Global Herbicide Tolerance Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

21.31 Billion

2024

2032

USD

4.92 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 21.31 Billion | |

|

|

|

|

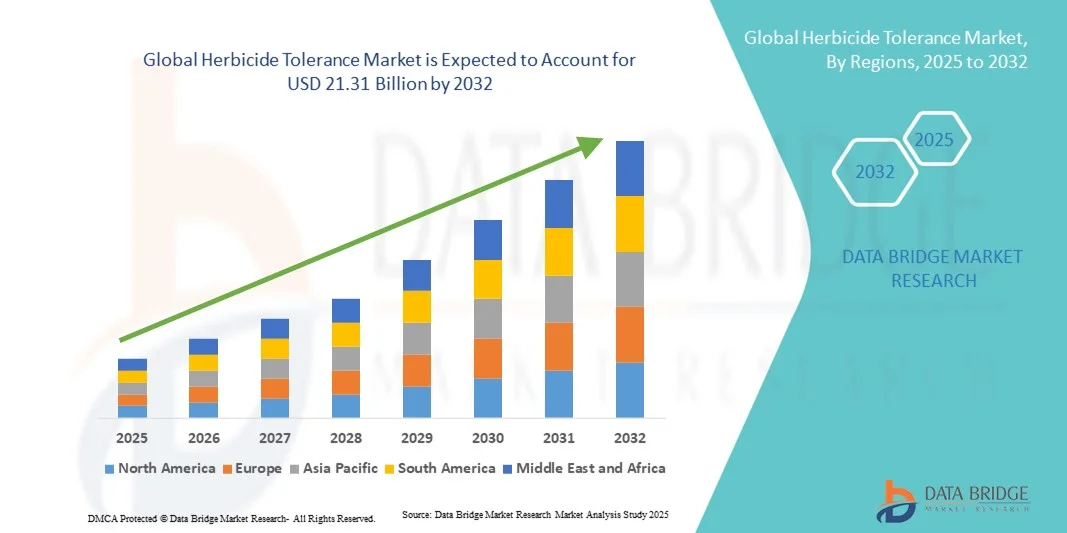

What is the Global Herbicide Tolerance Market Size and Growth Rate?

- The global herbicide tolerance market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 20.10% during the forecast period

- The growth in the popularity of herbicide tolerance technology owning to its less environmental impact and human risk factors and the initiatives taken by the government to promote the use of this tool over the non- GM counterparts are majorly driving the herbicide tolerance market. The increase in demand for the solution among farmers as it provides flexibility to control the weeds during any stage of plant growth, less number of sprays, reduction of fuel usage and decreased soil compaction accelerate the herbicide tolerance market growth

- The inclination towards herbicide tolerance technology as they do not damage the crop’s growth nor result in poorer agronomic performance in comparison with parental crops because except addition of enzyme or alteration of enzyme, no other metabolic change is made which also acts as a driving factor. The application gives excellent weed control and high crop yield and uses low toxicity compounds which do not remain active in the soil boosting the herbicide tolerance market

What are the Major Takeaways of Herbicide Tolerance Market?

- The rise in research and development activities, favorable regulations, the absence of toxins or allergens, growing food requirement across the globe, increase in investment and growing concerns regarding the environmental issues positively affect the herbicide tolerance market

- Furthermore, the emphasis on preventing soil structure and the increasing demand for no-tillage and reduced tillage practices among farmers extend profitable opportunities to the herbicide tolerance market players

- Asia-Pacific dominated the herbicide tolerance market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, technological adoption, and the increasing focus on modern agricultural practices

- North America is expected to witness the fastest CAGR of 7.5% from 2025 to 2032, driven by high awareness of advanced crop technologies, rising farm productivity requirements, and the expanding adoption of precision agriculture

- The Glyphosate-Tolerant Crops segment dominated the market with the largest revenue share of 62% in 2024, driven by their widespread adoption in major crops such as soybean, maize, and canola

Report Scope and Herbicide Tolerance Market Segmentation

|

Attributes |

Herbicide Tolerance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Herbicide Tolerance Market?

Precision Agriculture and Biotech Integration

- A key and rapidly growing trend in the global herbicide tolerance market is the integration of advanced biotechnology with precision agriculture systems. This combination allows for crops that are genetically engineered to withstand specific herbicides while simultaneously enabling farmers to optimize field operations using AI-driven analytics and IoT-enabled devices

- For instance, herbicide-tolerant soybean and corn varieties now integrate with precision spraying systems, enabling targeted herbicide application while reducing overall chemical use. This integration improves yield, minimizes environmental impact, and reduces operational costs

- The adoption of CRISPR and other genome-editing technologies is enhancing the development of next-generation herbicide-tolerant crops, providing resilience against evolving weed resistance patterns. Companies such as Bayer, Corteva, and Syngenta are investing heavily in this R&D to create smarter, more sustainable solutions

- Combining biotech crops with farm management software allows centralized control over planting, fertilization, irrigation, and herbicide application, creating highly efficient and automated farming practices

- This trend is transforming grower expectations, with farmers increasingly prioritizing crop varieties that deliver both higher yield potential and herbicide flexibility, fostering a shift toward precision, sustainable agriculture practices

What are the Key Drivers of Herbicide Tolerance Market?

- Increasing global food demand, coupled with the need to reduce labor and chemical costs in farming, is driving the adoption of herbicide-tolerant crops

- In April 2024, Corteva announced an expansion of its herbicide-tolerant crop portfolio, including soybeans and maize, aimed at improving yield performance in North America and Latin America. Such strategies by leading companies are expected to stimulate market growth during the forecast period

- Herbicide-tolerant crops offer improved weed management efficiency, allowing farmers to apply herbicides selectively while protecting crop health, ultimately increasing productivity per hectare

- The rising popularity of integrated pest and weed management practices, along with government incentives for sustainable agriculture, encourages farmers to adopt herbicide-tolerant varieties that align with these initiatives

- Ease of adoption, reduced operational complexity, and compatibility with precision spraying equipment further drive adoption across large-scale commercial farms, while DIY farm management solutions make these crops increasingly accessible to smaller growers

Which Factor is Challenging the Growth of the Herbicide Tolerance Market?

- Regulatory constraints and public concerns over genetically modified organisms (GMOs) continue to pose challenges for the broader adoption of herbicide-tolerant crops. Strict compliance requirements can delay product approvals in certain regions, especially in Europe and parts of Asia-Pacific

- Environmental and sustainability concerns related to herbicide overuse, such as soil and water contamination, make some farmers cautious about integrating herbicide-tolerant varieties into their operations

- Addressing these challenges through transparent regulatory approvals, advanced stewardship programs, and the development of next-generation crops requiring lower herbicide volumes is crucial. Companies such as Bayer and Syngenta emphasize sustainable use programs and crop rotation strategies to build grower confidence

- Furthermore, premium pricing of some herbicide-tolerant seed varieties can be a barrier for smallholders or farmers in developing regions, even as yields and efficiency improvements justify long-term benefits

- Educating farmers on safe herbicide application, promoting eco-friendly biotech solutions, and expanding affordable crop options will be vital for sustained growth in the Herbicide Tolerance market

How is the Herbicide Tolerance Market Segmented?

The market is segmented on the basis of herbicide tolerance type, technology, and crops.

- By Herbicide Tolerance Type

On the basis of herbicide tolerance type, the market is segmented into Glyphosate-Tolerant Crops and Glufosinate-Tolerant Crops. The Glyphosate-Tolerant Crops segment dominated the market with the largest revenue share of 62% in 2024, driven by their widespread adoption in major crops such as soybean, maize, and canola. Glyphosate-tolerant varieties enable farmers to efficiently manage weeds with broad-spectrum herbicides, reduce labor costs, and improve overall yields. Farmers also favor these crops due to their compatibility with precision spraying technologies and integrated farm management systems.

The Glufosinate-Tolerant Crops segment is anticipated to witness the fastest CAGR of 20.3% from 2025 to 2032, fueled by rising demand in regions with regulatory restrictions on glyphosate use. Glufosinate-tolerant crops provide alternative weed control solutions, particularly in Europe and parts of Asia-Pacific, offering farmers flexibility in managing resistant weed species while complying with local environmental regulations.

- By Technology

On the basis of technology, the market is segmented into Production of New Protein, Modification of Target Protein, and Creation of Physical or Physiological Barriers. The Modification of Target Protein segment held the largest market revenue share of 55% in 2024, driven by its ability to directly alter crop susceptibility to specific herbicides, enabling effective weed management and improved crop resilience. This technology is widely used in major commercial crops such as maize, soybean, and cotton, offering predictable performance and ease of regulatory approval in key markets.

The Production of New Protein segment is expected to witness the fastest CAGR of 18.7% during 2025–2032, supported by advancements in biotechnology and gene-editing tools such as CRISPR. This technology allows the development of crops with novel herbicide resistance traits, catering to regions facing multiple herbicide-resistant weed challenges, thereby enhancing global adoption and market expansion.

- By Crops

On the basis of crops, the market is segmented into Alfalfa, Argentine Canola, Carnation, Chicory, Cotton, Creeping Bentgrass, Flax, Linseed, Maize, Polish Canola, Potato, Rice, Soybean, Sugar Beet, Tobacco, Wheat, and Others. The Soybean segment dominated the market with the largest revenue share of 38% in 2024, attributed to its global cultivation, high adoption of herbicide-tolerant varieties, and critical role in food and feed industries. Soybean’s compatibility with glyphosate-tolerant and glufosinate-tolerant traits makes it a preferred choice for commercial farmers seeking improved weed management and higher yields.

The Maize segment is expected to witness the fastest CAGR of 17.5% from 2025 to 2032, driven by rising demand for maize-based food products, biofuels, and livestock feed, along with the increasing adoption of herbicide-tolerant maize hybrids in North America, South America, and Asia-Pacific. The expansion in maize cultivation and technological innovations in crop protection are set to fuel sustained market growth.

Which Region Holds the Largest Share of the Herbicide Tolerance Market?

- Asia-Pacific dominated the herbicide tolerance market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, technological adoption, and the increasing focus on modern agricultural practices

- Consumers and commercial farmers in the region highly value the productivity and efficiency benefits offered by herbicide-tolerant crops, which help in effective weed management, yield optimization, and cost reduction

- The widespread adoption is further supported by strong government initiatives promoting digital agriculture, high investments in crop research, and the presence of major agricultural biotechnology firms, establishing Herbicide Tolerance technologies as a preferred solution across major APAC countries

China Herbicide Tolerance Market Insight

The China herbicide tolerance market captured the largest revenue share in Asia-Pacific in 2024, driven by the country’s expanding middle class, extensive farmland, and high acceptance of advanced agricultural technologies. The growing need for higher crop productivity and resistance to weeds has encouraged farmers to adopt glyphosate- and glufosinate-tolerant crops. Furthermore, the push for smart agriculture and precision farming solutions is significantly contributing to the market expansion. China’s strong domestic manufacturing base and government-backed initiatives for sustainable agriculture are also key factors driving the adoption of Herbicide Tolerance solutions.

Japan Herbicide Tolerance Market Insight

The Japan herbicide tolerance market is witnessing steady growth due to the country’s emphasis on technological innovation and sustainable agriculture. Japanese farmers increasingly adopt herbicide-tolerant crops to improve operational efficiency and reduce labor costs in weed management. The integration of modern agritech solutions, including crop monitoring systems and precision spraying techniques, is further fueling market growth. Moreover, Japan’s aging agricultural workforce is driving demand for solutions that simplify crop management and increase efficiency, creating strong opportunities for Herbicide Tolerance adoption.

Which Region is the Fastest Growing Region in the Herbicide Tolerance Market?

North America is expected to witness the fastest CAGR of 7.5% from 2025 to 2032, driven by high awareness of advanced crop technologies, rising farm productivity requirements, and the expanding adoption of precision agriculture. The region’s strong regulatory framework, coupled with increasing investments in biotechnology and crop research, is facilitating rapid adoption of glyphosate- and glufosinate-tolerant crops. Furthermore, the growing trend of sustainable farming practices and integrated pest management is propelling the market, while the presence of major agribusiness companies ensures easy availability and support for farmers.

U.S. Herbicide Tolerance Market Insight

The U.S. herbicide tolerance market captured the largest revenue share within North America in 2024, with farmers prioritizing high-yield crops resistant to commonly used herbicides. The rapid adoption of smart farming technologies and automated crop management systems is significantly contributing to market expansion. The growing preference for precision agriculture, coupled with advanced supply chain management and biotechnology innovations, continues to drive adoption across soybean, maize, and cotton crops. Strong R&D investments and the availability of certified herbicide-tolerant seeds further reinforce North America’s position as the fastest-growing market globally.

Which are the Top Companies in Herbicide Tolerance Market?

The herbicide tolerance industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- Bayer AG (Germany)

- Corteva Agriscience (U.S.)

- UPL Limited (India)

- ADAMA Ltd. (Israel)

- Zhejiang Xinan Chemical Industrial Group Co., Ltd (China)

- Nufarm (Australia)

- Excel Crop Care Ltd (India)

- Jiangsu Good Harvest Weien Agrochemical Co., Ltd (China)

- AMVAC Chemical Corporation (U.S.)

- King Quenson (China)

- Nantong Jiangshan Agrochemical & Chemicals Ltd Liability Co (China)

- DuPont (U.S.)

- Syngenta (Switzerland)

- Vilmorin & Cie (France)

- Suntory Holdings Limited (Japan)

What are the Recent Developments in Global Herbicide Tolerance Market?

- In October 2025, Bayer AG introduced Mateno More, a herbicide designed to provide extended control against resistant wheat weeds affecting farmers across India, marking the first herbicide in India to combine three active ingredients for comprehensive weed management in wheat crops, further strengthening Bayer’s position in the Indian herbicide market

- In June 2025, Syngenta Group launched its new herbicide molecule, metproxybicyclone, which has been officially recognized by the Herbicide Resistance Action Committee (HRAC) and the Weed Science Society of America (WSSA) as a new chemical subclass within the ACCase-inhibitor family, enhancing Syngenta’s portfolio with innovative solutions for resistant weeds

- In February 2025, UPL Limited, a global provider of agricultural solutions, received registration from the U.S. Environmental Protection Agency for INTRAVA DX herbicide, a pre-emergent solution for corn, containing a new active ingredient that provides both control and residual protection against resistant weeds, supporting UPL’s expansion in the North American market

- In November 2024, Corteva Agriscience launched Kyber Pro and Sonic Boom herbicides, offering pre-emergence products with multiple modes of action and extended residual control, helping soybean farmers increase yield potential while managing weed resistance, strengthening Corteva’s presence in sustainable crop protection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.