Global Heel Incision Devices Market

Market Size in USD Million

CAGR :

%

USD

200.86 Million

USD

254.24 Million

2025

2033

USD

200.86 Million

USD

254.24 Million

2025

2033

| 2026 –2033 | |

| USD 200.86 Million | |

| USD 254.24 Million | |

|

|

|

|

Heel Incision Devices Market Size

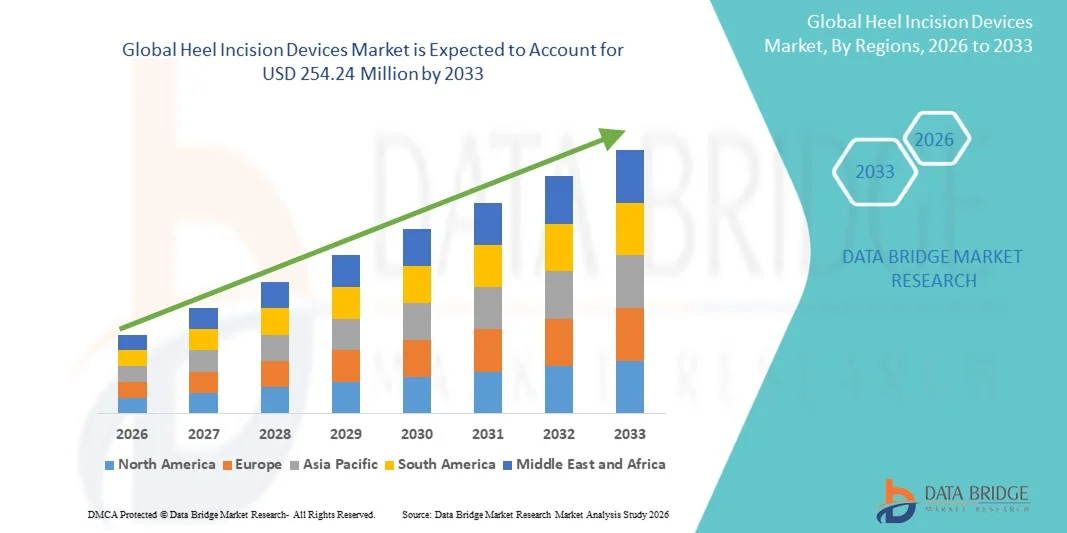

- The global heel incision devices market size was valued at USD 200.86 million in 2025 and is expected to reach USD 254.24 million by 2033, at a CAGR of 2.99% during the forecast period

- The market growth is largely fueled by the increasing adoption of minimally invasive surgical procedures and rising prevalence of chronic diseases, which are driving demand for efficient blood sampling tools and incision devices in neonatal and clinical settings

- Furthermore, technological advancements in device design, integration of precision‑focused features, and the expanding focus on early disease detection and improved patient outcomes are strengthening the uptake of heel incision devices in both hospitals and specialty clinics globally

Heel Incision Devices Market Analysis

- Heel incision devices, used primarily for blood sampling in neonates and infants, are increasingly critical in hospitals, specialty clinics, and ambulatory surgical centers due to their precision, safety, and ability to minimize patient discomfort

- The rising demand for heel incision devices is largely driven by the increasing prevalence of chronic diseases such as diabetes, growing neonatal care requirements, and a stronger focus on early diagnosis and patient-centric care in both developed and emerging markets

- North America dominated the heel incision devices market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative medical devices, and strong presence of key market players providing precision-focused solutions for neonatal and clinical care

- Asia-Pacific is expected to be the fastest-growing region in the heel incision devices market during the forecast period due to increasing birth rates, rising healthcare investments, and expanding access to modern medical technologies in emerging economies

- Newborn segment dominated the heel incision devices market with a market share of 42.9% in 2025, driven by the high demand for safe and precise sampling tools for neonatal care

Report Scope and Heel Incision Devices Market Segmentation

|

Attributes |

Heel Incision Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Heel Incision Devices Market Trends

“Adoption of Minimally Invasive and Precision Devices”

- A significant and accelerating trend in the global heel incision devices market is the growing adoption of minimally invasive devices with enhanced precision and safety features, reducing patient discomfort and improving sample quality

- For instance, micro-preemie lancets with controlled depth settings allow clinicians to perform accurate blood sampling in extremely low birth weight neonates with minimal risk of tissue damage

- Technological advancements in device ergonomics and materials are enabling more consistent puncture depth and reduced pain, enhancing user confidence among healthcare professionals and caregivers

- Integration with digital monitoring systems allows real-time tracking of blood collection events and sample volumes, improving clinical workflow and reducing the risk of errors in neonatal and infant care

- Manufacturers are increasingly focusing on eco-friendly and single-use designs to reduce contamination risks and support hospital sustainability initiatives

- Smart devices with connectivity options are emerging, enabling data logging, tracking patient history, and integration with hospital electronic medical records

- This trend towards safer, more precise, and digitally compatible heel incision devices is reshaping neonatal care protocols and raising expectations for device performance in hospitals and specialty clinics

- The demand for devices that offer precision, safety, and workflow integration is growing rapidly across hospitals, specialty clinics, and ambulatory surgical centers, as caregivers increasingly prioritize patient comfort and clinical efficiency

Heel Incision Devices Market Dynamics

Driver

“Increasing Neonatal Care Needs and Chronic Disease Prevalence”

- The rising prevalence of chronic diseases, coupled with increasing neonatal care requirements, is a key driver for the heightened demand for heel incision devices in clinical settings

- For instance, rising cases of diabetes and other metabolic disorders in newborns and infants necessitate frequent blood sampling for early diagnosis and monitoring

- Healthcare providers increasingly require devices that ensure precision and minimize pain, encouraging adoption of advanced heel incision tools across hospitals and specialty clinics

- Growing awareness of the benefits of early diagnosis and continuous monitoring in neonatal care is prompting healthcare facilities to invest in safer and more efficient heel incision devices

- The convenience of controlled depth devices, ergonomic designs, and compatibility with digital tracking is propelling adoption in hospitals, specialty clinics, and ambulatory surgical centers

- The trend towards patient-centric care and improved clinical outcomes is further reinforcing market growth in both developed and emerging regions

- Increasing government and NGO initiatives supporting neonatal health programs are boosting demand for reliable heel incision devices in public and private healthcare facilities

- Rising investments in neonatal research and development are driving innovation, making advanced and safer heel incision devices more widely available globally

Restraint/Challenge

“Risk of Infection and Regulatory Compliance Hurdles”

- Concerns over potential infection and strict regulatory compliance requirements pose significant challenges to broader market penetration for heel incision devices

- For instance, improper sterilization or device misuse can lead to contamination, making hospitals and clinics cautious in device selection and usage

- Meeting international safety and regulatory standards requires rigorous testing, certification, and adherence to clinical guidelines, adding to product development complexity

- Device manufacturers must balance precision and safety with ease of use, ensuring products are both effective for clinicians and safe for neonates and infants

- High development and compliance costs, along with the need for staff training, can restrict adoption in price-sensitive regions or smaller healthcare facilities

- Overcoming these challenges through enhanced sterilization protocols, rigorous clinical validation, and training programs is crucial for sustained growth in the heel incision devices market

- Limited awareness among caregivers in emerging markets regarding proper use of heel incision devices can slow adoption rates

- Competition from alternative sampling methods, such as venous draws or capillary tubes, may restrain market growth in some regions

Heel Incision Devices Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the heel incision devices market is segmented into micro-preemie, preemie, newborn, and infant. The Newborn segment dominated the market with the largest market revenue share of 42.9% in 2025, driven by the high prevalence of neonatal care procedures in hospitals and specialty clinics. Newborns represent the largest patient population requiring heel blood sampling for routine screening, including glucose monitoring, bilirubin testing, and metabolic disorder checks. Devices designed for newborns often feature controlled puncture depth and ergonomic designs, minimizing pain and risk of tissue injury. In addition, these devices are widely preferred due to their reliability, ease of use, and compatibility with standard neonatal care protocols. The market also benefits from increasing hospital investments in neonatal care units, which drive consistent demand for newborn-specific heel incision devices. Hospitals and clinics often prioritize newborn-focused devices for their balance of precision, safety, and workflow efficiency.

The Micro-preemie segment is expected to witness the fastest growth rate of 9% CAGR from 2026 to 2033, fueled by rising awareness and specialized care for extremely low birth weight infants. These micro-preemie devices offer ultra-precise puncture depth control to prevent excessive tissue injury, which is critical for fragile neonates in neonatal intensive care units (NICUs). Technological innovations, such as integrated depth stops and minimally invasive lancet designs, are enhancing adoption in advanced hospitals and specialty clinics. Growing investments in NICU infrastructure and increasing premature birth rates, especially in developing regions, are further propelling market growth. Manufacturers are also focusing on designing micro-preemie devices compatible with digital monitoring systems to track blood collection and improve clinical workflows. The increasing emphasis on patient safety and reducing procedural complications is further encouraging hospitals to adopt micro-preemie-specific heel incision devices.

- By Application

On the basis of application, the heel incision devices market is segmented into hospitals, specialty clinics, ambulatory surgical centres, and others. The Hospitals segment dominated the market with a revenue share of 47% in 2025, driven by the high patient throughput and concentration of neonatal intensive care units (NICUs). Hospitals require frequent and precise heel blood sampling for routine screening, diagnostics, and continuous monitoring, making them the largest consumers of heel incision devices. The presence of well-established neonatal care protocols and investments in modern equipment further drive adoption. Hospitals also prefer devices with digital integration capabilities to streamline sample tracking and minimize human error. Their need for reliable, consistent, and high-volume use devices reinforces the dominance of this segment. In addition, hospitals often influence broader adoption trends by demonstrating clinical efficacy and safety of specific device types to specialty clinics and other care centers.

The Specialty Clinics segment is expected to witness the fastest growth rate of 8.5% CAGR from 2026 to 2033, fueled by increasing outpatient neonatal care and preventive health check-ups. Specialty clinics are expanding their services to include neonatal screenings, early disease detection, and metabolic monitoring, creating a rising demand for safe, precise, and easy-to-use heel incision devices. These clinics often favor compact, portable, and ergonomic devices suitable for outpatient workflows. Increasing awareness among parents and caregivers about early neonatal care benefits is further driving adoption in this segment. Manufacturers are also targeting specialty clinics with cost-effective, single-use, and digitally compatible devices to support efficient patient management. The growing trend of home-based neonatal care and private clinic visits is expected to sustain this segment’s rapid growth.

Heel Incision Devices Market Regional Analysis

- North America dominated the heel incision devices market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative medical devices, and strong presence of key market players providing precision-focused solutions for neonatal and clinical care

- Healthcare providers in the region prioritize precision, safety, and reliability in heel incision devices, ensuring better patient outcomes for newborns and infants in neonatal intensive care units (NICUs) and routine blood sampling procedures

- This widespread adoption is further supported by strong government initiatives for neonatal health, high awareness of early disease detection, and continuous advancements in device technology, establishing heel incision devices as a standard solution in both hospital and specialty care settings

U.S. Heel Incision Devices Market Insight

The U.S. heel incision devices market captured the largest revenue share of 82% in North America in 2025, driven by the presence of advanced neonatal care infrastructure and widespread adoption of precision medical devices. Hospitals and specialty clinics prioritize safe and accurate blood sampling tools for newborns and infants, supporting high demand for heel incision devices. The growing prevalence of premature births and chronic neonatal conditions further fuels the need for frequent, minimally invasive sampling. Moreover, ongoing investments in neonatal intensive care units (NICUs) and hospital modernization programs are significantly contributing to market expansion. The emphasis on patient safety, workflow efficiency, and integration with digital monitoring systems is further reinforcing the adoption of advanced devices.

Europe Heel Incision Devices Market Insight

The Europe heel incision devices market is projected to expand at a substantial CAGR during the forecast period, driven by increasing awareness of neonatal care standards and stringent healthcare regulations. The rise in specialized neonatal units and routine newborn screening programs across hospitals and specialty clinics is fostering adoption. European healthcare providers also prioritize devices that minimize pain, reduce infection risk, and provide consistent sampling outcomes. Growing investments in healthcare infrastructure, along with initiatives to standardize neonatal care practices, are supporting market growth. In addition, the focus on integrating devices with hospital data systems and improving clinical efficiency further promotes demand.

U.K. Heel Incision Devices Market Insight

The U.K. heel incision devices market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing neonatal care initiatives and awareness of early disease detection. Hospitals and specialty clinics are investing in precision devices that ensure safe, minimally invasive blood sampling for newborns and infants. Concerns regarding neonatal complications and the demand for standardized, reliable devices encourage the adoption of advanced heel incision tools. The country’s emphasis on digital healthcare and connected hospital systems further supports market expansion. In addition, increasing use of outpatient neonatal screening programs is contributing to steady growth.

Germany Heel Incision Devices Market Insight

The Germany heel incision devices market is expected to expand at a considerable CAGR during the forecast period, driven by advanced neonatal care infrastructure and high healthcare standards. Hospitals and specialty clinics demand devices that are both precise and safe, ensuring minimal tissue injury during sampling. Germany’s focus on medical innovation, patient safety, and digital integration in healthcare workflows promotes adoption. The increasing number of NICUs and routine newborn screening programs further supports market growth. Moreover, the preference for ergonomically designed, high-quality devices aligns with local healthcare providers’ expectations.

Asia-Pacific Heel Incision Devices Market Insight

The Asia-Pacific heel incision devices market is poised to grow at the fastest CAGR of 25% from 2026 to 2033, fueled by increasing birth rates, rising healthcare investments, and expanding neonatal care facilities in countries such as China, Japan, and India. Governments are emphasizing maternal and child health initiatives, driving demand for reliable and safe sampling devices. Rapid urbanization, growing awareness of neonatal care best practices, and technological advancements in device design further support adoption. In addition, increasing availability of cost-effective and portable heel incision devices is expanding access in both public and private healthcare settings.

Japan Heel Incision Devices Market Insight

The Japan heel incision devices market is gaining momentum due to the country’s advanced neonatal care infrastructure and high awareness of early disease detection. Hospitals and specialty clinics focus on devices that provide precision, minimize pain, and integrate with digital monitoring systems. The rising number of NICUs and connected healthcare facilities is supporting market expansion. Moreover, Japan’s emphasis on quality, reliability, and patient safety is driving demand for advanced heel incision devices. Aging healthcare personnel and the need for user-friendly devices further encourage adoption in both clinical and outpatient settings.

India Heel Incision Devices Market Insight

The India heel incision devices market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to increasing birth rates, rapid urbanization, and expanding neonatal care infrastructure. Hospitals and specialty clinics are investing in precise, safe, and affordable devices for newborn and infant blood sampling. Government initiatives promoting maternal and child health, coupled with awareness programs for neonatal care, are boosting adoption. The availability of cost-effective devices, along with increasing private healthcare services, further propels market growth. In addition, rising outpatient screenings and specialty clinics’ focus on preventive neonatal care are contributing to steady demand.

Heel Incision Devices Market Share

The Heel Incision Devices industry is primarily led by well-established companies, including:

- BD (U.S.)

- Cardinal Health (U.S.)

- Owen Mumford Ltd (U.K.)

- Smiths Medical (U.K.)

- MEDICORE Co. Ltd. (Japan)

- Vitrex Medical A/S (Denmark)

- NSP Tech Pte Ltd (Singapore)

- Torvan Medical Inc. (U.S.)

- DeviceLab, Inc. (U.S.)

- MediPurpose (Singapore)

- Abbott (U.S.)

- Medtronic (Ireland)

- Carl Zeiss AG (Germany)

- Takagi Seiko Co., Ltd. (Japan)

- Konan Medical USA, Inc. (U.S.)

- Centervue S.p.A. (Italy)

- Bausch + Lomb Corporation (U.S.)

- Geister Medizintechnik GmbH (Germany)

- DYNAREX Corporation (U.S.)

What are the Recent Developments in Global Heel Incision Devices Market?

- In February 2025, the U.S. FDA cleared a Heel Incision Safety Lancet (SteriHeel 2) for capillary blood sampling from the heel of newborns, preemies, and toddlers, marking regulatory progress and enabling broader clinical adoption of safer, standardized devices for neonatal screening and diagnostics

- In October 2023, Owen Mumford Ltd. launched the Unistik® Heelstik neonatal and paediatric capillary blood sampling device range, offering tailored devices for micro‑preemie, preemie, full‑term babies, and toddlers to enhance ease, precision, and comfort for healthcare professionals and patients

- In February 2023, Clinical Innovations, LLC obtained FDA 510(k) documentation for the babyLance® Safety Heelstick Device, a single‑use heel incision tool designed for neonates and infants with built‑in sharps injury prevention, underscoring industry movement toward enhanced safety and usability for caregivers

- In June 2022, a Heel Incision Safety Lancet device received FDA 510(k) documentation clearance, confirming regulatory acceptance for sterile, single‑use heel incision lancets intended for capillary blood collection from newborns, preemies, and toddlers an important step toward broader clinical adoption

- In July 2021, Greiner Bio‑One introduced the MiniCollect® PIXIE Heel Incision Safety Lancet designed for gentle capillary blood collection from infants, expanding available options for heel incision devices aimed at minimizing tissue trauma and ensuring safety during neonatal blood sampling

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.