Global Hereditary Sensory Motor Neuropathy Market

Market Size in USD Billion

CAGR :

%

USD

7.80 Billion

USD

12.15 Billion

2024

2032

USD

7.80 Billion

USD

12.15 Billion

2024

2032

| 2025 –2032 | |

| USD 7.80 Billion | |

| USD 12.15 Billion | |

|

|

|

|

Hereditary Sensory Motor Neuropathy Market Size

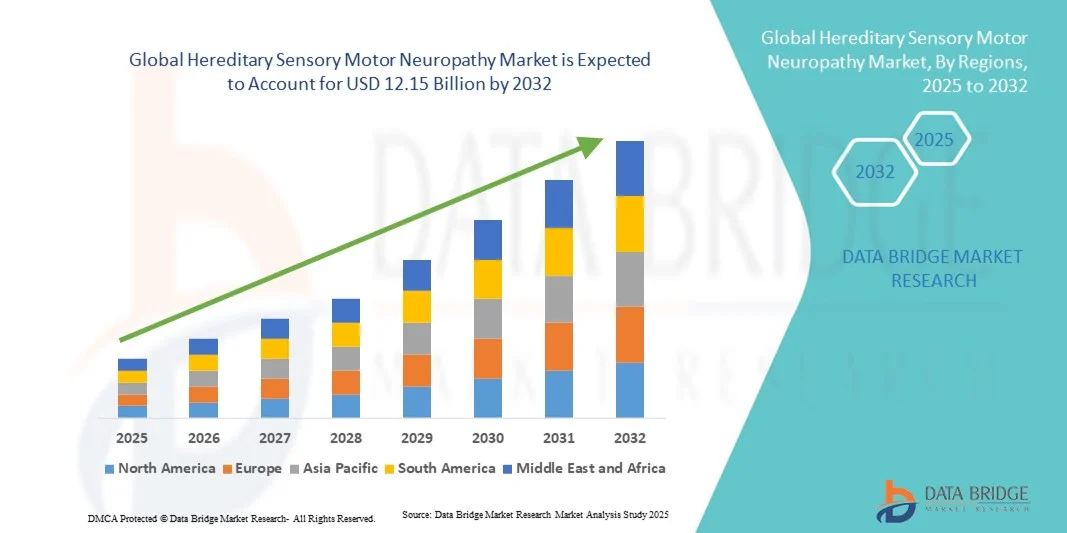

- The global hereditary sensory motor neuropathy market size was valued at USD 7.80 billion in 2024 and is expected to reach USD 12.15 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of inherited peripheral neuropathies and ongoing advancements in genetic testing and molecular diagnostics, enabling earlier and more accurate disease identification across global healthcare systems

- Furthermore, rising investment in gene therapy research, along with growing awareness and screening initiatives for rare neurological disorders, is driving innovation in treatment approaches. These converging factors are accelerating the adoption of novel diagnostic and therapeutic solutions, thereby significantly boosting the industry's growth

Hereditary Sensory Motor Neuropathy Market Analysis

- Hereditary sensory motor neuropathy (HSMN), also known as Charcot-Marie-Tooth disease, comprises a group of inherited peripheral nerve disorders that lead to progressive muscle weakness, sensory loss, and impaired motor coordination. The market is witnessing steady growth driven by genetic research advancements, improved diagnostic techniques, and the rising prevalence of inherited neuropathic conditions globally

- The increasing demand for accurate diagnosis and effective management is primarily fueled by the expansion of molecular testing, growing patient awareness, and supportive government initiatives promoting rare disease research and genetic counselling

- North America dominated the hereditary sensory motor neuropathy market with the largest revenue share of 40.7% in 2024, supported by advanced healthcare infrastructure, higher adoption of next-generation sequencing technologies, and active gene therapy trials across the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by expanding diagnostic networks, increasing healthcare expenditure, and greater awareness of hereditary neurological disorders in China, Japan, and India

- The Molecular Genetic Testing segment dominated the market with a 43.1% share in 2024 under the diagnosis category, owing to its high accuracy in identifying causative gene mutations and its growing integration into early disease screening and personalized treatment strategies

Report Scope and Hereditary Sensory Motor Neuropathy Market Segmentation

|

Attributes |

Hereditary Sensory Motor Neuropathy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Hereditary Sensory Motor Neuropathy Market Trends

Advancements in Gene Therapy and Precision Medicine

- A significant and accelerating trend in the global hereditary sensory motor neuropathy (HSMN) market is the rapid advancement of gene therapy and precision medicine approaches aimed at addressing the genetic mutations underlying the disorder. These innovations are reshaping how hereditary neuropathies are diagnosed and treated worldwide

- For instance, research initiatives led by companies such as Pharnext and Passage Bio are developing gene-based and small molecule therapies designed to target the root causes of hereditary neuropathies rather than only managing symptoms

- Gene therapy integration in HSMN treatment allows direct correction of defective genes and holds the potential to slow or halt disease progression. For instance, preclinical trials exploring viral vector-based therapies for Charcot-Marie-Tooth disease have demonstrated promising efficacy and long-term functional recovery in nerve cells. Furthermore, precision medicine enables patient-specific approaches using genetic profiling to guide therapy selection

- The growing focus on personalized treatment is driving collaborations between genetic testing firms and biotech developers to enhance diagnostic accuracy and therapeutic success rates. Through this synergy, patients benefit from targeted interventions and improved clinical outcomes

- This trend toward gene-centered innovation and tailored medical solutions is fundamentally transforming the therapeutic landscape of HSMN. Consequently, companies such as InFlectis BioScience and PTC Therapeutics are expanding R&D in novel drug candidates and gene repair platforms to achieve disease-modifying outcomes

- The demand for therapies offering genetic correction and personalized disease management is rising rapidly across both clinical and research environments, as stakeholders increasingly prioritize long-term efficacy and curative potential

Hereditary Sensory Motor Neuropathy Market Dynamics

Driver

Growing Prevalence and Advancements in Genetic Diagnostics

- The increasing global prevalence of inherited neuropathies, coupled with breakthroughs in genetic testing technologies, is a major driver fueling the hereditary sensory motor neuropathy market’s expansion

- For instance, in January 2024, Pharnext announced progress in its late-stage trials for PXT3003, a combination therapy targeting Charcot-Marie-Tooth Type 1A, marking a significant step toward effective disease management

- As awareness of rare neurological disorders rises, patients and clinicians are increasingly relying on molecular diagnostics such as next-generation sequencing (NGS) for early and precise detection, enhancing disease management outcomes

- Furthermore, the growing accessibility of genetic counseling and integration of comprehensive testing panels into routine clinical practice are enabling faster diagnosis and broader patient reach globally

- The improved ability to identify hereditary neuropathies, combined with growing patient registries and funding for rare disease research, continues to propel innovation in both therapeutic and diagnostic domains

- Increasing government initiatives to support rare disease screening programs and public-private partnerships aimed at improving diagnostic infrastructure are accelerating early detection and patient enrollment in clinical studies

- The emergence of AI-based genomic analysis tools is also enhancing mutation interpretation accuracy, significantly reducing diagnosis time and enabling more personalized treatment decisions

Restraint/Challenge

High Cost of Genetic Testing and Limited Therapeutic Availability

- The high cost associated with advanced genetic testing and the absence of approved curative therapies pose significant challenges to broader market accessibility and growth

- For instance, while next-generation sequencing offers precise mutation identification, its cost remains prohibitive in developing economies, limiting patient diagnosis and follow-up care

- The lack of effective curative options and dependence on symptomatic management approaches, such as physiotherapy and pain relief, further restricts treatment advancement and patient satisfaction

- In addition, the rarity and clinical variability of HSMN complicate clinical trial recruitment and regulatory approvals, slowing drug development timelines

- Addressing these barriers through cost reduction in genetic testing, government support for rare disease programs, and increased investment in gene therapy research will be essential for sustaining long-term market growth

- Limited awareness among primary healthcare providers often results in misdiagnosis or delayed identification, leading to suboptimal treatment and management outcomes

- Furthermore, insufficient reimbursement coverage for genetic tests and rare disease treatments continues to hinder patient access to advanced diagnostics and emerging therapies

Hereditary Sensory Motor Neuropathy Market Scope

The market is segmented on the basis of diagnosis, treatment, distribution channel, and end user.

- By Diagnosis

On the basis of diagnosis, the hereditary sensory motor neuropathy (HSMN) market is segmented into EMGs and motor nerve conduction test, specialized DNA blood tests, molecular genetic testing, and others. The Molecular Genetic Testing segment dominated the market with the largest revenue share of 42.6% in 2024, owing to its superior precision in identifying specific gene mutations responsible for hereditary neuropathies. This diagnostic approach allows clinicians to classify subtypes of HSMN more accurately, enabling early diagnosis and improved disease management strategies. The growing use of next-generation sequencing (NGS) and whole exome sequencing (WES) is enhancing mutation detection rates, leading to a greater understanding of disease mechanisms. In addition, increasing integration of molecular testing into clinical workflows and research collaborations between diagnostic laboratories and biotech companies are driving adoption across developed healthcare markets.

The Specialized DNA Blood Tests segment is projected to witness the fastest growth rate of 8.9% from 2025 to 2032, driven by increasing accessibility of genetic testing technologies and reduced turnaround times. These tests offer a less invasive and cost-effective alternative for preliminary genetic screening, making them ideal for mass diagnostic programs and early-stage evaluations. Growing awareness of family genetic risks and the expansion of direct-to-consumer DNA testing services are also contributing to this segment’s growth, particularly in emerging economies.

- By Treatment

On the basis of treatment, the market is segmented into surgery, drugs, and others. The Drugs segment dominated the hereditary sensory motor neuropathy market in 2024, accounting for the largest share, supported by the high reliance on pharmacological management to alleviate symptoms such as neuropathic pain, muscle weakness, and sensory deficits. Drug therapies, including pain relievers, neuroprotective agents, and vitamin supplementation, remain the primary form of treatment while curative therapies are still under development. The increasing availability of off-label medications and supportive therapies is further reinforcing segment growth. Rising research interest in neuroprotective compounds and drug repurposing for HSMN subtypes such as Charcot-Marie-Tooth (CMT) disease also supports the segment’s dominance.

The Surgery segment is anticipated to record the fastest growth rate of 8.2% during the forecast period, mainly due to the growing adoption of orthopedic and corrective surgical procedures for patients with severe deformities or advanced muscle wasting. Advances in surgical interventions such as tendon transfers, foot reconstruction, and joint stabilization are helping improve mobility and quality of life for patients. The expansion of specialized orthopedic care centers and increasing availability of minimally invasive techniques are driving this trend, especially in developed healthcare systems.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies and retail & online pharmacies. The Hospital Pharmacies segment dominated the market in 2024 with the largest revenue share, as hospitals serve as primary points for diagnosis and treatment of hereditary sensory motor neuropathy. Patients frequently depend on hospital-based pharmacies for prescribed medications, physiotherapy support, and specialized care products. The close integration between diagnostic services, neurologists, and in-house pharmacies ensures treatment accuracy and patient compliance. Furthermore, hospital pharmacies benefit from strong collaborations with healthcare providers and insurance networks, enabling access to a broader range of specialized drugs and clinical supplies.

The Retail & Online Pharmacies segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, fueled by the rapid digitalization of healthcare and rising consumer preference for convenient medication access. Online platforms are expanding the availability of neurocare products and symptom-management drugs, particularly in regions with limited hospital infrastructure. The rise of e-pharmacy startups, home delivery models, and patient-centric platforms offering genetic counseling and drug refill reminders are further accelerating segment growth globally.

- By End User

On the basis of end user, the market is segmented into hospitals, homecare, specialty clinics, and others. The Hospitals segment dominated the hereditary sensory motor neuropathy market in 2024 with the largest share, attributed to the concentration of advanced diagnostic technologies, multidisciplinary treatment teams, and access to genetic testing infrastructure. Hospitals play a key role in early diagnosis, genetic counseling, and long-term management of HSMN patients through integrated care pathways. The presence of specialized neuromuscular units and access to clinical trial networks further strengthens hospital-based treatment adoption. In addition, hospital-based research programs focusing on molecular and gene therapy are expanding the segment’s leadership position.

The Specialty Clinics segment is projected to witness the fastest growth rate of 9.3% during the forecast period, driven by increasing patient preference for personalized and continuous care outside hospital environments. These clinics offer specialized neurological assessments, rehabilitation services, and follow-up consultations, ensuring improved patient engagement and quality of life. The proliferation of dedicated neuromuscular and genetic counseling centers, especially in North America and Europe, supports segment expansion. Furthermore, the integration of telemedicine into specialty clinic services is enhancing accessibility for patients with mobility limitations, contributing to strong growth momentum.

Hereditary Sensory Motor Neuropathy Market Regional Analysis

- North America dominated the hereditary sensory motor neuropathy market with the largest revenue share of 40.7% in 2024, supported by advanced healthcare infrastructure, higher adoption of next-generation sequencing technologies, and active gene therapy trials across the U.S. and Canada

- Patients and healthcare providers in the region highly value the accessibility of genetic counseling, early screening programs, and participation in clinical trials aimed at developing gene-based and disease-modifying therapies for hereditary neuropathies

- This leadership position is further supported by substantial R&D investments, favorable reimbursement frameworks, and strong collaborations between biotech companies, academic research institutions, and healthcare organizations, establishing North America as a key hub for innovation and clinical advancement in the hereditary sensory motor neuropathy market

U.S. Hereditary Sensory Motor Neuropathy Market Insight

The U.S. hereditary sensory motor neuropathy (HSMN) market captured the largest revenue share of 81% in 2024 within North America, driven by the growing prevalence of inherited neuropathies and the rapid adoption of advanced genetic diagnostics. The U.S. remains a global leader in rare disease research, supported by the presence of major biotechnology firms and academic institutions engaged in gene therapy development. Increasing access to next-generation sequencing and strong healthcare infrastructure continue to enhance early detection and patient management. Moreover, favorable government policies, such as orphan drug designations and research funding, are accelerating therapeutic innovation in the HSMN space.

Europe Hereditary Sensory Motor Neuropathy Market Insight

The Europe hereditary sensory motor neuropathy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in genetic research and strong regulatory support for rare disease treatment programs. The region’s advanced healthcare networks and growing adoption of precision diagnostics are facilitating earlier detection and intervention. European countries are also witnessing a surge in collaborative research initiatives focused on gene-based and protein-targeted therapies. Furthermore, the expansion of patient registries and cross-border healthcare access under the EU’s rare disease policies are strengthening disease monitoring and patient care standards.

U.K. Hereditary Sensory Motor Neuropathy Market Insight

The U.K. hereditary sensory motor neuropathy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the National Health Service (NHS) focus on genomic medicine and increased participation in global clinical trials. Rising public awareness of inherited neurological conditions and improved availability of genetic counseling are key growth contributors. The U.K.’s robust research ecosystem, supported by organizations such as Genomics England and academic partnerships, is fostering the development of advanced diagnostic and therapeutic tools. In addition, strong government funding for rare disease initiatives continues to propel innovation and patient access to personalized care.

Germany Hereditary Sensory Motor Neuropathy Market Insight

The Germany hereditary sensory motor neuropathy market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on medical innovation and strong biotechnology sector. Germany’s well-established healthcare system, coupled with its investment in molecular research, supports widespread adoption of advanced genetic testing. Increasing collaborations between universities, research institutes, and pharmaceutical companies are promoting the discovery of novel therapeutic pathways. Furthermore, patient advocacy groups and public awareness campaigns are improving diagnosis rates, while healthcare digitization initiatives facilitate data sharing and clinical research advancements.

Asia-Pacific Hereditary Sensory Motor Neuropathy Market Insight

The Asia-Pacific hereditary sensory motor neuropathy market is poised to grow at the fastest CAGR of 8.9% during 2025–2032, driven by growing awareness of genetic disorders, expanding healthcare infrastructure, and rising investments in genomics across countries such as China, Japan, and India. Increasing government support for rare disease diagnosis and treatment programs is fostering early screening adoption. As APAC becomes a regional hub for molecular diagnostics and biopharmaceutical manufacturing, cost-effective genetic testing is becoming more accessible. The growing participation of regional research institutes in global collaborations is also accelerating innovation and clinical trial activity.

Japan Hereditary Sensory Motor Neuropathy Market Insight

The Japan hereditary sensory motor neuropathy market is gaining momentum due to the country’s strong biomedical research ecosystem and emphasis on advanced genetic testing technologies. Japan’s healthcare system prioritizes early diagnosis and patient-specific treatment approaches, leading to increased adoption of molecular diagnostics for hereditary neuropathies. For instance, collaborations between research centers and biotech firms are driving development in gene therapy and regenerative medicine. Moreover, Japan’s aging population and increasing government support for rare disease initiatives are expected to boost demand for effective management and therapeutic solutions in both clinical and homecare settings.

India Hereditary Sensory Motor Neuropathy Market Insight

The India hereditary sensory motor neuropathy market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, growing population awareness, and advancements in molecular diagnostics. India’s strong network of medical research institutions and cost-efficient testing capabilities make it an emerging hub for genetic testing and clinical studies. The government’s push toward rare disease policy implementation and inclusion of genomic testing in national healthcare programs are further supporting market growth. In addition, the rise of domestic biotech firms and telemedicine platforms is improving accessibility to specialized diagnostics and treatment across urban and semi-urban regions.

Hereditary Sensory Motor Neuropathy Market Share

The Hereditary Sensory Motor Neuropathy industry is primarily led by well-established companies, including:

- PTC Therapeutics. (U.S.)

- Sarepta Therapeutics, Inc. (U.S.)

- Ionis Pharmaceuticals, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Merck & Co., Inc., (U.S.)

- Takeda Pharmaceutical Company Limited. (Japan)

- Pfizer Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- BioMarin. (U.S.)

- Novartis AG (Switzerland)

- Sanofi (France)

- Biogen Inc. (U.S.)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- GSK plc (U.K.)

- Bayer AG (Germany)

- Vertex Pharmaceuticals Incorporated (U.S.)

- UCB S.A., Belgium (Belgium)

- Dynacure (France)

What are the Recent Developments in Global Hereditary Sensory Motor Neuropathy Market?

- In May 2025, Applied Therapeutics presented full 12- and 24-month topline data at the Peripheral Nerve Society (PNS) 2025 Annual Meeting in Edinburgh for the same Govorestat trial in CMT-SORD. The data revealed sustained reductions in sorbitol, improvements in the CMT-HI (CMT-Health Index) and MRI indicators of disease progression, and the therapy remained generally safe and well-tolerated. The company reiterated its intention to submit an NDA in 2025

- In September 2024, the Institut de Myologie published a review summarizing the growing number of gene-therapy products in development for CMT, noting that multiple sub-types (including CMT2, CMT4, etc.) are now targeted with AAV gene-delivery, antisense oligonucleotides (ASOs) and other molecular platforms

- In July 2024, an article in The Hospitalist indicated that an experimental small-molecule drug for CMT has reached Phase III in human trials, and genetic-based therapies (gene replacement, gene silencing) are increasingly entering the clinic

- In February 2024, Applied Therapeutics (through its alliance with the Charcot‑Marie‑Tooth Association, CMTA) reported positive 12-month results from the INSPIRE Phase III trial of its drug Govorestat (AT-007) in the CMT-SORD subtype (Sorbitol Dehydrogenase deficiency). The statement indicated a statistically significant correlation between reductions in sorbitol levels and improvement in the CMT Functional Outcomes Measure, and treatment maintained lower sorbitol over 12 months versus placebo

- In July 2023, research on DNA-based therapeutics targeting the CMT2E subtype (as documented by CMTA) has shown that antisense oligonucleotide (ASO) approaches in preclinical/early clinical models led to reductions in biomarkers of axonal degeneration and overall disease-relevant mutation correction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.