Global Hemophilia B Drug Market

Market Size in USD Billion

CAGR :

%

USD

3.25 Billion

USD

6.12 Billion

2024

2032

USD

3.25 Billion

USD

6.12 Billion

2024

2032

| 2025 –2032 | |

| USD 3.25 Billion | |

| USD 6.12 Billion | |

|

|

|

|

Hemophilia B Drug Market Size

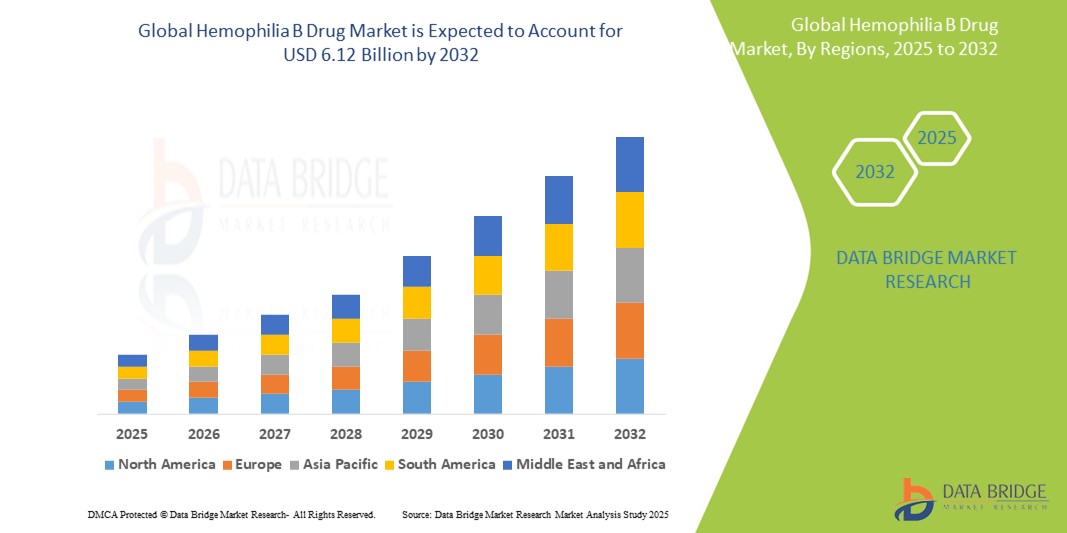

- The global hemophilia B drug market size was valued at USD 3.25 billion in 2024 and is expected to reach USD 6.12 billion by 2032, at a CAGR of 8.25% during the forecast period

- This growth is driven by factors such as the increasing disease prevalence, rising awareness, advancements in gene therapy, and expanding access to novel treatment options

Hemophilia B Drug Market Analysis

- Hemophilia B drugs are essential treatments for managing bleeding episodes in patients with a deficiency of clotting Factor IX, helping prevent severe complications and improving quality of life

- The market demand is significantly driven by increasing disease prevalence, advancements in gene therapy and recombinant products, and improved diagnostic capabilities

- North America is expected to dominate the hemophilia B drugs market with a market share of 44.5%, due to advanced healthcare infrastructure, high adoption of innovative treatments, and a strong presence of key pharmaceutical players

- Asia-Pacific is expected to be the fastest growing region in the Hemophilia B drug market with a market share of 19.5%, during the forecast period due to rapid expansion in healthcare infrastructure, increasing awareness about genetic disorders, and rising diagnosis rates

- The recombinant coagulation factor concentrates segment is expected to dominate the market with a market share of 58.7% due to its superior safety profile, as it eliminates the risk of blood-borne infections associated with plasma-derived products

Report Scope and Hemophilia B Drug Market Segmentation

|

Attributes |

Hemophilia B Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hemophilia B Drug Market Trends

“Advancements in Gene Therapy & Long-Acting Coagulation Products for Hemophilia B”

- One prominent trend in the evolution of hemophilia B treatment is the increasing integration of gene therapy and long-acting coagulation factor product

- These innovations aim to provide more sustainable and effective treatments by potentially offering a one-time cure or longer periods between infusions, thus reducing the burden of frequent treatments

- For instance, recent advancements in gene therapy have led to the development of treatments that target the underlying genetic cause of hemophilia B, offering the possibility of long-term or permanent relief from bleeding episodes

- These advancements are revolutionizing the management of Hemophilia B, improving patient quality of life, and driving the demand for next-generation therapies with extended half-lives and gene therapies

Hemophilia B Drug Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Hemophilia B and Advancements in Treatments”

- The increasing prevalence of hemophilia B, a rare but serious bleeding disorder, is significantly contributing to the rising demand for specialized drugs and therapies

- As the global awareness of genetic disorders improves and diagnostic capabilities expand, more individuals are being diagnosed, leading to an increased need for effective treatments

- Advancements in Hemophilia B therapies, including recombinant clotting factors and gene therapy, have improved treatment outcomes, reduced the frequency of bleeding episodes, and enhanced patients' quality of life, further driving demand for these treatments

For instance,

- In 2023, a report from the World Health Organization highlighted that the incidence of hemophilia is approximately 1 in 5,000 male births, with Hemophilia B making up around 15% of the total cases. As awareness grows, more people are seeking appropriate treatments, increasing the market demand

- As a result of the rising prevalence of Hemophilia B and continued innovations in treatment options, the demand for specialized drugs and advanced therapies is expected to increase significantly

Opportunity

“Advancing Hemophilia B Treatment with Gene Therapy and Personalized Medicine”

- Gene therapy and personalized medicine are emerging as significant opportunities in the treatment of hemophilia B, offering the potential for long-term or permanent relief from the disorder

- Advancements in gene therapy aim to address the root cause of Hemophilia B by introducing functional copies of the missing or defective clotting factor gene, reducing or eliminating the need for regular infusions of clotting factor concentrates

- Personalized medicine, driven by genetic profiling and advanced diagnostics, allows for treatments tailored to individual patients, improving outcomes and minimizing side effects

For instance,

- In 2024, the approval of gene therapy for hemophilia B by regulatory bodies such as the FDA and EMA marked a major milestone. Patients receiving this therapy have experienced a dramatic reduction in bleeding episodes, allowing them to live without frequent treatments

- The integration of gene therapy and personalized treatment options in hemophilia B can significantly improve patient outcomes, reduce long-term treatment costs, and increase the quality of life for patients. By offering more durable and individualized solutions, these innovations present a major opportunity for the market

Restraint/Challenge

“High Treatment Costs and Limited Access to Advanced Therapies”

- The high cost of hemophilia B treatments, particularly recombinant factor products and gene therapies, poses a significant challenge, especially for patients in low-income regions or those without comprehensive insurance coverage

- Recombinant clotting factor therapies can cost tens of thousands of dollars annually, and the emerging gene therapies, although offering long-term benefits, come with high initial costs, often exceeding several hundred thousand dollars per treatment

- These financial barriers can limit patient access to these life-changing therapies, particularly in developing countries or in healthcare systems with limited resources

For instance,

- In 2024, according to a report by the World Hemophilia Federation, the cost of recombinant clotting factor therapy can exceed USD 300,000 per year for a single patient, making it unaffordable for many in low-income countries

- Consequently, the high treatment costs can lead to inequalities in access to care, with some patients unable to receive the full benefit of available therapies, ultimately hindering the overall growth and adoption of Hemophilia B treatments globally

Hemophilia B Drug Market Scope

The market is segmented on the basis of product type, therapy type, drug class, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Therapy Type |

|

|

By Drug class |

|

|

By Distribution Channel

|

|

In 2025, the recombinant coagulation factor concentrates is projected to dominate the market with a largest share in product segment

The recombinant coagulation factor concentrates segment is expected to dominate the hemophilia B Drug market with the largest share of 58.7% in 2024 due to its superior safety profile, as it eliminates the risk of blood-borne infections associated with plasma-derived products. In addition, these products offer improved efficacy, longer half-lives, and are increasingly preferred in both prophylactic and on-demand treatment regimens. Ongoing advancements in recombinant technology further support their widespread adoption

The factor replacement therapy is expected to account for the largest share during the forecast period in therapy type market

In 2025, the factor replacement therapy segment is expected to dominate the market with the largest market share of 60.5% due to its proven efficacy in managing bleeding episodes and preventing complications in Hemophilia B patients. This therapy remains the cornerstone of treatment, offering rapid and reliable clotting factor restoration. In addition, advancements such as extended half-life products have improved dosing convenience and patient compliance, further supporting its widespread adoption

Hemophilia B Drug Market Regional Analysis

“North America Holds the Largest Share in the Hemophilia B Drug Market”

- North America dominates the hemophilia B drug market with a market share of estimated 44.5%, driven, by advanced healthcare infrastructure, high adoption of innovative treatments, and a strong presence of key pharmaceutical players

- U.S. holds a market share of 45.6%, due to its well-established healthcare system, higher awareness of rare diseases, and continuous advancements in hemophilia treatments, including recombinant clotting factor products and gene therapies

- The availability of favorable reimbursement policies and substantial investments in R&D by major pharmaceutical companies further strengthens the market

- In addition, the increasing number of hemophilia B diagnoses, better access to treatment options, and improved care infrastructure are fueling the market’s growth in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Hemophilia B Drug Market”

- Asia-Pacific is expected to witness the highest growth rate in the hemophilia B drug market with a market share of 19.5%, driven by rapid expansion in healthcare infrastructure, increasing awareness about genetic disorders, and rising diagnosis rates

- Countries such as China, India, and Japan are emerging as key markets due to improvements in diagnostic capabilities, growing healthcare investments, and a rising number of patients seeking advanced treatment options

- Japan, with its advanced healthcare system and increasing access to newer therapies, remains a crucial market for hemophilia B drugs. The country is a leader in the adoption of cutting-edge treatments, including gene therapies and extended half-life factor products

- India is projected to register the highest CAGR in the hemophilia B drug market, driven by a growing prevalence of hemophilia B, expanding healthcare infrastructure, and increasing government initiatives to improve access to essential therapies

Hemophilia B Drug Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Pfizer Inc. (U.S.)

- CSL (Australia)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Sanofi (France)

- Bayer AG (Germany)

- Novo Nordisk A/G (Denmark)

- Genentech, Inc. (U.S.)

- Baxter (U.S.)

- Grifols, S.A. (Spain)

- Spark Therapeutics, Inc. (U.S.)

- uniQure NV. (Netherlands)

- Be Biopharma (U.S.)

- Bayer AG (Germany)

- Apellis Pharmaceuticals (U.S.)

- Hemopharm (Germany)

- Hepalink (China)

- Takeda Pharmaceutical Company Limited. (Japan)

- Octapharma AG (Switzerland)

- Swedish Orphan Biovitrum AB (Sweden)

Latest Developments in Global Hemophilia B Drug Market

- In March 2025, the U.S. FDA approved Sanofi's Qfitlia (fitusiran), a novel subcutaneous therapy for hemophilia A and B patients aged 12 and older, with or without inhibitors. Administered every two months, Qfitlia demonstrated a 90% reduction in annualized bleeding rates in clinical trials. Priced at USD 642,000 annually, it offers a significant improvement in treatment convenience and quality of life for patients

- In February 2025, Pfizer announced the discontinuation of its hemophilia B gene therapy, fidanacogene elaparvovec (marketed as Beqvez in the U.S. and Durveqtix in the EU), citing limited patient and clinician interest. Despite initial approvals, including a conditional marketing authorization from the European Commission in July 2024, the therapy has been withdrawn from the market

- In February 2025, Pfizer announced the discontinuation of its hemophilia B gene therapy, fidanacogene elaparvovec (Beqvez), citing limited patient and clinician interest despite its FDA approval in April 2024

- In January 2025, CSL Behring announced a strategic shift in its gene therapy pipeline, deprioritizing ex vivo lentiviral-based gene therapies. This decision included the closure of its R&D facility in Pasadena, California, which was previously involved in the development of Hemgenix

- In May 2024, Be Biopharma's BE-101, an engineered B Cell medicine for Hemophilia B, received Orphan Drug Designation from the U.S. FDA. The company initiated the Phase 1/2 BeCoMe-9 clinical trial in late 2024 to evaluate BE-101 in adults with severe or moderately severe Hemophilia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.