Global Immuno Oncology And Adcs Market

Market Size in USD Billion

CAGR :

%

USD

11.88 Billion

USD

34.12 Billion

2024

2032

USD

11.88 Billion

USD

34.12 Billion

2024

2032

| 2025 –2032 | |

| USD 11.88 Billion | |

| USD 34.12 Billion | |

|

|

|

|

Immuno-Oncology & ADCs Market Size

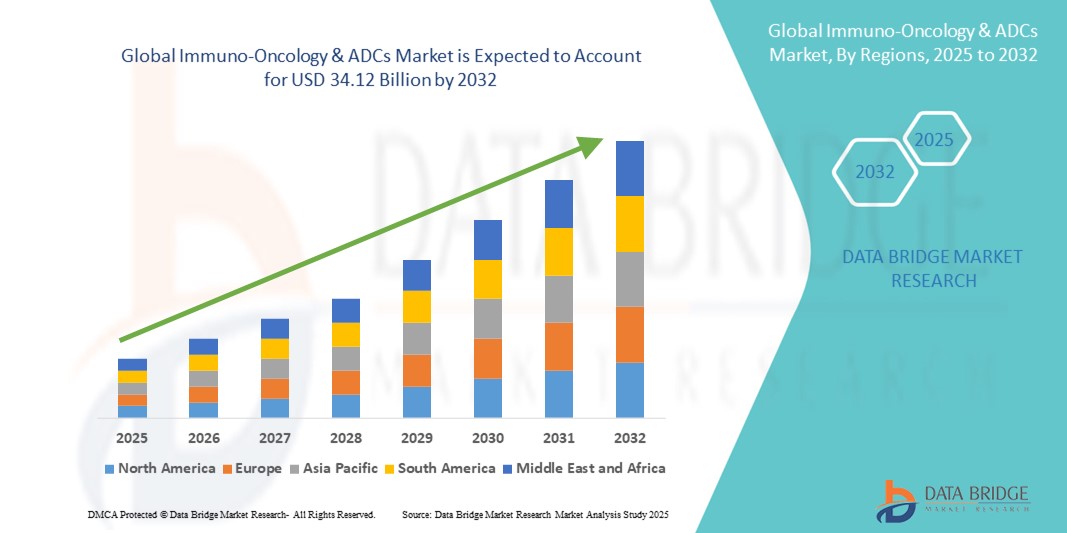

- The global immuno-oncology & ADCs market size was valued at USD 11.88 billion in 2024 and is expected to reach USD 34.12 billion by 2032, at a CAGR of 14.10% during the forecast period

- The market growth is largely fueled by rapid technological advancements in immunotherapies and antibody-drug conjugates, including CAR-T cell therapies, immune checkpoint inhibitors, and bispecific antibodies, leading to highly targeted and effective cancer treatments

- Furthermore, the rising global prevalence of cancer and increasing demand for personalized and precision therapies are driving the adoption of IO and ADC solutions in hospitals and specialty clinics, thereby significantly boosting the industry’s growth

Immuno-Oncology & ADCs Market Analysis

- Immuno-oncology therapies and antibody-drug conjugates (ADCs) are increasingly vital components of modern cancer treatment due to their targeted mechanisms, enhanced efficacy, and potential for personalized therapy in both solid tumors and hematologic malignancies

- The escalating demand for IO and ADC therapies is primarily fueled by rising global cancer incidence, rapid technological advancements in immunotherapies and ADCs, and growing preference for precision medicine approaches that improve patient outcomes

- North America dominated the immuno-oncology and ADCs market with the largest revenue share of 40.5% in 2024, characterized by early adoption of advanced therapies, high healthcare expenditure, and a strong presence of leading pharmaceutical and biotech companies, with the U.S. experiencing substantial growth in IO and ADC approvals, driven by innovations in CAR-T therapies, immune checkpoint inhibitors, and targeted drug conjugates

- Asia-Pacific is expected to be the fastest growing region in the IO and ADCs market during the forecast period due to increasing healthcare infrastructure investments, rising awareness of advanced cancer therapies, and growing access to novel treatment options

- Immune checkpoint inhibitors dominated the immuno-oncology and ADCs market with a market share of 45.5% in 2024, driven by their proven clinical efficacy across multiple cancer types and widespread adoption in combination therapy regimens

Report Scope and Immuno-Oncology & ADCs Market Segmentation

|

Attributes |

Immuno-Oncology & ADCs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Immuno-Oncology & ADCs Market Trends

Personalized Cancer Therapies and Combination Approaches

- A significant and accelerating trend in the global immuno-oncology (IO) and antibody-drug conjugates (ADCs) market is the shift towards personalized medicine and the growing adoption of combination therapies. These approaches are enhancing treatment efficacy, overcoming resistance, and improving patient outcomes across multiple cancer types

- For instance, the combination of PD-1/PD-L1 immune checkpoint inhibitors with ADCs has shown promising clinical outcomes, particularly in breast and lung cancers. Similarly, CAR-T therapies are increasingly being paired with checkpoint inhibitors to enhance durability of response in hematologic malignancies

- Advancements in biomarker discovery and genomic profiling are enabling the identification of patients most such asly to benefit from specific IO and ADC regimens, thereby reducing trial-and-error approaches and improving treatment precision

- Pharmaceutical companies are also developing next-generation ADCs with novel linkers and payloads designed to enhance tumor targeting while minimizing toxicity. For example, recent trials with Trop-2 targeted ADCs have demonstrated encouraging results in hard-to-treat cancers

- This trend towards tailored, multimodal cancer treatments is reshaping the oncology landscape, as regulators and healthcare providers increasingly support biomarker-driven clinical trials and personalized treatment pathways

- The demand for innovative IO and ADC therapies that deliver superior efficacy and reduced side effects is rapidly growing across both developed and emerging markets, as patients and healthcare systems prioritize outcomes and value-based care

Immuno-Oncology & ADCs Market Dynamics

Driver

Rising Cancer Incidence and Expanding Pipeline of Novel Therapies

- The global rise in cancer prevalence, coupled with accelerated R&D in immunotherapies and ADCs, is a major driver of market growth

- For instance, in 2024, multiple new IO and ADC therapies received FDA approvals, including HER2-targeted ADCs for breast cancer and CAR-T therapies for refractory lymphomas. Such breakthroughs highlight the rapid pace of innovation in this sector

- IO and ADC therapies offer targeted mechanisms of action, delivering improved efficacy and reduced off-target toxicity compared to conventional chemotherapy, which has fueled their adoption across oncology care

- Furthermore, increasing investments from major pharma companies and biotech startups, alongside supportive regulatory frameworks, are strengthening the development pipeline

- Growing physician confidence in immunotherapies, patient preference for precision oncology, and global initiatives to improve cancer survival rates continue to expand the adoption of IO and ADC solutions in clinical practice

Restraint/Challenge

High Treatment Costs and Safety Concerns

- The high cost of IO and ADC therapies poses a major barrier to widespread adoption, particularly in developing countries where healthcare budgets are constrained. A single course of treatment can cost hundreds of thousands of dollars, limiting patient access

- For instance, CAR-T therapies and newly approved ADCs have faced reimbursement hurdles in certain markets, delaying broader adoption despite their clinical effectiveness

- Safety challenges such as cytokine release syndrome, immune-related adverse events, and off-target toxicity in ADCs further complicate treatment and may limit physician confidence in prescribing these therapies

- Addressing these concerns through next-generation ADC designs, improved safety monitoring, and innovative pricing models such as outcome-based reimbursement will be crucial to building long-term adoption

- While ongoing research is improving safety profiles and expanding indications, the dual challenges of cost and risk remain significant hurdles. Overcoming these barriers will be key for ensuring equitable access to life-saving IO and ADC treatments worldwide

Immuno-Oncology & ADCs Market Scope

The market is segmented on the basis of technology, target, cancer type, and end user.

- By Technology

On the basis of technology, the immuno-oncology & ADCs market is segmented into Immune Checkpoint Inhibitors, CAR-T Cell Therapies, Cancer Vaccines, Monoclonal Antibodies, Bispecific Antibodies, Antibody-Drug Conjugates, Cleavable Linkers, Non-Cleavable Linkers, and Linkerless ADCs. Immune Checkpoint Inhibitors dominated the technology segment in 2024, holding the largest market revenue share of 45.5%. Their leadership is driven by proven success in treating melanoma, lung, bladder, and kidney cancers with drugs such as pembrolizumab and nivolumab. The ability of checkpoint inhibitors to restore anti-tumor immune responses has made them a backbone of cancer therapy regimens globally. Expanding approvals across multiple tumor types and increasing usage in combination therapies are further boosting market penetration. Strong reimbursement policies and long-term survival benefits demonstrated in clinical trials also support sustained adoption. As more next-generation checkpoint inhibitors targeting novel pathways such as LAG-3 and TIGIT advance, dominance of this segment is expected to remain stable.

CAR-T Cell Therapies are expected to be the fastest-growing technology segment during the forecast period. These therapies have shown transformative results in hematologic malignancies such as leukemia and lymphoma, achieving durable remissions in refractory cases. Rapid regulatory approvals across the U.S., Europe, and Asia-Pacific are expanding patient access, while strong R&D efforts are extending CAR-T applications into solid tumors. Growing investment in manufacturing scalability, automation, and allogeneic CAR-T approaches is addressing previous limitations of high cost and long production times. Global pharmaceutical collaborations and increasing adoption in emerging markets are accelerating commercialization. The personalized nature of CAR-T, coupled with its curative potential, positions it as a breakthrough therapy driving rapid growth.

- By Target

On the basis of target, the immuno-oncology & ADCs market is segmented into HER2, Trop-2, CD30, CD22, and Other Tumor-Specific Targets. HER2 was the dominant target in 2024, owing to its strong clinical validation and success in breast and gastric cancers. HER2-directed therapies, including trastuzumab-based ADCs, have become standard of care, delivering superior efficacy and survival benefits. Multiple HER2-targeted ADCs and monoclonal antibodies are widely approved and supported by large-scale clinical evidence. Global availability, strong physician confidence, and high adoption in both early-stage and metastatic cancers contribute to HER2’s leadership. Expansion of HER2 therapies into colorectal and lung cancers is broadening the patient pool. The robust late-stage pipeline and continuous innovation in HER2-targeted therapies reinforce this target’s dominant role in the market.

Trop-2 is anticipated to be the fastest-growing target during the forecast period. Its emergence in hard-to-treat cancers such as triple-negative breast cancer and non-small cell lung cancer has positioned it as a promising biomarker. Recently approved Trop-2 directed ADCs have shown superior progression-free survival, fueling physician adoption and patient demand. Multiple clinical trials in advanced stages are evaluating Trop-2 in solid tumors, strengthening its growth outlook. Pharmaceutical companies are investing heavily in this area due to its strong commercial potential. Rising prevalence of cancers expressing Trop-2, coupled with expanding regulatory approvals, will drive rapid uptake. This positions Trop-2 as one of the most dynamic growth areas within IO and ADC markets.

- By Cancer Type

On the basis of cancer type, the immuno-oncology & ADCs market is segmented into breast cancer, lung cancer, ovarian cancer, colorectal cancer, melanoma, hematologic malignancies, and other solid tumors. Breast Cancer dominated the market in 2024, accounting for the largest revenue share due to its high global incidence and strong therapeutic innovation. HER2-targeted therapies have transformed outcomes in HER2-positive breast cancer, while checkpoint inhibitors are making inroads in triple-negative subtypes. ADCs targeting HER2 and Trop-2 have further strengthened treatment portfolios, improving survival in refractory cases. Widespread screening and early detection programs increase patient access to advanced therapies, boosting demand. Breast cancer’s role as a priority research focus for major pharmaceutical companies ensures robust investment. Continuous expansion of targeted therapies into early-stage and adjuvant settings supports its dominant position in the market.

Lung Cancer is projected to be the fastest-growing cancer segment during the forecast period. Rising incidence of non-small cell lung cancer (NSCLC) worldwide is creating significant demand for innovative therapies. PD-1/PD-L1 checkpoint inhibitors have already become standard of care, improving survival outcomes and broadening patient eligibility through biomarker-driven approaches. Ongoing research is combining immunotherapy with ADCs, radiotherapy, and chemotherapy to enhance effectiveness in lung cancer treatment. Increasing adoption in both first-line and second-line settings, supported by favorable reimbursement in developed markets, accelerates growth. Clinical success in targeting specific mutations such as EGFR and ALK alongside immuno-oncology further expands treatment options. Growing focus in Asia-Pacific, where lung cancer burden is highest, positions this segment for rapid expansion.

- By End User

On the basis of end user, the immuno-oncology & ADCs market is segmented into hospitals and specialty clinics / cancer centers. Hospitals dominated the market in 2024, holding the largest share of end-user adoption for IO and ADC therapies. Hospitals serve as the central hub for cancer diagnosis, therapy administration, and multidisciplinary care, making them the primary treatment setting. Availability of advanced infusion facilities, clinical trials, and trained oncologists drives patient preference for hospital-based care. Strong reimbursement mechanisms and integration of precision oncology testing within hospitals further support this dominance. Hospitals also benefit from strategic partnerships with pharmaceutical companies for early access to pipeline therapies. Their ability to deliver comprehensive and complex therapies ensures they remain the leading segment.

Specialty Clinics / Cancer Centers are expected to register the fastest growth during the forecast period. The increasing trend toward outpatient oncology treatment is driving patient preference for specialized cancer centers. These clinics offer personalized treatment plans, shorter wait times, and focused expertise in immuno-oncology and ADC therapies. Their ability to provide access to cutting-edge treatments in less resource-intensive settings is gaining traction globally. Rapid expansion of private and regional cancer centers in Asia-Pacific and Latin America is boosting availability. In addition, cancer centers are often involved in clinical research, accelerating patient access to investigational therapies. Their growing role in decentralized cancer care delivery makes them the fastest-growing end-user segment.

Immuno-Oncology & ADCs Market Regional Analysis

- North America dominated the immuno-oncology and ADCs market with the largest revenue share of 40.5% in 2024, characterized by early adoption of advanced therapies, high healthcare expenditure, and a strong presence of leading pharmaceutical and biotech companies

- The region benefits from a high prevalence of cancer cases, advanced healthcare infrastructure, and the presence of major pharmaceutical and biotech companies driving innovation and commercialization

- Favorable reimbursement frameworks, widespread availability of precision diagnostics, and rapid FDA approvals for novel immuno-oncology and ADC therapies further strengthen market expansion in the U.S. and Canada

U.S. Immuno-Oncology & ADCs Market Insight

The U.S. immuno-oncology & ADCs market captured the largest revenue share within North America in 2024, driven by the rapid approval and commercialization of immune checkpoint inhibitors, CAR-T therapies, and novel ADCs. A strong ecosystem of biopharmaceutical companies, advanced cancer centers, and access to cutting-edge clinical trials continues to fuel adoption. Patients benefit from favorable reimbursement pathways and early access to breakthrough therapies through the FDA’s accelerated approval programs. Furthermore, the integration of genomic testing and precision medicine strategies is reinforcing treatment personalization, making the U.S. the most influential hub for this market.

Europe Immuno-Oncology & ADCs Market Insight

The Europe immuno-oncology & ADCs market is projected to grow steadily throughout the forecast period, supported by a rising cancer burden and strong government-backed healthcare systems. Increasing EMA approvals of novel ADCs and immunotherapies, alongside pan-European collaborations for oncology research, are fostering adoption across hospitals and cancer centers. The region also emphasizes equitable access to high-cost therapies through national health systems, which boosts uptake across key markets. Strong academic and pharmaceutical research networks are expected to further advance the development of next-generation oncology drugs.

U.K. Immuno-Oncology & ADCs Market Insight

The U.K. immuno-oncology & ADCs market is anticipated to expand at a notable CAGR, driven by government initiatives to improve cancer care and strengthen clinical trial infrastructure. National Health Service (NHS) programs, including partnerships with biotech companies for early drug access, are accelerating the introduction of novel therapies. Growing emphasis on personalized medicine, combined with the U.K.’s strong genomics research ecosystem, is facilitating rapid integration of immuno-oncology and ADC-based treatments. These factors are making the U.K. an important European hub for oncology innovation.

Germany Immuno-Oncology & ADCs Market Insight

The Germany immuno-oncology & ADCs market is expected to expand significantly during the forecast period, supported by the country’s strong pharmaceutical sector and well-established oncology research institutions. Rising cancer incidence, combined with reimbursement support for advanced biologics, is encouraging wider adoption across hospitals. Germany’s emphasis on R&D, coupled with clinical partnerships between academia and global biopharma companies, strengthens its position as a leader in European cancer drug development. Sustainability in healthcare practices and a growing focus on precision oncology are further shaping the adoption of innovative immunotherapies and ADCs.

Asia-Pacific Immuno-Oncology & ADCs Market Insight

The Asia-Pacific immuno-oncology & ADCs market is poised to record the fastest CAGR from 2025 to 2032, driven by rising cancer prevalence, expanding healthcare access, and rapid drug approvals in countries such as China, Japan, and India. Governments are actively promoting oncology research and accelerating regulatory pathways to attract biopharma investment. Increasing healthcare expenditure, combined with the availability of biosimilars and region-specific partnerships, is boosting adoption. Furthermore, local manufacturing capacity is improving the affordability of these therapies, expanding patient access across a wider population base.

Japan Immuno-Oncology & ADCs Market Insight

The Japan immuno-oncology & ADCs market is gaining strong momentum, supported by its advanced biotechnology sector and culture of rapid adoption of innovative therapies. Japan has become a strategic hub for early launches of immuno-oncology drugs, driven by its streamlined regulatory framework and partnerships with global pharma leaders. The country’s aging population, coupled with a high incidence of solid tumors, is fueling demand for ADCs and checkpoint inhibitors. Integration of these therapies with Japan’s robust precision medicine ecosystem is positioning the country as a leader in oncology adoption within Asia-Pacific.

India Immuno-Oncology & ADCs Market Insight

The India immuno-oncology & ADCs market accounted for one of the largest revenue shares in Asia-Pacific in 2024, supported by the country’s rapidly growing cancer burden and expanding healthcare infrastructure. Rising disposable incomes and increasing awareness of advanced treatment options are driving demand for novel cancer therapies. Government-led cancer care initiatives, combined with the presence of strong domestic pharmaceutical companies, are enabling wider adoption of immunotherapies and ADCs. In addition, India’s role as a global hub for clinical trials and biosimilar production is making these therapies more accessible and affordable to its large patient population.

Immuno-Oncology & ADCs Market Share

The immuno-oncology & ADCs industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc., (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- AstraZeneca (U.K.)

- GSK plc (U.K.)

- Sanofi (France)

- Lilly USA, LLC (U.S.)

- Amgen Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Regeneron Pharmaceuticals Inc. (U.S.)

- Genmab A/S (Denmark)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Seagen Inc. (U.S.)

- ADC Therapeutics SA (Switzerland)

- Zymeworks Inc. (Canada)

- MacroGenics, Inc. (U.S.)

- BeiGene, Ltd. (China)

What are the Recent Developments in Global Immuno-Oncology & ADCs Market?

- In August 2025, Daiichi Sankyo’s investigational ADC ifinatamab deruxtecan (I-DXd) which targets B7-H3 was granted Breakthrough Therapy Designation by the FDA for the treatment of extensive-stage small cell lung cancer, signaling promise for a novel mechanism in a difficult-to-treat cancer

- In June 2025, the U.S. Food and Drug Administration (FDA) approved telisotuzumab vedotin (Emrelis), the first c-MET-targeted antibody–drug conjugate (ADC), for adults with previously treated non-squamous non-small cell lung cancer (NSCLC) exhibiting high c-MET protein overexpression, offering a precision-targeted alternative to traditional therapy

- In March 2025, GSK announced a groundbreaking £50 million partnership with the University of Oxford to develop cancer immuno-prevention vaccines utilizing mRNA technology, aimed at mobilizing the immune system to intercept cancer development an important shift toward prophylactic immuno-oncology approaches

- In January 2025, the FDA approved datopotamab deruxtecan (Datroway) a Trop-2-directed ADC for adults with unresectable or metastatic hormone receptor (HR)-positive, HER2-negative breast cancer who had previously received endocrine therapy and chemotherapy, marking a significant new treatment option for this common cancer subtype

- In November 2024, the U.S. Food and Drug Administration granted accelerated approval to zanidatamab-hrii (Ziihera) a bispecific HER2-directed antibody for previously treated, unresectable or metastatic HER2-positive (IHC 3+) biliary tract cancer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.