Global High Throughput Sample Prep And Reagents Market

Market Size in USD Billion

CAGR :

%

USD

1.02 Billion

USD

2.35 Billion

2025

2033

USD

1.02 Billion

USD

2.35 Billion

2025

2033

| 2026 –2033 | |

| USD 1.02 Billion | |

| USD 2.35 Billion | |

|

|

|

|

High-Throughput Sample Prep and Reagents Market Size

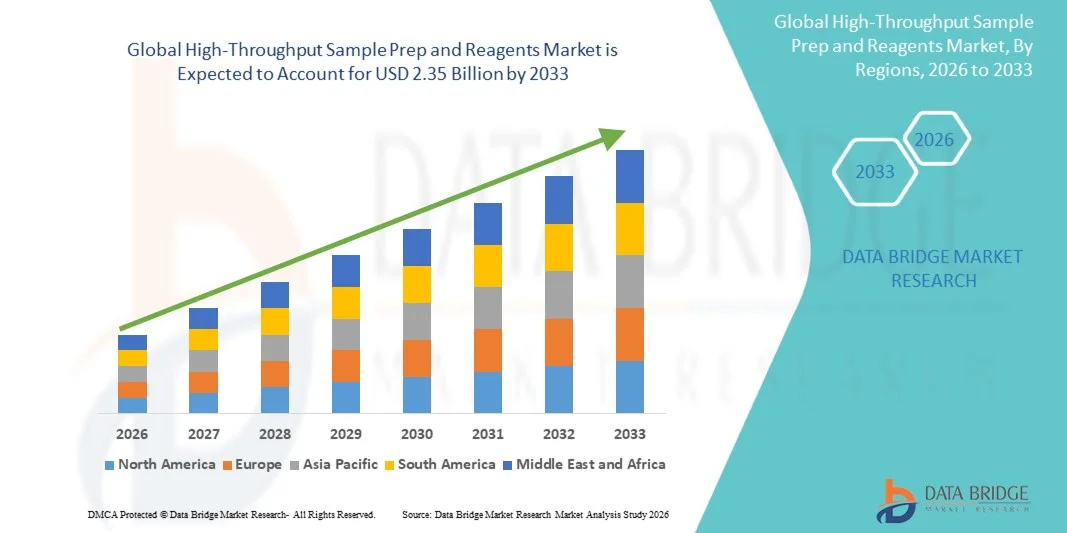

- The global high-throughput sample prep & reagents market size was valued at USD 1.02 billion in 2025 and is expected to reach USD 2.35 billion by 2033, at a CAGR of 11.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of automated and high-throughput sample processing technologies across genomics, proteomics, drug discovery, and clinical diagnostics, which enhance laboratory efficiency, throughput, and reproducibility

- Furthermore, rising demand for streamlined and scalable sample preparation workflows to support precision medicine, biomarker discovery, and large-scale screening is establishing these solutions as a core component of modern research and diagnostic laboratories. These converging factors are accelerating the uptake of high-throughput sample preparation systems and reagents, thereby significantly boosting the industry’s growth

High-Throughput Sample Prep & Reagents Market Analysis

- High-throughput sample preparation systems and reagents, enabling automated and scalable processing of biological samples, are increasingly vital components of modern life sciences research and clinical diagnostics due to their ability to enhance laboratory efficiency, consistency, and throughput across high-volume workflows

- The escalating demand for high-throughput sample prep & reagents is primarily fueled by the rapid growth of genomics and proteomics research, increasing adoption of precision medicine, and rising reliance on large-scale screening and biomarker discovery in pharmaceutical and biotechnology R&D

- North America dominated the high-throughput sample prep & reagents market with the largest revenue share of 34.4% in 2025, characterized by strong research funding, advanced laboratory infrastructure, and a high concentration of pharmaceutical and biotechnology companies, with the U.S. witnessing substantial adoption across genomics, drug discovery, and clinical research laboratories

- Asia-Pacific is expected to be the fastest growing region in the high-throughput sample prep & reagents market during the forecast period due to expanding life sciences research activities, increasing government investments in biotechnology and healthcare infrastructure, and the rapid establishment of advanced diagnostic and research laboratories

- The consumables & reagents segment dominated the market with a share of 62.5% in 2025, driven by their recurring usage, high consumption rates across workflows, and growing demand for specialized reagents compatible with automated and high-throughput sample preparation systems

Report Scope and High-Throughput Sample Prep & Reagents Market Segmentation

|

Attributes |

High-Throughput Sample Prep & Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

High-Throughput Sample Prep & Reagents Market Trends

“Rising Automation and AI-Enabled Sample Preparation Workflows”

- A significant and accelerating trend in the global high-throughput sample prep & reagents market is the increasing integration of automation, robotics, and artificial intelligence (AI) into laboratory workflows, enabling faster, more consistent, and scalable sample processing across research and diagnostic settings

- For instance, leading life sciences companies are introducing automated liquid handling and sample preparation platforms that integrate AI-driven software to optimize reagent usage, minimize human error, and enhance reproducibility in genomics and proteomics workflows

- AI-enabled high-throughput sample prep systems support intelligent workflow optimization, predictive maintenance, and adaptive protocol adjustments based on sample type and volume, thereby improving turnaround times and data quality in large-scale screening applications

- The growing adoption of fully automated and integrated sample preparation platforms is enabling laboratories to centralize and standardize workflows, seamlessly connecting sample prep with downstream analytical technologies such as next-generation sequencing and mass spectrometry

- This trend toward intelligent, automated, and interconnected laboratory solutions is reshaping operational expectations in life sciences research, prompting companies to develop end-to-end sample prep ecosystems that combine instruments, reagents, and software into unified platforms

- The demand for automated and AI-enhanced high-throughput sample preparation solutions is increasing rapidly across pharmaceutical, biotechnology, and clinical laboratories as organizations seek to boost productivity while addressing skilled labor shortages

High-Throughput Sample Prep & Reagents Market Dynamics

Driver

“Growing Demand Driven by Expanding Genomics, Proteomics, and Precision Medicine”

- The increasing volume of genomics, proteomics, and molecular diagnostics research, coupled with the rapid advancement of precision medicine initiatives, is a major driver fueling demand for high-throughput sample prep & reagents

- For instance, in 2025, several pharmaceutical and biotechnology companies expanded large-scale sequencing and biomarker discovery programs, significantly increasing the need for automated and reagent-intensive sample preparation workflows to support high sample volumes

- As research institutions and clinical laboratories generate larger datasets and process thousands of samples simultaneously, high-throughput sample prep solutions offer critical advantages in speed, consistency, and data reliability compared to manual methods

- Furthermore, the growing emphasis on translational research and personalized therapies is driving laboratories to adopt scalable sample preparation systems capable of handling diverse sample types with minimal variability

- The ability to standardize workflows, reduce hands-on time, and support high-throughput screening makes these solutions essential across drug discovery, clinical research, and diagnostic testing, thereby accelerating market adoption

- Rising government and private funding for life sciences research is further supporting the procurement of advanced sample preparation systems and recurring reagent consumption

- The expansion of molecular diagnostics and population-scale screening programs is also increasing demand for high-throughput, reproducible sample preparation solutions in clinical laboratory setting

Restraint/Challenge

“High Capital Costs and Workflow Integration Complexity”

- The high initial investment associated with automated high-throughput sample preparation systems and specialized reagents represents a significant challenge to market expansion, particularly for small and mid-sized laboratories

- For instance, laboratories transitioning from manual or semi-automated workflows often face substantial costs related to instrument procurement, reagent compatibility, staff training, and infrastructure upgrades

- Integrating new high-throughput systems into existing laboratory workflows can be complex, requiring customization, validation, and alignment with downstream analytical platforms, which may delay adoption timelines

- In addition, the ongoing cost of proprietary reagents and consumables can strain laboratory budgets, especially in academic and emerging-market research settings with limited funding

- Overcoming these challenges through the development of cost-effective platforms, open-system reagent compatibility, and streamlined integration solutions will be critical for enabling broader adoption and sustaining long-term market growth

- Limited technical expertise and resistance to workflow changes within laboratories can further slow the adoption of fully automated high-throughput sample preparation solutions

- Regulatory and quality compliance requirements for clinical and diagnostic applications may also increase validation timelines and operational complexity for new system deployments

High-Throughput Sample Prep & Reagents Market Scope

The market is segmented on the basis of product, technology, application, and end user.

- By Product

On the basis of product, the global high-throughput sample prep & reagents market is segmented into instruments, consumables & reagents, and kits. The consumables & reagents segment dominated the market in 2025 with a market share of 62.5%, driven by their recurring usage, high consumption rates, and indispensable role across genomics, proteomics, and molecular diagnostics workflows. Consumables and reagents are required for every sample processed, resulting in continuous demand regardless of instrument replacement cycles. Pharmaceutical, biotechnology, and clinical laboratories heavily rely on specialized reagents for nucleic acid extraction, purification, and protein preparation. The growing volume of high-throughput testing and large-scale research studies further reinforces the dominance of this segment. In addition, the increasing complexity of assays has led to higher demand for premium and application-specific reagents. The strong presence of proprietary reagent ecosystems offered by major vendors also supports sustained revenue generation.

The kits segment is expected to witness the fastest growth during the forecast period, fueled by rising demand for standardized, ready-to-use solutions that reduce manual handling and variability. Kits simplify complex workflows by bundling reagents and protocols, making them particularly attractive to diagnostic laboratories and research institutes with limited technical expertise. The growing adoption of molecular diagnostics and decentralized testing is accelerating demand for easy-to-use kits. Furthermore, kits support faster turnaround times and improved reproducibility, which are critical in clinical and regulatory environments. Increasing use of kits in emerging markets and academic research further contributes to rapid growth. Continuous innovation in multi-omics and application-specific kits is also driving this segment forward.

- By Technology

On the basis of technology, the market is segmented into manual, semi-automated, fully automated, robotic & integrated platforms, and microfluidic technologies. The fully automated segment dominated the market in 2025, owing to its ability to process large sample volumes with minimal human intervention. Fully automated systems significantly reduce labor requirements, error rates, and processing time, making them ideal for high-throughput laboratories. These systems are widely adopted in pharmaceutical drug discovery, genomics research, and large clinical laboratories. The demand for reproducibility and standardized workflows further supports adoption of fully automated solutions. Integration with downstream analytical platforms such as next-generation sequencing enhances their value proposition. In addition, increasing labor shortages in skilled laboratory personnel continue to drive automation adoption.

The robotic & integrated platforms segment is expected to grow at the fastest rate during the forecast period, driven by increasing demand for end-to-end workflow integration. These platforms combine sample preparation, liquid handling, reagent management, and data analytics into a single system. The ability to handle complex, multi-step workflows without manual intervention is particularly valuable in large-scale screening and multi-omics research. Growing investments in AI-enabled laboratory automation are accelerating adoption of robotic systems. Pharmaceutical companies increasingly prefer integrated platforms to improve throughput and reduce operational complexity. Continuous technological advancements and falling costs are further supporting rapid growth in this segment.

- By Application

On the basis of application, the market is segmented into genomics, proteomics, epigenomics, and molecular diagnostics & clinical testing. The genomics segment dominated the market in 2025, driven by the widespread adoption of next-generation sequencing and large-scale genomic research initiatives. High-throughput sample preparation is essential for DNA and RNA extraction, library preparation, and sequencing workflows. The growing focus on precision medicine, population genomics, and cancer research has significantly increased sample volumes. Pharmaceutical and biotechnology companies rely heavily on genomics-based drug discovery and biomarker identification. Government-funded genomics projects and biobanking initiatives further reinforce this segment’s dominance. Continuous advancements in sequencing technologies are sustaining long-term demand.

The molecular diagnostics & clinical testing segment is projected to be the fastest growing during the forecast period, supported by the rising adoption of high-throughput testing in clinical laboratories. Increasing prevalence of infectious diseases, genetic disorders, and oncology diagnostics is driving demand for efficient sample preparation solutions. Clinical labs require rapid, reproducible, and scalable workflows to support growing test volumes. The expansion of centralized diagnostic labs and reference laboratories further fuels growth. In addition, growing regulatory approvals for molecular diagnostic assays are increasing adoption of standardized sample prep systems. The shift toward personalized diagnostics is also accelerating this segment’s expansion.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, and contract research organizations (CROs). The pharmaceutical & biotechnology companies segment dominated the market in 2025, driven by heavy investment in drug discovery, biomarker research, and high-throughput screening programs. These organizations process thousands of samples daily, necessitating robust and scalable sample preparation solutions. Automation helps reduce timelines and improve reproducibility in preclinical and clinical research. The increasing use of multi-omics approaches in drug development further boosts demand. Strong R&D budgets allow pharma and biotech firms to invest in advanced instruments and proprietary reagents. Strategic collaborations with technology providers also strengthen this segment’s dominance.

The diagnostic laboratories segment is expected to register the fastest growth during the forecast period, fueled by expanding molecular testing volumes and the centralization of diagnostic services. High-throughput sample prep solutions enable diagnostic labs to handle large sample loads efficiently while maintaining accuracy. Growing adoption of molecular diagnostics for oncology, infectious diseases, and genetic screening is accelerating demand. The rise of reference laboratories and hospital networks further supports rapid growth. Increasing automation adoption to meet regulatory and quality requirements is another key driver. Expansion of diagnostic infrastructure in emerging markets is also contributing to the segment’s strong growth trajectory.

High-Throughput Sample Prep & Reagents Market Regional Analysis

- North America dominated the high-throughput sample prep & reagents market with the largest revenue share of 34.4% in 2025, characterized by strong research funding, advanced laboratory infrastructure, and a high concentration of pharmaceutical and biotechnology companies, with the U.S. witnessing substantial adoption across genomics, drug discovery, and clinical research laboratories

- Laboratories and research institutions in the region place high value on workflow efficiency, reproducibility, and scalability, leading to widespread adoption of automated and high-throughput sample preparation systems integrated with downstream analytical technologies

- This strong market position is further supported by robust research funding, a well-established life sciences ecosystem, early adoption of advanced laboratory technologies, and the presence of leading market players, establishing North America as the dominant region for both research and clinical applications

U.S. High-Throughput Sample Prep & Reagents Market Insight

The U.S. high-throughput sample prep & reagents market captured the largest revenue share within North America in 2025, driven by strong pharmaceutical and biotechnology R&D activity and early adoption of advanced laboratory automation technologies. Research organizations increasingly prioritize high-throughput workflows to support large-scale genomics, proteomics, and drug discovery programs. The presence of leading life sciences companies, well-funded academic institutions, and large reference laboratories further strengthens demand. Growing investments in precision medicine and molecular diagnostics continue to propel market expansion. In addition, widespread adoption of integrated and automated sample preparation platforms is reinforcing the U.S. market’s leadership position.

Europe High-Throughput Sample Prep & Reagents Market Insight

The Europe high-throughput sample prep & reagents market is projected to expand at a steady CAGR during the forecast period, primarily driven by strong research infrastructure and increasing emphasis on standardized laboratory workflows. Rising investments in genomics research, clinical diagnostics, and translational medicine are fostering adoption across the region. European laboratories value reproducibility, regulatory compliance, and workflow efficiency, supporting demand for automated sample preparation solutions. Growth is evident across pharmaceutical research, academic institutes, and diagnostic laboratories. Continued focus on innovation and cross-border research collaborations further supports market growth.

U.K. High-Throughput Sample Prep & Reagents Market Insight

The U.K. high-throughput sample prep & reagents market is anticipated to grow at a notable CAGR, supported by expanding genomics initiatives and strong government-backed research programs. Increasing use of high-throughput sequencing and molecular diagnostics is driving demand for efficient sample preparation workflows. Academic research institutes and biotechnology firms are key adopters of automated systems. The U.K.’s well-established life sciences ecosystem and emphasis on precision medicine continue to stimulate market growth. In addition, growing collaboration between academia and industry is accelerating adoption of advanced sample prep technologies.

Germany High-Throughput Sample Prep & Reagents Market Insight

The Germany high-throughput sample prep & reagents market is expected to expand at a considerable CAGR, driven by the country’s strong focus on biomedical research and technological innovation. Germany’s advanced laboratory infrastructure and emphasis on quality and standardization support adoption of automated sample preparation systems. Pharmaceutical companies and research institutes increasingly rely on high-throughput workflows to enhance efficiency and data reliability. The demand for scalable and reproducible sample prep solutions is growing across genomics and proteomics applications. Integration of automation with analytical platforms is further fueling market growth.

Asia-Pacific High-Throughput Sample Prep & Reagents Market Insight

The Asia-Pacific high-throughput sample prep & reagents market is poised to grow at the fastest CAGR during the forecast period, driven by rapid expansion of life sciences research, increasing healthcare investments, and growing adoption of molecular diagnostics. Countries such as China, Japan, and India are witnessing significant growth in genomics research and clinical testing volumes. Government initiatives supporting biotechnology and healthcare infrastructure development are accelerating market adoption. The rising number of research laboratories and diagnostic centers is further boosting demand. In addition, increasing awareness of automation benefits is driving uptake across the region.

Japan High-Throughput Sample Prep & Reagents Market Insight

The Japan high-throughput sample prep & reagents market is gaining momentum due to the country’s strong emphasis on advanced research, precision medicine, and technological innovation. Japanese laboratories prioritize accuracy, efficiency, and reproducibility, driving adoption of automated and high-throughput sample preparation systems. Growth in genomics, oncology research, and molecular diagnostics is supporting market expansion. Integration of sample prep solutions with advanced analytical technologies is becoming increasingly common. Furthermore, Japan’s aging population is indirectly increasing demand for advanced diagnostics, supporting long-term market growth.

India High-Throughput Sample Prep & Reagents Market Insight

The India high-throughput sample prep & reagents market accounted for a significant revenue share within Asia-Pacific in 2025, driven by rapid expansion of research infrastructure and growing adoption of molecular diagnostics. Increasing investments in biotechnology, pharmaceutical R&D, and academic research are key growth drivers. India’s growing focus on genomics, infectious disease testing, and precision medicine is boosting demand for scalable sample preparation solutions. The rise of centralized diagnostic laboratories and research hubs further supports market expansion. In addition, improving access to automated technologies and cost-effective reagents is accelerating adoption across the country.

High-Throughput Sample Prep & Reagents Market Share

The High-Throughput Sample Prep & Reagents industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- PerkinElmer (U.S.)

- QIAGEN (Netherlands)

- Illumina, Inc. (U.S.)

- Beckman Coulter Life Sciences (U.S.)

- Hamilton Company (U.S.)

- Tecan Group AG (Switzerland)

- Eppendorf AG (Germany)

- Bio‑Rad Laboratories, Inc. (U.S.)

- Sartorius AG (Germany)

- Analytik Jena AG (Germany)

- CTC Analytics AG (Switzerland)

- SPT Labtech (U.K.)

- Integra Biosciences AG (Switzerland)

- Promega Corporation (U.S.)

- Waters Corporation (U.S.)

- Shimadzu Corporation (Japan)

- Bruker Corporation (U.S.)

- Miltenyi Biotec (Germany)

What are the Recent Developments in Global High-Throughput Sample Prep & Reagents Market?

- In May 2025, MGI Tech unveiled its next‑generation automation portfolio at SLAS Europe 2025, including the new PrepALL flexible liquid handling system and enhanced Smart8 platform with advanced robotics and AI‑optimized pipetting, aimed at improving precision, scalability, and reproducibility in high‑throughput sample prep across genomics, drug discovery, synthetic biology, and molecular diagnostics lab

- In April 2025, QIAGEN announced advancing plans to launch three new automated sample preparation instruments QIAsymphony Connect, QIAsprint Connect, and QIAmini between 2025 and 2026, designed to expand the company’s automation portfolio with scalable solutions capable of processing from dozens to hundreds of samples per run, thus addressing both high‑ and low‑throughput lab demands with improved productivity and sustainability features

- In November 2024, 10x Genomics and Hamilton Company announced a strategic partnership to integrate 10x’s Chromium GEM‑X Universal library preparation kits with Hamilton’s NGS STAR Assay Ready Workstation, creating a high‑throughput and automated single‑cell workflow solution that simplifies complex library prep steps and enables processing of up to 96 samples on a single run, thereby accelerating single‑cell research workflows

- In November 2024, 10x Genomics and Beckman Coulter Life Sciences jointly launched a new automation‑friendly solution to streamline single‑cell gene expression workflows; the offering combines optimized library prep kits from 10x Genomics with Beckman Coulter’s Biomek i7 Hybrid Workstation, enabling laboratories to process up to 96 single‑cell samples per run while reducing hands‑on time by more than 7 hours, significantly enhancing throughput for large‑scale single‑cell studies

- In October 2023, Beckman Coulter Life Sciences and 10x Genomics entered into a broad partnership to enable high‑throughput automation of single‑cell library preparation workflows by adapting dedicated Chromium Single Cell kits for use on the Biomek i7 Automated Liquid Handler, aimed at reducing manual bottlenecks and boosting throughput for large sample sets in oncology, immunology, and neuroscience research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.