Global Healthcare Virtual Assistants Market

Market Size in USD Billion

CAGR :

%

USD

1.40 Billion

USD

8.45 Billion

2024

2032

USD

1.40 Billion

USD

8.45 Billion

2024

2032

| 2025 –2032 | |

| USD 1.40 Billion | |

| USD 8.45 Billion | |

|

|

|

|

Healthcare Virtual Assistants Market Size

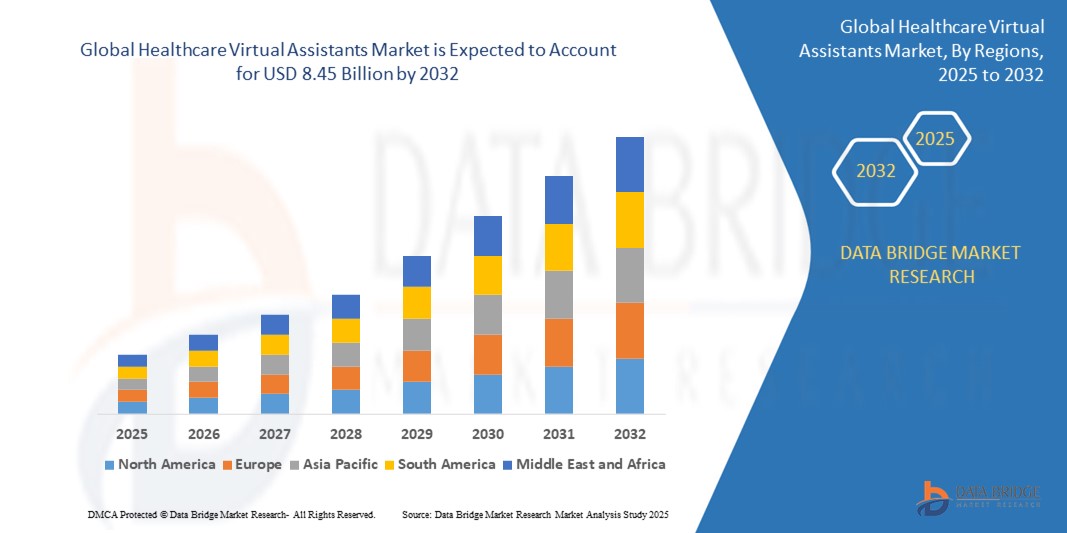

- The global healthcare virtual assistants market size was valued at USD 1.4 billion in 2024 and is expected to reach USD 8.45 billion by 2032, at a CAGR of 25.20% during the forecast period

- This growth is primarily driven by the aging population, which increases the demand for healthcare services, and the rising prevalence of chronic diseases, leading to a need for personalized healthcare assistance

Healthcare Virtual Assistants Market Analysis

- Healthcare virtual assistants are becoming essential tools for improving patient care and streamlining administrative processes, offering services like appointment scheduling, answering patient inquiries, and managing health records

- The demand for healthcare virtual assistants is driven by the aging population, which increases the need for healthcare services, and the growing prevalence of chronic conditions, making healthcare management more complex and in need of automation

- North America is expected to dominate the global healthcare virtual assistants market, with an estimated market share of 45%. This dominance is driven by advanced healthcare infrastructure, widespread adoption of digital technologies, and significant investments in healthcare AI solutions

- Asia-Pacific is anticipated to be the fastest-growing region, with a projected market share of 30% due to rising healthcare demands, increased smartphone and internet penetration, and growing awareness of AI's potential in healthcare

- Cloud-based solutions in the global healthcare virtual assistants market are expected to dominate with an estimated market share of 30.5%, driven by their scalability, cost-effectiveness, and accessibility for healthcare providers

Report Scope and Healthcare Virtual Assistants Market Segmentation

|

Attributes |

Healthcare Virtual Assistants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Virtual Assistants Market Trends

“Advancements in Healthcare Virtual Assistants Market”

- One prominent trend in the evolution of healthcare virtual assistants is the increasing integration of artificial intelligence (AI) and natural language processing (NLP) technologies

- These innovations enhance patient engagement by enabling virtual assistants to provide personalized healthcare advice, facilitate remote monitoring, and streamline administrative workflows

- For instance, AI-powered chatbots and voice assistants are being integrated into electronic health records (EHR) systems to improve clinical decision-making and patient interactions

- These advancements are transforming healthcare delivery, reducing costs, and driving the demand for next-generation virtual assistants with predictive analytics and cloud-based solutions

Healthcare Virtual Assistants Market Dynamics

Driver

“Growing Need Due to Advancements in AI and Healthcare Automation”

- The increasing integration of artificial intelligence (AI), natural language processing (NLP), and machine learning in healthcare is significantly driving the demand for healthcare virtual assistants (HVAs). These technologies are enhancing patient engagement, streamlining administrative workflows, and optimizing healthcare delivery systems

- The rising prevalence of chronic diseases such as diabetes and cardiovascular conditions necessitates tools like HVAs for remote monitoring, health data management, and personalized health reminders

- The adoption of HVAs was notably accelerated by the COVID-19 pandemic, as they provided accessible, cost-effective, and remote solutions for patient care during a time of global healthcare crisis

For instance,

- In January 2022, Sensely, a leading healthcare tech company, expanded its virtual assistant services through collaborations with Mayo Clinic and NHS. The enhanced features included symptom checking, personalized health content, and seamless integration into healthcare provider platforms

- In March 2024, Babylon Health launched an advanced version of its AI-driven virtual assistant, which now offers multilingual support and expanded functionalities for medication management, benefiting patients globally

- As a result of such technological advancements and the growing need for efficient healthcare solutions, the demand for healthcare virtual assistants is projected to rise significantly in the coming years

Opportunity

“Transforming Healthcare with Artificial Intelligence Integration”

- AI-powered healthcare virtual assistants (HVAs) are revolutionizing patient care by automating administrative tasks, enhancing patient engagement, and improving healthcare delivery efficiency

- These virtual assistants leverage AI algorithms to provide real-time health monitoring, personalized health recommendations, and medication reminders, ensuring better treatment adherence and patient outcomes

- HVAs are also being integrated into wearable health technologies, enabling real-time health tracking and proactive interventions, which are particularly beneficial for managing chronic diseases like diabetes and hypertension

For instance,

- In March 2025, a leading healthcare technology firm launched an advanced AI-powered virtual assistant capable of multilingual support and integration with electronic health records (EHR) systems, streamlining clinical decision-making and patient interactions

- In April 2025, a report highlighted that the global healthcare virtual assistant market is projected to grow at a compound annual growth rate (CAGR) of 29.8% from 2025 to 2035, driven by advancements in AI and the increasing adoption of digital health solutions

- The integration of AI in healthcare virtual assistants is expected to significantly enhance patient care, reduce healthcare costs, and improve operational efficiency, making it a transformative opportunity in the healthcare sector

Restraint/Challenge

“High Development and Implementation Costs Hindering Market Penetration”

- The high costs associated with the development, deployment, and maintenance of healthcare virtual assistants (HVAs) pose a significant challenge, particularly for smaller healthcare providers and facilities in developing regions

- These virtual assistants, which rely on advanced AI, natural language processing (NLP), and machine learning technologies, require substantial investment in infrastructure, software, and skilled personnel for effective implementation

- This financial barrier can deter healthcare organizations with limited budgets from adopting HVAs, leading to a slower rate of market penetration and reliance on traditional methods of patient care and administrative management

For instance,

- In February 2025, a report highlighted that the high initial investment required for integrating AI-powered virtual assistants into healthcare systems remains a key concern for small and medium-sized healthcare providers, particularly in regions with limited technological infrastructure

- In addition, the ongoing costs of software updates, data storage, and cybersecurity measures further add to the financial burden, making it challenging for healthcare facilities to fully embrace these technologies

- Consequently, such limitations can result in disparities in the adoption of HVAs, affecting the efficiency and quality of healthcare services, and ultimately hindering the overall growth of the market

Healthcare Virtual Assistants Market Scope

The market is segmented on the basis of type, deployment mode, functionalities, applications, product, user interface and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Deployment Mode |

|

|

By Functionalities |

|

|

By Applications |

|

|

By Product |

|

|

By User Interface

|

|

|

By End User |

|

In 2025, the cloud-based is projected to dominate the market with a largest share in type segment

Cloud-based solutions are projected to dominate the global healthcare virtual assistants market, accounting for an estimated 30.5% of the market share. Their scalability, cost-effectiveness, and accessibility make them highly attractive to healthcare providers. Regionally, North America leads with approximately 45% market share, driven by advanced healthcare infrastructure and widespread adoption of AI technologies. Europe follows with around 25%, benefiting from strong government support for digital health initiatives. Asia-Pacific holds about 20%, fueled by rapid technological advancements and increasing demand for virtual healthcare solutions in countries like India and China. These trends highlight the growing reliance on cloud-based healthcare virtual assistants globally.

The integrated with EHR/EMR is expected to account for the largest share during the forecast period in deployment mode segments

In 2025, integrated with EHR/EMR systems is anticipated to dominate the global healthcare virtual assistants market within the deployment mode segment, accounting for the largest market share due to its ability to streamline clinical workflows and enhance patient data management. This segment is projected to hold approximately 55% of the market share globally, with North America leading at 40%, driven by advanced healthcare infrastructure and widespread adoption of AI technologies. Europe follows with 30%, supported by strong government initiatives for digital health. Asia-Pacific accounts for 20%, fueled by rapid technological advancements and increasing demand for virtual healthcare solutions in countries such as India and China.

Healthcare Virtual Assistants Market Regional Analysis

“North America Holds the Largest Share in the Healthcare Virtual Assistants Market”

- North America is expected to dominate the global healthcare virtual assistants market, with an estimated market share of 45%. This dominance is driven by advanced healthcare infrastructure, widespread adoption of digital technologies, and significant investments in healthcare AI solutions

- The U.S. holds a significant share with around 30% due to the increasing demand for virtual healthcare solutions, rising prevalence of chronic diseases, and continuous advancements in AI-driven healthcare technologies

- The availability of well-established reimbursement policies and growing investments in research and development by leading technology companies further strengthen the market

- In addition, the increasing adoption of telehealth services, coupled with a high rate of integration of virtual assistants into electronic health records (EHR) systems, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Healthcare Virtual Assistants Market”

- Asia-Pacific is anticipated to be the fastest-growing region, with a projected market share of 30% due to rising healthcare demands, increased smartphone and internet penetration, and growing awareness of AI's potential in healthcare

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, growing prevalence of chronic diseases, and increasing focus on improving healthcare accessibility and efficiency

- Japan, with its advanced medical technology and strong government support for digital health initiatives proximately 8% of the global market, remains a crucial market for healthcare virtual assistants. The country continues to lead in the adoption of AI-powered solutions to enhance patient care and streamline healthcare operations

- China and India are poised to be major contributors to the global healthcare virtual assistants market, with China expected to account for approximately 12-15% due to its large population, rising investments in AI-driven healthcare technologies, and supportive government initiatives for digital health infrastructure. India is projected to hold around 10-12% of the market, driven by rapid advancements in technology, growing demand for virtual healthcare solutions, and the increasing prevalence of chronic diseases

Healthcare Virtual Assistants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Nuance Communications (U.S.)

- Microsoft (U.S.)

- Amazon (U.S.)

- Verint Systems (U.S.)

- Infermedica (Poland)

- Sensely (U.S.)

- eGain Corporation (U.S.)

- Kognito Solutions LLC (U.S.)

- HealthTap Inc. (U.S.)

- Babylon Healthcare Services Ltd (U.K.)

- Uniphore (India)

- CitiusTech (India)

- Tunstall Healthcare (U.K.)

- Napier Healthcare (Singapore)

- Haptik (U.S.)

Latest Developments in Global Healthcare Virtual Assistants Market

- In April 2023, EVA.ai introduced EVA Bot, an AI Virtual Assistant powered by a cutting-edge Large Language Model (LLM) with 6 billion parameters. This innovation enhances intelligent communication for large organizations, including the United Nations. EVA Bot aims to revolutionize recruitment and talent management by offering deep personalization and advanced question-answering capabilities. It supports HR teams with tailored conversations, streamlining processes like onboarding, talent profiling, and responding to FAQs. EVA Bot's integration with LLM technology ensures efficient, accurate communication, transforming the employee and candidate experience

- In March 2023, Royal Philips, part of Koninklijke Philips N.V., unveiled Philips Virtual Care Management, a versatile suite of solutions designed to help healthcare providers, systems, employers, and payers connect with patients more effectively, regardless of location. This innovative platform aims to alleviate hospital staff workloads by reducing emergency department visits and enhancing chronic disease management. By improving patient engagement and streamlining care delivery, Philips Virtual Care Management contributes to lowering healthcare costs while fostering better health outcomes

- In November 2022, East and North Hertfordshire NHS Trust introduced Enquire, an intelligent virtual assistant powered by IBM Watson Assistant on IBM Cloud. Designed to support the HR team, Enquire handles inquiries from the trust's 6,500 staff members, providing 24/7 assistance. This innovative solution aims to alleviate the administrative workload of HR employees, enabling them to concentrate on more complex and impactful tasks. By leveraging advanced natural language processing technology, Enquire ensures accurate and efficient responses, enhancing employee support and streamlining HR operations

- In October 2022, AtlantiCare partnered with Orbita, Inc., a provider of virtual assistant and conversational AI solutions, to implement its advanced AI platform. This collaboration aims to streamline communication between patients and healthcare providers, enhancing accessibility and convenience. By leveraging Orbita's technology, AtlantiCare focuses on improving patient access to self-scheduling options, ensuring a seamless and user-friendly experience. This initiative reflects AtlantiCare's commitment to modernizing healthcare delivery and addressing the evolving needs of its diverse patient base

- In April 2022, Real Chemistry acquired ConversationHealth.com, integrating its advanced conversational AI technologies and medical expertise into its offerings. This strategic move enables Real Chemistry to provide large-scale medical interactions through diverse mediums, including text, voice, and digital humans, across multiple markets and languages. By leveraging ConversationHealth's capabilities, Real Chemistry enhances its ability to deliver personalized, efficient, and impactful healthcare communication solutions. This acquisition underscores Real Chemistry's commitment to innovation in healthcare and life sciences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.