Global Histone Deacetylase Inhibitors Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

2.30 Billion

2024

2032

USD

1.30 Billion

USD

2.30 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 2.30 Billion | |

|

|

|

|

Histone Deacetylase Inhibitors Market

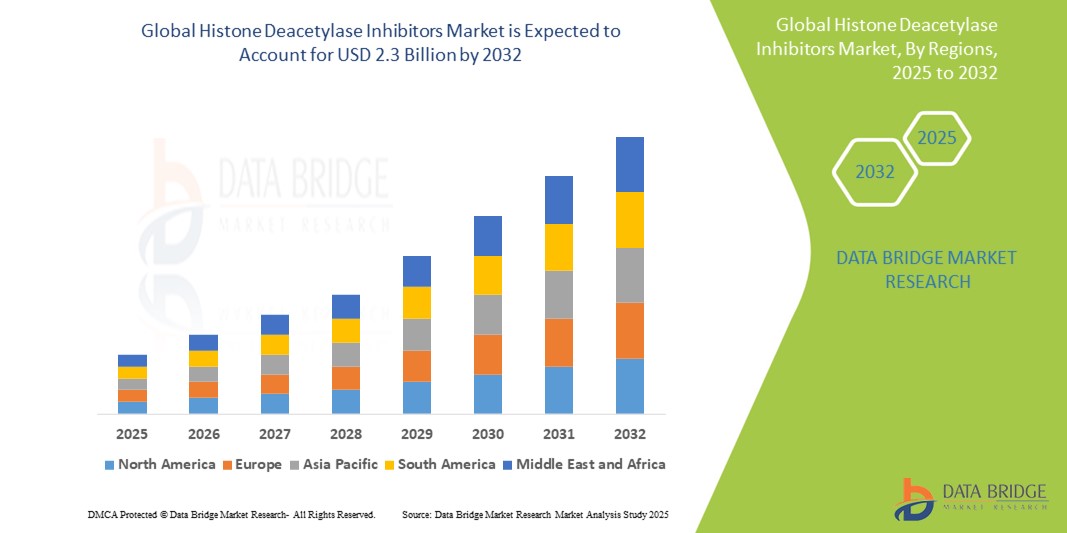

- The Global Histone Deacetylase Inhibitors Market was valued at USD 1.3 billion in 2024 and is expected to reach USD 2.3 billion by 2032, at a CAGR of 7.7% during the forecast period

- The market growth is primarily driven by the increasing prevalence of cancer and neurological disorders, which continue to push demand for advanced epigenetic therapies. Additionally, expanding research in HDAC inhibition and ongoing clinical trials are fostering innovation and broadening therapeutic applications

- Moreover, rising investments in oncology drug development, along with a growing focus on personalized medicine and targeted therapies, are reinforcing the strategic importance of HDAC inhibitors in modern treatment protocols. These cumulative trends are accelerating the adoption of HDAC inhibitors, contributing significantly to the market's long-term expansion

Histone Deacetylase Inhibitors Market Analysis

- Histone deacetylase (HDAC) inhibitors, a class of epigenetic drugs that modulate gene expression by altering histone acetylation, are becoming increasingly important in the treatment of cancer and neurological disorders due to their targeted mechanism of action and potential to reverse abnormal cell behavior at the molecular level

- The surging demand for HDAC inhibitors is primarily driven by the rising global burden of cancer, growing awareness of epigenetic-based therapies, and the increasing number of clinical trials focused on novel HDAC-targeted formulations. Their use is also expanding into neurological and inflammatory diseases, further enhancing market potential

- North America dominates the HDAC inhibitors market with the largest revenue share of over 45% in 2025, attributed to the region's strong R&D infrastructure, high prevalence of cancer, favorable regulatory support, and robust investments from pharmaceutical and biotechnology companies. The U.S., in particular, leads due to its advanced clinical research ecosystem and growing adoption of precision oncology treatments

- Asia-Pacific is projected to be the fastest-growing region in the HDAC inhibitors market during the forecast period, driven by increasing healthcare spending, rising cancer incidence, and expanding access to novel therapeutics in countries like China, India, and South Korea

- The Oncology segment is expected to dominate the market with a market share exceeding 60% in 2025, as HDAC inhibitors are widely used in treating hematologic malignancies and solid tumors. Drugs such as vorinostat, romidepsin, and belinostat continue to lead the clinical application landscape due to their proven efficacy in cutaneous and peripheral T-cell lymphomas

Report Scope and Histone Deacetylase Inhibitors Market Segmentation

|

Attributes |

Histone Deacetylase Inhibitors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Histone Deacetylase Inhibitors Market Trends

“Advancements in Isoform-Selective HDAC Inhibitors and Combination Therapies”

- A significant trend shaping the global HDAC inhibitors market is the development of isoform-selective inhibitors and their use in combination therapies to improve clinical efficacy and minimize toxicity. Traditional HDAC inhibitors often exhibit broad activity, leading to off-target effects and limited tolerability in patients

- To address this, biopharmaceutical companies are increasingly focusing on next-generation HDAC inhibitors that target specific HDAC isoforms associated with disease pathology. This precision-based approach is enhancing the safety profile and therapeutic effectiveness of these agents

- For instance, Regenacy Pharmaceuticals is developing selective HDAC1 and HDAC2 inhibitors aimed at treating peripheral neuropathy without the adverse effects commonly seen in pan-HDAC inhibitors. Similarly, Syndax Pharmaceuticals’ entinostat, an oral class I HDAC inhibitor, is being evaluated in combination with checkpoint inhibitors for breast and lung cancers

- The growing trend of combining HDAC inhibitors with immunotherapies, DNA-damaging agents, and hormone therapies is also gaining momentum. These synergistic approaches are showing promise in clinical trials by overcoming resistance mechanisms and enhancing response rates in various cancers

- Furthermore, the integration of HDAC inhibitors in personalized medicine frameworks—supported by biomarker-driven patient selection—is transforming their clinical application and expanding their use beyond hematologic malignancies to solid tumors, neurological disorders, and inflammatory diseases

- This shift toward more selective, targeted, and combinatory treatment strategies is reshaping the landscape of epigenetic therapy, making HDAC inhibitors a more versatile and promising class of therapeutics in oncology and beyond

Histone Deacetylase Inhibitors Market Dynamics

Driver

“Rising Cancer Burden and Expanding Applications in Epigenetic Therapies”

- The global HDAC inhibitors market is being significantly driven by the increasing incidence of cancer, particularly hematologic malignancies and certain solid tumors, where HDAC dysregulation plays a crucial role in disease progression

- According to the World Health Organization (WHO), global cancer cases are expected to increase by over 47% by 2040, creating substantial demand for innovative therapies like HDAC inhibitors

- For instance, FDA-approved HDAC inhibitors such as vorinostat (Zolinza), romidepsin (Istodax), and belinostat (Beleodaq) are already being used in the treatment of T-cell lymphomas, and further clinical trials are exploring their use in multiple myeloma, breast cancer, and glioblastoma

- The expansion of HDAC inhibitor use in non-oncology indications, such as neurodegenerative diseases (e.g., Huntington’s and Alzheimer’s), and inflammatory conditions, presents additional growth avenues. Epigenetic mechanisms are increasingly recognized in the pathogenesis of these diseases, and HDAC inhibitors are showing neuroprotective and anti-inflammatory effects in preclinical studies

- Additionally, increasing research funding, growing partnerships between academic institutions and pharmaceutical companies, and a robust clinical development pipeline are accelerating innovation and expanding the therapeutic landscape for HDAC inhibitors

Restraint/Challenge

“Safety Concerns and Limited Isoform Specificity”

- Despite their therapeutic promise, HDAC inhibitors face significant challenges related to safety and tolerability. The lack of isoform selectivity in many first-generation HDAC inhibitors can lead to widespread off-target effects, including fatigue, thrombocytopenia, and gastrointestinal disturbances, limiting their long-term use

- For instance, vorinostat and romidepsin, while effective, are often associated with dose-limiting toxicities, making them suitable only for a limited subset of patients

- This narrow therapeutic window presents a challenge for broader market adoption, especially in non-oncology settings where tolerance for side effects is lower

- Additionally, the complex mechanisms of action and uncertain long-term impact on epigenetic regulation raise concerns among clinicians, particularly regarding irreversible gene expression changes

- Another barrier is the high cost of HDAC inhibitor therapies, which can limit access in emerging markets and for patients without adequate insurance coverage

- Overcoming these challenges will require continued investment in selective HDAC inhibitor development, better biomarker identification, and more refined clinical trial designs to target the right patient populations and minimize adverse effects. The ability to demonstrate long-term safety and cost-effectiveness will be key to sustaining market growth

Histone Deacetylase Inhibitors Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Classification

On the basis of classification, the HDAC inhibitors market is segmented into Class I HDACs, Class II HDACs, Class III HDACs, and Others. The Class I HDACs segment is projected to hold the largest market revenue share of approximately 54.8% in 2025, driven by their strong association with oncogenic pathways and widespread use in approved therapies. These inhibitors, such as vorinostat and romidepsin, primarily target HDAC1, HDAC2, and HDAC3, and have demonstrated significant efficacy in treating hematologic malignancies, making them a preferred choice in clinical applications.

The Class II HDACs segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, attributed to expanding research efforts focusing on their role in non-oncology conditions such as neurological and inflammatory diseases. Their isoform-specific action and emerging therapeutic potential offer attractive opportunities for targeted drug development and future expansion beyond oncology.

• By Drug Type

On the basis of drug type, the market is segmented into Vorinostat, Romidepsin, Belinostat, and Others. Vorinostat accounted for the largest market revenue share in 2025, being the first FDA-approved HDAC inhibitor for cutaneous T-cell lymphoma (CTCL). Its established clinical use and continued relevance in both monotherapy and combination regimens contribute to its dominance.

The Belinostat segment is anticipated to register the highest CAGR from 2025 to 2032 due to its increasing adoption in peripheral T-cell lymphoma (PTCL) treatment and growing acceptance in emerging markets. Ongoing clinical evaluations for expanded indications are further accelerating its market presence.

• By Route of Administration

On the basis of route of administration, the market is categorized into Oral, Injectable, and Others. The Oral segment is expected to dominate the market with the largest revenue share in 2025, owing to better patient compliance, convenience, and an increasing number of orally administered HDAC inhibitors in development and approval stages.

The Injectable segment is projected to grow at the fastest CAGR during the forecast period, driven by its rapid onset of action and higher bioavailability, particularly in acute care settings and in the treatment of aggressive cancers where immediate drug response is critical.

• By Application

On the basis of application, the HDAC inhibitors market is segmented into Oncology, Neurology, and Others. The Oncology segment holds the largest market share in 2025, supported by strong clinical evidence, growing cancer prevalence, and robust demand for epigenetic therapies. HDAC inhibitors are widely used in hematologic malignancies and are increasingly being evaluated for various solid tumors.

The Neurology segment is anticipated to register the highest growth from 2025 to 2032, propelled by growing interest in HDACs as therapeutic targets in neurodegenerative diseases. Preclinical success in conditions like Huntington’s and Alzheimer’s diseases is stimulating development pipelines and research collaborations.

• By End User

On the basis of end user, the market is segmented into Hospitals, Homecare, Specialty Clinics, and Others. Hospitals accounted for the largest market revenue share in 2025 due to the high volume of cancer treatments, availability of specialized oncology departments, and the presence of advanced drug administration facilities.

The Specialty Clinics segment is projected to exhibit the fastest growth during the forecast period, driven by the increasing trend toward personalized cancer care and the availability of targeted therapies in outpatient settings.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others. Hospital Pharmacy dominated the market in 2025, benefiting from institutional drug procurement for oncology departments and close coordination with clinical oncologists.

The Online Pharmacy segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to the increasing digitalization of healthcare, home delivery preferences, and rising awareness of specialty drug availability through regulated e-commerce platforms.

Histone Deacetylase Inhibitors Market Regional Analysis

- North America dominates the histone deacetylase inhibitors market with the largest revenue share of approximately 45.6% in 2024, driven by a strong presence of leading pharmaceutical companies, high cancer incidence rates, and an advanced healthcare infrastructure

- The region’s proactive approach to oncology drug development, widespread availability of HDAC inhibitor therapies, and favorable regulatory support contribute significantly to market growth

- Additionally, the region benefits from increased investment in epigenetic research, a high level of clinical trial activity, and strong collaborations between academia and industry. The presence of key market players and access to cutting-edge treatment options have firmly positioned North America as the leading hub for HDAC inhibitor adoption, especially in cancer care and emerging neurological indications

U.S. Histone Deacetylase Inhibitors Market Insight

The U.S. HDAC inhibitors market captured the largest revenue share of approximately 84% within North America in 2025, driven by a high prevalence of cancer, robust pharmaceutical R&D activity, and a favorable regulatory landscape. The U.S. leads in clinical trials and FDA approvals for HDAC inhibitors, with major drugs such as vorinostat, romidepsin, and belinostat already approved for T-cell lymphomas.

Growing investment in precision oncology and epigenetic research, combined with strong academic-industry collaborations, continues to accelerate the development of both monotherapy and combination therapies. The U.S. market also benefits from extensive insurance coverage for oncology treatments and early adoption of innovative therapeutics, cementing its dominance in the global HDAC inhibitors landscape.

Europe HDAC Inhibitors Market Insight

The European HDAC inhibitors market is projected to expand at a substantial CAGR throughout the forecast period, supported by a rising cancer burden, increasing healthcare expenditure, and expanding epigenetic research infrastructure.

The region is witnessing a steady increase in clinical trials focusing on solid tumors and hematologic cancers using HDAC inhibitors. Additionally, regulatory bodies such as the European Medicines Agency (EMA) are showing growing openness to approving novel epigenetic therapies, facilitating broader access.

Collaborations between pharmaceutical companies and academic institutions in countries like Germany, France, and the U.K. are fostering innovation, while a growing demand for targeted and personalized therapies continues to boost adoption in oncology and neurology.

U.K. HDAC Inhibitors Market Insight

The U.K. HDAC inhibitors market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the country’s emphasis on precision medicine and cancer genomics.

The National Health Service (NHS)’s focus on innovation, early diagnosis, and advanced treatment options has created fertile ground for HDAC inhibitor uptake. Additionally, government-backed initiatives like Genomics England and research programs at institutions such as The Institute of Cancer Research are enabling HDAC inhibitor integration into modern cancer care strategies.

Heightened awareness about epigenetics and expanding clinical trial networks are expected to further propel the market.

Germany HDAC Inhibitors Market Insight

The German HDAC inhibitors market is expected to expand at a considerable CAGR during the forecast period, supported by a well-established healthcare infrastructure and a strong focus on R&D.

Germany’s pharmaceutical sector, known for innovation and regulatory compliance, is actively involved in the development and evaluation of next-generation HDAC inhibitors. Additionally, the country’s strategic role in pan-European clinical studies, coupled with growing public investment in oncology and neuroscience research, is fostering market growth.

Patient access to new therapies through specialty clinics and academic hospitals is also contributing to the steady rise in HDAC inhibitor use.

Asia-Pacific HDAC Inhibitors Market Insight

The Asia-Pacific HDAC inhibitors market is poised to grow at the fastest CAGR of over 9.2% in 2025, driven by increasing cancer prevalence, healthcare infrastructure improvements, and rising investments in pharmaceutical R&D across the region.

Countries such as China, Japan, and India are seeing a surge in demand for advanced cancer therapies, including epigenetic modulators. Government initiatives to promote clinical research and drug accessibility are further propelling growth.

As multinational companies expand their operations in APAC and domestic players invest in innovation, HDAC inhibitors are becoming more accessible and affordable, particularly in oncology care.

Japan HDAC Inhibitors Market Insight

The Japan HDAC inhibitors market is gaining momentum due to the nation’s aging population and rising cancer incidence. Japan’s emphasis on advanced therapeutics and strong regulatory support for novel oncology treatments are driving market expansion.

The integration of HDAC inhibitors into clinical research for hematologic malignancies and neurological disorders is being facilitated by institutions such as RIKEN and university hospitals with active pipelines.

Furthermore, Japan’s pharmaceutical companies are investing in developing isoform-selective and combination HDAC therapies, aligning with the national focus on personalized medicine and precision oncology.

China HDAC Inhibitors Market Insight

The China HDAC inhibitors market accounted for the largest market revenue share in Asia Pacific in 2025, bolstered by rapid healthcare modernization, a growing middle class, and increasing participation in global oncology drug development.

China’s biopharma sector is advancing rapidly, with domestic firms like Shenzhen Chipscreen Biosciences leading HDAC inhibitor innovation. Government policies promoting drug approval reforms and incentives for cancer drug research have made China a hotspot for clinical trials.

In addition, the inclusion of some HDAC inhibitors in national reimbursement drug lists and a high patient base for both cancer and neurological conditions make China a pivotal player in the regional market.

Histone Deacetylase Inhibitors Market Share

The Histone Deacetylase Inhibitors industry is primarily led by well-established companies, including:

- Midatech Pharma PLC (U.K.)

- Crystal Genomics Inc. (South Korea)

- CELGENE CORPORATION (U.S.)

- Novartis AG (Switzerland)

- Shenzhen Chipscreen Biosciences Co., Ltd. (China)

- Spectrum Pharmaceuticals, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Celleron Therapeutics (U.K.)

- FORUM Pharmaceuticals Inc. (U.S.)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Eisai Co., Ltd. (Japan)

- REGENACY PHARMACEUTICALS, INC. (U.S.)

- Karyopharm (U.S.)

- Aurobindo Pharma (India)

- CARDIFF ONCOLOGY (U.S.)

- Wellness Pharma International (India)

- Syndax (U.S.)

- MEI Pharma, Inc. (U.S.)

- Onxeo (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.