Global Ibc Materials Market

Market Size in USD Billion

CAGR :

%

USD

19.30 Billion

USD

29.85 Billion

2024

2032

USD

19.30 Billion

USD

29.85 Billion

2024

2032

| 2025 –2032 | |

| USD 19.30 Billion | |

| USD 29.85 Billion | |

|

|

|

|

IBC Materials Market Size

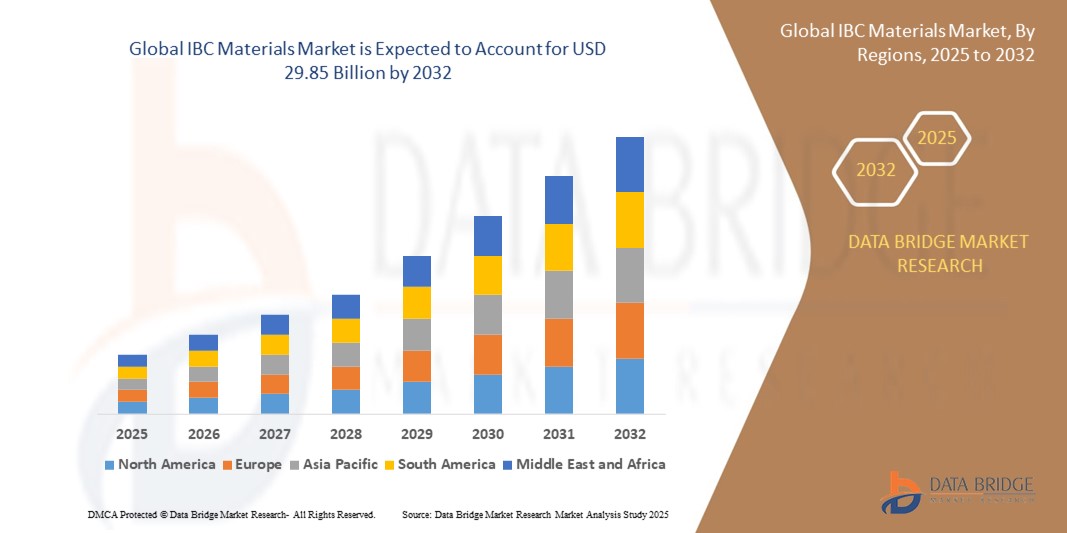

- The global IBC Materials market size was valued at USD 19.30 billion in 2024 and is expected to reach USD 29.85 billion by 2032, at a CAGR of 5.60% during the forecast period

- This growth is driven by increasing demand for sustainable and cost-effective storage and transportation solutions across various industries

IBC Materials Market Analysis

- IBC Materials are critical materials used across a wide range of industries including electronics, medical devices, automotive, aerospace, and energy, due to their superior thermal resistance, electrical insulation, biocompatibility, and mechanical strength

- The demand for these materials is significantly driven by technological advancements, the rise in electric vehicle production, and growing adoption in semiconductor and medical applications

- Asia-Pacific is expected to dominate the IBC Materials market with the largest market share of 46.11%, driven by its robust industrial base, expanding chemical manufacturing sector, and high demand from end-use industries such as water treatment, textiles, plastics, and pharmaceuticals

- North America is expected to witness the fastest growth in the IBC Materials market, driven by increasing demand in water treatment, pharmaceuticals, and the production of disinfectants and PVC-based products

- The plastic segment is expected to dominate the IBC Materials market with the largest share of 68.27% in 2025 due to Its lightweight nature and cost-effectiveness, making it a preferred choice over metal and corrugated alternatives for various industries

Report Scope and IBC Materials Market Segmentation

|

Attributes |

IBC Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

IBC Materials Market Trends

“Growth in Sustainable Packaging Solutions”

- A notable trend in the IBC Materials market is the increasing demand for sustainable and eco-friendly packaging solutions, with a focus on recycling and reducing environmental impact

- IBC Materials are being increasingly used in the development of multi-trip, reusable containers, reducing waste and promoting circular economies

- Manufacturers are also focusing on using recycled materials to produce IBC containers, contributing to the growing sustainability trend

- For instance, in January 2024, Mauser Packaging Solutions introduced a new line of reusable IBC containers made from 50% recycled materials

- This trend is expected to continue as industries, particularly those in food and beverage and chemicals, push toward more sustainable and cost-effective packaging solutions

IBC Materials Market Dynamics

Driver

“Surge in Demand for Food and Beverage Packaging”

- A notable trend in the IBC Materials market is the increasing demand for sustainable and eco-friendly packaging solutions, with a focus on recycling and reducing environmental impact

- IBC Materials are being increasingly used in the development of multi-trip, reusable containers, reducing waste and promoting circular economies

- Manufacturers are also focusing on using recycled materials to produce IBC containers, contributing to the growing sustainability trend

- For instance, in January 2024, Mauser Packaging Solutions introduced a new line of reusable IBC containers made from 50% recycled materials

- This trend is expected to continue as industries, particularly those in food and beverage and chemicals, push toward more sustainable and cost-effective packaging solutions

Opportunity

“Expanding Use of IBC Materials in Agriculture”

- A notable trend in the IBC Materials market is the increasing demand for sustainable and eco-friendly packaging solutions, with a focus on recycling and reducing environmental impact

- IBC Materials are being increasingly used in the development of multi-trip, reusable containers, reducing waste and promoting circular economies

- Manufacturers are also focusing on using recycled materials to produce IBC containers, contributing to the growing sustainability trend

- For instance, in January 2024, Mauser Packaging Solutions introduced a new line of reusable IBC containers made from 50% recycled materials

- This trend is expected to continue as industries, particularly those in food and beverage and chemicals, push toward more sustainable and cost-effective packaging solutions

Restraint/Challenge

“Challenges with Recycling and Disposal of IBC Materials”

- One of the major challenges faced by the IBC Materials market is the difficulty in recycling and disposal, especially for single-use IBC containers

- The complexity of recycling composite materials used in IBC construction can make it challenging to reuse these containers, leading to environmental concerns

- The market faces additional pressure from both regulatory bodies and environmental organizations pushing for solutions that minimize the environmental impact of these materials

- For instance, in April 2024, environmental organizations in the U.K. raised concerns about the increasing environmental footprint of single-use IBC containers, prompting calls for more recycling initiatives

- Overcoming these challenges and implementing more efficient recycling and disposal processes will be critical to the long-term growth of the IBC Materials market

IBC Materials Market Scope

The market is segmented on the basis of type and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type

|

|

|

By End-User

|

|

In 2025, the plastic is projected to dominate the market with a largest share in type type segment

The plastic segment is expected to dominate the IBC Materials market with the largest share of 68.27% in 2025 due to Its lightweight nature and cost-effectiveness, making it a preferred choice over metal and corrugated alternatives for various industries.

The food and beverage is expected to account for the largest share during the forecast period in end-user segment

In 2025, the food and beverage segment is expected to dominate the market with the largest market share of 38.31% due to high demand for safe and sanitary packaging for transporting food and beverages, ensuring product integrity and quality.

IBC Materials Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the IBC Materials Market”

- Asia-Pacific is expected to dominate the IBC Materials market with the largest market share of 46.11%, driven by its strong industrial ecosystem, rapidly expanding chemical and polymer industries, and extensive use in PVC, textiles, pharmaceuticals, and water treatment applications

- China and India are the primary growth engines due to increasing demand for infrastructure, packaging, and sanitation, along with favorable trade policies and large-scale domestic production of chlorine-based compounds

- The region benefits from low production costs, availability of raw materials, and an increasing number of capacity expansion initiatives by leading IBC Materials manufacturers

- Growing urban population, industrial wastewater management needs, and emphasis on sustainable chemical production continue to support strong demand across the region

“North America is Projected to Register the Highest CAGR in the IBC Materials Market”

- North America is expected to register the highest growth rate in the IBC Materials market, owing to increased consumption in municipal water treatment, pharmaceuticals, and construction sectors

- The U.S. leads the region with rising adoption of environmentally compliant and high-purity IBC derivatives, along with a strong push for infrastructure development and modernization

- Government-backed programs such as the Bipartisan Infrastructure Law that include investments in clean water access and wastewater treatment are significantly boosting market potential

- Sustainable innovation, such as membrane cell technology for eco-friendly chlor-alkali production and strategic collaborations with downstream industries, position the region for accelerated long-term growth

IBC Materials Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amcor Plc (Switzerland)

- LC Packaging (Ireland)

- ILC Dover LP (U.S.)

- Brambles Ltd (Australia)

- Arena Products Inc. (U.S.)

- Qingdao LAF Packaging Co., Ltd. (China)

- CDF Corporation (U.S.)

- Nittel (Germany)

- Qbig Packaging (Netherlands)

- Zasfa Composite Containers Pvt Ltd (India)

- Peak Liquid Packaging (U.S.)

- TPS Rental Systems Ltd IBC Containers (U.K.)

- HOYER GmbH (Germany)

- Arlington Packaging (Rental) Limited (U.K.)

- CHEP (Australia)

- Berry Global Inc. (U.S.)

- Bulk Lift International, LLC (U.S.)

- Conitex Sonoco (U.S.)

- Greif (U.S.)

- Mondi (U.K.)

- BWAY Corporation (U.S.)

Latest Developments in Global IBC Materials Market

- In September 2024, Greif inaugurated a new facility in Pasir Gudang, Johor, Malaysia, underscoring its commitment to providing high-quality packaging solutions while contributing to the local economy. The facility manufactures Intermediate Bulk Containers (IBCs) for a wide range of industries, including food, chemicals, lubricants, flavors, and fragrances

- In April 2024, Anova, a global leader in remote monitoring of industrial assets, launched its Universal Tank Monitor with Rada Lever Sensor. This innovative technology is particularly beneficial for companies managing liquids in Intermediate Bulk Containers (IBCs), helping reduce container waste and streamline business tracking and management

- In March 2024, Greif and CDF Corporation collaborated to introduce the redesigned GCUBE IBC Flex, which is specifically engineered for safely transporting sensitive liquids under sterile conditions. This partnership provides a cutting-edge solution for secure and sterile transportation of delicate materials

- In March 2024, Mauser Packaging Solutions and RIKUTEC Packaging announced an exclusive partnership to develop sustainable IBC solutions. Their collaboration aims to create a new, reusable, and robust 1,000-liter IBC, designed for multi-trip use with recycled plastic materials, contributing to the circular economy and reducing CO2 emissions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ibc Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ibc Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ibc Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.