Global Hydraulic Fracturing Well Testing Services Market

Market Size in USD Billion

CAGR :

%

USD

2.39 Billion

USD

3.37 Billion

2024

2032

USD

2.39 Billion

USD

3.37 Billion

2024

2032

| 2025 –2032 | |

| USD 2.39 Billion | |

| USD 3.37 Billion | |

|

|

|

|

What is the Global Hydraulic Fracturing Well Testing Services Market Size and Growth Rate?

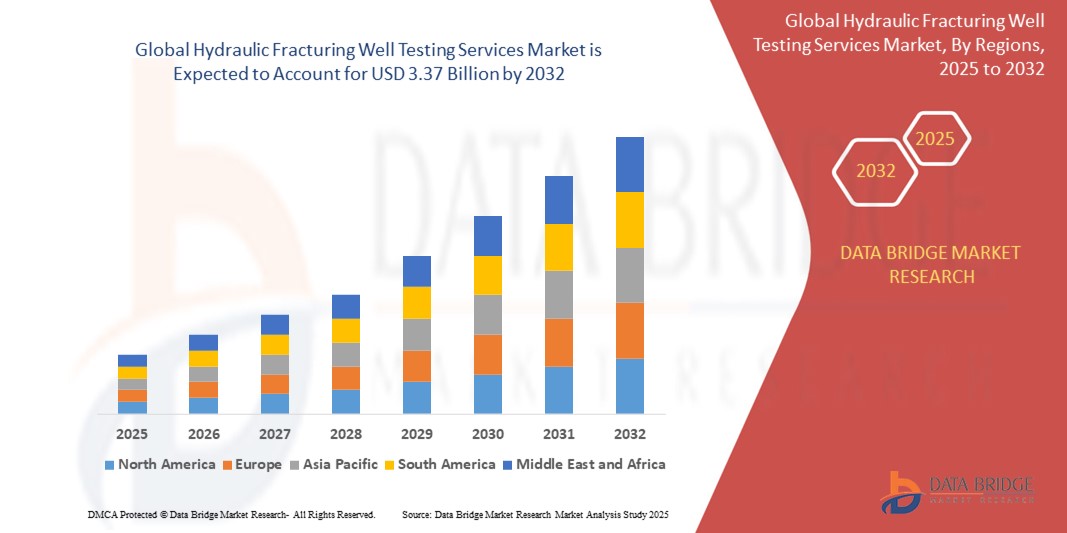

- The global hydraulic fracturing well testing services market size was valued at USD 2.39 billion in 2024 and is expected to reach USD 3.37 billion by 2032, at a CAGR of 4.40% during the forecast period

- Optimizing well performance through hydraulic fracturing well testing services involves leveraging detailed assessments to enhance productivity and efficiency. These services analyze various parameters post-fracturing, such as flow rates, pressure gradients, and fluid composition, to evaluate the effectiveness of fracturing treatments

- By pinpointing optimal production zones and identifying potential issues such as fluid containment or reservoir connectivity, operators can fine-tune their operational strategies. This data-driven approach maximizes initial production rates and supports long-term reservoir management and well maintenance

What are the Major Takeaways of Hydraulic Fracturing Well Testing Services Market?

- Rapid urbanization leads to increased exploration and production activities in both conventional and unconventional oil and gas reservoirs. Hydraulic fracturing, a key technology in accessing unconventional resources, experiences heightened adoption to exploit previously inaccessible reserves beneath urban areas

- Consequently, hydraulic fracturing well testing services become essential to assess the effectiveness of these operations, optimize well productivity, and ensure environmental compliance amidst urban environments. The demand for reliable testing services grows as urbanization intensifies the pressure to efficiently utilize and manage energy resources sustainably

- North America dominated the hydraulic fracturing well testing services market with the largest revenue share of 41.6% in 2024, primarily due to intense shale gas and tight oil exploration, advanced fracking infrastructure, and a mature energy services ecosystem

- Asia-Pacific is projected to register the fastest CAGR of 11.45% from 2025 to 2032, driven by exploration and production activities in emerging unconventional plays across China, India, and Southeast Asia

- The Plug and Perf segment dominated the market with the largest revenue share of 62.4% in 2024, owing to its operational flexibility, cost-efficiency, and suitability for multi-stage horizontal well completions

Report Scope and Hydraulic Fracturing Well Testing Services Market Segmentation

|

Attributes |

Hydraulic Fracturing Well Testing Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hydraulic Fracturing Well Testing Services Market?

Integration of Digital Technologies and Real-Time Analytics in Well Testing

- In the hydraulic fracturing well testing services market, there's a growing trend toward real-time data acquisition, remote monitoring, and digital integration for improved reservoir evaluation and operational efficiency

- Service providers are increasingly adopting advanced telemetry systems, cloud-based data platforms, and AI-powered analytics to enable predictive insights and optimize production strategies

- In April 2024, SLB (U.S.) introduced a new smart well testing platform with edge computing capabilities for dynamic reservoir modeling and real-time pressure and flow analysis

- The trend also includes the use of automated multiphase flow meters and wireless sensors to reduce HSE risks and minimize human intervention at well sites

- With increasing demand for sustainable and efficient resource extraction, digitalization is becoming central to reducing costs, enhancing well performance, and meeting regulatory compliance

- This shift is redefining traditional workflows and creating competitive advantages for tech-forward service providers in a complex and capital-intensive market

What are the Key Drivers of Hydraulic Fracturing Well Testing Services Market?

- Increases in global shale gas and tight oil exploration particularly in regions such as North America and Argentina are driving demand for accurate, efficient, and timely well testing operations

- In March 2024, Halliburton (U.S.) expanded its real-time well testing services in the Permian Basin, integrating downhole sensors with surface data logging for enhanced reservoir characterization

- Rising global energy demand and the need for unconventional energy sources have pushed operators to maximize production using advanced stimulation and flowback monitoring technologies

- Government support and favorable policies for E&P (Exploration & Production) projects in developing economies are encouraging investments in upstream services, including well testing

- The expansion of digital oilfields and focus on enhancing reservoir management are further fueling the adoption of high-precision testing solutions across offshore and onshore operations

- These drivers collectively support robust market growth as operators seek to boost ROI and reduce uncertainty in complex reservoir environments

Which Factor is challenging the Growth of the Hydraulic Fracturing Well Testing Services Market?

- One major challenge is the high cost and complexity of deploying advanced well testing technologies, especially in remote or offshore environments with harsh operating conditions

- For instance, small E&P companies in Africa and Southeast Asia face budget constraints in adopting digital well testing tools, limiting regional growth potential

- Environmental regulations and growing scrutiny around hydraulic fracturing processes, including water usage and methane emissions, are also adding operational constraints

- The shortage of skilled personnel capable of operating integrated and digital testing platforms adds further delays and raises training costs for service providers

- Market volatility, including fluctuating crude oil prices and geopolitical tensions, makes it difficult for companies to commit to long-term service contracts and capital expenditures

- These barriers hinder widespread adoption, particularly among smaller players and in price-sensitive regions, slowing overall market acceleration

How is the Hydraulic Fracturing Well Testing Services Market Segmented?

The market is segmented on the basis of technology, application, and well type.

- By Technology

On the basis of technology, the hydraulic fracturing well testing services market is segmented into Plug and Perf and Sliding Sleeve. The Plug and Perf segment dominated the market with the largest revenue share of 62.4% in 2024, owing to its operational flexibility, cost-efficiency, and suitability for multi-stage horizontal well completions. Its widespread usage in unconventional plays, especially in the U.S. shale basins, has made it the preferred method among service providers and operators.

The Sliding Sleeve segment, while used in specific formations requiring selective zonal isolation, is gaining traction in regions such as Canada and the Middle East for its simplicity and speed in low-complexity reservoirs.

- By Application

On the basis of application, the market is segmented into Shale Gas, Tight Oil, and Tight Gas. The Shale Gas segment held the dominant market share of 47.9% in 2024, driven by robust drilling and completion activity in regions such as the Permian, Marcellus, and Haynesville basins. The growing global emphasis on gas as a cleaner transition fuel has further supported shale gas development.

Tight Oil is the second-largest application segment and continues to grow due to increasing extraction in formations such as the Bakken and Eagle Ford.

- By Well Type

On the basis of well type, the market is divided into Horizontal Well and Vertical Well. The Horizontal Well segment dominated the market with a revenue share of 69.1% in 2024, attributed to its superior reservoir contact, higher production rates, and widespread adoption in unconventional plays.

The Vertical Well segment is still relevant in conventional and early-stage exploration environments, particularly in developing regions with limited fracking infrastructure.

Which Region Holds the Largest Share of the Hydraulic Fracturing Well Testing Services Market?

- North America dominated the hydraulic fracturing well testing services market with the largest revenue share of 41.6% in 2024, primarily due to intense shale gas and tight oil exploration, advanced fracking infrastructure, and a mature energy services ecosystem. The presence of prolific basins such as the Permian, Eagle Ford, and Bakken continues to drive demand for well testing solutions to ensure reservoir productivity and operational efficiency

- The U.S. leads the regional market due to high horizontal drilling activity, enhanced oil recovery efforts, and an increasing focus on data-driven well performance analysis. The implementation of real-time monitoring technologies and post-fracturing diagnostics across Texas and North Dakota are key drivers

- Canada maintains a steady market presence, supported by operations in regions such as Alberta’s Montney and Duvernay formations. The country’s regulatory emphasis on environmental compliance and accurate reservoir evaluation is boosting the uptake of reliable testing technologies

U.S. Hydraulic Fracturing Well Testing Services Market Insight

The U.S. hydraulic fracturing well testing services market held the largest share in North America in 2024, driven by extensive horizontal drilling operations, increased focus on data-driven reservoir management, and growing multi-well pad developments. The demand for portable separators, frac flowback services, and production monitoring remains high across key shale plays.

Canada Hydraulic Fracturing Well Testing Services Market Insight

The Canada hydraulic fracturing well testing services market is growing steadily, supported by active development in the Montney and Duvernay formations, regulatory compliance for emissions tracking, and increased investment in LNG projects. The push toward ESG reporting and water management is also spurring demand for advanced testing services in unconventional fields.

Which Region is the Fastest Growing in the Hydraulic Fracturing Well Testing Services Market?

Asia-Pacific is projected to register the fastest CAGR of 11.45% from 2025 to 2032, driven by exploration and production activities in emerging unconventional plays across China, India, and Southeast Asia. Rising energy demand, government support for domestic oil & gas output, and increasing foreign investments are propelling market expansion. Countries such as China and India are accelerating hydraulic fracturing efforts to reduce import dependency and tap into shale and tight gas resources. The demand for accurate pressure, temperature, and flow rate monitoring services is growing across pilot and commercial frac projects. The adoption of mobile and automated well testing units is expanding due to cost efficiency and adaptability in remote or developing fields.

China Hydraulic Fracturing Well Testing Services Market Insight

The China hydraulic fracturing well testing services market accounted for the largest share in Asia-Pacific in 2024, bolstered by aggressive shale gas exploration in Sichuan and Tarim basins, state-driven E&P initiatives, and advancements in testing equipment. Strategic collaborations with global oilfield service providers are enhancing capabilities in high-pressure, high-temperature environments.

India Hydraulic Fracturing Well Testing Services Market Insight

The India hydraulic fracturing well testing services market is witnessing rapid growth amid increasing interest in the Cambay and Krishna-Godavari basins, supportive government reforms, and public-private partnerships to boost unconventional oil & gas output. The focus on reducing flaring and optimizing flowback operations is fueling demand for precise well testing technologies.

Which are the Top Companies in Hydraulic Fracturing Well Testing Services Market?

The hydraulic fracturing well testing services industry is primarily led by well-established companies, including:

- SLB (U.S.)

- Weatherford (U.S.)

- Halliburton Energy Services, Inc. (U.S.)

- TETRA Technologies, Inc. (U.S.)

- TechnipFMC plc (U.S.)

- China Oilfield Services Limited (China)

- Expro Group (U.K.)

- PTS Production Technology & Services Inc (U.S.)

- Oil States International, Inc. (U.S.)

- National Energy Services Reunited Corp. (U.S.)

What are the Recent Developments in Global Hydraulic Fracturing Well Testing Services Market?

- In November 2024, ProFrac Holding Corp. collaborated with Prairie Operating Co. to launch an electric frac fleet in Colorado, featuring 25 state-of-the-art 3,000 HHP single E-Pumps for fully electrified hydraulic fracturing and pump-down operations. This initiative marks a significant step toward reducing emissions and enhancing efficiency in fracking activities

- In September 2024, Halliburton rolled out its Octiv Auto Frac service, a platform designed to automate and digitize workflows, equipment, and data across the entire fracture operation lifecycle. This advancement is expected to significantly improve operational consistency and accelerate completion timelines

- In December 2023, Tamboran Resources Ltd formed a strategic partnership with Liberty Energy Inc., which included a USD 10 million equity investment. As part of the deal, Liberty committed to deploying a modern frac fleet to support Tamboran’s 40 million cubic feet per day Shenandoah South Pilot Project in the Beetaloo Basin. This move strengthens Australia’s onshore gas capabilities and frac technology adoption

- In January 2022, Texas A&M University introduced a cutting-edge 3D printing technique to replicate hydraulic fracturing scenarios, aimed at improving insights into oil and gas extraction. This approach offers a valuable tool for refining and optimizing fracking strategies through physical modeling

- In January 2021, the U.S. Environmental Protection Agency (EPA) authorized the Texas Commission on Environmental Quality to take over federal duties related to water discharge regulation. This delegation empowers Texas to enforce localized control over fracking-related water management, fostering more responsive governance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydraulic Fracturing Well Testing Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydraulic Fracturing Well Testing Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydraulic Fracturing Well Testing Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.