Global Hydrotreating Catalysts Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

2.22 Billion

2024

2032

USD

1.29 Billion

USD

2.22 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 2.22 Billion | |

|

|

|

|

Hydrotreating Catalysts Market Size

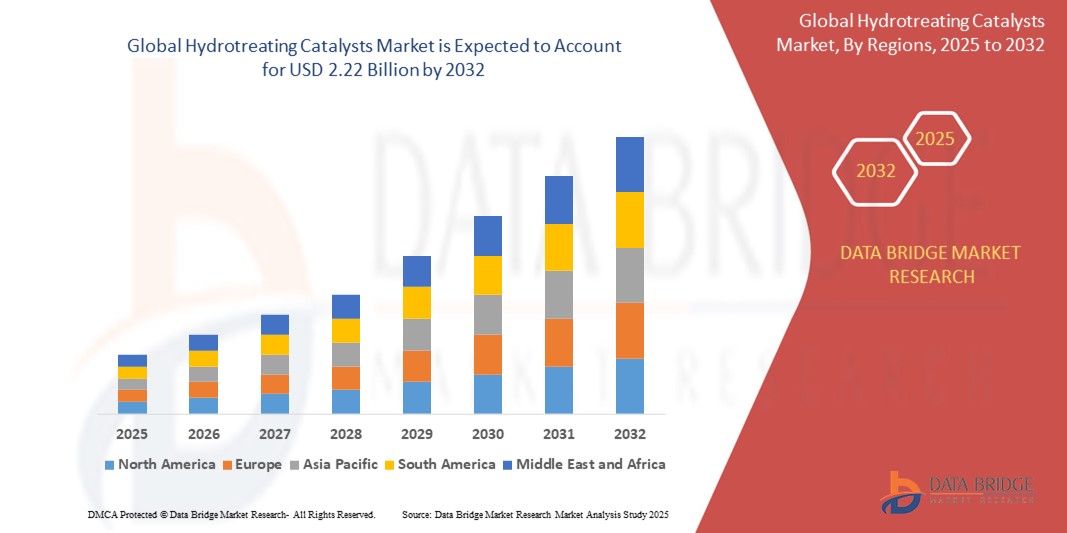

- The global hydrotreating catalysts market size was valued at USD 1.29 billion in 2024 and is expected to reach USD 2.22 billion by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is primarily driven by increasing demand for cleaner fuels, stringent environmental regulations, and advancements in refining technologies, enhancing the efficiency and performance of hydrotreating processes

- The rising need for high-quality, low-sulfur petroleum products and the expansion of refining capacities in emerging economies are significantly contributing to the market’s growth

Hydrotreating Catalysts Market Analysis

- Hydrotreating catalysts are critical in the petroleum refining industry, removing impurities such as sulfur, nitrogen, and metals from crude oil fractions to ensure compliance with environmental standards and improve fuel quality

- The demand for hydrotreating catalysts is fueled by global pushes for ultra-low sulfur diesel (ULSD), low-sulfur gasoline, and compliance with regulations such as the International Maritime Organization’s sulfur cap

- Asia-Pacific dominated the hydrotreating catalysts market with the largest revenue share of 43.3% revenue share in 2024 due to its extensive refining infrastructure and high fuel demand, particularly in China and India

- North America is expected to be the fastest-growing region during the forecast period, driven by technological innovations, refinery upgrades, and stringent environmental regulations in the U.S. and Canada

- The load type segment dominated the market with the largest market revenue share of 68.7%in 2024, due to its high efficiency in removing impurities such as sulfur, nitrogen, and metals from heavy crude oil, making it essential for refining processes under stringent environmental regulations

Report Scope and Hydrotreating Catalysts Market Segmentation

|

Attributes |

Hydrotreating Catalysts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrotreating Catalysts Market Trends

“Enhanced Efficiency through Advanced Catalyst Formulations and Digital Integration”

- A prominent trend in the global hydrotreating catalysts market is the increasing focus on advanced catalyst formulations, incorporating nanotechnology and hybrid catalysts, to enhance efficiency and adaptability in refining processes

- For instance, companies such as Axens have introduced the P/PR 200 Series, which optimizes hydrotreating processes by improving selectivity and enabling shorter loading times for refineries

- Integration of digital technologies, such as AI-driven process optimization and real-time monitoring, is transforming the market. These systems analyze catalyst performance and feedstock variations, enabling predictive maintenance and maximizing catalyst lifespan

- The growing adoption of hybrid catalysts, combining hydrotreating and hydrocracking functionalities, is gaining traction. These catalysts process diverse feedstocks, including heavy oils and bio-based materials, supporting the production of cleaner fuels such as ultra-low sulfur diesel (ULSD) and renewable diesel

- The market is also seeing increased demand for catalyst regeneration and recycling technologies, driven by sustainability goals. Regenerated catalysts, particularly metal-based ones, have seen a 6% rise in adoption due to cost savings and environmental benefits

- These advancements are reshaping refinery expectations, with a focus on sustainability, cost-efficiency, and compliance with global emission standards, such as the International Maritime Organization’s (IMO) sulfur cap regulations

Hydrotreating Catalysts Market Dynamics

Driver

“Rising Demand for Cleaner Fuels and Stringent Environmental Regulations”

- The global push for cleaner fuels, such as ultra-low sulfur diesel and low-sulfur gasoline, is a major driver for the hydrotreating catalysts market

- For instance, in 2023, the diesel hydrotreat segment dominated the market with a 48.7% share, driven by the high demand for low-sulfur diesel to comply with emission standards

- The rapid expansion of refining capacities, particularly in Asia-Pacific, which accounted for 43.3% of the global market share in 2023, is boosting demand. Countries such as China and India are modernizing refineries to process heavier crude oils and produce cleaner fuels, necessitating advanced hydrotreating catalysts

- The growing adoption of biofuels, such as renewable diesel and sustainable aviation fuel, is further driving the market. Hydrotreating catalysts are critical for converting bio-based feedstocks, such as vegetable oils and animal fats, into high-quality fuels, supporting global sustainability goals

- Increasing investments in refinery modernization, such as exxonmobil’s expansion in beaumont, texas, adding 250,000 barrels per day of refining capacity, are propelling the demand for catalysts that enhance fuel quality and operational efficiency

- The trend toward digitalization in refineries, including IoT-based monitoring and AI-driven process control, is also enhancing the role of hydrotreating catalysts in achieving higher yields and meeting regulatory requirements

Restraint/Challenge

“High Initial Costs and Operational Complexity”

- The high initial costs of hydrotreating catalysts and the infrastructure required for hydroprocessing units pose a significant barrier to market growth, particularly for smaller or older refineries in developing regions. The capital-intensive nature of installing and maintaining these systems can deter investment, limiting market penetration

- For example, the procurement of advanced catalysts, such as those using precious metals such as platinum or palladium, can be cost-prohibitive, with high metal prices contributing to a 6% increase in demand for regenerated catalysts as a cost-saving alternative

- Operational complexity is another challenge, as hydrotreating processes require skilled personnel to manage sophisticated systems and troubleshoot issues. The need for ongoing maintenance and the risk of catalyst deactivation due to feedstock impurities add to operational costs and complexity

- Concerns about catalyst durability and performance under harsh conditions, such as processing heavy or sour crude oils, can also hinder adoption. Refineries face challenges in maintaining catalyst activity over extended periods, which impacts profitability

- Addressing these challenges requires innovations in cost-effective catalyst formulations, improved regeneration techniques, and training programs for refinery operators. Companies such as W.R. Grace and Albemarle are investing in R&D to develop more durable and affordable catalysts, while also promoting recycling to reduce costs

Hydrotreating Catalysts market Scope

The market is segmented on the basis of type, material, and application.

- By Type

On the basis of type, the hydrotreating catalysts market is segmented into load type and non-load type. The load type segment dominated the market with the largest market revenue share of 68.7%in 2024, due to its high efficiency in removing impurities such as sulfur, nitrogen, and metals from heavy crude oil, making it essential for refining processes under stringent environmental regulations. Load Type catalysts are favored for their regeneration capability and ability to maintain refined product quality, particularly in petroleum refineries.

The non-load type segment is projected to exhibit the fastest CAGR of 8.1% from 2025 to 2032, driven by its increasing adoption in specialized refining processes that require flexibility and lower operational complexity. Non-Load Type catalysts are gaining traction in smaller-scale refineries and for processing lighter feedstocks due to their cost-effectiveness and ease of integration.

- By Material

On the basis of material, the hydrotreating catalysts market is segmented into zeolites, chemical compounds, metals, and others. The zeolites led the market with the largest market revenue share of 38.7% in 2024, driven by their high porosity and molecular sieve properties, which are ideal for removing sulfur and nitrogen compounds from crude oil refining. Zeolites’ structural stability and catalytic activity make them a preferred choice for diesel and naphtha hydrotreating applications.

The chemical compounds segment is expected to grow at the fastest CAGR of 7.5% from 2025 to 2032, fueled by advancements in formulations such as alumina and silica-based catalysts. These compounds offer versatility across a wide range of refining conditions and are increasingly adopted for their precision in catalytic processes, particularly in response to evolving fuel quality standards.

- By Application

On the basis of application, the hydrotreating catalysts market is segmented by application into diesel hydrotreat, lube oils, naphtha, and others. The diesel hydrotreat segment held the largest market revenue share of 48.7% in 2024, driven by stringent global regulations mandating ultra-low sulfur diesel to reduce emissions. The high demand for cleaner diesel fuels in transportation and industrial sectors has solidified this segment’s dominance.

The lube oils segment is anticipated to grow at the fastest CAGR of 7.8% from 2025 to 2032, propelled by the rising need for high-purity lubricants in automotive and manufacturing industries. Hydrotreating catalysts enhance lube oil quality, improving engine efficiency and longevity, which drives demand in commercial and industrial applications.

Hydrotreating Catalysts Market Regional Analysis

- Asia-Pacific dominated the hydrotreating catalysts market with the largest revenue share of 43.3% revenue share in 2024 due to its extensive refining infrastructure and high fuel demand, particularly in China and India

- North America is expected to be the fastest-growing region during the forecast period, driven by technological innovations, refinery upgrades, and stringent environmental regulations in the U.S. and Canada

U.S. Hydrotreating Catalysts Market Insight

The U.S. hydrotreating catalysts market is anticipated to grow at a significant CAGR during the forecast period, driven by the country’s advanced refining infrastructure and stringent environmental regulations. The increasing demand for low-sulfur fuels, coupled with investments in refinery modernization, is boosting the adoption of high-performance hydrotreating catalysts. The U.S. focus on sustainable energy practices and technological innovation in catalyst development further accelerates market growth, particularly in large-scale refining operations.

Europe Hydrotreating Catalysts Market Insight

The Europe hydrotreating catalysts market is expected to expand at a substantial CAGR throughout the forecast period, driven by stringent environmental regulations and the need for low-sulfur fuels. Countries such as Germany and the United Kingdom are prioritizing sustainability, leading to increased adoption of hydrotreating catalysts in refineries. The region's focus on energy efficiency and the integration of advanced catalyst technologies in refining processes further supports market growth across both existing and new facilities.

U.K. Hydrotreating Catalysts Market Insight

The UK hydrotreating catalysts market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by the country’s commitment to reducing emissions and enhancing fuel quality. The demand for cleaner fuels, coupled with investments in refinery upgrades, is encouraging the adoption of advanced hydrotreating catalysts. The UK’s robust regulatory framework and focus on sustainable energy solutions are expected to continue driving market growth in both refining and industrial applications

Germany Hydrotreating Catalysts Market Insight

The Germany hydrotreating catalysts market is projected to expand at a considerable CAGR, driven by the country’s strong industrial base and emphasis on environmental compliance. Germany’s advanced refining infrastructure and focus on sustainable technologies promote the adoption of high-performance hydrotreating catalysts. The integration of these catalysts with modern refining processes, alongside a preference for eco-conscious solutions, is gaining traction, aligning with Germany’s sustainability and innovation goals.

Asia-Pacific Hydrotreating Catalysts Market Insight

The Asia-Pacific hydrotreating catalysts market holds the dominating revenue share in 2024, attributed to rapid industrialization, expanding refining capacities, and high energy demand in countries such as China, India, and Japan. The region's focus on meeting stringent fuel quality standards, alongside government initiatives promoting cleaner energy, is driving the adoption of hydrotreating catalysts. The presence of major refineries and domestic catalyst manufacturers further strengthens the market, making Asia-Pacific a key hub for production and consumption.

Japan Hydrotreating Catalysts Market Insight

The Japan hydrotreating catalysts market is gaining traction due to the country’s high demand for high-tech refining processes and commitment to environmental standards. Japan’s advanced technological culture and focus on energy efficiency drive the adoption of hydrotreating catalysts in its refining sector. The increasing need for cleaner fuels, combined with investments in refinery modernization, is fueling market growth. In addition, Japan’s aging infrastructure and energy-intensive industries are likely to spur demand for efficient, high-performance catalysts.

China Hydrotreating Catalysts Market Insight

The China hydrotreating catalysts market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s rapid industrialization, expanding middle class, and significant refining capacity. China’s push toward cleaner fuels and compliance with stringent emission standards has led to widespread adoption of hydrotreating catalysts in refineries and industrial applications. The availability of cost-effective, domestically produced catalysts and government support for sustainable energy initiatives are key factors propelling market growth in China.

Hydrotreating Catalysts Market Share

The hydrotreating catalysts industry is primarily led by well-established companies, including:

- Shell (Netherlands)

- BASF SE (Germany)

- Grace (U.S.)

- Albemarle Corporation (U.S.)

- Honeywell International Inc (U.S.)

- Haldor Topsoe A/S (Denmark)

- Axens (France)

- Johnson Matthey (U.K.)

- JGC C&C (Japan)

- China Petrochemical Corporation (China)

- Arkema (France)

- Exxon Mobil Corporation (U.S.)

- DuPont (U.S.)

- UNICAT Catalyst Technologies, LLC (U.S.)

- Criterion (U.S.)

What are the Recent Developments in Global Hydrotreating Catalysts Market?

- In July 2024, Advanced Refining Technologies LLC (ART), a joint venture between Chevron and W. R. Grace & Co., launched the ENDEAVOR hydrotreating catalyst system to produce renewable diesel (RD) and sustainable aviation fuel (SAF) from 100% renewable sources. The system integrates EnRich guard and hydrotreating catalysts alongside Chevron’s EnHance isomerization catalysts, optimizing contaminant removal, deoxygenation, and dewaxing. This innovation supports decarbonization efforts in heavy-duty transportation, enabling refiners to maximize yields and profits from biofeeds

- In September 2024, Shell Catalysts & Technologies partnered with Licella to develop low-carbon biomass-to-biofuel solutions, including sustainable aviation fuel (SAF). This collaboration integrates Shell’s hydroprocessing expertise with Licella’s Cat-HTR™ hydrothermal liquefaction technology, converting biomass into low-carbon biocrude. Shell will serve as the exclusive global upgrader for biocrude produced by Licella’s units, advancing SAF certification and commercial-scale production

- In September 2024, Ravindra Heraeus Pvt. Ltd. acquired Arora Matthey’s catalyst and recycling site in Vizag, India. This strategic move strengthens Ravindra Heraeus’s presence in the precious metal catalyst sector, enhancing hydrotreating catalyst manufacturing and recycling capabilities. The acquisition supports India’s growing pharmaceutical and chemical industries, ensuring high-quality catalyst production and sustainable recycling solutions

- In March 2024, BASF SE introduced a next-generation hydrotreating catalyst designed to enhance activity and lifecycle for ultra-low sulfur diesel (ULSD) production. This innovation aligns with stringent environmental regulations, improving refining efficiency and supporting the global transition to cleaner fuels. BASF’s refinery catalysts portfolio continues to evolve, integrating advanced hydroprocessing solutions to optimize fuel quality and sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrotreating Catalysts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrotreating Catalysts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrotreating Catalysts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.