Global Hospital Treated Gram Negative Infections Market

Market Size in USD Billion

CAGR :

%

USD

10.87 Billion

USD

22.10 Billion

2025

2033

USD

10.87 Billion

USD

22.10 Billion

2025

2033

| 2026 –2033 | |

| USD 10.87 Billion | |

| USD 22.10 Billion | |

|

|

|

|

Hospital-Treated Gram-Negative Infections Market Size

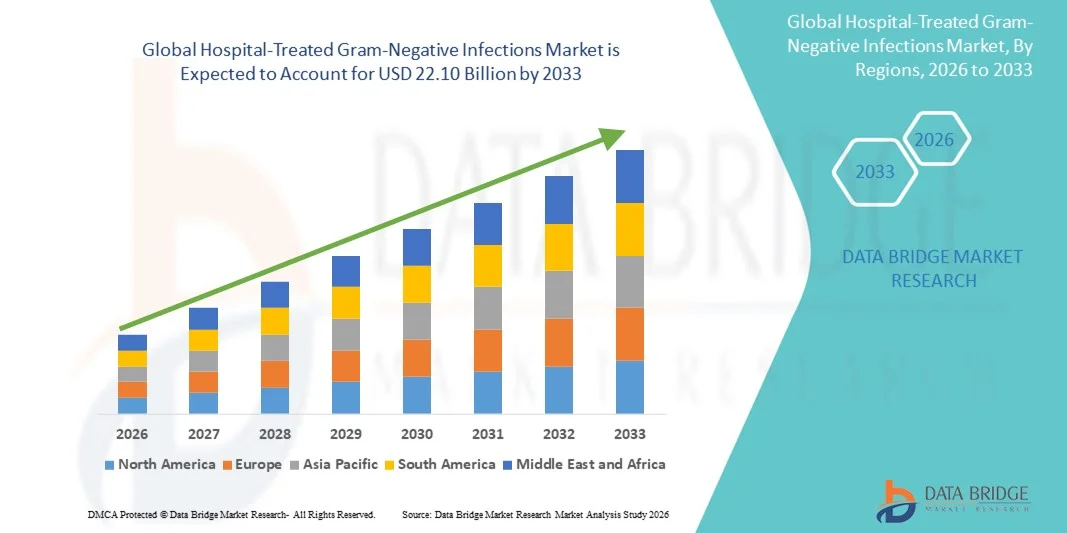

- The global hospital-treated Gram-negative infections market size was valued at USD 10.87 billion in 2025 and is expected to reach USD 22.10 billion by 2033, at a CAGR of 9.28% during the forecast period

- The market growth is largely fueled by the rising prevalence of multidrug-resistant Gram-negative bacterial infections in hospitals, such as pneumonia, bloodstream infections, urinary tract infections, and intra-abdominal infections, which demand advanced treatment and management protocols

- Furthermore, growing antimicrobial resistance (AMR), increasing awareness of hospital-acquired infections, improvements in healthcare infrastructure, and rising hospital admissions are driving demand for effective therapies and diagnostic & treatment solutions

Hospital-Treated Gram-Negative Infections Market Analysis

- Hospital-treated Gram-negative infections, including bloodstream infections, pneumonia, urinary tract infections, and intra-abdominal infections, are increasingly critical concerns in healthcare settings due to their high morbidity, mortality, and the complexity of treatment associated with multidrug-resistant strains

- The escalating demand for effective hospital-treated Gram-negative infection management is primarily fueled by the rising prevalence of multidrug-resistant Gram-negative bacteria, increasing hospital admissions, and growing awareness of hospital-acquired infections

- North America dominated the hospital-treated Gram-negative infections market with the largest revenue share of 37.2% in 2025, characterized by advanced healthcare infrastructure, high adoption of novel antimicrobial therapies, and a strong presence of key pharmaceutical and biotechnology companies, with the U.S. experiencing substantial growth in infection management solutions, driven by innovations in diagnostics, therapeutics, and stewardship programs

- Asia-Pacific is expected to be the fastest growing region in the hospital-treated Gram-negative infections market during the forecast period due to increasing healthcare spending, rising patient population, and expanding hospital infrastructure

- Carbapenem segment dominated the hospital-treated Gram-negative infections market with a market share of 33.9% in 2025, driven by their established efficacy against multidrug-resistant Gram-negative pathogens and widespread adoption in hospital treatment protocols

Report Scope and Hospital-Treated Gram-Negative Infections Market Segmentation

|

Attributes |

Hospital-Treated Gram-Negative Infections Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Hospital-Treated Gram-Negative Infections Market Trends

Advancements in Rapid Diagnostics and AI-Based Infection Management

- A significant and accelerating trend in the global hospital-treated Gram-negative infections market is the integration of rapid diagnostic technologies and AI-driven infection management tools, enabling timely identification and targeted treatment of multidrug-resistant pathogens

- For instance, the BioFire FilmArray system rapidly identifies Gram-negative bacteria and resistance genes from blood cultures, reducing the time to appropriate therapy and improving patient outcomes

- AI integration allows predictive analytics for patient infection risk, antimicrobial stewardship recommendations, and optimization of therapy duration, helping hospitals minimize treatment failures and resistance development

- The seamless adoption of digital platforms for infection tracking and hospital-wide monitoring facilitates centralized control over patient care, lab diagnostics, and therapeutic interventions, improving operational efficiency

- This trend towards smarter, data-driven, and rapid-response infection management is reshaping hospital protocols, with companies such as Accelerate Diagnostics developing AI-enabled platforms that provide real-time pathogen identification and resistance profiling

- The demand for solutions combining rapid diagnostics and AI-supported therapy guidance is growing across hospitals worldwide, as healthcare providers increasingly prioritize timely, effective, and personalized infection management

- Increasing collaborations between diagnostic and pharmaceutical companies to develop companion diagnostics and tailored therapies are strengthening the trend toward precision infection management

- Growing adoption of point-of-care testing in hospital wards is enabling faster decision-making, reducing empirical broad-spectrum antibiotic use, and improving patient outcomes

Hospital-Treated Gram-Negative Infections Market Dynamics

Driver

Rising Burden of Multidrug-Resistant Gram-Negative Infections

- The increasing prevalence of multidrug-resistant Gram-negative infections in hospitals is a significant driver for heightened demand for effective therapeutic and diagnostic solutions

- For instance, in March 2025, Pfizer announced advancements in its antibiotic pipeline targeting carbapenem-resistant Enterobacteriaceae, demonstrating industry commitment to tackling critical infections

- As hospitals face growing challenges with resistance and treatment complexity, effective therapies and stewardship programs provide compelling solutions to improve patient outcomes and reduce mortality

- Furthermore, the rise in hospital admissions, particularly among immunocompromised and elderly patients, is fueling the adoption of advanced infection management strategies

- Rapid adoption of hospital-based antimicrobial stewardship programs and integration of next-generation therapies for Gram-negative infections are key factors propelling market growth in both developed and emerging regions

- The demand for innovative, hospital-ready therapeutic solutions combined with improved diagnostics and monitoring capabilities continues to drive the market forward

- Increasing investments in research and development by key pharmaceutical companies are expanding the pipeline of targeted therapies for resistant Gram-negative infections

- Growing awareness among clinicians about early intervention and combination therapy strategies is encouraging the uptake of advanced treatment protocols

Restraint/Challenge

Limited Pipeline and Regulatory Hurdles

- Challenges surrounding limited new antibiotic approvals and stringent regulatory requirements pose significant barriers to market growth, delaying the availability of novel therapies for Gram-negative infections

- For instance, delays in FDA approval of new broad-spectrum antibiotics have slowed access to urgently needed treatment options in hospitals facing multidrug-resistant outbreaks

- Addressing regulatory compliance, clinical trial challenges, and safety concerns is crucial for bringing new therapeutics to market and maintaining hospital confidence

- In addition, high treatment costs and hospital budget constraints, particularly in emerging markets, can restrict the adoption of innovative therapies despite clinical need

- While some public-private partnerships and incentives for antibiotic development are emerging, perceived risk and financial barriers can still hinder widespread uptake

- Overcoming these challenges through accelerated approvals, government incentives, and development of cost-effective therapies will be vital for sustained market growth

- Insufficient awareness among healthcare providers in certain regions about newly approved therapies can slow adoption and limit market expansion

- Limited hospital infrastructure in low-resource regions for advanced infection management and rapid diagnostics can constrain overall market growth

Hospital-Treated Gram-Negative Infections Market Scope

The market is segmented on the basis of therapy type, indication, pathogen type, application, and distribution channel.

- By Therapy Type

On the basis of therapy type, the hospital-treated Gram-negative infections market is segmented into Cephalosporin, Aminoglycoside, Ampicillin/Sulbactam, Carbapenem, Colistin, Fosfomycin, Rifampin, Tigecycline, Ceftolozane/Tazobactam, Ceftazidime/Avibactam, and Others. The Carbapenem segment dominated the market with the largest market revenue share of 33.9% in 2025, driven by its broad-spectrum efficacy against multidrug-resistant Gram-negative pathogens. Hospitals often prefer carbapenems as a first-line therapy for severe infections, especially in ICU settings. The segment’s dominance is further supported by clinical guidelines recommending carbapenems for bloodstream infections and complicated intra-abdominal infections caused by resistant strains. In addition, the availability of multiple carbapenem derivatives and their proven safety profile in hospital protocols reinforces their widespread adoption. Strong demand in developed regions such as North America and Europe contributes significantly to the revenue share of this segment.

The Ceftazidime/Avibactam segment is anticipated to witness the fastest growth rate of 19.2% from 2026 to 2033, fueled by increasing incidence of carbapenem-resistant Enterobacteriaceae (CRE) infections. This combination therapy provides an effective solution for multidrug-resistant Gram-negative pathogens, including Pseudomonas and Klebsiella species. Growing hospital adoption, favorable reimbursement policies, and increasing awareness of next-generation antibiotics contribute to its rapid uptake. Clinicians are increasingly recommending ceftazidime/avibactam in complex infections where standard therapies fail. The segment’s growth is further supported by ongoing clinical trials demonstrating its safety and efficacy in severe hospital-acquired infections. Emerging markets are also adopting this therapy due to its potential to address unmet medical needs.

- By Indication

On the basis of indication, the market is segmented into Nosocomial Pneumonia (NP), Complicated Skin and Skin Structure Infections (cSSSIs/SSIs), Bloodstream Infections (BSIs), Complicated Intra-Abdominal Infections (cIAIs), and Urinary Tract Infections (UTIs). The Bloodstream Infections (BSIs) segment dominated the market with the largest revenue share of 28.9% in 2025, driven by the critical nature of BSIs and high associated mortality rates. Hospitals prioritize rapid and effective treatment for BSIs, as delays can result in sepsis and severe complications. The segment benefits from extensive clinical research guiding antibiotic choice and stewardship programs to optimize therapy. BSIs are frequently caused by Klebsiella, Pseudomonas, and Acinetobacter species, which are often multidrug-resistant, further fueling demand for effective therapeutics. Advanced diagnostics are increasingly used to detect pathogens quickly, enabling targeted treatment. Strong hospital adoption in ICU and tertiary care units continues to sustain the segment’s dominance.

The Nosocomial Pneumonia (NP) segment is expected to witness the fastest growth rate of 17.5% from 2026 to 2033 due to rising incidence in ventilated patients and the growing prevalence of hospital-acquired pneumonia in aging populations. Increasing ICU admissions and the prevalence of comorbidities such as chronic lung disease drive demand for NP-targeted therapies. Development of novel inhaled and intravenous antibiotics for NP is also encouraging rapid adoption. Hospitals in emerging markets are increasingly investing in NP treatment protocols, contributing to segment growth. Awareness programs emphasizing early diagnosis and targeted therapy are further accelerating uptake. The segment’s growth is bolstered by integration of rapid pathogen identification technologies in clinical practice.

- By Pathogen Type

On the basis of pathogen type, the market is segmented into Klebsiella, Acinetobacter, E. coli, Burkholderia cepacia, Pseudomonas, Serratia, Enterobacter, and Others. The Klebsiella segment dominated the market with the largest revenue share of 30.3% in 2025, driven by the high prevalence of Klebsiella pneumoniae in hospital-acquired infections and its increasing multidrug resistance. Hospitals prioritize targeted therapies against Klebsiella due to its association with bloodstream infections, pneumonia, and urinary tract infections. Clinical guidelines recommend specific antibiotic regimens based on pathogen resistance profiles, further reinforcing the segment’s adoption. Ongoing research on carbapenem-resistant Klebsiella strains supports the continued use of broad-spectrum antibiotics and newer therapies. Rapid diagnostic tools help hospitals quickly identify Klebsiella infections, improving treatment outcomes. The dominance is particularly strong in North America and Europe, where hospital infection monitoring is well-established.

The Acinetobacter segment is expected to witness the fastest growth rate of 18.8% from 2026 to 2033 due to increasing infections caused by multidrug-resistant Acinetobacter baumannii in ICUs. Its rapid spread in hospital settings, combined with limited effective treatment options, is driving demand for next-generation antibiotics. Hospitals are adopting strict infection control measures along with targeted therapies, boosting the segment’s market growth. Ongoing development of combination therapies and adjunct treatments for Acinetobacter infections further supports adoption. Emerging markets with rising ICU infrastructure are contributing to the uptake of specialized treatments. Increased awareness of the pathogen’s high mortality risk is encouraging proactive management in hospital protocols.

- By Application

On the basis of application, the market is segmented into Hospitals, Labs, and Others. The Hospitals segment dominated the market with the largest revenue share of 84.5% in 2025, driven by the majority of Gram-negative infections being hospital-acquired and requiring inpatient treatment. Hospitals adopt advanced antimicrobial therapies, rapid diagnostics, and infection monitoring programs to manage high-risk patients. ICUs, surgical wards, and oncology units represent key areas of therapeutic demand. The segment benefits from ongoing investments in hospital infrastructure, antimicrobial stewardship programs, and the availability of specialized therapeutics. Hospitals’ preference for comprehensive infection management solutions reinforces the segment’s dominance. Strong adoption in developed regions continues to sustain the revenue share.

The Labs segment is expected to witness the fastest growth rate of 16.3% from 2026 to 2033, fueled by increasing use of clinical microbiology labs for rapid pathogen detection and antibiotic susceptibility testing. Rising adoption of automated diagnostic platforms and AI-assisted analysis enhances lab efficiency and accuracy. Hospitals and diagnostic centers increasingly rely on lab data to guide targeted therapy for Gram-negative infections. Expansion of molecular diagnostic capabilities and point-of-care testing drives market growth. Collaboration between labs and hospitals for early detection programs further contributes to segment adoption. Emerging economies are investing in lab infrastructure, supporting rapid market growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct and Indirect. The Direct segment dominated the market with the largest revenue share of 63.7% in 2025, driven by direct sales of antibiotics and therapeutics to hospitals and healthcare institutions. Pharmaceutical companies often establish long-term contracts with hospitals to supply high-demand drugs efficiently. Direct distribution ensures timely delivery, regulatory compliance, and access to hospital formularies. Companies can provide technical support, training, and monitoring for optimal use of therapies, increasing adoption rates. The segment is particularly strong in developed markets with structured healthcare systems. Continuous expansion of hospital networks contributes to sustained revenue growth.

The Indirect segment is expected to witness the fastest growth rate of 14.9% from 2026 to 2033 due to increasing reliance on distributors, wholesalers, and pharmacy networks to reach smaller hospitals and clinics in emerging markets. Indirect channels help expand the geographic reach of pharmaceutical products where direct sales infrastructure is limited. The segment benefits from growing e-commerce and logistics solutions for healthcare products. Collaboration with regional distributors accelerates market penetration. Indirect channels also facilitate faster introduction of newly launched antibiotics in secondary care hospitals. Rising awareness and demand for effective Gram-negative infection therapies further support segment growth.

Hospital-Treated Gram-Negative Infections Market Regional Analysis

- North America dominated the hospital-treated Gram-negative infections market with the largest revenue share of 37.2% in 2025, characterized by advanced healthcare infrastructure, high adoption of novel antimicrobial therapies, and a strong presence of key pharmaceutical and biotechnology companies

- Hospitals and healthcare providers in the region prioritize rapid diagnostics, antimicrobial stewardship programs, and next-generation therapeutics to manage high-risk patients effectively

- This widespread adoption is further supported by well-established hospital networks, high healthcare spending, access to novel antibiotics, and growing awareness of hospital-acquired infections, establishing advanced infection management as a standard of care for both public and private healthcare institutions

U.S. Hospital-Treated Gram-Negative Infections Market Insight

The U.S. hospital-treated Gram-negative infections market captured the largest revenue share of 42% in 2025 within North America, driven by the high prevalence of multidrug-resistant Gram-negative infections and advanced healthcare infrastructure. Hospitals are increasingly prioritizing rapid diagnostics, next-generation antibiotics, and antimicrobial stewardship programs to manage critical infections effectively. The growing focus on ICU and tertiary care units, combined with well-established hospital networks, further propels market growth. Moreover, integration of AI-assisted infection management tools and rapid pathogen identification systems is enhancing clinical outcomes. The U.S. market also benefits from strong regulatory support, robust R&D pipelines, and widespread clinician awareness of emerging therapies.

Europe Hospital-Treated Gram-Negative Infections Market Insight

The Europe hospital-treated Gram-negative infections market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and increasing prevalence of multidrug-resistant Gram-negative pathogens. Hospitals in countries such as Germany, France, and Italy are adopting advanced diagnostic platforms and next-generation antibiotic therapies. Increasing urbanization, rising hospital admissions, and implementation of hospital infection control programs are fostering market growth. European healthcare providers emphasize precision treatment protocols and antimicrobial stewardship to improve outcomes. The region is experiencing notable adoption across public and private hospitals, particularly in ICU and surgical units. Collaboration between hospitals and pharmaceutical companies is further strengthening market expansion.

U.K. Hospital-Treated Gram-Negative Infections Market Insight

The U.K. hospital-treated Gram-negative infections market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising hospital-acquired infection cases and the demand for effective treatment protocols. Heightened awareness among clinicians regarding multidrug-resistant pathogens and early intervention strategies is encouraging adoption of advanced therapies. The U.K.’s well-developed healthcare infrastructure, combined with robust clinical research initiatives and hospital networks, continues to support market growth. Government programs promoting antimicrobial stewardship and infection control also play a key role. Hospitals increasingly rely on rapid diagnostic and therapeutic solutions to reduce mortality and hospital stays. The country’s focus on both residential healthcare facilities and large hospital systems further stimulates market expansion.

Germany Hospital-Treated Gram-Negative Infections Market Insight

The Germany hospital-treated Gram-negative infections market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of multidrug-resistant infections and adoption of innovative hospital treatment protocols. German hospitals emphasize infection control, early pathogen detection, and effective therapy management to combat resistant Gram-negative bacteria. Well-developed healthcare infrastructure, high healthcare expenditure, and adoption of advanced diagnostic tools support rapid market growth. Hospitals increasingly integrate hospital-wide infection monitoring systems and AI-based decision support. The preference for evidence-based therapies and sustainable antimicrobial practices aligns with local clinical guidelines. Germany’s strong R&D environment further reinforces market growth.

Asia-Pacific Hospital-Treated Gram-Negative Infections Market Insight

The Asia-Pacific hospital-treated Gram-negative infections market is poised to grow at the fastest CAGR of 21% during the forecast period of 2026 to 2033, driven by rising hospital admissions, increasing prevalence of multidrug-resistant Gram-negative pathogens, and expanding healthcare infrastructure in countries such as China, India, and Japan. Growing urbanization and government initiatives to improve hospital infection control practices are accelerating market adoption. Investment in ICU and tertiary care units, along with rising awareness among clinicians about early detection and targeted therapies, further boosts growth. Availability of next-generation antibiotics and diagnostic tools at more affordable prices enhances access. Hospitals across APAC are increasingly adopting hospital-based stewardship programs to optimize therapy. Rising demand from both public and private hospitals is contributing to the region’s rapid market expansion.

Japan Hospital-Treated Gram-Negative Infections Market Insight

The Japan hospital-treated Gram-negative infections market is gaining momentum due to high hospital standards, growing awareness of multidrug-resistant infections, and widespread adoption of advanced diagnostics and therapies. Hospitals focus on timely intervention in ICU and surgical wards to reduce complications and mortality. Integration of AI-assisted diagnostic tools and rapid pathogen identification systems supports efficient treatment decisions. The aging population further drives demand for effective infection management in both residential care and hospital settings. Strong healthcare infrastructure, continuous R&D, and adherence to stringent clinical guidelines contribute to market growth. Hospitals are increasingly incorporating evidence-based treatment protocols to optimize outcomes.

India Hospital-Treated Gram-Negative Infections Market Insight

The India hospital-treated Gram-negative infections market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising hospital admissions, and growing prevalence of multidrug-resistant Gram-negative infections. Hospitals are increasingly investing in advanced diagnostic platforms, ICU expansion, and next-generation antibiotics. Government initiatives to strengthen infection control practices and antimicrobial stewardship programs are supporting adoption. The expanding middle-class patient base and growing healthcare expenditure further boost demand. Hospitals across India, including private and tertiary care centers, are focusing on rapid pathogen detection and targeted treatment strategies. In addition, increasing awareness among clinicians regarding resistance patterns is contributing to market expansion.

Hospital-Treated Gram-Negative Infections Market Share

The Hospital-Treated Gram-Negative Infections industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Basilea Pharmaceutica Ltd. (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Lupin (India)

- Wockhardt Ltd. (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Fresenius Kabi AG (Germany)

- Sandoz AG (Switzerland)

- Shionogi & Co., Ltd. (Japan)

- Aurobindo Pharma Limited (India)

- Alkem Laboratories Ltd. (India)

- Cipla (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Zydus Cadila (India)

- Glenmark Pharmaceuticals Ltd. (India)

What are the Recent Developments in Global Hospital-Treated Gram-Negative Infections Market?

- In September 2025, the Centers for Disease Control and Prevention (CDC) published data showing a sharp increase (over 460%) between 2019–2023 in NDM‑producing carbapenem‑resistant Enterobacterales (NDM‑CRE) infections in the U.S., underscoring escalating antimicrobial resistance (AMR) and urgency for novel therapies and stewardship

- In February 2025, EMBLAVEO (aztreonam + avibactam) gained approval from the U.S. Food and Drug Administration (FDA) for adults with complicated intra‑abdominal infections (cIAI) caused by Gram‑negative bacteria when limited or no alternative treatment options exist

- In July 2024, World Health Organization (WHO) issued a warning on a rising global incidence of hyper‑virulent Klebsiella pneumoniae (hvKp) strains including carbapenem‑resistant variants across all six WHO regions, highlighting growing challenges in treating hospital-acquired Gram-negative infections

- In February 2024, EXBLIFEP (cefepime + enmetazobactam) was approved by FDA for treatment of complicated urinary tract infections (cUTI), including pyelonephritis, in adults offering a new treatment option against multidrug‑resistant (MDR) Gram-negative bacteria

- In January 2023, Alkem Laboratories launched Zidavi (ceftazidime + avibactam) in India, targeting multidrug‑resistant Gram‑negative infections including carbapenem‑resistant Enterobacteriaceae (CRE). The launch aimed to improve accessibility of next‑generation antibiotic therapy for hospital-treated Gram-negative infections in emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.