Global Healthcare And Medical System Integrators Market

Market Size in USD Billion

CAGR :

%

USD

2.61 Billion

USD

6.02 Billion

2025

2033

USD

2.61 Billion

USD

6.02 Billion

2025

2033

| 2026 –2033 | |

| USD 2.61 Billion | |

| USD 6.02 Billion | |

|

|

|

|

Healthcare and Medical System Integrators Market Size

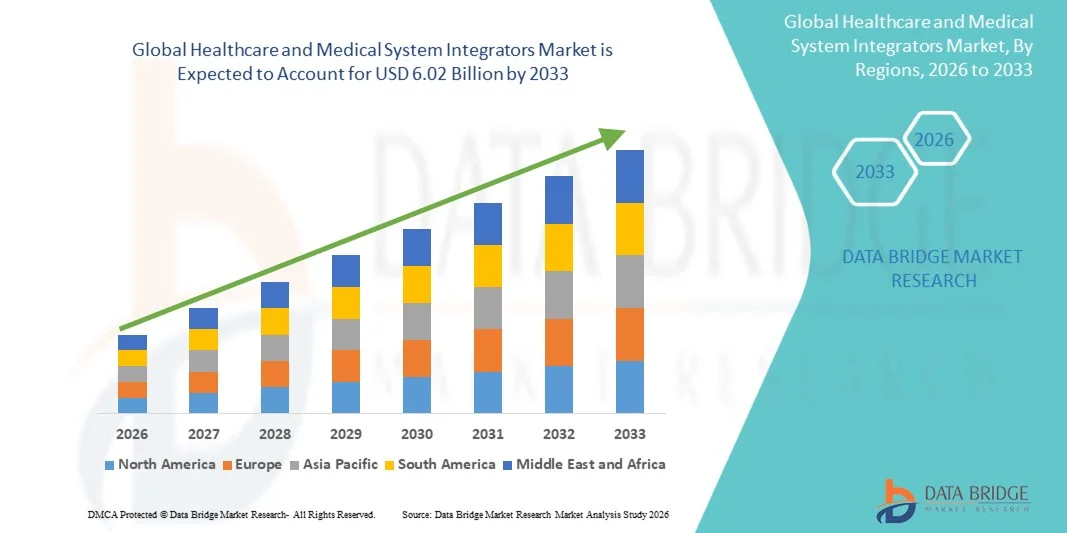

- The global healthcare and medical system integrators market size was valued at USD 2.61 billion in 2025 and is expected to reach USD 6.02 billion by 2033, at a CAGR of 11.02% during the forecast period

- The market growth is largely fueled by increasing digitization in healthcare, rising adoption of integrated healthcare IT solutions, and the urgent need for interoperability among disparate medical systems enabling seamless data exchange across hospitals, clinics, and diagnostic centers

- Furthermore, escalating demand for enhanced operational efficiency, improved patient care coordination, and sophisticated connected healthcare platforms is positioning medical system integrators as essential enablers of modern healthcare infrastructure. These converging factors are accelerating the uptake of integrated solutions, thereby significantly boosting market expansion through the forecast period

Healthcare and Medical System Integrators Market Analysis

- Healthcare and medical system integrators, providing comprehensive integration solutions for healthcare IT systems, are becoming increasingly essential for hospitals, clinics, and healthcare organizations due to their ability to streamline patient data management, enhance operational efficiency, and ensure interoperability across multiple medical devices and platforms

- The rising demand for healthcare system integrators is primarily driven by the growing digitization of healthcare infrastructure, increasing adoption of connected healthcare technologies, and the need to improve patient care quality through integrated solutions

- North America dominated the healthcare and medical system integrators market with the largest regional revenue share of 42.5% in 2025, supported by advanced healthcare infrastructure, high IT adoption rates, and the strong presence of leading integrator companies offering AI-enabled analytics, cloud-based platforms, and telehealth integration services

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period, fueled by expanding hospital networks, increasing healthcare investments, government initiatives for digital healthcare transformation, and rising adoption of connected healthcare systems

- Vertical Integration segment dominated the market with a market share of 62.1% in 2025, driven by demand for integrated, end-to-end system solutions across hospital operations

Report Scope and Healthcare and Medical System Integrators Market Segmentation

|

Attributes |

Healthcare and Medical System Integrators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Healthcare and Medical System Integrators Market Trends

“Enhanced Efficiency Through AI and Telehealth Integration”

- A significant and accelerating trend in the global healthcare and medical system integrators market is the increasing integration of artificial intelligence (AI) and telehealth platforms, enhancing operational efficiency and patient care coordination across hospitals, clinics, and healthcare networks

- For instance, Epic Systems’ AI-enabled integration platform allows hospitals to analyze patient data and optimize clinical workflows, while Cerner’s telehealth solutions enable seamless remote patient monitoring and virtual consultations

- AI integration in medical system platforms facilitates predictive analytics for patient outcomes, intelligent resource allocation, and real-time alerts for critical events. For instance, some Allscripts solutions use AI to optimize staffing and detect abnormal patient vitals, improving care quality

- The integration of telehealth and AI-enabled systems supports centralized management of hospital operations, patient records, and connected medical devices, creating a unified, efficient, and automated healthcare ecosystem

- This trend toward smarter, more connected healthcare systems is transforming expectations for operational performance and patient care quality. Consequently, companies such as GE Healthcare and Philips are developing AI-driven integrator platforms with predictive analytics and telehealth compatibility

- The adoption of integrated solutions that combine AI and telehealth is increasing rapidly across hospitals and healthcare organizations, as providers prioritize efficiency, continuity of care, and real-time decision-making capabilities

Healthcare and Medical System Integrators Market Dynamics

Driver

“Rising Demand Due to Increasing Healthcare Digitization and Operational Complexity”

- The accelerating digitization of healthcare infrastructure and the need for streamlined hospital operations are significant drivers for the rising demand for medical system integrators

- For instance, in March 2025, Cerner announced a major deployment of its AI-enabled hospital integration platform in multiple U.S. hospitals to centralize patient records and optimize workflows

- As hospitals and clinics face growing operational complexity, integrator solutions offer advanced features such as real-time patient data access, automated reporting, and interoperability across medical devices, enhancing clinical efficiency

- Furthermore, the increasing adoption of connected healthcare technologies and telehealth services makes system integrators indispensable for ensuring seamless data exchange and coordinated patient care

- The ability to centralize hospital operations, improve patient care, and support regulatory compliance drives the adoption of integrator platforms across both public and private healthcare facilities, with for instance, Allscripts enabling efficient workflow management and telehealth integration

Restraint/Challenge

“Data Security Concerns and High Implementation Costs”

- Concerns regarding data privacy, cybersecurity vulnerabilities, and compliance with healthcare regulations pose key challenges to market growth, limiting broader adoption of integrated systems

- For instance, high-profile reports of EHR breaches and ransomware attacks on hospital networks have made some healthcare providers cautious about adopting integrated IT solutions

- Addressing these cybersecurity concerns through encryption, secure authentication protocols, and regular software updates is crucial. For instance, Epic Systems and Cerner emphasize secure data handling and compliance features to build trust with hospitals

- High initial costs of advanced integration solutions compared to legacy systems can be a barrier for smaller clinics or budget-constrained hospitals. While cloud-based platforms are becoming more affordable, premium features such as predictive analytics or full telehealth integration still carry higher expenses

- Overcoming these challenges via enhanced cybersecurity, provider education on best practices, and development of cost-effective solutions will be vital to sustain market growth and adoption

Healthcare and Medical System Integrators Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the healthcare and medical system integrators market is segmented into horizontal integration and vertical integration. The Vertical Integration segment dominated the market with the largest revenue share of 62.1% in 2025, driven by the increasing demand for end-to-end integrated healthcare solutions across hospitals and multi-specialty clinics. Hospitals and healthcare organizations prioritize vertically integrated platforms because they enable centralized management of patient data, streamlined workflows, and enhanced interoperability across multiple systems and medical devices. Vertical integration solutions often include AI-enabled analytics, telehealth connectivity, and automated administrative functions, improving operational efficiency and clinical decision-making. Providers also favor vertical integration for its ability to ensure compliance with healthcare regulations and security standards. The adoption of vertical integration is further supported by government initiatives to modernize healthcare IT infrastructure and enhance quality of care. Large hospital networks and healthcare organizations continue to deploy these solutions to optimize resource utilization and patient outcomes while minimizing operational complexities.

The Horizontal Integration segment is anticipated to witness the fastest growth rate of 11.5% CAGR from 2026 to 2033, fueled by rising adoption among smaller hospitals, clinics, and healthcare organizations seeking standardized IT solutions that connect multiple independent systems. Horizontal integration allows seamless data sharing between different departments, hospitals, or service providers without requiring full end-to-end platform replacement, making it cost-effective and flexible. Providers value horizontal integration for its scalability, interoperability, and ability to integrate legacy systems with modern digital platforms. It supports initiatives such as shared electronic health records (EHRs), telehealth networks, and collaborative care across multiple facilities. The growing emphasis on population health management, remote patient monitoring, and cross-institutional collaboration is further accelerating the adoption of horizontal integration solutions.

- By Application

On the basis of application, the healthcare and medical system integrators market is segmented into government hospitals, private hospitals and clinics, healthcare organizations, and others. The Government Hospitals segment dominated the market with the largest share of 54% in 2025, driven by large-scale digitization initiatives and government programs aimed at modernizing public healthcare infrastructure. Government hospitals often handle high patient volumes and require integrated solutions to streamline workflows, manage electronic health records, and coordinate care across departments. Investments in AI, predictive analytics, and telehealth platforms are helping government hospitals optimize patient outcomes and operational efficiency. These institutions also prioritize system integrators to maintain compliance with national healthcare regulations, data security standards, and standardized reporting. The integration of hospital information systems with lab, pharmacy, and imaging departments improves coordination and reduces errors. Furthermore, government funding and policy support accelerate the deployment of integration solutions across multiple facilities, creating a strong market for integrators in the public healthcare segment.

The Private Hospitals and Clinics segment is expected to witness the fastest growth rate of ~12% CAGR from 2026 to 2033, fueled by increasing adoption of advanced healthcare IT solutions to enhance patient experience, operational efficiency, and service differentiation. Private healthcare providers are investing in integrated platforms that offer real-time patient monitoring, seamless EHR access, and telehealth services. The flexibility, scalability, and customization offered by integration solutions appeal to private hospitals looking to compete on quality of care and service innovation. Integration solutions in private hospitals enable efficient scheduling, billing, and remote consultations, enhancing both administrative and clinical performance. Growing patient expectations for connected care and technological convenience are accelerating deployment. In addition, partnerships with technology vendors and AI-focused integrators are enabling private healthcare providers to adopt sophisticated digital platforms more rapidly than their public counterparts.

Healthcare and Medical System Integrators Market Regional Analysis

- North America dominated the healthcare and medical system integrators market with the largest regional revenue share of 42.5% in 2025, supported by advanced healthcare infrastructure, high IT adoption rates, and the strong presence of leading integrator companies offering AI-enabled analytics, cloud-based platforms, and telehealth integration services

- Healthcare providers in the region highly value integrated solutions that improve operational efficiency, ensure interoperability across departments, and support AI-enabled analytics, telehealth services, and centralized patient data management

- This widespread adoption is further supported by high healthcare spending, a technology-oriented provider base, and increasing demand for connected care platforms, establishing system integrators as essential enablers for both public and private healthcare facilities.

U.S. Healthcare and Medical System Integrators Market Insight

The U.S. healthcare and medical system integrators market captured the largest revenue share of 44% in 2025, driven by the early adoption of digital healthcare solutions and the presence of advanced hospital IT infrastructure. Healthcare providers are increasingly prioritizing the integration of electronic health records, AI-enabled analytics, and telehealth platforms to improve operational efficiency and patient care quality. The growing demand for interoperable systems that connect multiple departments and facilities is further propelling market growth. Moreover, government initiatives supporting digital health modernization and compliance with healthcare regulations are accelerating adoption. Hospitals and private clinics are deploying integrated platforms to streamline workflows, reduce administrative burden, and enhance clinical decision-making. Strong partnerships between technology vendors and healthcare providers continue to expand the market in the U.S.

Europe Healthcare and Medical System Integrators Market Insight

The Europe healthcare and medical system integrators market is projected to expand at a substantial CAGR during the forecast period, primarily driven by government investments in digital hospital infrastructure and stringent healthcare compliance regulations. Increasing urbanization and the adoption of connected healthcare technologies are fostering the implementation of integration platforms across hospitals and clinics. Providers value integrated solutions for their ability to optimize workflows, ensure secure data exchange, and support telehealth services. The region is witnessing significant growth across both public and private hospitals, with system integrators being deployed in new hospitals as well as modernization projects. Advanced analytics and cloud-based integration platforms are increasingly adopted to enhance operational efficiency and patient outcomes.

U.K. Healthcare and Medical System Integrators Market Insight

The U.K. healthcare and medical system integrators market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of digital transformation in the National Health Service (NHS) and private healthcare facilities. Concerns regarding patient data security and operational efficiency are encouraging providers to adopt integrated IT platforms. The U.K.’s robust healthcare infrastructure, coupled with strong IT support and digital health initiatives, is expected to continue driving market growth. System integrators are increasingly used to connect multiple hospital departments, streamline administrative processes, and enable telehealth services. Providers are also leveraging AI-enabled platforms for predictive analytics, resource management, and patient monitoring.

Germany Healthcare and Medical System Integrators Market Insight

The Germany healthcare and medical system integrators market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong emphasis on innovation, digital healthcare modernization, and data security compliance. Germany’s advanced hospital infrastructure and focus on sustainable healthcare technology promote the adoption of integrated solutions, particularly in large multi-specialty hospitals and university medical centers. Providers are increasingly integrating AI analytics, electronic health records, and connected medical devices to optimize patient care. Integration platforms are being deployed in both new hospital constructions and renovation projects to enhance workflow efficiency. Secure, privacy-focused solutions that align with local regulatory standards are particularly preferred.

Asia-Pacific Healthcare and Medical System Integrators Market Insight

The Asia-Pacific healthcare and medical system integrators market is poised to grow at the fastest CAGR of 13% during the forecast period of 2026 to 2033, driven by increasing healthcare investments, rapid hospital network expansion, and rising demand for connected healthcare solutions in countries such as China, Japan, and India. Government initiatives promoting digital health transformation, telehealth adoption, and smart hospital development are driving market growth. Integration platforms are increasingly implemented across both urban and semi-urban healthcare facilities. The growing adoption of AI, cloud-based solutions, and interoperable EHR systems is facilitating better patient outcomes and operational efficiency. Local technology providers and partnerships with global integrators are enhancing accessibility and affordability of integration solutions in the region.

Japan Healthcare and Medical System Integrators Market Insight

The Japan healthcare and medical system integrators market is gaining momentum due to the country’s advanced healthcare IT infrastructure, high technology adoption, and focus on connected care. Hospitals and clinics increasingly deploy integration platforms to connect multiple departments, streamline workflows, and enable telehealth services. The adoption of AI-enabled analytics supports predictive care, resource management, and patient outcome optimization. Japan’s aging population is further driving demand for efficient, integrated healthcare systems to support chronic disease management and elderly care. Government incentives and investment in hospital IT modernization are also fueling market expansion. Integration solutions are being implemented in both new hospitals and renovations of existing facilities to enhance operational efficiency and patient care quality.

India Healthcare and Medical System Integrators Market Insight

The India healthcare and medical system integrators market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid hospital network expansion, rising healthcare investments, and increasing adoption of digital health solutions. India is witnessing growing deployment of electronic health records, telehealth platforms, and AI-based analytics to optimize patient care and hospital workflows. The push towards smart hospitals, healthcare modernization programs, and government initiatives for digital healthcare are key factors propelling market growth. Integration platforms are increasingly used in both private hospitals and government facilities to streamline operations and improve patient outcomes. Partnerships with global technology providers and the rise of domestic integrator solutions are further enhancing adoption across the country.

Healthcare and Medical System Integrators Market Share

The Healthcare and Medical System Integrators industry is primarily led by well-established companies, including:

- Allscripts Company LLC (U.S.)

- Veradigm LLC (U.S.)

- NextGen Healthcare, Inc. (U.S.)

- Merative L.P. (U.S.)

- eClinicalWorks, LLC (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Oracle (U.S.)

- IBM (U.S.)

- Dell Technologies (U.S.)

- Cisco Systems, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- SAP SE (Germany)

- Accenture plc (Ireland)

- Deloitte (U.K.)

- KPMG International (Netherlands)

- PwC (U.K.)

- Cognizant Technology Solutions (U.S.)

- Infosys Limited (India)

- TCS (India)

What are the Recent Developments in Global Healthcare and Medical System Integrators Market?

- In October 2025, Deutsche Telekom/T‑Systems acquires Austrian healthcare IT specialist synedra to strengthen hospital data integration and AI‑driven health platforms. Deutsche Telekom’s T‑Systems division expanded its healthcare IT footprint by acquiring synedra, a company specializing in medical data management solutions for hospitals

- In July 2025, U.S. CMS announces a new interoperability initiative with major tech firms to build a digital health ecosystem. The Centers for Medicare & Medicaid Services (CMS), alongside tech leaders including Amazon, Apple, Google, and OpenAI, committed to creating a “digital health ecosystem” aimed at improving health information sharing between patients and providers via a new interoperability framework

- In March 2025, InterSystems launches InterSystems IntelliCare, an AI‑powered EHR designed to enhance clinician workflows and streamline hospital operations. InterSystems unveiled its next‑generation electronic health record and healthcare information system, called InterSystems IntelliCare, leveraging AI to optimize clinical workflows, reduce administrative burden, and improve operational efficiency across healthcare enterprises

- In May 2024, Health Data Movers forms a strategic alliance partnership with MEDITECH to enhance EHR integration for healthcare providers. Health Data Movers announced it joined MEDITECH’s Alliance Partnership program, positioning itself as a trusted integrator of MEDITECH’s Best in KLAS EMR technology and expanding its role in healthcare data management and system integration services

- In December 2021, Oracle completes its acquisition of Cerner, a major EHR and integration platform provider. Oracle completed the historic acquisition of Cerner Corporation, one of the largest healthcare IT and integration technology suppliers, aiming to strengthen its position in electronic health records, cloud services, and integrated healthcare platforms globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.