Global Hemodialysis Vascular Grafts Market

Market Size in USD Million

CAGR :

%

USD

349.61 Million

USD

499.97 Million

2024

2032

USD

349.61 Million

USD

499.97 Million

2024

2032

| 2025 –2032 | |

| USD 349.61 Million | |

| USD 499.97 Million | |

|

|

|

|

Hemodialysis Vascular Grafts Market Size

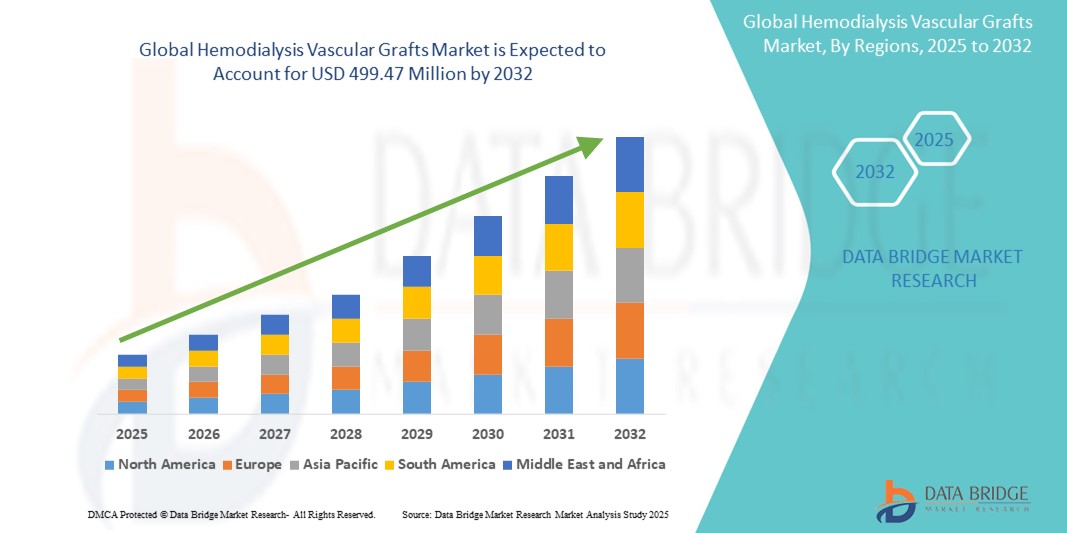

- The global hemodialysis vascular grafts market size was valued at USD 349.61 million in 2024 and is expected to reach USD 499.47 million by 2032, at a CAGR of 4.56 % during the forecast period

- The market growth is primarily driven by the rising prevalence of end-stage renal disease (ESRD) and the increasing number of patients requiring long-term hemodialysis treatment, particularly among aging populations and those with chronic health conditions such as diabetes and hypertension

- In addition, continuous advancements in graft materials, biocompatibility, and infection-resistant technologies are contributing to improved patient outcomes and prolonged graft life. These factors are collectively enhancing the adoption of hemodialysis vascular grafts globally, thus propelling the market’s expansion

Hemodialysis Vascular Grafts Market Analysis

- Hemodialysis vascular grafts, designed to provide reliable vascular access for patients undergoing long-term hemodialysis, are becoming increasingly critical in managing end-stage renal disease (ESRD), especially as the global burden of kidney-related disorders continues to rise

- The surging demand for these grafts is primarily fueled by the growing prevalence of chronic kidney disease (CKD), increasing dialysis patient population, and technological advancements aimed at improving graft patency and reducing infection rates

- North America dominated the hemodialysis vascular grafts market with the largest revenue share of 39.2% in 2024, supported by a well-established healthcare infrastructure, rising ESRD cases, and strong reimbursement frameworks, particularly in the U.S. where dialysis care networks and specialized vascular access centers are expanding

- Asia-Pacific is expected to be the fastest growing region in the hemodialysis vascular grafts market during the forecast period due to rising healthcare investments, growing awareness of kidney disease management, and expanding dialysis patient base

- Polytetrafluoroethylene segment dominated the hemodialysis vascular grafts market with a market share of 52.9% in 2024, driven by its excellent biocompatibility, low thrombogenicity, and long-term durability, making it ideal for repeated vascular access

Report Scope and Hemodialysis Vascular Grafts Market Segmentation

|

Attributes |

Hemodialysis Vascular Grafts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hemodialysis Vascular Grafts Market Trends

“Innovation in Graft Materials and Bioengineered Solutions”

- A notable and accelerating trend in the global hemodialysis vascular grafts market is the advancement in graft materials and the emergence of bioengineered and hybrid graft solutions designed to improve biocompatibility, reduce infection rates, and enhance long-term patency in dialysis patients

- For instance, companies such as Gore Medical have developed expanded polytetrafluoroethylene (ePTFE) grafts with heparin-bonded surfaces, aimed at reducing thrombosis and infection. Similarly, Becton, Dickinson and Company (BD) has focused on developing grafts that promote endothelialization to minimize complications

- These innovations support improved clinical outcomes by addressing key limitations of traditional grafts such as stenosis and clotting. New materials offer better mechanical properties, flexibility, and resistance to kinking, contributing to fewer interventions and hospitalizations

- Furthermore, the development of grafts with antimicrobial coatings and tissue-engineered scaffolds is helping meet the growing demand for safer and more durable vascular access solutions. Companies such as Humacyte are advancing bioengineered human acellular vessels (HAVs), which are currently under clinical trials for dialysis use

- This shift toward advanced, biologically inspired graft solutions is enhancing the standard of care in dialysis access and is expected to reshape treatment protocols, particularly in patients with limited vascular sites or prior graft failures

- The growing focus on personalized vascular access strategies, supported by innovation in graft design and function, is driving strong demand for next-generation hemodialysis vascular grafts across key global markets

Hemodialysis Vascular Grafts Market Dynamics

Driver

“Rising Global Burden of ESRD and Expanding Dialysis Infrastructure”

- The increasing incidence of end-stage renal disease (ESRD) and chronic kidney disease (CKD), combined with rising awareness and accessibility of dialysis treatment options, is a major driver of the hemodialysis vascular grafts market

- For instance, according to recent data, the number of patients undergoing hemodialysis is steadily rising, especially in aging populations and regions with high diabetes and hypertension prevalence. As a result, the need for reliable, long-term vascular access has never been greater

- Healthcare providers are expanding dialysis centers, and governments in emerging economies are investing in renal care infrastructure. For instance, initiatives in India and China to subsidize dialysis access and improve nephrology services are increasing graft procedure volumes

- Furthermore, advancements in surgical techniques and imaging technologies are making vascular access procedures more efficient and widely available. This, coupled with physician preference for grafts in patients with poor native vein quality, is boosting demand

- Increased training of vascular surgeons and the presence of multi-specialty dialysis centers offering one-stop access creation and maintenance are further propelling market growth in both developed and developing regions

Restraint/Challenge

“Infection Risk and Regulatory Hurdles in Novel Graft Approvals”

- The risk of infection and graft-related complications such as thrombosis and stenosis remain a key challenge in the adoption of hemodialysis vascular grafts. Despite improvements in material design, these complications can lead to increased hospitalizations and higher healthcare costs

- For instance, biologically derived grafts or tissue-engineered options such as Humacyte’s HAV must undergo extensive clinical trials before gaining FDA or EMA clearance, potentially slowing their entry into mainstream use

- Infection is particularly problematic in immunocompromised and elderly patients, making infection-resistant technologies essential but still underutilized in many regions due to cost concerns

- In addition, the development and clinical validation of new graft materials, especially bioengineered or drug-eluting variants, face stringent regulatory scrutiny, which can delay product approvals and increase R&D expenditures

- Moreover, reimbursement disparities across countries, especially in lower- and middle-income economies, may hinder the widespread adoption of advanced or premium-priced grafts

- To overcome these challenges, manufacturers must focus on post-market surveillance data, physician training, and cost-effective product strategies while actively engaging regulatory bodies to streamline the approval process and accelerate innovation adoption

Hemodialysis Vascular Grafts Market Scope

The market is segmented on the basis of raw material, end-user, and indication.

- By Raw Material

On the basis of raw material, the hemodialysis vascular grafts market is segmented into polytetrafluoroethylene, polyester, biological materials, and polyurethane. The polytetrafluoroethylene segment dominated the market with the largest revenue share of 52.9% in 2024, driven by its high biocompatibility, chemical inertness, and resistance to thrombosis, making it the most widely used material for long-term vascular access in hemodialysis patients. Its durability and ease of implantation make it a preferred choice for both surgeons and healthcare providers.

The Biological Materials segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing R&D in tissue-engineered grafts and the growing demand for grafts that mimic natural vessel properties. Their potential to reduce immune response and infection risk is accelerating adoption, particularly in high-risk and repeat-access patients.

- By End User

On the basis of end-user, the hemodialysis vascular grafts market is segmented into hospitals and ambulatory surgical centers (ASCs). The Hospitals segment held the largest market share of 69.4% in 2024, attributed to their comprehensive vascular surgery capabilities, availability of dialysis units, and well-established reimbursement systems. Hospitals serve as the primary centers for complex access creation procedures and post-operative monitoring.

The ASCs segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the rising trend of outpatient dialysis access surgeries, shorter recovery times, and cost-efficiency. Growing healthcare investments and policy support for same-day procedures are further boosting ASC adoption for graft placements

- By Indication

On the basis of indication, the hemodialysis vascular grafts market is segmented into hemodialysis access, endovascular aneurysm repair, and peripheral vascular repair. The Hemodialysis Access segment dominated the market with a market share of 68.7% in 2024, primarily due to the global surge in end-stage renal disease (ESRD) cases and the high frequency of vascular access procedures required for chronic dialysis treatment. The reliability and repeat usability of grafts make them a cornerstone in hemodialysis management.

The Peripheral Vascular Repair segment is expected to witness notable growth during forecast period, due to rising incidences of peripheral arterial disease and the expanding adoption of minimally invasive vascular interventions, especially in elderly populations.

Hemodialysis Vascular Grafts Market Regional Analysis

- North America dominated the hemodialysis vascular grafts market with the largest revenue share of 39.2% in 2024, supported by a well-established healthcare infrastructure, rising ESRD cases, and strong reimbursement frameworks, particularly in the U.S. where dialysis care networks and specialized vascular access centers are expanding

- Patients and healthcare providers in North America increasingly adopt advanced graft technologies due to their reliability, improved patency, and lower infection risk, particularly in populations with high comorbidity rates such as diabetes and hypertension

- This widespread adoption is further supported by the presence of key medical device companies, ongoing clinical research, and a robust healthcare system, positioning vascular grafts as a preferred option for long-term dialysis access in both hospital and outpatient settings

U.S. Hemodialysis Vascular Grafts Market Insight

The U.S. hemodialysis vascular grafts market captured the largest revenue share of 84% in 2024 within North America, fueled by a high prevalence of end-stage renal disease (ESRD), a mature dialysis care infrastructure, and favorable reimbursement policies. The presence of major players, such as W. L. Gore & Associates and BD, along with continuous advancements in graft technologies, is driving widespread clinical adoption. In addition, the country’s strong focus on outpatient vascular access centers and integrated nephrology care further supports the demand for durable and infection-resistant graft solutions.

Europe Hemodialysis Vascular Grafts Market Insight

The Europe hemodialysis vascular grafts market is projected to expand at a steady CAGR throughout the forecast period, supported by the rising burden of chronic kidney disease (CKD), aging populations, and expanding dialysis services across the region. Countries such as Germany, France, and Italy are seeing increased uptake of advanced synthetic and bioengineered grafts. Moreover, stringent EU regulations encouraging biocompatibility and safety in medical devices are prompting manufacturers to invest in next-generation graft technologies that minimize complications and improve patient outcomes.

U.K. Hemodialysis Vascular Grafts Market Insight

The U.K. hemodialysis vascular grafts market is anticipated to grow at a moderate CAGR during the forecast period, driven by growing awareness of CKD management, the expansion of public dialysis programs under the NHS, and efforts to reduce catheter dependency. With a strong network of renal care centers and increasing emphasis on early access planning, the U.K. is focusing on the use of durable and safe grafts for long-term dialysis patients, particularly among elderly demographics and those with poor vascular anatomy.

Germany Hemodialysis Vascular Grafts Market Insight

The Germany hemodialysis vascular grafts market is expected to expand at a considerable CAGR during the forecast period, supported by its advanced healthcare infrastructure, high incidence of lifestyle-related kidney diseases, and government investments in dialysis services. The country’s emphasis on clinical outcomes, coupled with a strong base of vascular access surgeons, is driving demand for grafts that reduce intervention rates. In addition, Germany’s early adoption of bioengineered grafts and integration of digital health tools for dialysis management is enhancing procedural efficiency and patient care.

Asia-Pacific Hemodialysis Vascular Grafts Market Insight

The Asia-Pacific hemodialysis vascular grafts market is poised to grow at the fastest CAGR of 26% during the forecast period of 2025 to 2032, fueled by rising CKD prevalence, growing dialysis patient population, and expanding healthcare access in developing nations. Countries such as India, China, and Japan are witnessing rapid dialysis infrastructure development. Government initiatives promoting affordable ESRD treatment and the establishment of dialysis centers under public-private partnerships are accelerating market penetration. The region also benefits from local manufacturing of cost-effective graft solutions.

Japan Hemodialysis Vascular Grafts Market Insight

The Japan hemodialysis vascular grafts market is gaining momentum due to its aging population, high dialysis prevalence, and focus on quality-driven healthcare delivery. Japan’s strong emphasis on minimally invasive vascular access techniques and infection control is spurring the use of PTFE grafts with advanced coatings. The integration of robotic and imaging technologies into vascular procedures is further optimizing graft placement and outcomes, driving adoption across public and private dialysis centers.

India Hemodialysis Vascular Grafts Market Insight

The India hemodialysis vascular grafts market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the country’s expanding dialysis network, rising burden of CKD, and increasing demand for long-term vascular access solutions. Rapid urbanization, government-backed programs such as PMNDP (Pradhan Mantri National Dialysis Programme), and the growing role of private nephrology chains are improving access to vascular graft procedures. Domestic manufacturing and affordability of synthetic grafts are playing a crucial role in scaling adoption across Tier 2 and Tier 3 cities.

Hemodialysis Vascular Grafts Market Share

The hemodialysis vascular grafts industry is primarily led by well-established companies, including:

- W. L. Gore & Associates, Inc. (U.S.)

- BD (U.S.)

- Humacyte, Inc. (U.S.)

- LeMaitre Vascular, Inc. (U.S.)

- Medtronic (Ireland)

- Terumo Corporation (Japan)

- Getinge AB (Sweden)

- Cook (U.S.)

- CryoLife, Inc. (U.S.)

- Shanghai Pujiang Medical Group Co., Ltd. (China)

- B. Braun AG (Germany)

- Maquet Cardiovascular LLC (U.S.)

- Endologix LLC (U.S.)

- Trivascular, Inc. (U.S.)

- Xeltis AG (Switzerland)

- Nipro Corporation (Japan)

- Lifeline Scientific, Inc. (U.S.)

- Artivion, Inc. (U.S.)

- CorMedix Inc. (U.S.)

- Suokang Medical Co., Ltd. (China)

What are the Recent Developments in Global Hemodialysis Vascular Grafts Market?

- In March 2024, W. L. Gore & Associates expanded its GORE PROPATEN vascular graft portfolio by introducing a new configuration optimized for hemodialysis access procedures. This product enhancement focuses on reducing the incidence of graft thrombosis and improving long-term patency rates. The development reflects Gore’s commitment to advancing synthetic graft technologies tailored for complex renal access needs, reinforcing its leadership in vascular innovation

- In February 2024, Humacyte, Inc. announced the completion of Phase III clinical trials for its bioengineered Human Acellular Vessel (HAV) designed for hemodialysis access. These vessels, created from human cells and decellularized to prevent immune rejection, showed promising results in terms of durability and infection resistance. This advancement marks a significant milestone in regenerative medicine and could redefine long-term access solutions for ESRD patients pending regulatory approval

- In January 2024, Becton, Dickinson and Company (BD) launched a new version of its AV access graft featuring antimicrobial properties and an improved heparin-bonded surface. Designed to reduce the risks of infection and stenosis, the graft supports better outcomes in patients with repeated access needs. This innovation aligns with BD’s strategic efforts to expand its presence in the vascular access market with differentiated technologies

- In December 2023, Medtronic plc announced a strategic partnership with a network of outpatient dialysis centers in Southeast Asia to pilot its next-generation vascular grafts. The partnership aims to address regional disparities in vascular access care by deploying advanced synthetic grafts with integrated monitoring capabilities. This initiative demonstrates Medtronic’s focus on increasing accessibility and standardizing graft performance across emerging healthcare markets

- In October 2023, LeMaitre Vascular, Inc. acquired Artegraft, Inc., a company specializing in biologic vascular grafts for hemodialysis. The acquisition enhances LeMaitre’s biologic product offerings and expands its customer base in North America. This move underscores a growing industry trend toward consolidating biologic and synthetic graft portfolios to provide comprehensive vascular access solutions for dialysis patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.