Global Hot Dogs Market

Market Size in USD Billion

CAGR :

%

USD

6.47 Billion

USD

8.99 Billion

2024

2032

USD

6.47 Billion

USD

8.99 Billion

2024

2032

| 2025 –2032 | |

| USD 6.47 Billion | |

| USD 8.99 Billion | |

|

|

|

|

Hot Dogs Market Size

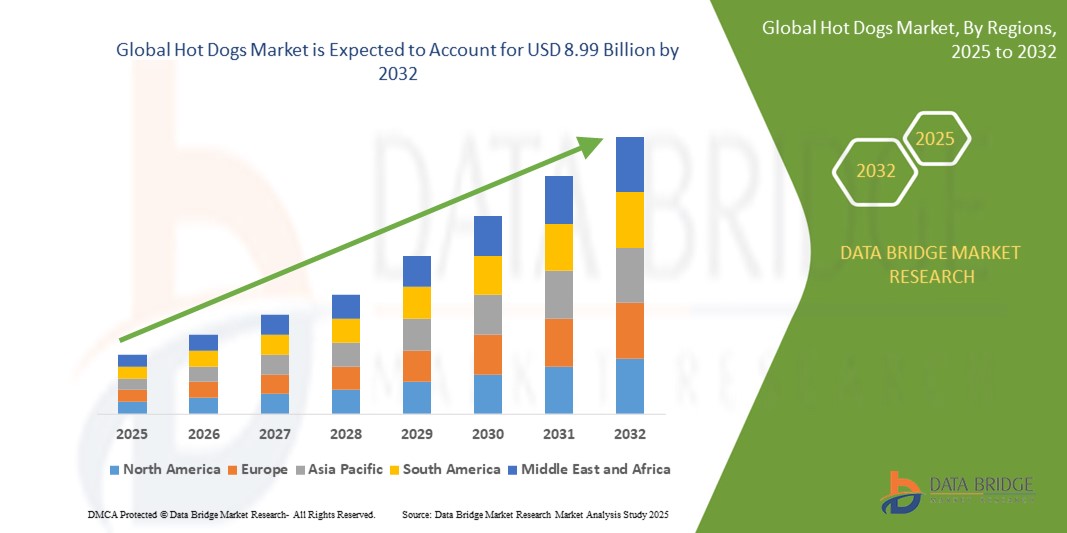

- The global hot dogs market size was valued at USD 6.47 billion in 2024 and is expected to reach USD 8.99 billion by 2032, at a CAGR of 4.20% during the forecast period

- This growth is driven by factors such as convenience, on-the-go consumption, and the continual introduction of innovative and gourmet variations

Hot Dogs Market Analysis

- Hot dogs are a popular processed meat product made from ground meat, typically beef, pork, chicken, or turkey, seasoned and encased in a cylindrical shape. Widely consumed as a convenient, ready-to-eat food item, hot dogs are commonly served in buns and accompanied by various condiments, making them a staple in fast food menus, sporting events, and household meals. The product comes in various types, including traditional, wiener-style, and specialty hot dogs, catering to diverse consumer tastes and dietary preferences

- The market is growing steadily, driven by increasing demand for convenient and protein-rich food options, evolving consumer taste preferences, and product innovations such as organic, gluten-free, and low-fat variants

- North America is expected to dominate the hot dogs market due to its deeply rooted hot dog culture, high per capita meat consumption, and well-established food service infrastructure

- Asia-Pacific is expected to be the fastest growing region in the hot dogs market during the forecast period due to rapid urbanization, westernization of diets, and increasing popularity of convenient snack and meal options among the younger population

- Food service segment is expected to dominate the market with a market share of 11.3% due to strong demand from quick-service restaurants, stadiums, and food trucks where hot dogs are popular, convenient, and customizable meal options.

Report Scope and Hot Dogs Market Segmentation

|

Attributes |

Hot Dogs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hot Dogs Market Trends

“Increasing Trend of On-The-Go Food Items”

- One prominent trend in the global Hot Dogs market is the increasing trend of on-the-go food items

- This trend is driven by the fast-paced urban lifestyles, rising workforce participation, and the growing need for convenient, ready-to-eat meal solutions

- For instance, brands such as Oscar Mayer and Nathan’s Famous are expanding their grab-and-go hot dog product lines, offering individually packaged, microwaveable, and pre-cooked options tailored for quick consumption

- The surge in convenience store sales, along with innovations in portable packaging and shelf-stable formats, is further accelerating the availability of hot dogs as a practical snack or meal option

- As consumer demand for mobility-friendly, time-saving food choices continues to grow, the hot dogs market is expected to see increased product development focused on portability and ease of use, shaping future market growth

Hot Dogs Market Dynamics

Driver

“Diverse Flavor and Ingredient Innovations”

- The rising consumer appetite for unique and adventurous food experiences is a key driver of growth in the global hot dogs market, as brands increasingly focus on flavor and ingredient innovation to capture diverse palates

- This shift is particularly evident in North America, Europe, and Asia-Pacific, where consumers are exploring global cuisines and demanding more than traditional beef or pork hot dogs

- With changing dietary habits and a growing interest in premiumization, hot dog producers are experimenting with a wide range of flavors, including spicy variants, smoked infusions, cheese-filled options, and globally inspired ingredients such as teriyaki, jalapeño, or curry

- Innovations in meat alternatives and health-forward formulations, such as hot dogs made with organic meat, plant-based proteins, and reduced sodium, are also gaining traction, broadening appeal across health-conscious and flexitarian demographics

- Leading players in the food industry are actively expanding their portfolios to include gourmet and specialty hot dogs that cater to evolving consumer preferences

For instance,

- Applegate has introduced organic turkey and chicken hot dogs with clean-label ingredients and no nitrates

- Beyond Meat and Lightlife are offering plant-based hot dogs with diverse seasoning profiles to replicate traditional flavors while appealing to vegetarian and vegan consumers

- As demand for culinary diversity and personalized taste options continues to grow, ingredient and flavor innovations are expected to remain a significant driver of the hot dogs market in the forecast period of 2025 to 2032

Opportunity

“Growing Consumer Awareness of Health and Wellness”

- The growing consumer awareness of health and wellness presents a significant opportunity for the global hot dogs market, as individuals increasingly seek protein-rich, cleaner-label, and nutritionally balanced food options

- Shoppers are becoming more attentive to ingredient lists, prompting demand for hot dogs that are free from artificial preservatives, nitrates, fillers, and excessive sodium

- This shift aligns with a broader movement toward mindful eating, where consumers, especially in North America and Europe, are choosing products that support long-term well-being without sacrificing flavor or convenience

For instance,

- Wellshire Farms has introduced hot dogs made with grass-fed beef and minimal ingredients, catering to health-focused consumers

- Oscar Mayer’s Natural line offers nitrate-free hot dogs with no artificial preservatives, targeting families and health-conscious buyers

- As health awareness continues to shape consumer preferences, this trend is expected to unlock new growth opportunities for manufacturers to innovate with functional ingredients, clean-label claims, and better-for-you hot dog formulations, creating space for product differentiation and brand loyalty in the market

Restraint/Challenge

“Health Concerns Related to Processed Meat Products”

- Growing health concerns associated with processed meat consumption present a significant challenge for the global hot dogs market. As awareness of nutrition and disease prevention increases, consumers are becoming more cautious about consuming foods high in sodium, saturated fats, and preservatives

- Studies linking processed meats to potential health risks, such as heart disease and certain types of cancer, have led to greater public scrutiny and influenced consumer purchasing behavior, particularly among health-conscious demographics

- This issue is especially pressing in developed markets such as North America and Europe, where health-driven food choices are more prevalent and regulatory bodies are increasingly promoting dietary guidelines that limit processed meat intake

For instance,

- Public health campaigns and dietary guidelines in the U.S. and EU encourage reduced consumption of processed meats, directly impacting sales of traditional hot dog products

- With these health concerns continuing to shape public perception, hot dog manufacturers face the challenge of balancing traditional product appeal with the need to reformulate offerings or diversify into healthier segments to sustain growth and consumer trust

Hot Dogs Market Scope

The market is segmented on the basis of meat type, product, packaging type, distribution channel, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Meat Type |

|

|

By Product |

|

|

By Packaging Type |

|

|

By Distribution Channel

|

|

|

By End-User |

|

In 2025, the food service is projected to dominate the market with a largest share in end-user segment

The food service segment is expected to dominate the hot dogs market with the largest share of 11.3% in 2025 due to strong demand from quick-service restaurants, stadiums, and food trucks where hot dogs are popular, convenient, and customizable meal options.

The beef hot dogs is expected to account for the largest share during the forecast period in meat type market

In 2025, the beef hot dogs segment is expected to dominate the market with the largest market share of 9.4% due to growing consumer preference for higher-quality meat products, perceived health benefits over pork-based alternatives, and the strong cultural and regional popularity of beef.

Hot Dogs Market Regional Analysis

“North America Holds the Largest Share in the Hot Dogs Market”

- North America dominates the hot dogs market, driven by the its deeply rooted hot dog culture, high per capita meat consumption, and well-established food service infrastructure

- U.S. holds a significant share due to its large consumer base, frequent consumption at events such as sports games and cookouts, and strong presence of major hot dog brands and quick-service restaurants

- The increasing rate of urbanization is facilitating the adoption of new consumption trends, as urban living is often associated with a higher demand for processed and ready-to-eat foods

- As North America continues to see innovation in meat products and growing demand for convenient protein sources, the region is expected to maintain its dominant position in the hot dogs market through the forecast period of 2025 to 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Hot Dogs Market”

- Asia-Pacific is expected to witness the highest growth rate in the hot dogs market, driven by rapid urbanization, westernization of diets, and increasing popularity of convenient snack and meal options among the younger population

- China holds a significant share due to a rising youth demographic, growing appetite for Western fast foods, and the widespread presence of international food chains offering hot dogs in urban centers

- Rising disposable incomes and the expansion of international fast-food chains in urban centers are significantly boosting regional consumption

- With growing interest in Western-style processed foods, continuous product innovation, and the expansion of cold chain logistics and retail infrastructure, Asia-Pacific is poised to become a major growth engine for the hot dogs market from 2025 to 2032

Hot Dogs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Kraft Heinz (U.S.)

- Tyson Foods Inc (U.S.)

- Nathan’s Famous (U.S.)

- Conagra Brands inc., (U.S.)

- Johnsonville, LLC (U.S.)

- Smithfield Foods (U.S.)

- Bar-S Foods Co (U.S.)

- Boar’s Head (U.S.)

- Hormel Foods (U.S.)

- Vienna Beef (U.S.),

- Babreet (U.S.)

Latest Developments in Global Hot Dogs Market

- In 2022, Johnsonville, LLC purchased the 190,000 square foot facility from sock maker Wigwam Mills. Johnsonville’s domestic and international sales of its fully cooked sausage product portfolio have increased significantly over the last few years, maxing out manufacturing capacity at its headquarters campus in Johnsonville.

- In April 2021, Applegate Farms, LLC, announced the launch of Do-Good Dog Hot Dog, the first nationally available hot dog made with beef raised on verified regenerative grasslands in the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hot Dogs Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hot Dogs Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hot Dogs Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.