Global Hyoscine Market

Market Size in USD Million

CAGR :

%

USD

429.03 Million

USD

578.19 Million

2024

2032

USD

429.03 Million

USD

578.19 Million

2024

2032

| 2025 –2032 | |

| USD 429.03 Million | |

| USD 578.19 Million | |

|

|

|

|

Hyoscine Market Size

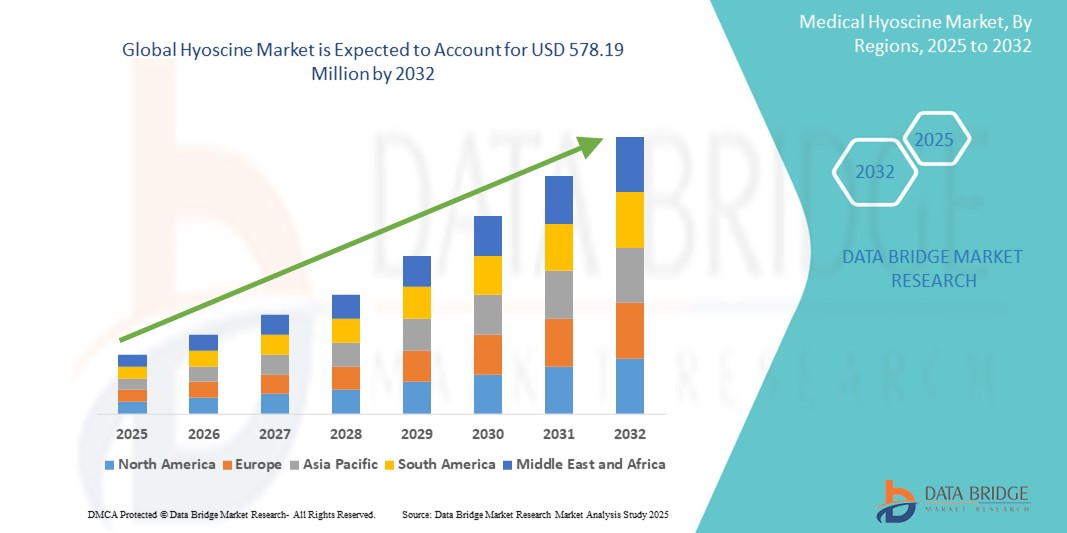

- The global hyoscine market size was valued at USD 429.03 million in 2024 and is expected to reach USD 578.19 million by 2032, at a CAGR of 3.80% during the forecast period

- The market growth is largely fueled by the increasing incidence of motion sickness, gastrointestinal disorders, and postoperative nausea, coupled with the drug’s expanding use in palliative care settings

- Furthermore, rising consumer awareness of over-the-counter antispasmodic and antiemetic treatments, along with increased pharmaceutical R&D investments, is establishing hyoscine as a frontline therapeutic option. These converging factors are accelerating the uptake of hyoscine-based medications, thereby significantly boosting the industry’s growth

Hyoscine Market Analysis

- Hyoscine, widely used as an anticholinergic agent for preventing motion sickness, gastrointestinal cramps, and postoperative nausea, is becoming an essential therapeutic component across both prescription and over-the-counter pharmaceutical markets due to its effectiveness, rapid action, and growing availability in oral and transdermal forms

- The escalating demand for hyoscine is primarily fueled by increasing global travel contributing to motion sickness prevalence, a rising geriatric population experiencing gastrointestinal disorders, and expanding use in palliative care for managing secretion control

- North America dominated the hyoscine market with the largest revenue share of 37.8% in 2024, characterized by strong healthcare infrastructure, widespread awareness of antiemetic treatments, and the presence of leading pharmaceutical players. The U.S. has seen substantial demand growth driven by consumer preference for non-invasive treatment options and increased availability of transdermal patches

- Asia-Pacific is expected to be the fastest growing region in the hyoscine market during the forecast period due to growing healthcare access, increasing disposable incomes, and rising awareness of gastrointestinal and motion-related conditions

- Hyoscine Butyl Bromide segment dominated the hyoscine market with a market share of 75.5% in 2024, driven by its widespread use in treating gastrointestinal spasms and strong over-the-counter availability across global markets

Report Scope and Hyoscine Market Segmentation

|

Attributes |

Hyoscine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hyoscine Market Trends

“Increased Demand for Non-Invasive and Long-Acting Drug Delivery Method”

- A significant and accelerating trend in the global hyoscine market is the rising preference for non-invasive and long-acting drug delivery methods, particularly transdermal patches. These formats offer extended therapeutic effects and improved patient adherence, especially in the treatment of motion sickness and postoperative nausea

- For instance, scopolamine transdermal patches provide up to 72 hours of continuous symptom relief, making them ideal for travelers and patients requiring long-duration dosing

- The growing popularity of patches is largely due to their convenience, minimal side effects compared to oral formulations, and suitability for patients with swallowing difficulties

- Pharmaceutical companies are increasingly focusing on developing advanced patch technologies with improved adhesion, controlled drug release, and reduced adverse effects, which are driving innovation and product differentiation

- This trend towards convenient, patient-friendly, and effective delivery systems is reshaping treatment protocols and consumer expectations, encouraging companies such as Novartis and GlaxoSmithKline to expand their transdermal product lines to meet growing demand

Hyoscine Market Dynamics

Driver

“Rising Incidence of Motion Sickness and Gastrointestinal Disorders”

- The increasing global prevalence of motion sickness due to frequent travel, coupled with rising cases of gastrointestinal disorders, is a major driver for the growing demand for hyoscine-based medications

- For instance, the surge in air and sea travel, particularly in North America and Asia-Pacific, is contributing to higher demand for antiemetic solutions such as hyoscine patches and oral tablets

- In addition, gastrointestinal conditions such as irritable bowel syndrome and abdominal cramping are becoming more prevalent, especially among the aging population, reinforcing the use of hyoscine butyl bromide as an effective antispasmodic agent

- The versatility of hyoscine across various treatment areas, along with its availability in both prescription and OTC formats, is increasing its adoption across diverse patient demographics

- The growing presence of hyoscine in online and retail pharmacies, supported by consumer preference for rapid relief and non-invasive formats, is further propelling market growth in both developed and emerging regions

Restraint/Challenge

“Side Effects and Regulatory Compliance Challenges”

- Side effects such as dry mouth, drowsiness, blurred vision, and potential skin irritation from transdermal patches remain key concerns that can limit wider adoption of hyoscine, particularly in sensitive patient groups

- In addition, inconsistent regulatory classifications and availability across global markets present hurdles to broader commercialization. While hyoscine is available over the counter in some countries, it remains prescription-bound in others, complicating market access strategies

- Manufacturers must ensure adherence to evolving drug safety regulations, particularly regarding labeling, dosage guidance, and contraindications, to maintain consumer trust and regulatory approval

- Moreover, competition from alternative treatments such as meclizine, ondansetron, and other antispasmodics may restrict market growth unless hyoscine-based products demonstrate superior efficacy, safety, and cost-effectiveness

- Overcoming these challenges through the development of improved delivery methods, comprehensive pharmacovigilance, and strategic education initiatives will be critical to supporting long-term growth and acceptance of hyoscine therapies

Hyoscine Market Scope

The market is segmented on the basis of drug type, application, route of administration, mode of purchase, and distribution channel.

- By Drug Type

On the basis of drug type, the hyoscine market is segmented into Hyoscine butyl bromide and hyoscine hydrobromide. The hyoscine butyl bromide segment dominated the market with the largest revenue share of 75.5% in 2024, driven by its extensive use in treating abdominal cramps, irritable bowel syndrome, and gastrointestinal disorders. Its wide over-the-counter availability and strong clinical efficacy as an antispasmodic agent have positioned it as the preferred formulation in both hospital and retail settings.

The hyoscine hydrobromide segment is expected to witness fastest growth during the forecast period, primarily used for preventing motion sickness and postoperative nausea. Though smaller in market share, it is gaining traction due to increasing travel-related health concerns and growing demand for non-invasive formats such as transdermal patches.

- By Application

On the basis of application, the hyoscine market is segmented into motion sickness, cramps, and nausea. The cramps segment held the dominant share in 2024, largely driven by rising cases of gastrointestinal spasms and functional abdominal pain. Hyoscine Butyl Bromide is the drug of choice in this application due to its rapid and effective muscle relaxant properties.

The motion sickness segment is expected to witness notable growth from 2025 to 2032, supported by increasing global travel and adoption of wearable drug delivery systems such as transdermal patches. The ease of use and extended relief duration make it popular among frequent travelers.

- By Route Of Administration

On the basis of route of administration, the hyoscine market is segmented into oral, intravenous, and patches. The oral segment dominated the market with a share of over 65% in 2024, attributed to its convenience, cost-effectiveness, and OTC accessibility in various countries. Oral formulations are preferred for gastrointestinal applications and are widely distributed through both prescription and non-prescription channels.

The patch segment is expected to grow at the fastest rate through 2032, driven by increasing adoption for motion sickness prevention. Transdermal delivery systems provide up to 72 hours of relief and are gaining favor for their non-invasiveness and patient-friendly nature.

- By Mode Of Purchase

On the basis of mode of purchase, the hyoscine market is segmented into Prescription and Over the Counter (OTC). The Prescription segment dominated in 2024, driven by the requirement for medical supervision in intravenous and certain high-dose oral applications, especially in hospital settings.

However, the OTC segment is projected to grow rapidly during forecast period, due to the availability of low-dose oral tablets and patches for motion sickness, which are increasingly stocked in retail and online pharmacies. Rising consumer self-care awareness is further fueling demand for OTC access.

- By Distribution Channel

On the basis of distribution channel, the hyoscine market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies accounted for the largest revenue share of 55% in 2024, due to strong institutional demand for injectable and high-strength formulations used in acute care and palliative settings.

Online pharmacies are the fastest growing channel during forecast period, driven by the increasing trend of digital health purchasing, home delivery convenience, and availability of both prescription and OTC variants across regions.

Hyoscine Market Regional Analysis

- North America dominated the hyoscine market with the largest revenue share of 37.8% in 2024, characterized by strong healthcare infrastructure, widespread awareness of antiemetic treatments, and the presence of leading pharmaceutical players. The U.S. has seen substantial demand growth driven by consumer preference for non-invasive treatment options and increased availability of transdermal patches

- Consumers in the region value the convenience and efficacy of non-invasive delivery systems such as hyoscine patches, particularly for travel-related conditions and postoperative care

- This widespread usage is further supported by a well-established pharmaceutical distribution network, high awareness of gastrointestinal and antiemetic treatments, and a strong presence of leading market players, making North America a key region for hyoscine product innovation and sales

U.S. Hyoscine Market Insight

The U.S. hyoscine market captured the largest revenue share of 81% in 2024 within North America, fueled by high travel frequency, advanced healthcare infrastructure, and rising demand for over-the-counter antiemetic and antispasmodic treatments. Consumers are increasingly opting for transdermal patches and oral formulations for motion sickness and gastrointestinal discomfort. The strong presence of leading pharmaceutical companies, coupled with regulatory support for OTC sales, continues to boost market expansion.

Europe Hyoscine Market Insight

The Europe hyoscine market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising incidences of irritable bowel syndrome (IBS) and postoperative nausea, along with growing awareness of non-invasive therapies. Countries across Europe are experiencing a surge in the use of hyoscine butyl bromide for gastrointestinal disorders. The region’s focus on quality healthcare, coupled with growing preference for OTC options and expanding elderly population, supports steady market growth.

U.K. Hyoscine Market Insight

The U.K. hyoscine market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by high demand for antispasmodic drugs and increasing OTC accessibility of motion sickness treatments. Rising travel activity and gastrointestinal issues among the population are fueling sales of both prescription and non-prescription hyoscine. Public awareness campaigns, strong NHS support, and the popularity of patches among travelers are also contributing to market expansion.

Germany Hyoscine Market Insight

The Germany hyoscine market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong pharmaceutical industry, increasing healthcare expenditure, and a well-informed patient base. With a growing aging population and rising prevalence of gastrointestinal disorders, demand for hyoscine butyl bromide remains high. Germany’s focus on high-quality, clinically backed treatments and preference for trusted brands support ongoing growth in both hospital and retail channels.

Asia-Pacific Hyoscine Market Insight

The Asia-Pacific hyoscine market is poised to grow at the fastest CAGR during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing awareness of gastrointestinal health and motion sickness solutions. Countries such as China, India, and Japan are witnessing growing demand for convenient, OTC hyoscine products, supported by expanding healthcare infrastructure and greater product availability. Government efforts to enhance access to essential medicines further bolster regional growth.

Japan Hyoscine Market Insight

The Japan hyoscine market is gaining momentum due to a high-tech healthcare system, an aging population, and increasing use of travel-related medications. The demand for transdermal patches and oral tablets is growing, especially among elderly individuals and frequent travelers. Japan’s emphasis on non-invasive, long-acting treatments and integration with digital health tools is supporting hyoscine’s adoption in both outpatient and retail environments.

India Hyoscine Market Insight

The India hyoscine market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to widespread OTC availability, rising awareness of gastrointestinal and motion-related disorders, and a booming travel industry. India’s expanding middle class, coupled with increasing retail pharmacy and online sales networks, is making hyoscine more accessible across urban and semi-urban areas. Domestic manufacturing strength and government support for affordable healthcare also play a key role in propelling market growth.

Hyoscine Market Share

The hyoscine industry is primarily led by well-established companies, including:

- Boehringer Ingelheim International GmbH (Germany)

- Novartis AG (Switzerland)

- Perrigo Company plc (Ireland)

- Sun Pharmaceutical Industries Ltd. (India)

- GSK plc (U.K.)

- Alchem International Pvt. Ltd. (India)

- Cipla Ltd. (India)

- Alkaloids Corporation (India)

- Pharmascience Inc. (Canada)

- MYUNGMOON PHARM CO., LTD. (South Korea)

- Alkaloid AD Skopje (North Macedonia)

- Rivopharm (Switzerland)

- Zydus Lifesciences Limited (India)

- Taj Pharmaceuticals Ltd. (India)

- Sterling Pharmaceuticals Ltd. (U.K.)

- Sawai Pharmaceutical Co., Ltd. (Japan)

- SGPharma Pvt. Ltd. (India)

- Gland Pharma Limited (India)

What are the Recent Developments in Global Hyoscine Market?

- In March 2024, Boehringer Ingelheim expanded the global reach of its hyoscine butyl bromide product line by introducing a new formulation optimized for faster onset in gastrointestinal spasm relief. This advancement reflects the company’s commitment to enhancing patient outcomes through improved drug efficacy, targeting both prescription and over-the-counter segments in Europe and Asia-Pacific. The move aims to address the growing demand for rapid-relief antispasmodics in both hospital and retail settings

- In February 2024, Novartis AG launched a next-generation transdermal hyoscine patch with extended-release technology in select European and North American markets. Designed for motion sickness and postoperative nausea, the patch offers up to 96 hours of relief with improved adhesion and reduced skin irritation. This innovation emphasizes Novartis’s strategic focus on user-friendly, long-acting drug delivery systems that enhance treatment adherence and travel convenience

- In January 2024, Sun Pharmaceutical Industries Ltd. announced the expansion of its hyoscine hydrobromide production capacity in India to meet the rising global demand for anti-nausea medications. This strategic investment is aligned with the company’s goal to strengthen its position in the gastrointestinal and travel medicine segments while supporting India’s role as a key hub for pharmaceutical exports

- In December 2023, Perrigo Company plc, a leader in consumer self-care products, introduced an over-the-counter oral hyoscine tablet targeting motion sickness, now available in major U.S. pharmacy chains. The launch marks a significant step in expanding hyoscine’s accessibility to a broader consumer base and reflects growing retail demand for convenient travel health solutions

- In November 2023, GlaxoSmithKline (GSK) initiated a clinical trial in the U.K. to evaluate the effectiveness of a combination therapy involving hyoscine and antiemetic agents in post-operative care. The study aims to strengthen clinical evidence for expanded indications and support GSK’s efforts to enhance product offerings in hospital-based nausea management. This development underscores the company’s focus on evidence-based expansion and hospital sector growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.