Global Healthcare Fraud Detection Market

Market Size in USD Billion

CAGR :

%

USD

7.33 Billion

USD

55.93 Billion

2025

2033

USD

7.33 Billion

USD

55.93 Billion

2025

2033

| 2026 –2033 | |

| USD 7.33 Billion | |

| USD 55.93 Billion | |

|

|

|

|

Healthcare Fraud Detection Market Size

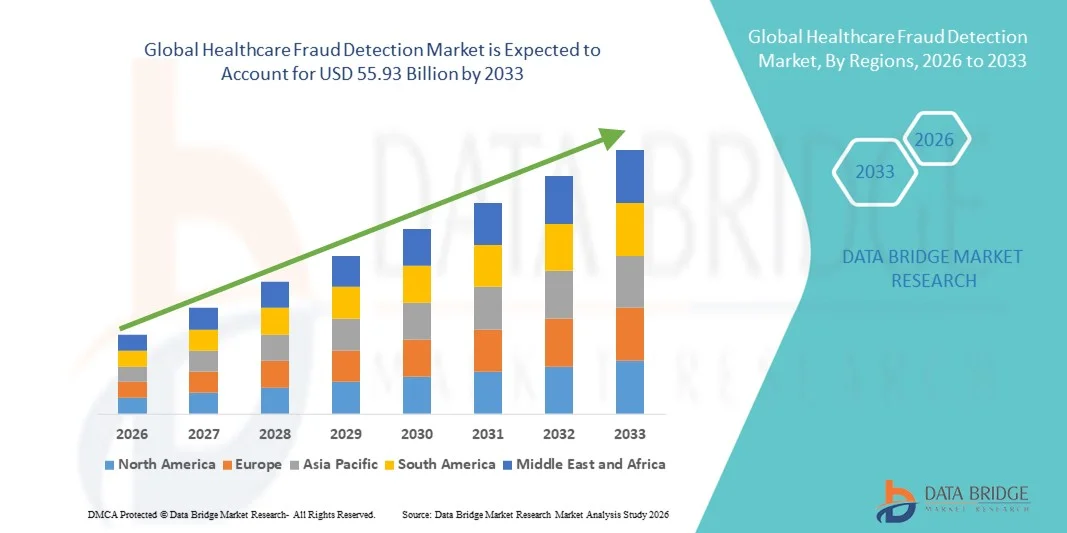

- The global healthcare fraud detection market size was valued at USD 7.33 billion in 2025 and is expected to reach USD 55.93 billion by 2033, at a CAGR of 28.92% during the forecast period

- The market growth is largely fueled by increasing digitization in healthcare systems, rising adoption of advanced analytics, and growing regulatory emphasis on reducing fraudulent claims

- Furthermore, the growing demand for secure, efficient, and accurate solutions for identifying and preventing fraudulent activities in healthcare is driving the uptake of Healthcare Fraud Detection solutions, thereby significantly boosting the industry's growth

Healthcare Fraud Detection Market Analysis

- The Healthcare Fraud Detection market is expanding rapidly due to the rising adoption of advanced analytics, AI-driven platforms, and real-time monitoring tools that help detect and prevent fraudulent activities in healthcare systems

- Growing healthcare expenditures, increasing instances of insurance fraud, and stricter regulatory compliance requirements are key factors driving the demand for effective Healthcare Fraud Detection solutions across hospitals, insurance providers, and government healthcare programs

- North America dominated the healthcare fraud detection market with the largest revenue share of 44% in 2025, driven by the presence of advanced healthcare infrastructure, strong regulatory frameworks, and high adoption of analytics-based fraud detection solutions. The U.S. continues to witness substantial growth due to increasing healthcare expenditures, rising instances of insurance fraud, and proactive initiatives by both private and public healthcare organizations

- Asia-Pacific is expected to be the fastest-growing region in the healthcare fraud detection market during the forecast period, with a market share in 2025, fueled by increasing digitization of healthcare systems, rising insurance penetration, and growing awareness of fraud prevention solutions in countries such as China, India, and Japan

- The on-demand segment dominated with a share of 57.2% in 2025, due to its flexibility, cost efficiency, and cloud-based access. On-demand platforms allow healthcare organizations to deploy fraud detection systems without heavy upfront IT costs

Report Scope and Healthcare Fraud Detection Market Segmentation

|

Attributes |

Healthcare Fraud Detection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Healthcare Fraud Detection Market Trends

Enhanced Market Intelligence and Automation Integration

- A significant and accelerating trend in the global healthcare fraud detection market is the integration of advanced analytics, machine learning, and process automation. This integration is significantly enhancing the accuracy, efficiency, and speed of detecting fraudulent claims, billing errors, and identity misuse in healthcare systems

- For instance, in March 2024, Optum, a leading health services and technology company, launched its “Optum Fraud Detection Suite” featuring real-time claims monitoring, predictive analytics, and automated investigation workflows to reduce fraud risk across payer and provider networks

- Advanced pattern recognition and anomaly detection algorithms are being employed to identify unusual billing patterns, duplicate claims, or potential fraudulent behavior more efficiently than traditional manual audits

- Healthcare providers and insurance payers are increasingly relying on integrated dashboards that consolidate claims data, patient records, and provider histories to enable faster investigation and decision-making

- This trend toward automation and predictive analytics is reshaping how organizations manage risk, prioritize investigations, and allocate compliance resources

- Companies such as SAS, IBM, and Cotiviti are developing platforms with enhanced data integration, visualization, and reporting capabilities to streamline fraud detection processes and improve actionable insights

- The growing adoption of electronic health records (EHR) and centralized claims processing systems further supports real-time monitoring and fraud prevention initiatives

- The demand for fraud detection solutions is increasing as regulatory bodies tighten compliance requirements and healthcare organizations seek cost efficiencies while maintaining accurate reimbursements

- Healthcare organizations are focusing on reducing false positives and improving the efficiency of investigative teams through intelligent automation

- Cloud-based fraud detection solutions are gaining traction, offering scalability and integration with existing IT infrastructure

- The trend toward proactive, predictive fraud detection rather than reactive audits is fundamentally changing operational strategies in the healthcare sector

- This market evolution is expected to drive significant investment in data analytics tools, predictive models, and integrated monitoring systems globally

Healthcare Fraud Detection Market Dynamics

Driver

Rising Need for Fraud Prevention and Regulatory Compliance

- The increasing prevalence of healthcare fraud, including false claims, identity theft, and billing irregularities, is a primary driver for the growing demand for Healthcare Fraud Detection solutions

- For instance, in June 2023, Change Healthcare launched its “Advanced Fraud Management Platform,” integrating real-time claim monitoring and predictive analytics to detect and prevent fraudulent activities, expected to enhance payer efficiency and compliance adherence

- Regulatory bodies such as the Centers for Medicare & Medicaid Services (CMS) and the Office of Inspector General (OIG) are enforcing stricter guidelines and audits, which has increased the demand for automated fraud detection systems

- Healthcare organizations face financial losses due to fraudulent claims, making early detection critical to cost management

- The rising adoption of electronic claims processing and digital patient records further supports fraud detection efforts

- Integration of advanced analytics and predictive modeling allows healthcare payers to detect unusual patterns faster and prioritize high-risk cases

- Organizations are increasingly implementing end-to-end fraud prevention strategies that combine data monitoring, auditing, and reporting tools

- The growing complexity of healthcare billing and multi-payer systems creates opportunities for fraud detection solutions that can handle diverse datasets

- Investments in healthcare IT infrastructure and analytics platforms are enabling more accurate detection and reduced manual intervention

- The need to maintain public trust, comply with regulations, and reduce operational losses drives the adoption of fraud detection systems

- Healthcare Fraud Detection solutions are expected to deliver significant ROI by minimizing unnecessary payouts and enhancing operational efficiency

- The market is witnessing growing interest from both public and private healthcare providers in deploying predictive fraud detection frameworks

Restraint/Challenge

Data Privacy Concerns and High Implementation Costs

- Concerns regarding patient data privacy and regulatory compliance pose a significant challenge for broader adoption of Healthcare Fraud Detection systems. Organizations need to ensure that sensitive health information is secured while analyzing large datasets

- For instance, in January 2024, a major U.S. healthcare provider faced scrutiny after a third-party fraud detection system exposed vulnerabilities in patient claim data, delaying its implementation and highlighting risks in integrating third-party solutions

- Ensuring compliance with regulations such as HIPAA in the U.S. or GDPR in Europe adds complexity to deploying automated fraud detection solutions

- The high initial cost of implementing advanced fraud detection platforms, including software licenses, integration, and staff training, can be a barrier for smaller healthcare providers

- Legacy systems and fragmented IT infrastructures in hospitals and clinics complicate the seamless integration of fraud detection solutions

- While cloud-based solutions offer scalability, concerns about data security and compliance slow adoption in certain regions

- Some organizations are hesitant to adopt fully automated systems due to perceived risks of false positives, which may affect provider relationships or patient experience

- Addressing these concerns through robust encryption, secure access controls, and compliance certifications is crucial for building trust

- Companies like SAS and IBM emphasize stringent data protection measures in marketing to reassure healthcare organizations of system safety

- Operational and maintenance costs, in addition to implementation, remain significant considerations, especially in developing regions

- Despite the growing need for fraud prevention, budget constraints and organizational resistance to change can hinder rapid adoption

- Overcoming these challenges through cost optimization, regulatory guidance, and secure system design will be vital for sustained growth in the Healthcare Fraud Detection market

Healthcare Fraud Detection Market Scope

The market is segmented on the basis of component, delivery mode, type, end-user, and application.

- By Component

On the basis of component, the Healthcare Fraud Detection market is segmented into services and software. The software segment dominated the largest market revenue share of 54.6% in 2025, driven by widespread adoption of AI-powered analytics and automated dashboards for real-time claims monitoring. Software allows healthcare organizations to process vast datasets efficiently, reducing fraud and improving operational efficiency. Cloud-enabled solutions enhance accessibility and provide remote monitoring capabilities. Integration with claims processing systems and EHRs ensures data consistency and compliance. Predictive and prescriptive analytics are widely incorporated in software platforms. Software solutions provide real-time alerts, anomaly detection, and automated reporting. Continuous updates and machine learning improvements enhance reliability. The software segment also supports risk scoring, trend analysis, and fraud pattern identification. Organizations increasingly rely on software to minimize losses from fraudulent claims. Regulatory compliance and audit-readiness further boost adoption. Software enables centralized fraud management and reduces manual intervention. Advanced software solutions improve accuracy, operational efficiency, and cost-effectiveness.

The services segment accounted for 45.4% of the market in 2025 and includes consulting, auditing, and investigative services. Services are projected to witness the fastest CAGR of 10.8% from 2026 to 2033, driven by increasing reliance on expert support for complex claims and regulatory compliance. Services include manual verification, provider audits, and fraud investigations. Expert services are critical for detecting sophisticated fraud schemes. Consulting services help optimize organizational fraud detection strategies. Training programs enhance internal capabilities of healthcare payers. Investigative services provide actionable insights and recommendations. Services also include risk management and operational efficiency support. The segment benefits from growing complexity of healthcare data. Increasing collaboration between insurers and third-party experts fuels growth. Demand rises due to regulatory pressure to prevent fraud. Services enhance decision-making and reduce financial losses. Expert guidance helps streamline operational processes and compliance.

- By Delivery Mode

On the basis of delivery mode, the market is segmented into on-premise and on-demand delivery models. The on-demand segment dominated with a share of 57.2% in 2025, due to its flexibility, cost efficiency, and cloud-based access. On-demand platforms allow healthcare organizations to deploy fraud detection systems without heavy upfront IT costs. Real-time monitoring and analytics provide rapid insights into suspicious claims. Cloud-based solutions allow centralized management across multiple offices. Integration with EHRs and claims processing systems enhances operational efficiency. On-demand models support automated reporting and compliance tracking. Subscription-based models lower total cost of ownership. Scalability allows organizations to expand services as needed. Multi-user access and remote monitoring enhance collaboration. Regulatory compliance features facilitate adoption in diverse regions. Continuous updates ensure latest algorithms are applied. Centralized dashboards provide real-time visibility and control. The segment enhances operational efficiency, reduces fraud, and is widely preferred in high-adoption regions.

The on-premise delivery model accounted for 42.8% in 2025 and is preferred by organizations with strict data privacy regulations. It is projected to grow at a CAGR of 11.1% from 2026 to 2033, driven by demand in regions with strict data security and compliance requirements. On-premise solutions allow direct control over data storage. They offer high customization to integrate with internal IT infrastructure. Security features prevent unauthorized access. On-premise delivery supports legacy systems and local processing. Regular software updates enhance system reliability. The model is preferred by large organizations with dedicated IT resources. It allows integration with enterprise-wide analytics platforms. On-premise solutions reduce dependency on internet connectivity. Organizations gain enhanced visibility into system usage. Regulatory compliance and audit-readiness drive adoption. Customizable reporting ensures operational transparency.

- By Type

On the basis of type, the market is segmented into descriptive analytics, predictive analytics, and prescriptive analytics. The predictive analytics segment dominated with 51.5% share in 2025, enabling healthcare organizations to detect potential fraud proactively. Predictive analytics leverages historical data, anomaly detection, and machine learning to identify high-risk claims. Real-time dashboards provide actionable insights to investigators. Integration with EHRs and claims management systems improves operational accuracy. Risk scoring and alert generation optimize resource allocation. Predictive tools reduce false positives and improve compliance. Cloud-enabled predictive solutions allow multi-location access. Centralized dashboards enhance decision-making and visibility. Continuous model training improves detection accuracy. Automated alerts accelerate fraud investigations. Organizations benefit from operational cost reduction and efficiency. The segment is widely adopted by private insurers and government agencies.

The prescriptive analytics segment is expected to witness the fastest CAGR of 12.3% from 2026 to 2033, providing recommendations for corrective actions and process optimization. Prescriptive analytics helps healthcare organizations prioritize high-risk cases. It integrates predictive outputs with workflow automation. Decision support tools improve investigative efficiency. Prescriptive solutions support fraud prevention strategy optimization. The segment also enhances audit readiness. Machine learning algorithms refine recommendations continuously. Integration with cloud and on-premise systems allows flexible deployment. Prescriptive analytics reduces manual intervention and operational costs. Real-time guidance supports compliance with regulatory mandates. Organizations benefit from actionable insights for provider management. Adoption is increasing due to growing demand for automated fraud detection and response solutions.

- By End-User

On the basis of end-user, the market is segmented into private insurance payers, public/government agencies, third-party service providers, and employers. The private insurance payers segment dominated with 48.7% market share in 2025, driven by high exposure to fraudulent claims and operational efficiency needs. Payers adopt predictive and prescriptive analytics to detect anomalies. Integration with EHRs and claims systems ensures seamless monitoring. AI-driven alerts and dashboards streamline investigations. Real-time reporting reduces false positives. Cloud-based solutions allow multi-location access. Automated scoring improves resource allocation. Compliance and regulatory reporting are simplified. Advanced analytics reduce operational losses. Predictive insights guide auditing priorities. Software solutions improve claims accuracy. Private insurers focus on fraud prevention and efficiency.

The public/government agencies segment is expected to witness the fastest CAGR of 11.6% from 2026 to 2033, driven by increasing government initiatives to prevent healthcare fraud. Agencies use software and analytics for large-scale monitoring. Predictive and prescriptive tools improve claim validation. Real-time dashboards enhance oversight. Multi-agency collaboration increases fraud detection efficiency. Cloud-enabled solutions reduce infrastructure costs. Integration with insurance providers ensures transparency. Automated alerts improve operational efficiency. Risk scoring supports audit and compliance activities. Public agencies prioritize early fraud detection. Analytics help reduce financial losses in national healthcare programs. The segment growth is supported by increasing adoption of AI-based detection technologies.

- By Application

On the basis of application, the market is segmented into insurance claims review, payment integrity, and other applications. The insurance claims review segment dominated with 53.3% market share in 2025, due to the critical need to evaluate claims, detect duplicate billing, and identify fraudulent activity. Automated workflows and predictive analytics enhance review accuracy. Real-time dashboards allow early detection of suspicious claims. Risk scoring prioritizes high-risk investigations. Integration with cloud platforms enables remote access and centralized management. Continuous monitoring ensures proactive detection. Regulatory compliance drives adoption. Fraud reduction improves operational efficiency. Alerts and notifications enhance investigator productivity. Reporting and dashboards simplify audit and compliance processes. The segment reduces financial losses and increases process transparency.

The payment integrity segment is projected to witness the fastest CAGR of 12.0% from 2026 to 2033, driven by increasing complexity of claims, stricter regulatory mandates, and adoption of AI-based solutions. Payment integrity analytics optimize claim reimbursement processes. Cloud-enabled tools provide real-time monitoring. Automated scoring improves accuracy. Integration with multiple payer systems ensures consistency. Alerts and dashboards enhance operational efficiency. Continuous algorithm improvements improve detection rates. SaaS-based delivery allows scalability and flexibility. Segment growth is driven by rising healthcare fraud costs. Predictive and prescriptive insights support better decision-making. Adoption ensures cost reduction and compliance across organizations.

Healthcare Fraud Detection Market Regional Analysis

- North America dominated the healthcare fraud detection market with the largest revenue share of 44% in 2025

- Driven by the presence of advanced healthcare infrastructure, strong regulatory frameworks, and high adoption of analytics-based fraud detection solutions

- The market continues to witness substantial growth due to increasing healthcare expenditures, rising instances of insurance fraud, and proactive initiatives by both private and public healthcare organizations

U.S. Healthcare Fraud Detection Market Insight

The U.S. healthcare fraud detection market captured the largest revenue share in 2025 within North America, fueled by growing awareness of healthcare fraud risks, widespread adoption of AI- and analytics-based detection solutions, and increasing investments in healthcare IT systems. The market growth is further supported by favorable government initiatives, strong reimbursement policies, and active monitoring programs implemented by insurance providers and public agencies.

Europe Healthcare Fraud Detection Market Insight

The Europe healthcare fraud detection market is projected to expand steadily during the forecast period, primarily driven by stringent regulations on healthcare fraud, rising healthcare costs, and increasing digitalization in insurance claims and payment systems. The region is witnessing significant growth in both private and public healthcare sectors, with countries such as the U.K. and Germany implementing robust fraud detection initiatives to curb financial losses.

U.K. Healthcare Fraud Detection Market Insight

The U.K. healthcare fraud detection market is anticipated to grow steadily, supported by government-led programs targeting fraud prevention in the National Health Service (NHS), increased adoption of advanced analytics tools, and rising healthcare IT investments. Private insurers are also increasingly leveraging predictive and prescriptive analytics to identify suspicious claims and reduce fraudulent payouts.

Germany Healthcare Fraud Detection Market Insight

The Germany healthcare fraud detection market is expected to expand consistently, fueled by growing regulatory oversight, rising healthcare expenditures, and increasing adoption of software-based fraud detection solutions. Both public and private healthcare organizations are deploying AI-driven analytics platforms to improve detection accuracy and streamline claims processing.

Asia-Pacific Healthcare Fraud Detection Market Insight

The Asia-Pacific healthcare fraud detection market is expected to be the fastest-growing globally, with a market share of 27% in 2025, driven by increasing digitization of healthcare systems, rising insurance penetration, and growing awareness of fraud prevention solutions. Countries such as China, India, and Japan are witnessing rapid adoption of advanced analytics and AI-based fraud detection platforms in hospitals, insurance companies, and government agencies.

Japan Healthcare Fraud Detection Market Insight

The Japan healthcare fraud detection market is gaining momentum due to growing implementation of AI-powered fraud detection systems, increasing government initiatives for healthcare fraud prevention, and rising healthcare IT investments. The country’s proactive approach in monitoring insurance claims and digitalizing healthcare records is fueling market growth.

China Healthcare Fraud Detection Market Insight

The China healthcare fraud detection market accounted for the largest market revenue share within Asia-Pacific in 2025, supported by the digitization of healthcare insurance systems, growing awareness of fraud prevention solutions, and high adoption of AI- and analytics-based detection platforms. Expanding healthcare infrastructure and supportive government policies are further boosting market penetration in hospitals, insurance companies, and public healthcare programs.

Healthcare Fraud Detection Market Share

The Healthcare Fraud Detection industry is primarily led by well-established companies, including:

• IBM Corporation (U.S.)

• Optum (U.S.)

• Cotiviti (U.S.)

• FICO (U.S.)

• HCL Technologies (India)

• Fractal Analytics (U.S.)

• EXL Service (U.S.)

• Deloitte (U.S.)

• PwC (U.K.)

• Cognizant (U.S.)

• Tech Mahindra (India)

• Genpact (U.S.)

Latest Developments in Global Healthcare Fraud Detection Market

- In November 2024, Cotiviti, Inc. announced the launch of its “360 Pattern Review” healthcare fraud, waste & abuse (FWA) solution at the 2024 National Health Care Anti‑Fraud Association (NHCAA) Annual Training Conference, combining pre‑pay and post‑pay analytics to enhance payers’ anti‑fraud capabilities

- In August 2024, MediBuddy, a digital healthcare platform in India, launched “Sherlock,” an AI‑powered real‑time fraud detection system for healthcare reimbursement claims, designed to integrate with its cash‑less payment network and reduce fraudulent claims by an estimated 20 %

- In June 2025, Alivia Analytics introduced “Alivia 360™”, a unified platform for pre‑ and post‑payment FWA detection for healthcare payers and government agencies, including its “FWA Claims Manager™” module for early‑stage fraud intervention

- In April 2025, Pango unveiled its new medical‑identity protection and fraud prevention product, designed to monitor medical data, alert consumers of suspicious activity, and remediate billing fraud or identity misuse

- In January 2025, Shift Technology announced a partnership with the Insurance Fraud Bureau (IFB) to develop a unified fraud‑detection platform integrating insurer datasets and investigations, slated for launch in 2026 to strengthen industry collaboration and counter‑fraud efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.