Global Hot Drinks Market

Market Size in USD Billion

CAGR :

%

USD

215.96 Billion

USD

346.81 Billion

2024

2032

USD

215.96 Billion

USD

346.81 Billion

2024

2032

| 2025 –2032 | |

| USD 215.96 Billion | |

| USD 346.81 Billion | |

|

|

|

|

Hot Drinks Market Size

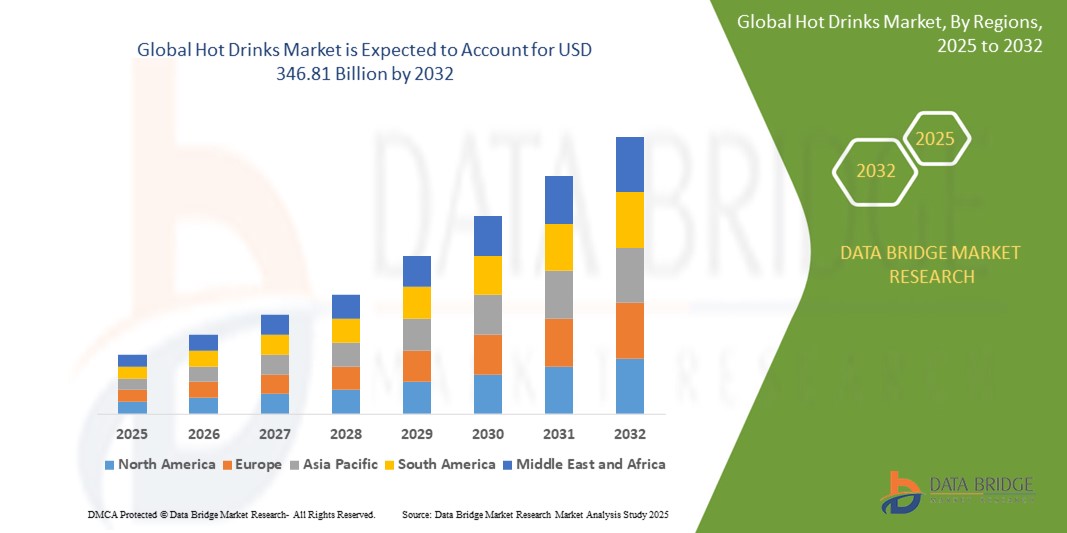

- The global hot drinks market size was valued at USD 215.96 billion in 2024 and is expected to reach USD 346.81 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by evolving consumer preferences, increased disposable income, and a rising focus on health and wellness, with premium and organic options gaining traction

- Increasing consumer interest in functional hot drinks offering benefits such as immune support, body cleansing, and stress relief is further propelling demand

Hot Drinks Market Analysis

- The hot drinks market is witnessing steady growth as more consumers prioritize comfort and wellness in their beverage choices

- Growing demand from both traditional and specialty segments is encouraging manufacturers to innovate with new flavors, blends, and brewing methods

- Asia-Pacific dominates the hot drinks market with the largest revenue share of 42.1% in 2024, driven by a large population, deeply ingrained tea and coffee cultures, and rising disposable incomes, particularly in countries such as China and India

- North America is expected to be the fastest growing region in the hot drinks market during the forecast period, driven by a substantial consumption of hot beverages, increasing demand for artisanal and specialty coffee, and a growing emphasis on high-quality ingredients

- The tea segment holds the largest market revenue share of 39.5% in 2024, supported by its widespread consumption globally as the second most consumed beverage after water, and increasing interest in health-conscious options such as green and herbal teas

Report Scope and Hot Drinks Market Segmentation

|

Attributes |

Hot Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hot Drinks Market Trends

“Rising Preference for Specialty and Artisanal Hot Drinks”

- Consumers are increasingly seeking high-quality, ethically sourced, and unique hot drink experiences beyond traditional offerings

- This trend is driving demand for specialty coffee blends, single-origin teas, and artisanal hot chocolates

- Coffee shops and cafes are at the forefront of this trend, offering diverse brewing methods and exotic flavors

- For instance, the popularity of third-wave coffee shops focusing on the origin and preparation of coffee beans highlights this shift

- Manufacturers are responding by introducing premium product lines and unique flavor combinations to cater to sophisticated palates

Hot Drinks Market Dynamics

Driver

“Increasing Focus on Health and Wellness”

- Growing consumer awareness about the health benefits associated with hot beverages, such as antioxidants in tea and the cognitive benefits of coffee, is fueling market growth

- There is a rising demand for functional hot drinks infused with superfoods, adaptogens, and vitamins

- Consumers are shifting from sugary cold drinks to healthier hot alternatives, leading to increased consumption of herbal teas and detox beverages

- Manufacturers are innovating with new product formulations that cater to specific health needs, such as low-sugar or organic options

- The rise of plant-based milk alternatives in hot drinks further emphasizes the health and wellness trend

Restraint/Challenge

“Fluctuations in Raw Material Prices and Supply Chain Disruptions”

- The hot drinks market is highly susceptible to volatility in the prices of key raw materials such as coffee beans and tea leaves, which can impact production costs and final product pricing

- Geopolitical events, climate change, and other factors can cause significant disruptions in the supply chain, affecting the availability and cost of these raw materials

- This can lead to increased operational costs for manufacturers and potentially higher prices for consumers, which might deter purchases

- For instance, adverse weather conditions in major coffee-producing regions can lead to price spikes and shortages, posing a challenge for market stability

- Managing these fluctuations and ensuring a stable supply of quality raw materials remains a significant challenge for industry players

Hot Drinks Market Scope

The market is segmented on the basis of type, end users, and distribution.

- By Type

On the basis of type, the hot drinks market is segmented into coffee, tea, and other drinks. The tea segment holds the largest market revenue share of 39.5% in 2024, supported by its global popularity as the second most consumed beverage after water, and increasing consumer interest in health-focused variants such as green and herbal teas.

The coffee segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the expanding coffee shop culture, increasing demand for specialty coffee, and the rising popularity of ready-to-drink (RTD) coffee products.

- By End Users

On the basis of end users, the hot drinks market is segmented into coffee shops, drink stores, and food services. The coffee shops segment is expected to hold the largest market share in 2024, driven by the growing café culture, the increasing demand for out-of-home consumption of hot beverages, and the diverse menu offerings, including specialty coffees and teas.

The food services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing consumption of hot drinks in restaurants, hotels, and catering services, as well as the rising demand for convenient hot beverage options in workplace cafeterias and institutional settings.

- By Distribution Channel

On the basis of distribution channel, the hot drinks market is segmented into hypermarkets and supermarkets, convenience stores, department stores, dollar stores, variety store, cash and carries and warehouse clubs, food and drinks specialists, drug stores and pharmacies, and health and beauty stores. The hypermarkets and supermarkets segment is expected to hold the largest market share in 2024, owing to their wide product selection, competitive pricing, and extensive reach to a broad consumer base.

The department stores segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their curated selection of premium and gourmet hot drink brands, often presented as part of a lifestyle or gifting experience. The focus on high-quality, specialty teas and coffees, along with sophisticated brewing accessories, appeals to consumers seeking exclusive or high-end products, positioning department stores as a niche but significant channel for aspirational hot drink purchases.

Hot Drinks Market Regional Analysis

- Asia-Pacific dominates the hot drinks market with the largest revenue share of 42.1% in 2024, driven by a large population, deeply ingrained tea and coffee cultures, and rising disposable incomes, particularly in countries such as China and India

- The region benefits from increasing urbanization, growing awareness of health benefits associated with hot drinks, and a burgeoning café culture that encourages out-of-home consumption

- Growth is further supported by the introduction of localized flavors and product innovations catering to regional preferences

U.S. Hot Drinks Market Insight

The U.S. is expected to dominate the North America hot drinks market with the highest revenue share in 2024, fueled by strong consumer demand for coffee and tea, the increasing popularity of specialty and artisanal beverages, and a growing emphasis on health and wellness. The vibrant coffee shop culture and the availability of diverse ready-to-drink options further boost market expansion.

Europe Hot Drinks Market Insight

The Europe hot drinks market is expected to witness the fastest growth rate, supported by high per capita consumption of coffee and tea, a strong cafe culture, and increasing consumer interest in premium and sustainable hot beverage options. Countries such as Germany and France show significant uptake due to a focus on quality ingredients and evolving consumer preferences for specialty blends.

U.K. Hot Drinks Market Insight

The U.K. market for hot drinks is expected to witness significant growth, driven by a robust tea-drinking tradition, increasing demand for coffee shop experiences, and a rising interest in healthy and functional hot beverages. The growing popularity of specialty teas and coffees, along with innovative product launches, is further contributing to market expansion.

Germany Hot Drinks Market Insight

Germany is expected to witness substantial growth in the hot drinks market, attributed to its strong coffee culture, high demand for specialty coffee products, and a growing consumer focus on organic and fair-trade options. The healthcare integration of advanced brewing technologies and the popularity of out-of-home coffee consumption further support market growth.

Asia-Pacific Hot Drinks Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding middle-class populations, increasing disposable incomes, and a deep-rooted cultural affinity for tea and coffee in countries such as China, India, and Japan. The region is seeing rapid urbanization and a growing trend towards premiumization and convenience in hot beverage consumption.

Japan Hot Drinks Market Insight

Japan's hot drinks market is expected to witness significant growth due to a strong consumer preference for high-quality coffee and a sophisticated tea culture. The presence of major hot drink manufacturers, coupled with innovation in ready-to-drink formats and vending machine accessibility, accelerates market penetration.

China Hot Drinks Market Insight

China holds the largest share of the Asia-Pacific hot drinks market, propelled by rapid urbanization, increasing vehicle ownership, and rising demand for heat and UV protection solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced tint films. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Hot Drinks Market Share

The Hot Drinks industry is primarily led by well-established companies, including:

- The Coffee Bean & Tea Leaf (U.S.)

- Unilever (U.K.)

- Gourmesso Coffee (U.S.)

- Harney & Sons Fine Teas (U.S.)

- Dualit (U.K.)

- Nestlé SA (Switzerland)

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Ippodo Tea Co. Ltd. (China)

- Tranquini (U.S.)

- Chillbev (U.S.)

- Som Sleep (U.S.)

- Phi Drinks, Inc. (U.S.)

- BevNet.com (U.S.)

- Tazo Tea Company (U.S.)

- Tata Global Beverages (India)

Latest Developments in Global Hot Drinks Market

-

In April 2025, Táche, a leading plant-based pistachio brand, launched its ready-to-drink Pistachio Milk Latte, tapping into the growing plant-based beverage market. This innovative latte blends smooth pistachio milk with rich cold brew, offering a nutrient-packed, dairy-free alternative. Designed for on-the-go convenience, it features no added oils or fillers, ensuring a clean, natural taste. The launch strengthens Táche’s commitment to sustainability, as pistachio trees require 75% less water than almonds

- In November 2024, Costa Coffee launched its first 24-hour drive-thru trial in Leicester, UK, aiming to serve night-shift workers, including healthcare professionals and delivery drivers. The initiative explores extended operating hours, ensuring greater accessibility for customers working non-traditional schedules. Costa Coffee plans to evaluate customer feedback during the trial to determine the feasibility of expanding 24-hour service across 350 UK locations. This move strengthens its community presence, offering round-the-clock convenience

- In August 2024, Tim Hortons, the renowned Canadian coffee chain, launched its first store in Ahmedabad, India, marking a significant expansion in the country. The brand aims to open 30-40 additional stores, recognizing India as one of the fastest-growing markets globally. With locations in 14 cities, Tim Hortons continues to strengthen its presence, offering its signature Arabica coffee, beverages, and fresh food options. The Ahmedabad store, located at Sardar Vallabhbhai Patel International Airport, features a glass-fronted donut station and operates 24/7

- In May 2024, NESCAFÉ launched its premium Espresso Concentrate Coffee, addressing the rising demand for convenient cold coffee and ready-to-drink options. This innovative product brings barista-style iced coffee to consumers’ homes, offering customizable flavors such as Sweet Vanilla and Espresso Black. Designed for easy preparation, it allows users to mix with milk, water, or juice for a personalized coffee experience. The launch strengthens Nestlé’s presence in the evolving coffee market, catering to younger generations embracing cold coffee trends

- In August 2023, Solar Art acquired Layr, a fast-growing window film company, reinforcing its market presence through strategic expansion. This acquisition enhances Solar Art’s footprint on the East Coast, adding new infrastructure in New York City. Layr’s expertise in commercial window film solutions strengthens Solar Art’s service offerings, supporting schools, office buildings, and high-end retailers. The move aligns with industry trends of growth through acquisitions, ensuring broader market reach and enhanced operational capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hot Drinks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hot Drinks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hot Drinks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.