Global Home Health And Hospice Care Market

Market Size in USD Billion

CAGR :

%

USD

284.97 Billion

USD

522.79 Billion

2024

2032

USD

284.97 Billion

USD

522.79 Billion

2024

2032

| 2025 –2032 | |

| USD 284.97 Billion | |

| USD 522.79 Billion | |

|

|

|

|

Home Health and Hospice Care Market Size

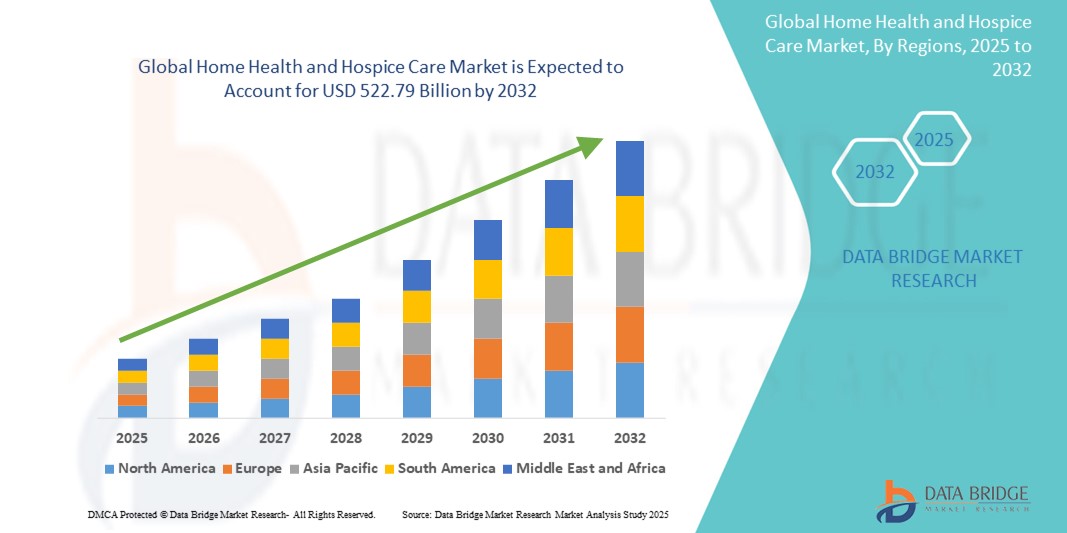

- The global home health and hospice care market size was valued at USD 284.97 billion in 2024 and is expected to reach USD 522.79 billion by 2032, at a CAGR of 7.88% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within home-based medical technologies and digital health platforms, leading to increased personalization and remote management in both chronic and palliative care settings

- Furthermore, rising consumer demand for cost-effective, patient-centered, and integrated care solutions is establishing home health and hospice care as a preferred alternative to institutionalized treatment. These converging factors are accelerating the uptake of Home health and hospice care solutions, thereby significantly boosting the industry's growth

Home Health and Hospice Care Market Analysis

- Home health and hospice care services, offering personalized medical and non-medical assistance to patients in residential settings, are becoming increasingly vital components of modern healthcare due to rising aging populations, the growing burden of chronic diseases, and the preference for cost-effective, home-based treatment alternatives over institutional care

- The escalating demand for these services is primarily driven by healthcare cost containment strategies, technological advancements in remote patient monitoring, and government support for home-based healthcare models

- North America dominated the home health and hospice care market with the largest revenue share of 40.6% in 2024, attributed to well-established reimbursement frameworks, rising elderly population, and the growing shift toward value-based care. The U.S. leads the region with increased adoption of home healthcare devices, remote monitoring tools, and hospice services, supported by Medicare and Medicaid expansion for at-home treatments

- Asia-Pacific is projected to be the fastest-growing region in the home health and hospice care market during the forecast period (2025–2032), with a CAGR of 10.9%, due to increasing urbanization, rapidly aging populations, and growing awareness of palliative and long-term care services. Countries such as Japan, China, and India are driving demand through government-led aging-in-place programs and expanding homecare networks

- The skilled care segment dominated the home health and hospice care market with a revenue share of 58.6% in 2024, driven by the increasing need for medical monitoring, wound care, physical therapy, and other professional healthcare services at home. The rising prevalence of chronic diseases and the aging population have significantly elevated the demand for licensed professionals such as registered nurses and therapists

Report Scope and Home Health and Hospice Care Market Segmentation

|

Attributes |

Home Health and Hospice Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Health and Hospice Care Market Trends

“Growing Demand for Seamless and Intelligent Care Solutions”

- A significant and accelerating trend in the global home health and hospice care market is the integration of intelligent systems and connected technologies to enhance patient monitoring, care coordination, and overall convenience for both patients and caregivers

- For instance, smart home technologies integrated with digital health platforms allow caregivers to remotely track vital signs, medication adherence, and behavioral patterns of patients, significantly improving the efficiency and responsiveness of home care services

- Intelligent software platforms now leverage data analytics and real-time health information to customize care plans, predict potential health issues, and automate alerts for emergency interventions, thereby boosting the quality of home-based care.

- Remote patient monitoring systems, when connected with centralized dashboards, enable healthcare providers to simultaneously track multiple patients, improving service scalability and response times. This seamless connectivity also supports proactive care and reduces hospital readmissions

- Moreover, the use of voice-assisted technologies like Amazon Alexa and Google Assistant in home health settings is increasing, offering elderly patients hands-free access to medication reminders, emergency calls, and daily routines, enhancing independence and safety

- The increasing demand for integrated, user-friendly, and adaptive care environments is reshaping the Home Health and Hospice Care industry, encouraging companies to invest in digital platforms and assistive technologies that bridge the gap between healthcare professionals and patients at home

Home Health and Hospice Care Market Dynamics

Driver

“Growing Need Due to Rising Aging Population and Preference for At-Home Care”

- The global home health and hospice care market is significantly driven by the increasing geriatric population and rising prevalence of chronic illnesses, which have fueled the demand for personalized and accessible care at home. This shift reduces hospital readmissions and allows patients to receive continuous monitoring and treatment in the comfort of their own homes

- For instance, in January 2024, Amedisys Inc. expanded its telehealth platform to include comprehensive chronic care management services, offering better continuity of care for elderly patients. Such innovations enhance accessibility and efficiency, contributing to market expansion

- Technological advancements such as remote patient monitoring, mobile health apps, and smart medical devices are further accelerating the transition to in-home healthcare delivery. These tools improve care outcomes and empower caregivers with real-time data, promoting better clinical decisions

- Patients and families are increasingly preferring hospice care over prolonged hospitalization, especially for terminally ill individuals, due to the emotional, physical, and financial benefits. This growing demand for end-of-life care services within familiar settings continues to elevate the demand for hospice services across both developed and emerging economies

- Furthermore, government programs such as Medicare’s Home Health Prospective Payment System (HH PPS) and the Hospice Benefit under Medicaid and private insurance reimbursements are making in-home services more financially feasible, increasing adoption and stimulating overall market growth

Restraint/Challenge

“Reimbursement Limitations and Workforce Shortages”

- Despite the increasing demand, reimbursement challenges pose a significant restraint to the Home Health and Hospice Care market. Variability in insurance coverage, particularly for long-term and palliative care, often limits the availability of services for some patients. Reimbursement models may not fully support emerging digital health solutions, delaying broader integration

- For instance, while Medicare covers certain skilled home health services, it does not always extend to personal care assistance unless deemed medically necessary, limiting service accessibility for many seniors

- In addition, a persistent shortage of qualified home health professionals—nurses, aides, therapists, and palliative care specialists—constrains the industry’s capacity to meet the growing demand. Burnout, low wages, and high turnover rates further exacerbate the workforce challenge

- According to the U.S. Bureau of Labor Statistics, employment for home health aides is projected to grow 22% from 2025 to 2032, yet the industry struggles to attract and retain enough trained workers to meet this need

- To address these challenges, stakeholders must invest in workforce development, advocate for improved reimbursement policies, and promote interdisciplinary training in geriatric and end-of-life care. These steps are essential to building a resilient and sustainable home-based care ecosystem

Home Health and Hospice Care Market Scope

The market is segmented into two notable segments based on service and equipment.

- By Service

On the basis of service, the home health and hospice care market is segmented into skilled care and unskilled care. The skilled care segment dominated the largest market revenue share of 58.6% in 2024, driven by the increasing need for medical monitoring, wound care, physical therapy, and other professional healthcare services at home. Rising chronic disease prevalence and the aging population have further fueled the demand for licensed professionals such as registered nurses and therapists in home-based care environments.

The unskilled care segment is anticipated to witness the fastest growth rate of 6.9% CAGR from 2025 to 2032, due to the rising need for daily assistance among elderly and disabled populations. Services such as personal hygiene assistance, mobility support, and companionship are becoming increasingly critical in ensuring the well-being of patients in non-clinical home care settings. The affordability and accessibility of unskilled care services are contributing significantly to their rapid adoption.

- By Equipment

On the basis of equipment, the home health and hospice care market is segmented into therapeutic, diagnostic, and mobility care. The therapeutic equipment segment held the largest market revenue share in 2024, accounting for 45.1%, due to the high demand for oxygen delivery systems, infusion pumps, and dialysis equipment used to manage chronic conditions in a home setting. These devices play a vital role in reducing hospital visits and enabling continuous treatment at home.

The mobility care segment is expected to witness the fastest CAGR of 7.4% from 2025 to 2032, driven by the increasing elderly population and rising demand for wheelchairs, walkers, and patient lifts. Improved product design and the development of smart mobility aids are further propelling this segment’s growth.

Home Health and Hospice Care Market Regional Analysis

- North America dominated the home health and hospice care market with the largest revenue share of 40.6% in 2024, driven by the aging population, increasing incidence of chronic diseases, and strong reimbursement frameworks such as Medicare and Medicaid

- The region’s well-established healthcare infrastructure, emphasis on value-based care, and rising demand for at-home recovery are key contributors to market growth

- In addition, increasing investment in digital health platforms and remote monitoring tools is supporting the expansion of home-based healthcare services across the U.S. and Canada

U.S. Home Health and Hospice Care Market Insight

The U.S. home health and hospice care market captured a revenue share of 78.2% in 2024 within North America, fueled by strong governmental support, high healthcare expenditure, and consumer preference for in-home care settings. The Centers for Medicare & Medicaid Services (CMS) continues to drive value-based models, encouraging a shift from hospital to home care. The rising geriatric population and increased use of remote patient monitoring, AI-enabled care coordination, and mobile nursing apps are significantly boosting the market.

Europe Home Health and Hospice Care Market Insight

The Europe home health and hospice care market held a 26.4% share of the global market in 2024, primarily driven by national health initiatives focused on palliative care, elderly wellness, and cost containment.The demand is increasing for hybrid care models that combine telehealth, home nursing, and hospice services. Government regulations in countries like Germany and France emphasize decentralized and preventive care, fueling the adoption of home-based healthcare.

U.K. Home Health and Hospice Care Market Insight

The U.K. Home Health and Hospice Care market accounted for 21.3% of the European market in 2024, supported by NHS programs focused on community care, home hospice access, and early discharge planning. The U.K. is witnessing increased adoption of digital tools such as remote vitals monitoring and virtual nursing, enhancing home health outcomes. The COVID-19 pandemic significantly accelerated home-based care, a trend that continues to persist.

Germany Home Health and Hospice Care Market Insight

Germany home health and hospice care market captured 24.8% of the Europe Home Health and Hospice Care market share in 2024, driven by a well-funded long-term care insurance system and a strong focus on geriatric care. Home care services are expanding through both public and private providers, supported by digital health records and home diagnostics. The country also promotes green and efficient infrastructure, with smart healthcare tools becoming standard in home nursing setups.

Asia-Pacific Home Health and Hospice Care Market Insight

The Asia-Pacific home health and hospice care market is expected to grow at the fastest CAGR of 11.2% from 2025 to 2032, and accounted for 19.7% of global market share in 2024. Growth is driven by rapidly aging populations in China, Japan, and India, along with expanding middle classes and improving healthcare access. Government support for digital health ecosystems and the rise of mobile-based nursing platforms are boosting adoption across both urban and rural areas.

Japan Home Health and Hospice Care Market Insight

The Japan home health and hospice care market accounted for 29.5% of the Asia-Pacific share in 2024, supported by a super-aged society and policy frameworks emphasizing home-based elder care. Innovations in robotic nursing, AI-enabled health monitoring, and digital palliative services are gaining traction. Urban areas, in particular, are seeing rapid deployment of tech-assisted home care due to hospital workforce shortages.

China Home Health and Hospice Care Market Insight

The China home health and hospice care market captured the largest regional share in Asia-Pacific at 36.2% in 2024, propelled by rapid urbanization, government healthcare reforms, and strong domestic telehealth capabilities. Programs under the “Healthy China 2030” initiative are encouraging community-based elder care and chronic condition management at home. A booming market for affordable health-tech devices is also driving market expansion in both Tier-1 and Tier-2 cities.

Home Health and Hospice Care Market Share

The home health and hospice care industry is primarily led by well-established companies, including:

- Air Liquide Medical Systems (India)

- Amedisys (U.S.)

- LHC Group Inc. (U.S.)

- General Electric Company (U.S.)

- Fresenius SE & Co. KGaA (Germany)

- Knight Health Holdings, LLC (U.S.)

- Linde PLC (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- A&D Company, Limited (Japan)

- Oklahoma Palliative & Hospice Care (U.S.)

- Lumina Hospice & Palliative Care (U.S.)

- Dierksen Hospice (U.S.)

- Covenant Care (U.S.)

- BAYADA Home Health Care (U.S.)

- Invacare Corporation (U.S.)

- Abbott (U.S.)

- OMRON Corporation (Japan)

Latest Developments in Global Home Health and Hospice Care Market

- In June 2023, Amedisys announced its decision to merge with Optum, a company specializing in diverse healthcare services. Amedisys delivers personalized home health and hospice care, conducting over 11.2 million patient home visits annually

- In May 2023, Medtronic revealed plans to acquire EOFlow Co. Ltd., the manufacturer of EOPatch, a tubeless, wearable, and fully disposable insulin delivery device

- In May 2023, Home Instead, Inc. formed a partnership with Meals on Wheels America to raise awareness, secure funding, and recruit volunteers, with the goal of supporting elderly community members and addressing health challenges

- In April 2023, Health Care At Home Private Limited (HCAH) acquired Nightingales Home Health Services, expanding its specialty home healthcare offerings

- In March 2023, Koninklijke Philips N.V. introduced its Philips Virtual Care Management solutions and services portfolio, aimed at enhancing patient engagement and health outcomes through a more comprehensive telehealth platform

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.