Global Hybrid Train Market

Market Size in USD Billion

CAGR :

%

USD

22.43 Billion

USD

39.62 Billion

2024

2032

USD

22.43 Billion

USD

39.62 Billion

2024

2032

| 2025 –2032 | |

| USD 22.43 Billion | |

| USD 39.62 Billion | |

|

|

|

|

Hybrid Train Market Size

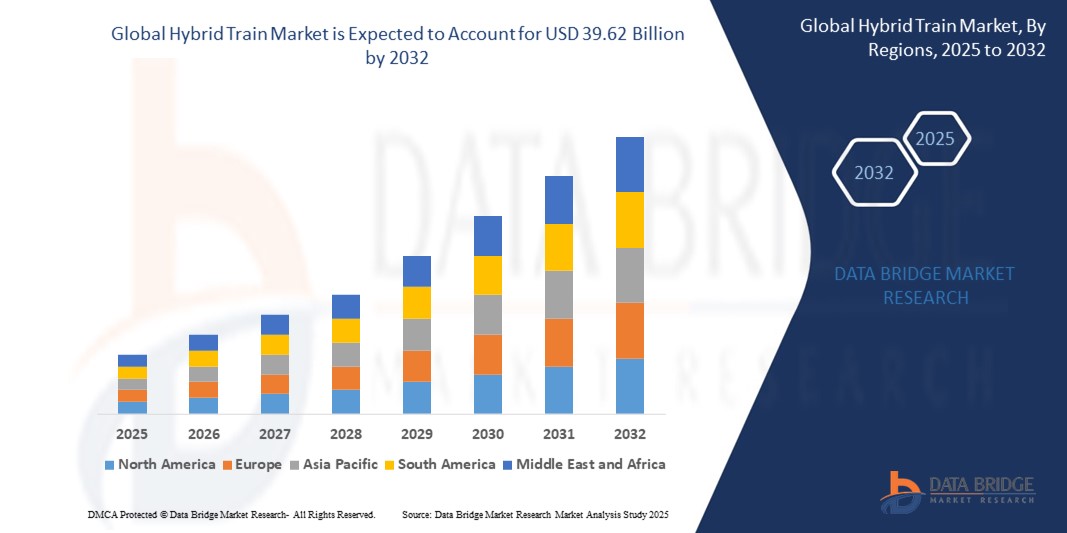

- The Global Hybrid Train Market size was valued at USD 22.43 billion in 2024 and is expected to reach USD 39.62 billion by 2032, at a CAGR of 7.37% during the forecast period

- The market growth is largely fueled by increasing focus on sustainability across the global transportation sector and technological advancements in hybrid train propulsion systems and energy storage

Hybrid Train Market Analysis

- Hybrid trains represent a transformative shift in rail transport by integrating traditional diesel or electric propulsion systems with battery or fuel-cell-based technologies to reduce carbon emissions, enhance energy efficiency, and improve operational flexibility. These systems play a vital role in decarbonizing the railway sector while offering cost-effective alternatives for non-electrified routes.

- Market growth is driven by the rising focus on sustainable transportation, stringent emission regulations across Europe and Asia, and increasing investments in modernizing railway infrastructure with hybrid and alternative fuel technologies.

- Europe is expected to dominate the Global Hybrid Train Market with 59.89% market share in 2024, supported by strong environmental policies, ambitious decarbonization goals, and widespread electrification programs. Countries like Germany, France, and the UK are leading large-scale adoption of hybrid and hydrogen-powered rail systems.

- The Asia Pacific region is projected to witness the fastest growth, driven by rapid urban transit expansion, rising demand for clean mobility solutions, and government support for hybrid railway projects, especially in China, Japan, and India.

- The battery-electric segment holds the largest market share of 47.69%, owing to its cost efficiency, ease of deployment on partially electrified routes, and growing use in regional and suburban rail networks. The flexibility of battery-assisted propulsion in reducing diesel dependency without major infrastructure changes makes it a preferred choice among operators.

Report Scope and Hybrid Train Market Segmentation

|

Attributes |

Hybrid Train Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hybrid Train Market Trends

“Integration of Hydrogen Fuel Cells and Advanced Battery Systems in Rail Transport”

- A significant trend reshaping the global hybrid train market is the growing integration of hydrogen fuel cells and next-generation lithium-ion and solid-state battery systems to decarbonize rail operations and improve energy efficiency.

- These technologies are enabling hybrid trains to operate over long distances without full electrification, making them ideal for regional and non-electrified routes in Europe and Asia.

- For instance, in February 2025, Alstom completed successful tests of its Coradia iLint hydrogen train in Italy, showcasing zero-emission performance with ranges up to 600 miles. The use of hydrogen fuel cells, combined with regenerative braking and battery storage, is emerging as a scalable alternative to diesel propulsion across the EU.

- Moreover, improvements in battery energy density and fuel cell durability are making hybrid solutions more economically viable and operationally efficient, contributing to the shift toward sustainable mobility in the rail sector.

Hybrid Train Market Dynamics

Driver

“Stringent Emission Regulations and Global Push Toward Green Transportation”

- The increasing enforcement of strict emission standards by governments worldwide is a key driver accelerating the demand for hybrid trains.

- Hybrid propulsion offers rail operators a low-emission alternative to diesel engines, aligning with global climate targets and urban air quality mandates.

- For instance, in July 2024, the UK’s Department for Transport mandated the phasing out of diesel-only trains by 2040, prompting major operators to invest in battery-hybrid and hydrogen-electric models. This regulation has fast-tracked hybrid technology adoption across regional and intercity routes.

- These mandates are particularly impactful in countries with partially electrified rail networks, where full electrification is not immediately feasible due to cost or topography. Hybrid trains offer a practical interim solution.

Restraint/Challenge

“High Initial Investment and Limited Charging or Refueling Infrastructure”

- One of the primary challenges facing the hybrid train market is the high upfront cost of developing and deploying hybrid propulsion systems, especially those based on hydrogen fuel cells and solid-state batteries.

- Additionally, the lack of dedicated charging or hydrogen refueling stations along key rail routes poses logistical constraints.

- For instance, in March 2024, Deutsche Bahn faced delays in deploying its hydrogen hybrid fleet in rural Germany due to the absence of fueling stations, requiring temporary reliance on mobile hydrogen refueling units. These infrastructure bottlenecks add complexity to deployment and increase project costs.

- While long-term savings on fuel and emissions make hybrids attractive, the short-term capital requirements and infrastructure gaps can deter adoption, especially among smaller rail operators or in cost-sensitive regions.

Hybrid Train Market Scope

The market is segmented on the basis of Propulsion type, speed, application

- By Propulsion Type

On the basis of propulsion type, the Hybrid Train Market is segmented into Electro-diesel, Battery Electric, Hydrogen Powered, and Others.

The battery-electric hybrid segment holds the largest market share of 47.69% in 2024, owing to its cost efficiency, ease of deployment on partially electrified routes, and growing use in regional and suburban rail networks. The flexibility of battery-assisted propulsion in reducing diesel dependency without major infrastructure changes makes it a preferred choice among operators.

The Electro-diesel segment is anticipated to witness the fastest growth rate 23.09% from 2025 to 2032, driven by global decarbonization initiatives and increased investments in clean mobility. Countries like Germany, the U.K., and Japan are aggressively adopting hydrogen trains, supported by government funding and technological advancements in hydrogen fuel cell systems.

- By Speed

On the basis of speed, the market is segmented into Below 100 Km/h, 100–200 Km/h, and Above 200 Km/h.

The 100–200 Km/h segment dominates the market with the highest revenue share in 2024, as most hybrid train deployments fall within regional and intercity rail services that operate at these moderate speeds. This segment benefits from fuel efficiency, reduced noise, and adaptability to mixed-use rail corridors.

The Above 200 Km/h segment is expected to grow at a significant CAGR, fueled by the development of high-speed hybrid trains combining battery and hydrogen propulsion systems for long-distance travel. Innovation in lightweight materials and aerodynamic design further supports growth in this segment.

- By Application

On the basis of application, the market is segmented into Passenger and Freight.

The Passenger segment captured the largest market share in 2024, driven by rising urbanization, the need for low-emission public transit, and increased rail infrastructure investments globally. Governments are prioritizing hybrid solutions for passenger trains as part of their green transportation agendas.

The Freight segment is expected to expand at a steady CAGR from 2025 to 2032, as rail operators seek to decarbonize cargo logistics without overhauling entire networks. Hybrid freight trains offer fuel savings, reduced carbon emissions, and improved last-mile connectivity for industrial zones.

Hybrid Train Market Regional Analysis

- Europe is expected to dominate the Global Hybrid Train Market with 59.89% market share in 2024, supported by strong environmental policies, ambitious decarbonization goals, and widespread electrification programs. Countries like Germany, France, and the UK are leading large-scale adoption of hybrid and hydrogen-powered rail systems.

- The European Commission’s Green Deal and the shift toward carbon-neutral mobility have accelerated the deployment of hydrogen-powered and battery-electric hybrid trains across countries like Germany, France, and the U.K.

Germany Hybrid Train Market Insight

The Germany Hybrid Train Market captured the largest revenue share of 80.12% in 2024 within Europe, fueled by its early adoption of hydrogen-powered trains and strong R&D ecosystem. The country’s Clean Mobility Initiative and partnership with manufacturers like Siemens and Alstom have fostered the rapid deployment of low-emission hybrid trains, especially for non-electrified regional lines. Government subsidies and ambitious decarbonization goals continue to drive domestic market growth.

North America Hybrid Train Market Insight

North America holds a moderate share of the global hybrid train market, led by increasing emphasis on environmental sustainability, infrastructure upgrades, and interest in fuel-efficient rail systems.

Federal and state-level funding for green transport, particularly in the U.S. and Canada, is promoting the adoption of hybrid locomotives in freight and passenger services. However, the market’s growth pace is slightly slower compared to Europe and Asia due to complex regulatory approvals and longer fleet replacement cycles.

U.S. Hybrid Train Market Insight

The U.S. market is gaining traction with rising investments in clean transport and smart city initiatives. Hybrid trains are increasingly viewed as a solution for aging diesel fleets on commuter and freight lines. Programs like the FRA’s (Federal Railroad Administration) grant for emissions reduction are encouraging rail operators to experiment with battery-electric and hybrid diesel-electric platforms.

Asia-Pacific Hybrid Train Market Insight

The Asia-Pacific Hybrid Train Market is poised to grow at the fastest CAGR of 22.04% during the forecast period of 2025 to 2032, driven by rapid urbanization, large-scale infrastructure projects, and rising demand for cost-effective, low-emission transportation.

Countries such as China, India, and Japan are investing heavily in rail modernization to support economic growth and reduce pollution. This includes hybrid train pilot programs and subsidies for electrification alternatives in semi-urban and regional corridors.

India Hybrid Train Market Insight

India is emerging as a promising market, driven by the Ministry of Railways’ vision to achieve net-zero carbon emissions by 2030. Hybrid trains are being tested on non-electrified routes to improve last-mile rail connectivity and reduce dependency on imported diesel. State-led initiatives and international collaborations are expected to boost growth in the coming years.

China Hybrid Train Market Insight

China leads the Asia Pacific market with the largest revenue share in 2025, thanks to its aggressive push toward electrified and sustainable public transport. The government’s “Made in China 2025” initiative encourages innovation in battery-powered and hydrogen hybrid trains. Domestic manufacturers such as CRRC are scaling up hybrid production to meet demand from high-density urban and regional transit routes.

Hybrid Train Market Share

The Hybrid Train Industry is primarily led by well-established companies, including:

- CRRC Corporation Limited (China)

- Alstom SA (France)

- Siemens AG (Germany)

- Hitachi Rail STS (Italy)

- Wabtec Corporation (US)

- Construcciones y Auxiliar de Ferrocarriles – CAF (Spain)

- Hyundai Rotem Company (South Korea)

- Talgo (Spain)

- The Kinki Sharyo Co., Ltd. (Japan)

Latest Developments in Global Hybrid Train Market

- In February 2025, Alstom launched its upgraded Coradia iLint hydrogen-powered hybrid train in the Netherlands, marking the company’s expanded commercialization in Western Europe. The new model features increased fuel cell efficiency, an extended range of up to 1,000 km, and quieter operation, making it suitable for non-electrified routes.

- In January 2025, Hitachi Rail extended its collaboration with Trenitalia to expand the fleet of Masaccio hybrid trains across Italy. These trains, which combine battery, diesel, and electric propulsion, are now being integrated into more regional lines under Italy’s sustainable mobility program. The partnership reflects a national strategy to phase out diesel trains while maintaining service across partially electrified routes, enhancing both environmental impact and regional connectivity.

- In December 2024, Siemens Mobility unveiled a new hybrid train prototype incorporating advanced battery-electric modules capable of regenerative braking and grid-independent operation. The design supports modular upgrades on existing electric multiple units (EMUs), allowing operators to convert legacy fleets into hybrid systems without full replacements. This innovation supports decarbonization efforts in Germany and Scandinavia, where infrastructure gaps still limit full electrification.

- In October 2024, Stadler Rail secured a contract with Renfe, Spain’s national rail operator, to deliver hydrogen-powered hybrid trains for use on rural and regional lines. This marks Stadler’s first hydrogen project in Western Europe outside Germany, signaling increasing demand for versatile, clean train systems across non-electrified networks. The trains are expected to enter service in early 2026 and support Spain’s national goal to achieve zero-emission rail operations by 2050.

- In November 2024, Spain’s CAF (Construcciones y Auxiliar de Ferrocarriles) acquired hydrogen propulsion technologies from Solaris Bus & Coach to accelerate development of its hybrid train lineup. This strategic acquisition enhances CAF’s ability to offer integrated hydrogen solutions across its train platforms and meets growing demand from countries seeking alternatives to diesel rail. The move strengthens CAF’s competitive positioning in the European hybrid train segment, especially in Eastern markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.