Global Healthcare Original Equipment Manufacturer Oem Market

Market Size in USD Billion

CAGR :

%

USD

273.96 Billion

USD

850.37 Billion

2024

2032

USD

273.96 Billion

USD

850.37 Billion

2024

2032

| 2025 –2032 | |

| USD 273.96 Billion | |

| USD 850.37 Billion | |

|

|

|

|

Healthcare Original Equipment Manufacturer (OEM) Market Size

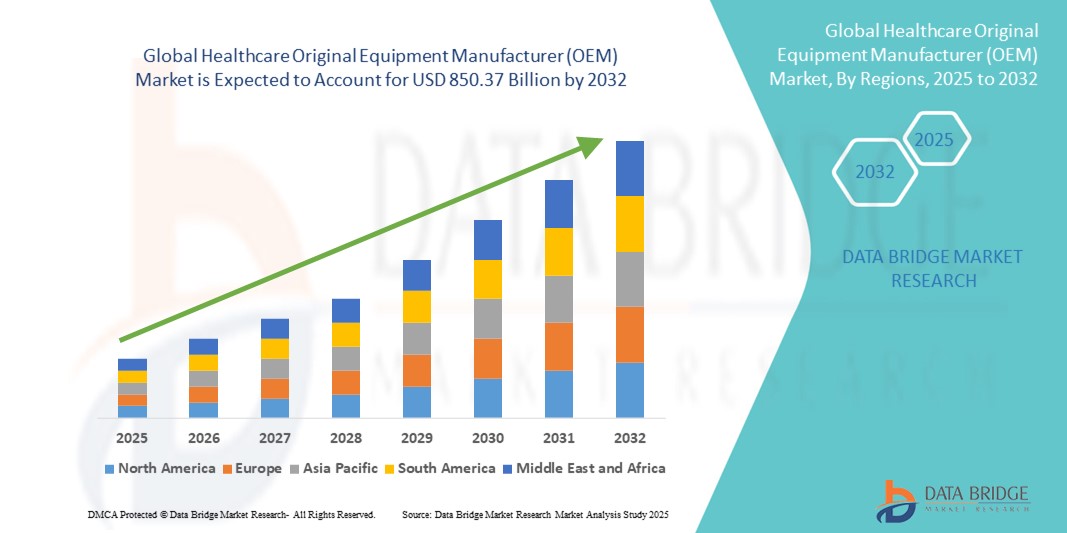

- The global healthcare original equipment manufacturer (OEM) market size was valued at USD 273.96 billion in 2024 and is expected to reach USD 850.37 billion by 2032, at a CAGR of 15.21% during the forecast period

- The market growth is largely fueled by the rising demand for advanced medical devices, diagnostic systems, and customized healthcare equipment, supported by continuous technological progress and increasing outsourcing by medtech companies to specialized OEM partners

- Furthermore, growing healthcare infrastructure investments, a strong focus on cost efficiency, and the need for regulatory-compliant, high-quality components are establishing OEMs as critical partners in the healthcare value chain. These converging factors are accelerating OEM adoption, thereby significantly boosting the industry's growth

Healthcare Original Equipment Manufacturer (OEM) Market Analysis

- Healthcare OEMs, providing critical components, devices, and system solutions to medical technology companies, are increasingly vital to the healthcare ecosystem due to their role in enabling innovation, cost efficiency, and regulatory-compliant manufacturing across diagnostics, therapeutic devices, and hospital equipment

- The escalating demand for healthcare OEM services is primarily fueled by rising outsourcing trends among medtech firms, growing complexity of medical devices, and the need for advanced, customized solutions that integrate emerging technologies such as AI, IoT, and robotics

- North America dominated the healthcare original equipment manufacturer (OEM) market with the largest revenue share of 39.4% in 2024, supported by robust healthcare infrastructure, strong R&D investments, and the presence of leading OEM service providers and device manufacturers, with the U.S. driving growth through higher adoption of precision medical technologies and specialized contract manufacturing

- Asia-Pacific is expected to be the fastest growing region in the healthcare original equipment manufacturer (OEM) market during the forecast period due to rapid healthcare infrastructure expansion, cost advantages in manufacturing, and rising demand for affordable medical devices

- The medical device components segment dominated the healthcare original equipment manufacturer (OEM) market with a market share of 42% in 2024, driven by increasing demand for precision-engineered parts and assemblies that support diagnostics, patient monitoring, and therapeutic applications

Report Scope and Healthcare Original Equipment Manufacturer (OEM) Market Segmentation

|

Attributes |

Healthcare Original Equipment Manufacturer (OEM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Original Equipment Manufacturer (OEM) Market Trends

Rising Shift Toward Advanced Technologies and Customized Solutions

- A significant and accelerating trend in the global healthcare OEM market is the increasing integration of advanced technologies such as AI, IoT-enabled devices, robotics, and additive manufacturing into OEM offerings. This is enhancing precision, efficiency, and innovation across the healthcare value chain

- For instance, OEM partners are increasingly leveraging 3D printing to design customized implants and surgical instruments, while IoT-enabled components are allowing real-time monitoring and predictive maintenance in medical equipment

- AI integration is enabling OEMs to deliver smarter device components with predictive analytics and automated functions, while robotics is transforming the design and manufacturing of minimally invasive surgical instruments

- In addition, the rising demand for tailored OEM solutions from medtech companies seeking differentiation in competitive markets is driving OEMs to expand capabilities in customization and rapid prototyping

- The seamless incorporation of these advanced technologies within OEM products is reshaping industry expectations for innovation and speed-to-market. Consequently, leading OEM providers are focusing on collaborative R&D models with healthcare companies to deliver integrated, next-generation device solutions

- The demand for OEMs capable of delivering technologically advanced and customized solutions is growing rapidly, particularly across diagnostic, surgical, and patient monitoring devices, as healthcare providers and patients increasingly prioritize efficiency, personalization, and improved outcomes

Healthcare Original Equipment Manufacturer (OEM) Market Dynamics

Driver

Increasing Outsourcing by Medtech Companies for Cost and Compliance Advantages

- The rising complexity of medical devices, coupled with stringent regulatory requirements, is driving medtech firms to increasingly outsource design, manufacturing, and compliance support to specialized OEM partners

- For instance, in March 2024, Integer Holdings expanded its OEM partnerships for cardiovascular devices, focusing on delivering advanced catheter technologies with regulatory compliance support. Such developments highlight the growing reliance on OEMs for innovation and cost efficiency

- Outsourcing allows medical device manufacturers to reduce capital expenditure, accelerate product timelines, and leverage OEM expertise in precision engineering, material sciences, and quality assurance

- Furthermore, the growing demand for regulatory-compliant manufacturing and the need to quickly scale production in response to healthcare crises (such as pandemics) make OEMs essential strategic partners

- The increasing preference for OEM collaboration is particularly strong in segments such as implantable devices, surgical equipment, and diagnostic systems, where both technical expertise and strict compliance standards are critical

Restraint/Challenge

Regulatory Complexity and Rising Cost Pressures

- The stringent regulatory landscape governing medical devices poses a significant challenge for OEMs, requiring adherence to diverse global standards such as FDA, CE Marking, and ISO certifications. This not only increases compliance costs but also lengthens product development timelines

- For instance, frequent updates to EU MDR requirements have increased documentation and testing burdens, making it more difficult for smaller OEMs to maintain compliance while staying cost-competitive

- In addition, rising raw material and labor costs, coupled with pricing pressures from medtech companies, are squeezing OEM margins, particularly for high-volume but low-margin components

- The reliance on global supply chains further exposes OEMs to disruptions, as witnessed during the COVID-19 pandemic, raising concerns over reliability and cost control

- Overcoming these challenges will require OEMs to invest in digital quality management systems, strengthen compliance infrastructure, and adopt lean manufacturing strategies to balance cost efficiency with regulatory rigor, ensuring long-term sustainability and trust in the market

Healthcare Original Equipment Manufacturer (OEM) Market Scope

The market is segmented on the basis of type, OEM solutions, and application.

- By Type

On the basis of type, the healthcare original equipment manufacturer (OEM) market is segmented into healthcare software, medical devices, instruments, and others. Medical Devices dominated the market with the largest revenue share of 42% in 2024, driven by the rising demand for diagnostic, therapeutic, and monitoring equipment across hospitals and clinics. OEMs supplying components for imaging systems, surgical instruments, and patient monitoring devices benefit from consistent demand due to ongoing healthcare infrastructure expansion and technology upgrades. The segment’s dominance is also supported by higher margins for complex device components and strong collaborations with leading medtech companies. In addition, regulatory compliance and precision engineering requirements position OEMs as critical partners in ensuring device quality and safety.

Healthcare Software is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of digital health solutions, AI-driven analytics, and cloud-based management platforms. OEMs developing software modules for medical devices, hospital administration, or telemedicine platforms are experiencing strong demand as healthcare providers seek integrated, data-driven solutions. The increasing focus on patient monitoring, workflow optimization, and remote diagnostics further accelerates growth in software OEM solutions.

- By OEM Solutions

On the basis of OEM solutions, the healthcare original equipment manufacturer (OEM) market is segmented into quality control and regulatory compliance, manufacturing and fabrication, packaging and sterilization, product design and development, order fulfillment and flexible distribution, technical support, project management, and others. Manufacturing and Fabrication dominated the market in 2024 due to the critical role OEMs play in producing high-precision medical components, devices, and assemblies. This subsegment benefits from the increasing outsourcing of production by medtech companies looking for cost efficiency, scalability, and regulatory-compliant manufacturing. OEMs’ expertise in material sciences, precision engineering, and production automation ensures consistent quality and supports rapid time-to-market for complex devices. Large hospitals and diagnostic centers also rely on OEM partners to supply specialized devices that require strict adherence to safety standards.

Quality Control and Regulatory Compliance is expected to witness the fastest growth during the forecast period, driven by stricter global regulations and the increasing complexity of medical devices. OEMs offering end-to-end compliance support, testing services, and validation processes are experiencing rising demand as medtech firms aim to minimize regulatory risk. With evolving standards such as EU MDR and FDA updates, this segment provides critical value by ensuring products meet global safety and performance requirements, enhancing OEM adoption across diverse device categories.

- By Application

On the basis of application, the healthcare original equipment manufacturer (OEM) market is segmented into healthcare administration, dentistry, surgery, laboratory, veterinary, pharmaceutical and cosmetics, ophthalmology, dialysis, and others. Surgery dominated the market with the largest revenue share in 2024, driven by increasing adoption of advanced surgical instruments, robotic-assisted devices, and minimally invasive solutions. OEMs supplying high-precision surgical components, disposable instruments, and assemblies benefit from the continual demand in hospitals and surgical centers. The segment’s dominance is further supported by higher margins on specialized surgical components and consistent innovation in instrumentation and device design. OEM partnerships are critical for ensuring quality, regulatory compliance, and timely delivery.

Laboratory is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing need for diagnostic testing, research, and development of new therapeutics. OEMs supplying laboratory instruments, diagnostic kits, and automated analyzers are experiencing rising demand due to expansions in clinical labs, pharmaceutical R&D, and biotechnology sectors. The segment’s growth is also driven by the adoption of high-throughput and automated systems, where OEMs play a key role in precision engineering and customization for diverse testing workflows.

Healthcare Original Equipment Manufacturer (OEM) Market Regional Analysis

- North America dominated the healthcare original equipment manufacturer (OEM) market with the largest revenue share of 39.4% in 2024, supported by robust healthcare infrastructure, strong R&D investments, and the presence of leading OEM service providers and device manufacturers

- Healthcare providers in the region highly value high-quality, regulatory-compliant, and precision-engineered components and devices supplied by OEMs, ensuring reliability and safety across hospitals, clinics, and diagnostic centers

- The widespread adoption of advanced medical devices and outsourcing of manufacturing to specialized OEM partners further supports market growth in the region

U.S. Healthcare Original Equipment Manufacturer (OEM) Market Insight

The U.S. healthcare original equipment manufacturer (OEM) market captured the largest revenue share of 42% in 2024 within North America, fueled by the high adoption of advanced medical devices and the strong trend of outsourcing manufacturing and regulatory-compliance solutions. Healthcare providers and medtech companies increasingly prioritize quality, precision-engineered components, and end-to-end OEM services for diagnostics, surgical instruments, and patient monitoring systems. The growing focus on personalized medicine, AI-enabled devices, and robotics further propels market growth. In addition, well-established R&D infrastructure, advanced healthcare facilities, and stringent quality standards are driving demand for innovative and compliant OEM solutions.

Europe Healthcare Original Equipment Manufacturer (OEM) Market Insight

The Europe healthcare original equipment manufacturer (OEM) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory requirements and the rising demand for high-quality medical devices across hospitals, clinics, and laboratories. Increasing healthcare infrastructure investments, urbanization, and adoption of digital health technologies are fostering the use of OEM solutions. European medtech firms are increasingly collaborating with OEMs for product design, manufacturing, and regulatory compliance. The region is experiencing notable growth across surgical, laboratory, and diagnostic applications, with OEMs playing a key role in enabling innovation and operational efficiency.

U.K. Healthcare Original Equipment Manufacturer (OEM) Market Insight

The U.K. healthcare original equipment manufacturer (OEM) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising need for advanced medical devices, precision components, and regulatory-compliant manufacturing. The country’s emphasis on healthcare innovation and digital transformation encourages collaborations between OEMs and medtech companies. In addition, the NHS and private healthcare providers’ adoption of cutting-edge diagnostic and surgical equipment supports OEM growth. Strong e-health infrastructure, increasing outsourcing trends, and demand for quality assurance services continue to stimulate market expansion in the U.K.

Germany Healthcare Original Equipment Manufacturer (OEM) Market Insight

The Germany healthcare original equipment manufacturer (OEM) market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, technological innovation, and high-quality manufacturing standards. OEMs providing surgical instruments, diagnostic devices, and laboratory equipment benefit from Germany’s emphasis on precision engineering, safety, and sustainability. Increasing integration of OEM-manufactured components with hospital automation systems and the demand for energy-efficient, technologically advanced solutions drive market adoption. Germany’s established medtech ecosystem and strong regulatory compliance culture further reinforce OEM market growth.

Asia-Pacific Healthcare Original Equipment Manufacturer (OEM) Market Insight

The Asia-Pacific healthcare original equipment manufacturer (OEM) market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rapid urbanization, expanding healthcare infrastructure, and rising demand for affordable medical devices in countries such as China, Japan, and India. The region’s focus on digital health, telemedicine, and high-volume diagnostic and therapeutic devices fuels OEM demand. In addition, APAC is emerging as a manufacturing hub for OEM medical components, offering cost-effective solutions and increasing accessibility to healthcare providers across the region. Government initiatives promoting healthcare modernization further support market expansion.

Japan Healthcare Original Equipment Manufacturer (OEM) Market Insight

The Japan healthcare original equipment manufacturer (OEM) market is gaining momentum due to the country’s advanced medical technology adoption, aging population, and emphasis on precision healthcare. OEMs supplying surgical instruments, diagnostic devices, and automated monitoring systems experience strong demand from hospitals, research centers, and specialized clinics. Integration of OEM-manufactured components with robotics, AI, and IoT-enabled medical systems further drives market growth. In addition, Japan’s focus on quality, safety, and innovation encourages medtech firms to collaborate extensively with OEM providers for customized and compliant solutions.

India Healthcare Original Equipment Manufacturer (OEM) Market Insight

The India healthcare original equipment manufacturer (OEM) market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid healthcare infrastructure development, rising adoption of medical devices, and cost advantages in manufacturing. India is emerging as a key hub for OEM production and supply of medical instruments, diagnostics, and device components. Increasing government investment in healthcare modernization, expansion of private hospitals, and the growing middle-class population drive demand. The availability of affordable OEM solutions and collaboration with domestic and international medtech companies are key factors propelling the market in India.

Healthcare Original Equipment Manufacturer (OEM) Market Share

The healthcare original equipment manufacturer (OEM) industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Siemens Healthineers AG (Germany)

- Baxter (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Toshiba International Corporation (Japan)

- FUJIFILM Holdings America Corporation (U.S.)

- Hitachi Healthcare Americas (U.S.)

- ESAOTE SPA (Italy)

- Drägerwerk AG & Co. KGaA (Germany)

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Stryker (U.S.)

- BD (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Smith & Nephew (U.K.)

- Olympus Corporation (Japan)

- Zimmer Biomet (U.S.)

- Cardinal Health (U.S.)

- Fresenius Medical Care (Germany)

What are the Recent Developments in Global Healthcare Original Equipment Manufacturer (OEM) Market?

- In July 2025, Philips expanded its partnership with leading device manufacturers to develop the "smart healing environment" concept. This initiative focuses on integrating patient monitoring systems with external devices to improve connectivity and patient care across healthcare facilities

- In June 2025, Johnson & Johnson MedTech launched the ETHICON 4000 Stapler, designed to manage tissue complexities and deliver exceptional staple line integrity. This advanced surgical stapler aims to minimize risks associated with surgical leaks and bleeding complications across various specialties

- In April 2025, Medtronic announced that its Expand URO U.S. clinical trial for the Hugo robotic-assisted surgery system met its primary safety and effectiveness endpoints. This milestone supports the system's potential for broader adoption in urologic procedures. The trial's success is a significant step toward enhancing the capabilities of robotic-assisted surgeries in the U.S

- In March 2025, GE HealthCare introduced the Revolution Vibe CT system, featuring Unlimited One-Beat Cardiac imaging and advanced AI solutions. This system aims to deliver high-quality cardiac imaging with improved speed and accuracy, enhancing diagnostic capabilities in clinical settings

- In January 2025, Siemens Healthineers showcased the Magnetom Flow RT Pro Edition at the Asian Oceanian Congress of Radiology (AOCR) 2025. The system incorporates AI-powered image reconstruction and energy-saving features, aiming to enhance MRI imaging efficiency and sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.