Global High Clear Film Market

Market Size in USD Billion

CAGR :

%

USD

669.60 Billion

USD

1,004.49 Billion

2024

2032

USD

669.60 Billion

USD

1,004.49 Billion

2024

2032

| 2025 –2032 | |

| USD 669.60 Billion | |

| USD 1,004.49 Billion | |

|

|

|

|

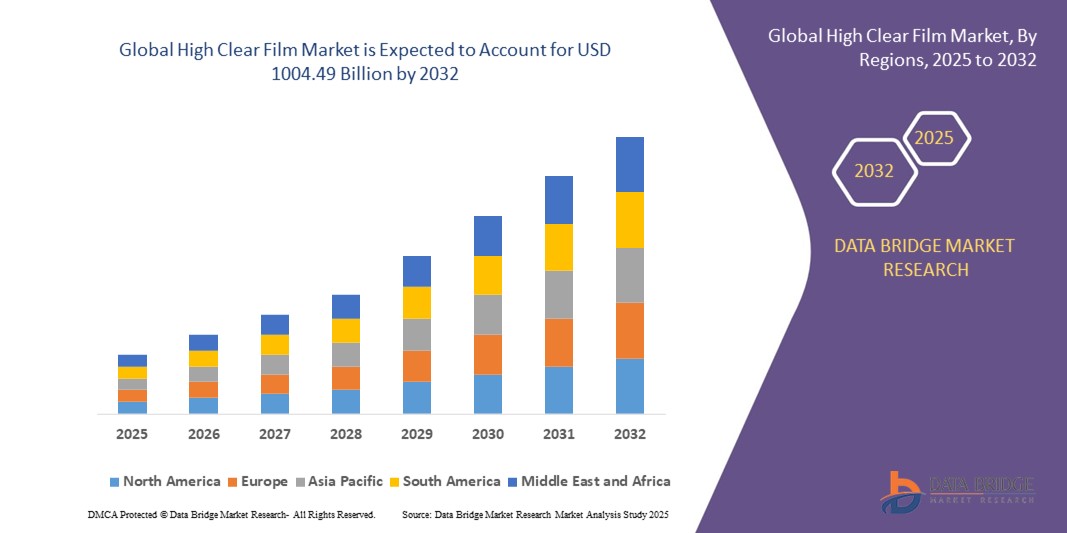

What is the Global High Clear Film Market Size and Growth Rate?

- The global high clear film market size was valued at USD 669.60 billion in 2024 and is expected to reach USD 1004.49 billion by 2032, at a CAGR of 5.20% during the forecast period

- Consumers increasingly prefer transparent packaging, allowing them to see the product clearly before making a purchase. -clear films fulfill this need by providing excellent clarity and visibility of the packaged products, thus driving their demand in various end-use industries such as food and beverages, personal care, and consumer electronics, which is expected to fuel the market growth

What are the Major Takeaways of High Clear Film Market?

- The exponential growth of e-commerce has sparked a surge in demand for protective packaging materials to safeguard products during transit. High clear films emerge as a preferred choice for e-commerce packaging owing to their robustness, resilience, and transparency. Their durability ensures products withstand the rigors of shipping, while their strength provides ample protection against damage

- Furthermore, their transparency enables consumers to inspect items upon delivery, enhancing trust and satisfaction. With the continuous expansion of e-commerce globally, the demand for high clear films is poised to escalate, underlining their indispensable role in ensuring safe and secure product delivery in the digital age

- North America dominated the high clear film market with the largest revenue share of 34.94% in 2024, driven by strong demand from automotive, construction, and electronics sectors where high-performance transparent films are widely applied

- Asia-Pacific high clear film market is poised to grow at the fastest CAGR of 8.28% from 2025 to 2032, driven by urbanization, rising disposable incomes, and rapid industrial growth in countries such as China, Japan, and India

- The Polyethylene (PE) segment dominated the high clear film market with the largest market revenue share of 38.6% in 2024, driven by its cost-effectiveness, flexibility, and widespread use in protective and packaging applications

Report Scope and High Clear Film Market Segmentation

|

Attributes |

High Clear Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the High Clear Film Market?

Rising Demand for High Transparency and Scratch Resistance in Display & Automotive Applications

- A significant trend in the global high clear film market is the growing demand for films offering exceptional optical clarity, scratch resistance, and UV protection, especially in electronics and automotive sectors

- High Clear Films are increasingly used in smartphones, tablets, TVs, and automotive displays, where maintaining screen visibility and durability against daily wear is critical

- Companies are innovating with multi-layer coatings to enhance anti-glare, anti-fingerprint, and self-healing properties, aligning with consumer expectations for high-quality screen experiences

- In automotive, High Clear Films are being adopted in head-up displays (HUDs) and infotainment screens, ensuring driver visibility and long-term durability

- For instance, LG Chem and Toray Industries are developing advanced films with superior transparency and mechanical strength for next-gen displays

- This trend is reshaping product innovation across industries, making High Clear Films an essential component of premium consumer electronics and advanced automotive interiors

What are the Key Drivers of High Clear Film Market?

- Increasing demand for smartphones, tablets, and OLED/AMOLED displays that require ultra-clear protective films is a major growth driver

- Expanding automotive sector adoption, particularly in EVs and luxury cars, where infotainment and HUD displays rely on clear protective films

- Rising consumer preference for premium screen protection with anti-scratch, UV resistance, and durability features

- For instance, in May 2024, Toray Advanced Materials launched a new high-transparency film designed for foldable smartphone screens, enhancing durability while maintaining clarity

- Growing use in architectural glass and solar panels, where films improve light transmission while offering protection against external elements

- The boom in e-commerce and DIY screen protection kits is further fueling demand across consumer electronics

Which Factor is Challenging the Growth of the High Clear Film Market?

- One of the major challenges is the high production cost of advanced high-clear films, especially those with multi-layer coatings and nanotechnology enhancements

- In addition, ensuring durability without compromising optical clarity remains a technical barrier, as films may yellow or lose transparency over time

- For instance, reports of screen discoloration or reduced brightness in some low-cost clear films have raised concerns about product reliability

- Another significant challenge is competition from alternative protective technologies, such as chemically strengthened glass (such as Corning Gorilla Glass), which reduces dependency on films

- Price sensitivity in developing markets also hinders adoption, as consumers often prefer cheaper screen protectors over premium high-clear films

- Addressing these challenges through cost-efficient production, enhanced material science, and consumer awareness will be critical for sustainable market growth

How is the High Clear Film Market Segmented?

The market is segmented on the basis of material type, application, and end-use industry.

- By Material Type

On the basis of material type, the high clear film market is segmented into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), and Others. The Polyethylene (PE) segment dominated the high clear film market with the largest market revenue share of 38.6% in 2024, driven by its cost-effectiveness, flexibility, and widespread use in protective and packaging applications. PE-based high clear films are highly preferred for their moisture resistance and transparency, making them suitable for food packaging and general industrial use.

The Polyethylene Terephthalate (PET) segment is expected to witness the fastest CAGR of 20.9% from 2025 to 2032, supported by its superior clarity, durability, and recyclability. PET films are increasingly used in consumer electronics, labeling, and healthcare due to their excellent dimensional stability and eco-friendly nature. Rising sustainability trends and demand for premium packaging solutions will further accelerate the adoption of PET-based high clear films.

- By Application

On the basis of application, the high clear film market is segmented into Packaging, Labeling, Protective Films, Laminations, and Others. The Packaging segment held the largest market revenue share of 46.3% in 2024, as high clear films are widely used for food, beverages, and pharmaceutical packaging where transparency and product visibility are critical. Their excellent sealing ability, protection from contamination, and lightweight characteristics make them a preferred choice among manufacturers. In addition, the growth of e-commerce and retail is further fueling the demand for packaging-grade clear films.

The Protective Films segment is projected to grow at the fastest CAGR of 18.7% from 2025 to 2032, driven by increasing demand from consumer electronics, automotive, and construction sectors. These films provide scratch resistance, durability, and UV protection, making them highly valuable in safeguarding displays, furniture, and automotive interiors. The growing trend toward protective digital device films and industrial safety layers is expected to accelerate this segment’s growth.

- By End-Use Industry

On the basis of end-use industry, the high clear film market is segmented into Food and Beverage, Healthcare and Pharmaceuticals, Personal Care and Cosmetics, Consumer Electronics, Automotive, Building and Construction, and Others. The Food and Beverage segment accounted for the largest market revenue share of 41.8% in 2024, owing to the widespread use of high clear films in packaging for snacks, dairy, frozen foods, and beverages. The ability of these films to extend shelf life, maintain product freshness, and provide visual appeal drives strong adoption. Moreover, the demand for lightweight, cost-effective packaging solutions is pushing growth in this segment.

The Healthcare and Pharmaceuticals segment is anticipated to record the fastest CAGR of 19.4% from 2025 to 2032, driven by increasing demand for sterile packaging, blister packs, and protective layers for medical devices. With rising healthcare expenditure and stricter safety regulations, high clear films are becoming indispensable in ensuring product safety and compliance across global markets.

Which Region Holds the Largest Share of the High Clear Film Market?

- North America dominated the high clear film market with the largest revenue share of 34.94% in 2024, driven by strong demand from automotive, construction, and electronics sectors where high-performance transparent films are widely applied

- Consumers and industries in the region highly value durability, clarity, and UV resistance, making high clear films preferred for protective coatings, packaging, and interior applications

- This widespread adoption is further supported by advanced R&D infrastructure, high consumer spending, and a robust presence of film manufacturers, establishing North America as a leading hub for high clear films

U.S. High Clear Film Market Insight

U.S. high clear film market captured the largest revenue share of 81% in 2024 within North America, fueled by high usage in automotive window films, display panels, and premium packaging. Demand is also driven by the growing trend of eco-friendly and recyclable films, combined with innovations in solar control and anti-scratch coatings. Moreover, collaborations between film producers and automotive/electronics OEMs continue to propel the high clear film industry in the country.

Europe High Clear Film Market Insight

Europe high clear film market is projected to expand at a substantial CAGR, primarily driven by stringent environmental regulations and the rising demand for sustainable packaging materials. Increasing urbanization and automotive production are boosting consumption of high clear films for both decorative and functional uses. Adoption is accelerating across residential, commercial, and industrial applications, particularly in packaging, architectural glass, and solar energy systems.

U.K. High Clear Film Market Insight

U.K. high clear film market is anticipated to grow at a noteworthy CAGR, driven by the shift toward sustainable packaging and energy-efficient building materials. Rising concerns about carbon emissions and eco-friendly solutions are pushing both industries and consumers to opt for recyclable high clear films. The U.K.’s advanced retail sector and strong demand for premium packaging further support market expansion.

Germany High Clear Film Market Insight

Germany high clear film market is expected to expand at a considerable CAGR, fueled by innovation in high-performance films for automotive and construction applications. The country’s focus on sustainability and green building standards encourages the use of high clear films in windows, solar panels, and protective coatings. Integration of smart glass and advanced polymer films is also boosting adoption across both residential and industrial sectors.

Which Region is the Fastest Growing in the High Clear Film Market?

Asia-Pacific high clear film market is poised to grow at the fastest CAGR of 8.28% from 2025 to 2032, driven by urbanization, rising disposable incomes, and rapid industrial growth in countries such as China, Japan, and India. Government initiatives promoting sustainable materials, renewable energy adoption, and digital infrastructure are accelerating demand. As APAC emerges as a manufacturing hub for high clear films, affordability and accessibility are expanding across consumer and industrial markets.

Japan High Clear Film Market Insight

Japan high clear film market is gaining momentum due to the country’s technological leadership and demand for premium materials. High Clear Films are widely used in electronics, displays, and automotive glass, driven by Japan’s advanced manufacturing ecosystem. The country’s aging population and strong emphasis on quality are also fostering demand for durable and easy-to-maintain film solutions.

China High Clear Film Market Insight

China high clear film market accounted for the largest revenue share in Asia-Pacific in 2024, supported by large-scale construction, automotive growth, and packaging demand. The expanding middle-class population and rapid urbanization are driving adoption across both residential and commercial applications. Strong domestic production capacity and the government’s push for smart cities and renewable energy further propel the high clear film market in China.

Which are the Top Companies in High Clear Film Market?

The high clear film industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Nitto Denko Corporation (Japan)

- Scapa Group plc (U.K.)

- Saint-Gobain Performance Plastics (France)

- Shurtape Technologies, LLC (U.S.)

- Plymouth Rubber Europa S.A. (France)

- Denka Company Limited (Japan)

- Four Pillars Enterprise Co., Ltd. (Taiwan)

What are the Recent Developments in Global High Clear Film Market?

- In April 2025, Germany’s BASF & Werz announced the introduction of a closed-loop packaging solution for the Horeca sector, where BASF Gastronomy now utilizes Werz’s meat packaging made with BASF’s sustainable Ultramid Cycled polyamide across its German facilities. This move highlights the increasing focus on circular economy practices and sustainable material use in the high clear film market

- In February 2025, TIPA, a global leader in compostable packaging innovation, launched an advanced home compostable metallized high-barrier film, designed to overcome critical challenges in eco-conscious packaging for chips and salty snacks by providing enhanced durability and functionality in a biodegradable solution. This development strengthens the role of compostable films in driving sustainable packaging adoption

- In November 2024, Jindal Films Europe (JFE), part of the USD 2.5-billion BC Jindal Group, committed to launching 5–10 innovative films each year, focusing on sustainable solutions for flexible packaging, with product offerings including multi-layer films from 12 to 70 microns in transparent, white, metalized, coated, and uncoated varieties. This initiative reinforces the company’s leadership in advancing eco-friendly and versatile packaging films

- In September 2023, Tosaf introduced its newly developed barrier solution UV9389PE EU, which ensures that clear packaging films deliver a strong UV-blocking effect across the 200 nm to 380 nm wavelength range, even when used at low thickness. This innovation enhances the protective performance of clear films, particularly for sensitive packaged goods

- In April 2022, Toppan expanded its GL Barrier series of transparent barrier films by adding the GL-ME-RC grade, which combines high-barrier functionality with light-shielding capabilities, making it available for domestic and international markets. This addition broadens the application potential of Toppan’s barrier films in diverse packaging sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.