Global Healthcare Logistics Market

Market Size in USD Billion

CAGR :

%

USD

99.38 Billion

USD

178.57 Billion

2024

2032

USD

99.38 Billion

USD

178.57 Billion

2024

2032

| 2025 –2032 | |

| USD 99.38 Billion | |

| USD 178.57 Billion | |

|

|

|

|

Healthcare Logistics Market Size

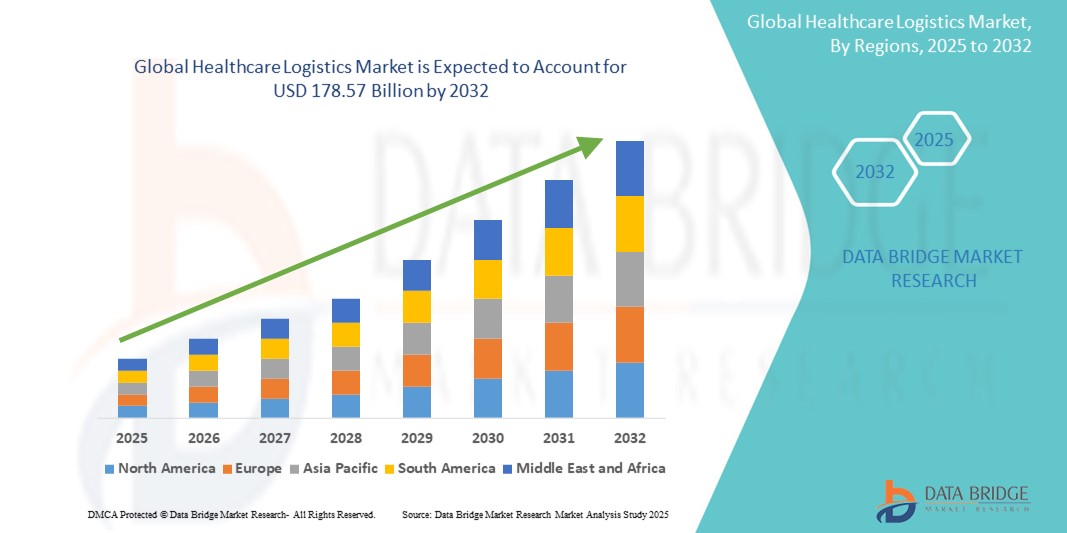

- The global healthcare logistics market size was valued at USD 99.38 billion in 2024 and is expected to reach USD 178.57 billion by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by increasing globalization of pharmaceutical supply chains and the rising need for temperature-sensitive transportation of biologics, vaccines, and personalized medicines

- Furthermore, growing investments in healthcare infrastructure, along with the rising demand for timely and secure delivery of medical equipment and drugs, are establishing healthcare logistics as a critical component of modern medical systems. These converging factors are accelerating the adoption of specialized logistics solutions, thereby significantly boosting the industry's growth

Healthcare Logistics Market Analysis

- Healthcare logistics, encompassing the efficient transportation, storage, and distribution of medical products and equipment, is becoming increasingly critical in supporting the global healthcare system due to the growing complexity and sensitivity of pharmaceutical and biomedical supply chains

- The escalating demand for healthcare logistics is primarily fueled by the rising prevalence of chronic diseases, increasing global pharmaceutical trade, and the growing need for temperature-controlled logistics for biologics, vaccines, and advanced therapies

- North America dominated the healthcare logistics market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, high pharmaceutical production and consumption, and the presence of major logistics service providers, with the U.S. experiencing robust growth due to a surge in e-pharmacy services and greater focus on cold chain capabilities

- Asia-Pacific is expected to be the fastest growing region in the healthcare logistics market during the forecast period due to expanding healthcare access, increasing pharmaceutical manufacturing, and rising demand for efficient distribution networks

- Services segment dominated the healthcare logistics market with a market share of 64% in 2024, driven by its critical role in ensuring timely, compliant, and cost-effective management of transportation, storage, and distribution operations across the healthcare supply chain

Report Scope and Healthcare Logistics Market Segmentation

|

Attributes |

Healthcare Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Logistics Market Trends

“Digitalization and Cold Chain Advancements Driving Smart, Responsive Supply Chains”

- A significant and accelerating trend in the global healthcare logistics market is the integration of digital technologies such as Internet of Things (IoT), blockchain, and Artificial Intelligence (AI) to enhance visibility, traceability, and efficiency across the supply chain. These advancements are reshaping how temperature-sensitive and high-value medical goods are stored, monitored, and transported globally

- For instance, companies such as DHL and UPS Healthcare are leveraging IoT-enabled tracking devices and AI-based analytics to ensure real-time monitoring of shipment conditions, helping to maintain the integrity of critical healthcare supplies, including biologics and vaccines

- Cold chain logistics is experiencing rapid innovation, with advanced temperature-controlled packaging solutions and cryogenic storage options now available for ultra-sensitive therapies such as mRNA-based vaccines and cell & gene therapies. These improvements are enabling safer, faster, and more compliant global distribution

- AI and predictive analytics tools also help forecast demand, optimize delivery routes, and prevent stockouts or spoilage by analyzing real-time and historical data. Such capabilities are critical in responding to public health emergencies or fluctuating pharmaceutical demands

- The trend toward end-to-end supply chain transparency, driven by regulatory compliance and quality assurance needs, is prompting widespread adoption of blockchain and RFID systems, ensuring that every touchpoint in the logistics journey is recorded, verified, and protected against tampering

- This shift toward smarter, responsive, and fully traceable healthcare logistics systems is positioning leading service providers as indispensable partners in the global healthcare ecosystem, especially as demand grows for temperature-sensitive and time-critical medical products

Healthcare Logistics Market Dynamics

Driver

“Rising Demand for Timely, Compliant Delivery of Temperature-Sensitive Healthcare Product”

- The growing global demand for biologics, specialty pharmaceuticals, and vaccines that require stringent temperature control is a major driver of the healthcare logistics market. As pharmaceutical companies increasingly develop sensitive therapies, the need for specialized logistics solutions with cold chain capabilities is expanding rapidly

- For instance, in 2024, UPS Healthcare announced the expansion of its global cold chain network, including new temperature-controlled facilities in Europe and Asia to support the rapid distribution of temperature-sensitive drugs

- Healthcare providers and pharmaceutical manufacturers rely on logistics partners for not only transportation, but also regulatory compliance, inventory management, and risk mitigation throughout the supply chain

- The complexity of modern healthcare products, particularly in the biologics and personalized medicine space, has made logistics services an essential extension of pharmaceutical operations, especially for maintaining product efficacy and safety

- In addition, the rise in home healthcare services and e-pharmacy models is fueling demand for last-mile delivery logistics that are fast, reliable, and patient-centric, further strengthening the need for specialized logistics services across regions

Restraint/Challenge

“Infrastructure Limitations and Stringent Regulatory Compliance in Emerging Markets”

- One of the primary challenges in the healthcare logistics market is the lack of advanced infrastructure, particularly in developing regions, which hampers the efficient storage and transportation of sensitive medical products. Insufficient cold chain facilities, limited access to specialized carriers, and inadequate tracking systems pose significant risks to product integrity

- For instance, inconsistent power supply and a lack of trained personnel in some emerging economies have led to vaccine spoilage and drug degradation, undermining healthcare outcomes and trust in distribution systems

- In addition, compliance with international regulations such as Good Distribution Practices (GDP) and local import/export requirements is complex and varies widely across regions. Meeting these standards requires substantial investment in documentation, training, and quality control mechanisms, which can be cost-prohibitive for smaller logistics providers

- These infrastructure and regulatory challenges can delay product delivery, increase costs, and restrict market access for global pharmaceutical companies. Overcoming them will require collaborative efforts among governments, logistics providers, and pharmaceutical firms to invest in local infrastructure, standardize compliance frameworks, and leverage technology to bridge operational gaps

Healthcare Logistics Market Scope

The market is segmented on the basis of type, component, temperature type, logistics, logistic type, application, and end user.

- By Type

On the basis of type, the healthcare logistics market is segmented into cold chain and non-cold chain. The non-cold chain segment dominated the market with the largest revenue share of 58.2% in 2024, driven by the high distribution volume of conventional pharmaceutical products and medical equipment that do not require specialized temperature control. These include general medicines, surgical instruments, and consumables, which form a significant portion of hospital and pharmacy inventories.

The cold chain segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing global demand for temperature-sensitive biologics, vaccines, and specialty therapies. The need to preserve product efficacy throughout transit is accelerating investments in cold storage infrastructure and validated supply chain solutions.

- By Component

On the basis of component, the healthcare logistics market is segmented into hardware, software, and services. The services segment dominated the market with the largest market revenue share of 64% in 2024, driven by its critical role in enabling secure, compliant, and efficient transportation, storage, and distribution of healthcare products. As pharmaceutical companies and healthcare providers increasingly outsource logistics operations, demand for third-party logistics services has surged. These providers offer expertise in regulatory compliance, supply chain optimization, and last-mile delivery.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by growing adoption of digital supply chain solutions, including warehouse management systems, real-time tracking, and AI-driven analytics, which enhance operational visibility and compliance.

- By Temperature Type

On the basis of temperature type, the healthcare logistics market is segmented into ambient, chilled/refrigerated, frozen, and cryogenic. The ambient segment dominated the market with the largest market share of 44.7% in 2024, driven by the bulk movement of pharmaceutical products, medical devices, and consumables that are stable at room temperature. These items do not require expensive temperature control and thus benefit from simpler, cost-effective logistics arrangements.

The cryogenic segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing global usage of advanced therapies such as cell and gene treatments, which require ultra-low temperature storage and transportation systems.

- By Logistics

On the basis of logistics, the healthcare logistics market is segmented into transportation, packaging, storage, and others. The transportation segment dominated the market with the largest market revenue share of 51.9% in 2024, driven by the core necessity to move healthcare products efficiently across regional and global supply chains. The increasing demand for timely delivery of time- and temperature-sensitive pharmaceuticals and medical goods significantly contributes to the segment’s dominance.

The packaging segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by growing emphasis on protective, temperature-resistant, and validated packaging solutions that maintain product integrity and comply with international safety standards during transit.

- By Logistic Type

On the basis of logistic type, the healthcare logistics market is segmented into sea freight logistics, air freight logistics, overland logistics, and contract logistics. The overland logistics segment dominated the market with the largest market revenue share of 39.3% in 2024, driven by its extensive use in domestic and regional transportation of pharmaceuticals and healthcare supplies. Road-based logistics provide cost-effective and flexible solutions, particularly in densely populated or urbanized regions.

The air freight logistics segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for rapid and reliable international transportation of vaccines, biologics, and urgent medical products requiring strict time-temperature control.

- By Application

On the basis of application, the healthcare logistics market is segmented into medicine, bulk drug handlers, vaccine, chemical & other raw material, biological material and organs, hazardous cargo, and others. The medicine segment dominated the market with the largest market revenue share of 37.8% in 2024, driven by the consistent global demand for prescription drugs and over-the-counter (OTC) medications, which require widespread distribution across pharmacies, hospitals, and clinics.

The vaccine segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by ongoing global immunization efforts, demand for pandemic preparedness, and increased production of temperature-sensitive vaccines requiring specialized cold chain logistics.

- By End User

On the basis of end user, the healthcare logistics market is segmented into biopharmaceutical companies, hospitals & clinics, research institutes, and others. The biopharmaceutical companies segment dominated the market with the largest market revenue share of 41.6% in 2024, driven by their high dependency on reliable, compliant logistics solutions for global distribution of drugs, vaccines, and biologics. These companies are primary contributors to cold chain demand due to the sensitivity and value of their products.

The hospitals & clinics segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising need for direct-to-site delivery of emergency medical supplies, diagnostics kits, and personalized treatments, particularly in response to healthcare digitization and remote care models.

Healthcare Logistics Market Regional Analysis

- North America dominated the healthcare logistics market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, high pharmaceutical production and consumption, and the presence of major logistics service providers

- The region benefits from well-established transportation networks, regulatory compliance capabilities, and widespread adoption of digital logistics technologies, which enhance supply chain efficiency and visibility across medical product distribution

- In addition, the presence of leading logistics providers, increased e-pharmacy penetration, and rising demand for personalized medicine and at-home care services are strengthening North America’s position as a key hub for healthcare logistics, catering to both domestic and global supply needs

U.S. Healthcare Logistics Market Insight

The U.S. healthcare logistics market captured the largest revenue share of 82% in 2024 within North America, driven by its advanced healthcare infrastructure, strong presence of biopharmaceutical companies, and high adoption of cold chain solutions. The rising demand for temperature-sensitive drug transportation, especially for biologics and specialty medicines, is a major contributor to market growth. Furthermore, the integration of real-time tracking technologies and automation across warehousing and distribution systems enhances supply chain efficiency and regulatory compliance, reinforcing the U.S. as a global healthcare logistics leader.

Europe Healthcare Logistics Market Insight

The Europe healthcare logistics market is projected to grow at a substantial CAGR throughout the forecast period, fueled by stringent regulatory frameworks such as GDP (Good Distribution Practices) and the expanding pharmaceutical sector. Demand for efficient logistics solutions is rising with the increase in biologics, personalized medicines, and clinical trial shipments across the region. Europe’s strong commitment to sustainability is also pushing logistics providers to adopt eco-friendly transportation and packaging methods. In addition, investments in cold chain infrastructure and cross-border healthcare trade are boosting market growth.

U.K. Healthcare Logistics Market Insight

The U.K. healthcare logistics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising pharmaceutical exports, increasing clinical trials, and the expansion of e-pharmacies. The country's regulatory alignment with international standards ensures quality and compliance, strengthening its position in global supply chains. Innovations in last-mile delivery, alongside growing demand for temperature-sensitive and time-critical shipments, are expected to support continued market expansion.

Germany Healthcare Logistics Market Insight

The Germany healthcare logistics market is expected to expand at a considerable CAGR during the forecast period, driven by the country's leading pharmaceutical manufacturing sector, well-developed logistics infrastructure, and technological innovation. Germany’s focus on automation, cold chain optimization, and digital tracking technologies is enabling efficient distribution of medical products domestically and across Europe. Moreover, increasing demand for biologics and personalized treatments is driving the need for advanced logistics services and cold storage capabilities.

Asia-Pacific Healthcare Logistics Market Insight

The Asia-Pacific healthcare logistics market is poised to grow at the fastest CAGR of 23.1% from 2025 to 2032, driven by rapid urbanization, increased healthcare spending, and expanding pharmaceutical manufacturing in countries such as China, India, and Japan. Government support for digitalization and healthcare reforms is facilitating modernized logistics systems. In addition, the emergence of local and international logistics providers, combined with the growth of cold chain infrastructure, is making temperature-controlled supply chains more accessible and reliable across the region.

Japan Healthcare Logistics Market Insight

The Japan healthcare logistics market is gaining momentum due to its advanced healthcare system, aging population, and demand for efficient delivery of high-value, time-sensitive medicines. Japan’s emphasis on quality control and technology adoption is supporting the integration of AI, robotics, and IoT into logistics operations. The rise in home-based care and medical e-commerce is further boosting demand for specialized last-mile delivery and temperature-regulated transportation services.

India Healthcare Logistics Market Insight

The India healthcare logistics market accounted for the largest revenue share in Asia Pacific in 2024, fueled by its rapidly growing pharmaceutical sector, increasing exports, and rising demand for medical supplies across urban and rural regions. Government initiatives such as “Make in India” and the development of smart logistics corridors are enhancing infrastructure and efficiency. In addition, the expansion of cold chain networks and the entry of global logistics players are helping meet the growing need for reliable healthcare delivery, particularly in vaccine and biologics distribution.

Healthcare Logistics Market Share

The healthcare logistics industry is primarily led by well-established companies, including:

- X2 Group (U.K.)

- Emerald Freight Express (Ireland)

- TOTAL QUALITY LOGISTICS LLC (U.S.)

- Cavalier Logistics Management II, Inc. (U.S.)

- Cencora, Inc. (U.S.)

- Agility (Kuwait)

- Air Canada (Canada)

- CEVA logistics (France)

- DB Schenker (Germany)

- Deutsche Post DHL Group (Germany)

- FedEx (U.S.)

- Burris Logistics (U.S.)

- OIA Global (U.S.)

- United Parcel Service of America, Inc (U.S.)

- VersaCold Logistics Services (Canada)

- Abbott (U.S.)

- ADAllen Pharma (U.K.)

- Biosensors International Group, Ltd. (Singapore)

- Entero Healthcare (U.K.)

- CRYOPDP (France)

- SF Express (China)

- Alloga (Switzerland)

- KERRY LOGISTICS NETWORK LIMITED (Hong Kong)

What are the Recent Developments in Global Healthcare Logistics Market?

- In April 2023, DHL Supply Chain, a leading logistics provider, announced the expansion of its global cold chain logistics network with the launch of new temperature-controlled facilities in India and the Netherlands. This strategic investment aims to strengthen the end-to-end delivery of biologics, vaccines, and high-value pharmaceuticals, demonstrating DHL’s commitment to addressing the rising demand for compliant and secure healthcare logistics solutions across key emerging and developed markets. The expansion enhances the company’s capacity to support temperature-sensitive distribution on a global scale

- In March 2023, UPS Healthcare unveiled a new 20,000-square-foot cold chain warehouse in Singapore as part of its broader Asia-Pacific expansion strategy. The facility, equipped with real-time monitoring and storage systems for products requiring 2°C to -80°C temperature control, is designed to meet the growing demand for advanced healthcare logistics in the region. This move strengthens UPS Healthcare’s footprint in Asia and underlines its focus on delivering specialized logistics services for biologics and cell & gene therapies

- In March 2023, Kuehne+Nagel partnered with Singapore’s National University Health System (NUHS) to optimize pharmaceutical supply chains using AI and IoT technologies. The collaboration focuses on increasing transparency, improving inventory accuracy, and reducing wastage in hospital and clinical logistics. This innovative initiative highlights the growing integration of smart technology in healthcare logistics to enhance service quality and operational efficiency

- In February 2023, AmerisourceBergen completed the expansion of its pharmaceutical distribution center in Carrollton, Texas, to accommodate growing demand for specialty drug logistics. The upgrade includes advanced automation and cold storage capabilities to better manage temperature-sensitive products. This development reflects AmerisourceBergen’s strategic emphasis on scaling logistics infrastructure to support the evolving needs of the healthcare industry, particularly in precision medicine and biologics

- In January 2023, FedEx Express introduced a new “FedEx® Cold Shipping Package” solution designed for small-volume, temperature-sensitive healthcare shipments. This ready-to-use packaging technology provides up to 96 hours of thermal protection without the need for batteries or external power. By enhancing accessibility and reliability in cold chain logistics, FedEx aims to support smaller pharmaceutical firms, clinical trial operators, and diagnostic labs with a flexible, scalable shipping solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.