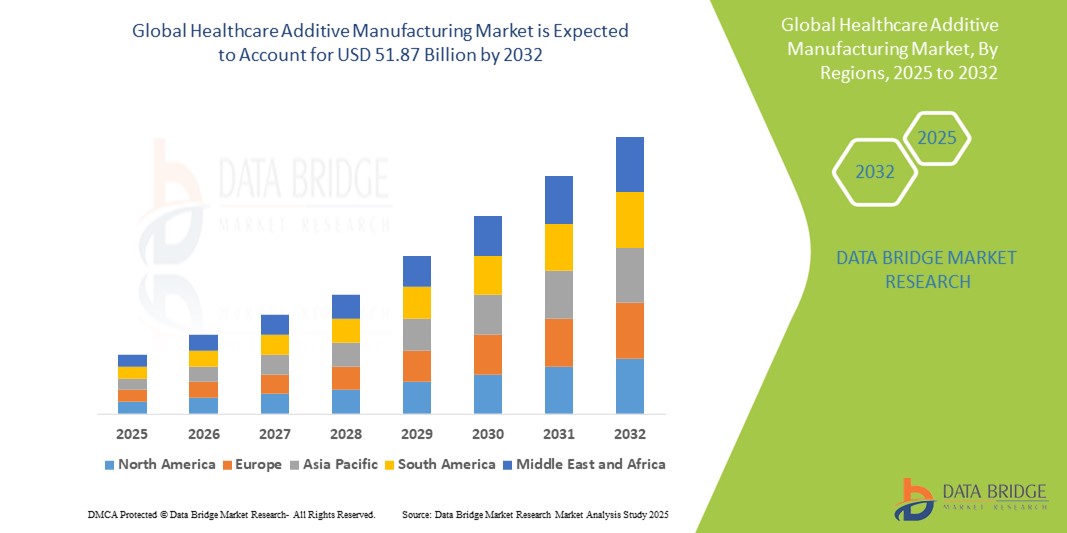

- The global healthcare additive manufacturing market size was valued at USD 10.92 billion in 2024 and is expected to reach USD 51.87 billion by 2032, at a CAGR of 21.50% during the forecast period

- The market growth is largely fueled by increasing applications of 3D printing in personalized medicine, prosthetics, surgical planning, and tissue engineering, enabling customized and patient-specific healthcare solutions

- Furthermore, rising investments in medical innovation and demand for cost-effective, rapid prototyping in healthcare are positioning additive manufacturing as a transformative tool in the medical sector. These converging factors are accelerating the adoption of additive manufacturing in healthcare, thereby significantly boosting the industry’s growth

Healthcare Additive Manufacturing Market Analysis

- Healthcare additive manufacturing, involving 3D printing technologies to produce customized medical components, is becoming a cornerstone in modern medical practices across prosthetics, implants, surgical planning, and bioprinting due to its precision, personalization, and reduced production lead times

- The rising demand for healthcare additive manufacturing is primarily fueled by the growing need for patient-specific medical solutions, advancements in biocompatible materials, and increasing investment in medical research and development

- North America dominated the healthcare additive manufacturing market with the largest revenue share of 38.6% in 2024, characterized by robust healthcare infrastructure, high R&D spending, and early adoption of advanced manufacturing technologies, particularly in the U.S., where 3D printing is increasingly used for orthopedic, dental, and cardiovascular applications

- Asia-Pacific is expected to be the fastest growing region in the healthcare additive manufacturing market during the forecast period due to expanding healthcare expenditure, government initiatives to modernize medical systems, and growing awareness of personalized healthcare solutions

- Laser Sintering segment dominated the healthcare additive manufacturing market with a market share of 30.9% in 2024, driven by its high precision, ability to process complex geometries, and compatibility with a wide range of biocompatible materials

Report Scope and Healthcare Additive Manufacturing Market Segmentation

|

Attributes |

Healthcare Additive Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Additive Manufacturing Market Trends

“Personalized Care through Bioprinting and Advanced Material Innovation”

- A significant and accelerating trend in the global healthcare additive manufacturing market is the rapid advancement in bioprinting technologies and the development of innovative, biocompatible materials. These breakthroughs are enabling the production of complex, patient-specific anatomical models, implants, and even tissue constructs, thereby transforming personalized care delivery

- For instance, companies such as 3D Systems and Organovo are pioneering bioprinting platforms capable of fabricating human tissue for drug testing and regenerative medicine applications. Similarly, CELLINK has developed bioinks tailored for specific tissue engineering needs, enhancing precision and functionality in bioprinted constructs

- Additive manufacturing now enables healthcare providers to produce implants, prosthetics, and surgical guides that are uniquely tailored to an individual’s anatomy, leading to improved fit, functionality, and patient outcomes. In addition, the availability of advanced materials such as titanium alloys and bioresorbable polymers is expanding the scope of applications in orthopedics and cardiovascular interventions

- The integration of additive manufacturing with digital imaging technologies such as CT and MRI further enhance precision by allowing seamless translation of diagnostic data into customized, 3D-printable solutions. For instance, Materialise’s Mimics software is widely used for converting imaging data into surgical planning models and implant designs

- This trend toward highly customized, patient-specific medical solutions is fundamentally redefining standards in surgical planning, prosthetic development, and implant fabrication. As a result, key players such as Stryker and EOS are investing heavily in additive technologies to expand personalized medical offerings

- The demand for tailored healthcare solutions driven by additive manufacturing continues to grow rapidly across orthopedic, dental, and surgical segments, as healthcare systems increasingly prioritize precision, patient-centric care, and operational efficiency

Healthcare Additive Manufacturing Market Dynamics

Driver

“Rising Demand for Personalized Medical Solutions and Advanced Surgical Planning”

- The increasing demand for patient-specific medical devices and the growing emphasis on precision medicine are significant drivers for the accelerated adoption of healthcare additive manufacturing technologies

- For instance, in February 2024, 3D Systems announced the expansion of its VSP (Virtual Surgical Planning) solutions in collaboration with leading hospitals to support personalized maxillofacial and orthopedic surgeries. Such initiatives highlight how key players are leveraging additive manufacturing to enhance clinical outcomes

- As healthcare providers prioritize individualized treatment strategies, additive manufacturing enables the production of customized implants, prosthetics, anatomical models, and surgical guides tailored to each patient’s anatomy, greatly improving surgical accuracy and recovery

- Furthermore, the integration of 3D printing with medical imaging tools such as CT and MRI allow clinicians to plan complex surgeries more effectively, reducing intraoperative risks and improving overall efficiency

- The ability to rapidly prototype and produce on-demand medical components shortens supply chains and lowers costs, especially in low-volume, high-complexity applications. This is particularly valuable in fields such as orthopedics, dentistry, and regenerative medicine

- Advancements in biocompatible materials and the rising availability of regulatory-cleared 3D printed devices are further propelling adoption. Together with increasing awareness among healthcare professionals and patients, these factors are contributing to the sustained growth of the healthcare additive manufacturing market

Restraint/Challenge

“Material Compatibility Limitations and Regulatory Compliance Hurdles”

- Despite its transformative potential, the healthcare additive manufacturing market faces challenges related to the limited availability of fully biocompatible and regulatory-approved materials for critical applications such as implants and tissue engineering

- For instance, while titanium and PEEK are widely used for implants, restrictions exist on their usage based on application-specific biocompatibility, sterilization needs, and long-term performance, limiting broader clinical adoption in some fields

- Navigating complex regulatory frameworks across regions also poses a major hurdle. Medical-grade 3D printed devices must comply with stringent guidelines set by regulatory bodies such as the U.S. FDA or the European Medicines Agency, which often demand extensive validation, documentation, and long clinical approval timelines

- Companies such as Stryker and Materialise invest heavily in regulatory compliance processes and quality management systems to meet these requirements, but the time and cost involved can be prohibitive for smaller players

- In addition, the lack of standardized protocols for 3D printing in clinical settings and concerns over reproducibility and quality consistency present barriers to widespread adoption, particularly for patient-specific devices and bioprinted tissues

- Overcoming these challenges through the development of next-generation biomaterials, clearer regulatory pathways, and industry-wide standardization will be essential to unlock the full potential of additive manufacturing in healthcare and ensure sustained market growth

Healthcare Additive Manufacturing Market Scope

The market is segmented on the basis of technology, application, and material.

- By Technology

On the basis of technology, the healthcare additive manufacturing market is segmented into stereolithography, deposition modeling, electron beam melting, laser sintering, jetting technology, laminated object manufacturing, and others. The laser sintering segment dominated the market with the largest market revenue share of 30.9% in 2024, driven by its ability to produce high-strength, complex, and durable parts with excellent dimensional accuracy. Laser sintering is widely used for manufacturing surgical instruments, orthopedic implants, and dental components due to its ability to work with high-performance thermoplastics and metals. Its suitability for batch production and functional prototypes makes it a preferred choice for healthcare manufacturers seeking both precision and scalability.

The stereolithography segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its high-resolution printing capabilities ideal for creating intricate anatomical models and dental applications. Its compatibility with biocompatible photopolymers and smooth surface finish makes it increasingly popular in pre-surgical planning and custom prosthetics, where detail and aesthetics are critical.

- By Application

On the basis of application, the healthcare additive manufacturing market is segmented into medical implants, prosthetics, wearable devices, tissue engineering, and others. The medical implants segment held the largest market revenue share in 2024 due to the growing demand for patient-specific orthopedic, spinal, and cranial implants. Additive manufacturing enables the design of porous structures that promote osseointegration and reduce implant rejection. Customization, rapid prototyping, and reduced surgical time are key factors driving the widespread adoption of 3D-printed implants.

The tissue engineering segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by advancements in bioprinting technologies and the increasing focus on regenerative medicine. The ability to print scaffolds and cell-laden structures tailored to individual patients is accelerating research and development in tissue engineering, offering promising applications in skin grafts, cartilage regeneration, and organ modeling.

- By Material

On the basis of material, the healthcare additive manufacturing market is segmented into metals and alloys, polymers, biological cells, and others. The metals and alloys segment dominated the market in 2024, attributed to their high strength, durability, and biocompatibility, making them suitable for load-bearing implants such as hip and knee replacements. Materials such as titanium, cobalt-chrome, and stainless steel are commonly used due to their favorable mechanical properties and regulatory acceptance.

The biological cells segment is projected to experience the fastest growth from 2025 to 2032, as bioprinting emerges as a revolutionary approach to developing tissue models and organ-on-chip systems. Continuous innovation in bioinks and cell-printing techniques is driving research in personalized regenerative therapies, with potential future applications in fully functional organ fabrication.

Healthcare Additive Manufacturing Market Regional Analysis

- North America dominated the healthcare additive manufacturing market with the largest revenue share of 38.6% in 2024, driven by robust healthcare infrastructure, high R&D spending, and early adoption of advanced manufacturing technologies

- The region’s healthcare providers and research institutions increasingly utilize additive manufacturing for patient-specific implants, surgical planning, and bioprinting applications, supported by collaborations between academia and key industry players

- Favorable regulatory frameworks, high healthcare expenditure, and the presence of leading market participants contribute to the widespread adoption of healthcare additive manufacturing across clinical and commercial settings, positioning North America as the leader in this space

U.S. Healthcare Additive Manufacturing Market Insight

The U.S. healthcare additive manufacturing market captured the largest revenue share of 78.4% in 2024 within North America, fueled by robust R&D investments, high demand for patient-specific solutions, and early adoption of advanced medical technologies. Leading institutions and companies in the U.S. are driving innovation in bioprinting, implants, and prosthetics, enabling faster prototyping and personalized treatment options. In addition, the presence of a strong regulatory framework supporting medical device development fosters a thriving environment for additive manufacturing adoption.

Europe Healthcare Additive Manufacturing Market Insight

The Europe healthcare additive manufacturing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by supportive government policies, growing healthcare expenditure, and increased use of customized medical solutions. The region’s strong focus on technological advancement in healthcare, especially in countries such as Germany, the U.K., and France, is accelerating the integration of 3D printing for implants, surgical planning, and prosthetics. Europe’s commitment to sustainability and precision medicine is also influencing market growth.

U.K. Healthcare Additive Manufacturing Market Insight

The U.K. healthcare additive manufacturing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong academic and clinical collaboration, investment in NHS innovation programs, and demand for cost-effective, tailored healthcare solutions. The country's increasing adoption of 3D printing in surgical planning, dental care, and orthopedics is transforming patient care. Furthermore, regulatory support for innovation and a growing focus on healthcare digitization are stimulating growth across the market.

Germany Healthcare Additive Manufacturing Market Insight

The Germany healthcare additive manufacturing market is expected to expand at a considerable CAGR during the forecast period, fueled by its leadership in engineering excellence, medtech innovation, and healthcare digitization. Germany’s emphasis on precision, efficiency, and sustainability aligns well with additive manufacturing, particularly for implants, prosthetics, and medical instruments. The integration of 3D printing within hospital networks and R&D institutions supports continuous advancement in personalized healthcare delivery.

Asia-Pacific Healthcare Additive Manufacturing Market Insight

The Asia-Pacific healthcare additive manufacturing market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by expanding healthcare infrastructure, government-backed innovation initiatives, and rising demand for affordable and localized medical devices. Countries such as China, Japan, and India are at the forefront of integrating 3D printing into their healthcare systems. The region’s role as a manufacturing hub and the increasing emphasis on accessible healthcare solutions are enhancing market penetration.

Japan Healthcare Additive Manufacturing Market Insight

The Japan healthcare additive manufacturing market is gaining momentum due to the country’s advanced technological capabilities and focus on aging population care. With rising demand for personalized healthcare solutions, Japan is integrating 3D printing in orthopedics, dental care, and bioprinting. The government’s support for medtech innovation, coupled with strong university-industry collaborations, is accelerating the adoption of additive manufacturing technologies in healthcare facilities and research centers.

India Healthcare Additive Manufacturing Market Insight

The India healthcare additive manufacturing market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to a growing medtech ecosystem, rapid urbanization, and the government’s push for digital healthcare innovation. India is increasingly leveraging 3D printing for low-cost prosthetics, dental implants, and surgical planning tools, particularly in rural and semi-urban regions. Local startups and academic institutions are playing a key role in driving adoption, supported by a rising focus on indigenized, cost-effective medical technologies.

Healthcare Additive Manufacturing Market Share

The healthcare additive manufacturing industry is primarily led by well-established companies, including:

- Stratasys (U.S.)

- Materialise (Belgium)

- 3D Systems, Inc. (U.S.)

- General Electric Company (U.S.)

- EOS GmbH (Germany)

- Nikon SLM Solutions Group AG (Germany)

- Renishaw plc (U.K.)

- voxeljet AG (Germany)

- ExOne (U.S.)

- TRUMPF (Germany)

- Desktop Metal, Inc. (U.S.)

- Optomec, Inc. (U.S.)

- Stryker (U.S.)

- Siemens Healthineers AG (Germany)

- HP Inc. (U.S.)

- Carbon, Inc. (U.S.)

- Prodways Group (France)

- Bego GmbH & Co. KG (Germany)

What are the Recent Developments in Global Healthcare Additive Manufacturing Market?

- In April 2025, The Electron Beam Consortium (EBC) was established by companies such as ALD Vacuum Technologies and Freemelt to advance PBF‑EB technology in healthcare, focusing on sustainability and performance enhancements in medical device production

- In March 2025, Flow Science launched FLOW‑3D 2025R1 with integrated AM simulation tools for Powder Bed Fusion and Directed Energy Deposition, enabling faster, more accurate medical device manufacturing workflows

- In April 2025, America Makes and ANSI published a "Gaps Progress Report" addressing standardization challenges in additive manufacturing, including materials, design, and process control—crucial for consistent implementation in healthcare

- In May 2025, AIIMS Bhopal (India) received a grant to integrate DLP/SLA 3D printing for kidney surgery, developing patient‑specific anatomical models and puncture guides to improve surgical precision and outcomes

- In May 2025, Researchers at Caltech developed a technique using focused ultrasound and bioinks to print drug-delivery implants in vivo, enabling real-time ultrasound guidance and localized chemotherapy delivery in animal models

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.