Global Immuno Oncology Assays Market

Market Size in USD Billion

CAGR :

%

USD

6.80 Billion

USD

16.45 Billion

2025

2033

USD

6.80 Billion

USD

16.45 Billion

2025

2033

| 2026 –2033 | |

| USD 6.80 Billion | |

| USD 16.45 Billion | |

|

|

|

|

Immuno Oncology Assays Market Size

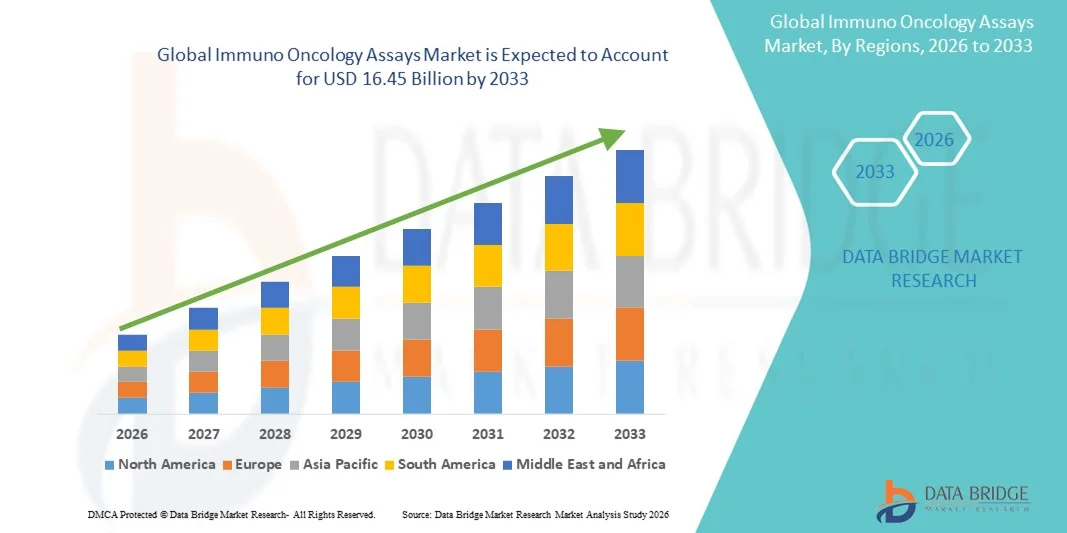

- The global immuno oncology assays market size was valued at USD 6.80 billion in 2025 and is expected to reach USD 16.45 billion by 2033, at a CAGR of 11.68% during the forecast period

- The market growth is largely fueled by the rising global cancer burden, increasing adoption of immunotherapy and precision medicine, and ongoing technological advancements in assay platforms which collectively enhance diagnostic accuracy and therapeutic monitoring in oncology settings

- Furthermore, growing demand for biomarker-driven personalized treatments, expansion of companion diagnostics, and increased research and clinical applications are driving immuno-oncology assays to become essential tools for tailored cancer care and drug development. These converging factors are accelerating the uptake of sophisticated assays across clinical and research environments, significantly boosting the industry’s growth

Immuno Oncology Assays Market Analysis

- Immuno-oncology assays, used for measuring immune responses and detecting biomarkers in cancer therapy, are becoming essential tools in modern oncology research, drug development, and personalized patient care due to their ability to guide immunotherapy decisions, monitor treatment efficacy, and support precision medicine initiatives

- The escalating demand for immuno-oncology assays is primarily fueled by the rising global cancer burden, increasing adoption of immunotherapies, and growing focus on biomarker-driven personalized treatments across both clinical and research settings

- North America dominated the immuno-oncology assays market with the largest revenue share of 40.9% in 2025, supported by advanced healthcare infrastructure, high R&D investments, and a strong presence of key market players. The U.S. experienced substantial growth in assay adoption for clinical trials and diagnostic applications, particularly in immune checkpoint inhibitors and CAR-T therapy monitoring

- Asia-Pacific is expected to be the fastest-growing region in the immuno-oncology assays market during the forecast period, driven by increasing cancer incidence, expanding healthcare infrastructure, rising clinical research activity, and growing investments in advanced diagnostic technologies

- The consumables segment dominated the immuno-oncology assays market in 2025 with a market share of 62.5%, driven by recurring demand for reagents, kits, and assay-specific consumables

Report Scope and Immuno Oncology Assays Market Segmentation

|

Attributes |

Immuno Oncology Assays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Immuno Oncology Assays Market Trends

Integration of AI and High-Throughput Technologies

- A significant and accelerating trend in the global immuno-oncology assays market is the adoption of artificial intelligence (AI) and high-throughput platforms such as NGS and multiplex assays, enhancing predictive biomarker analysis and treatment personalization

- For instance, NanoString’s GeoMx Digital Spatial Profiler integrates AI-driven data analysis to allow high-resolution biomarker mapping, improving tumor microenvironment characterization

- AI integration enables features such as automated data interpretation, identification of novel immune targets, and predictive modeling of patient response to immunotherapies, improving decision-making in both clinical and research applications

- The seamless integration of immuno-oncology assays with bioinformatics tools and electronic health records allows centralized management of patient data, facilitating precision oncology strategies and optimized treatment plans

- This trend towards more intelligent, automated, and high-throughput assay systems is fundamentally reshaping expectations for cancer diagnostics and therapeutic monitoring. Consequently, companies such as QIAGEN are developing AI-enabled platforms with capabilities such as automated workflow management and predictive biomarker analytics

- The demand for immuno-oncology assays that offer AI and high-throughput integration is growing rapidly across clinical and research sectors, as healthcare providers increasingly prioritize accuracy, efficiency, and personalized treatment strategies

- Increasing integration of spatial and single-cell analysis technologies with immuno-oncology assays enables detailed mapping of tumor heterogeneity, providing deeper insights into therapy response and resistance mechanisms

- Collaboration between assay developers and pharmaceutical companies is accelerating co-development of companion diagnostics, enhancing the relevance of assays in clinical decision-making and new drug approvals

Immuno Oncology Assays Market Dynamics

Driver

Rising Cancer Incidence and Immunotherapy Adoption

- The increasing prevalence of cancer globally, coupled with the growing adoption of immunotherapies, is a significant driver for the heightened demand for immuno-oncology assays

- For instance, in March 2025, Adaptive Biotechnologies announced advancements in its immunoSEQ assay for T-cell profiling, targeting improved monitoring of immunotherapy response

- As healthcare providers aim for personalized treatment strategies, immuno-oncology assays offer capabilities such as immune profiling, tumor microenvironment assessment, and treatment response prediction, providing a compelling alternative to conventional diagnostics

- Furthermore, the growing focus on biomarker-driven therapies and precision medicine is making immuno-oncology assays an integral component of clinical and translational research, ensuring optimized treatment selection

- The increasing investments in clinical trials, expansion of research infrastructure, and rising adoption of companion diagnostics are key factors propelling market growth, enabling faster development and validation of novel immunotherapies

- Rising collaborations between academic institutions, biotech companies, and pharmaceutical firms for assay development and clinical validation are driving faster adoption and innovation

- Expansion of government and private funding for cancer research and immunotherapy programs provides additional momentum to the global immuno-oncology assays market

Restraint/Challenge

High Costs and Regulatory Complexity

- The high cost of advanced immuno-oncology assays, including NGS-based and multiplex platforms, poses a challenge to wider market adoption, particularly in price-sensitive regions and smaller research facilities

- For instance, reports on the expensive consumables and reagents required for NGS and multiplex assays have made some laboratories hesitant to implement these solutions broadly

- Addressing these cost challenges through workflow optimization, reagent kits standardization, and scalable assay platforms is crucial for increasing adoption across diverse healthcare settings

- In addition, stringent regulatory requirements and complex validation protocols for clinical use can delay product approvals and market entry, limiting rapid commercialization

- Overcoming these challenges through cost-effective assay development, regulatory guidance support, and scalable solutions will be vital for sustained growth in the global immuno-oncology assays market

- Limited awareness and expertise among smaller clinical laboratories regarding assay selection, implementation, and data interpretation can restrict market penetration

- Variability in regulatory frameworks across regions creates additional hurdles for global commercialization and adoption of standardized assay protocols

Immuno Oncology Assays Market Scope

The market is segmented on the basis of product type, technology, and indication.

- Product Type

On the basis of product type, the immuno-oncology assays market is segmented into consumables and software. The consumables segment dominated the market with the largest revenue share of 62.5% in 2025, driven by the recurring demand for reagents, assay kits, and other consumable materials required for conducting immuno-oncology assays. Consumables are essential for maintaining assay accuracy and reproducibility, making them a critical component for both clinical and research applications. High adoption in clinical trials, diagnostic laboratories, and academic research is contributing to sustained demand. The need for validated reagents for immune profiling and biomarker detection further strengthens the consumables market. In addition, consumables are compatible with multiple assay platforms such as NGS, flow cytometry, and PCR, providing flexibility to end-users. Companies such as QIAGEN, Bio-Rad, and Thermo Fisher are actively expanding their consumable portfolios to support the growing number of assays.

The software segment is anticipated to witness the fastest growth rate of 18.4% CAGR from 2026 to 2033, fueled by the increasing integration of AI, bioinformatics, and data analytics in immuno-oncology workflows. Software solutions facilitate automated data interpretation, predictive modeling of patient response, and real-time monitoring of assay performance, improving clinical and research decision-making. Advanced software platforms enable multi-omics data integration, helping researchers identify novel biomarkers and potential therapeutic targets. The rise of digital pathology and spatial analysis further drives software adoption in immuno-oncology. Cloud-based platforms are making software more accessible to smaller laboratories and research facilities. As personalized medicine and precision oncology expand globally, software adoption is expected to accelerate significantly.

- By Technology

On the basis of technology, the market is segmented into Next Generation Sequencing (NGS), Flow Cytometry, PCR, and Others. The NGS segment dominated the market with the largest revenue share of 45% in 2025, due to its high sensitivity, scalability, and ability to detect multiple biomarkers simultaneously. NGS enables comprehensive profiling of immune responses, tumor mutational burden, and neoantigen identification, which are critical for immunotherapy decision-making. Its applications span clinical trials, companion diagnostics, and translational research. The growing focus on precision medicine and biomarker-driven treatments is further boosting NGS adoption. Technological advancements such as reduced sequencing costs and faster turnaround times are making NGS more accessible. Companies such as Illumina and Thermo Fisher Scientific are investing heavily in NGS assay development, expanding its reach in immuno-oncology.

The Flow Cytometry segment is expected to witness the fastest CAGR of 16.9% from 2026 to 2033, driven by its ability to perform multiparametric analysis of immune cells at the single-cell level. Flow cytometry is widely used for immune profiling, monitoring T-cell activity, and evaluating tumor-infiltrating lymphocytes in various cancer types. Its high throughput and quantitative capabilities make it indispensable for both research and clinical applications. Advancements in automated flow cytometry instruments and integration with AI-based analysis software further enhance its utility. Increasing adoption in clinical trials and translational research is accelerating growth. The versatility and reproducibility of flow cytometry assays support expanding applications in personalized immunotherapy.

- By Indication

On the basis of indication, the market is segmented into lung cancer, colorectal cancer, melanoma, leukemia, lymphoma, multiple myeloma, bladder cancer, and others. The Lung Cancer segment dominated the market with the largest revenue share of 28% in 2025, owing to the high global incidence of lung cancer and the extensive use of immunotherapies such as immune checkpoint inhibitors. Lung cancer research requires comprehensive immune profiling and biomarker detection, driving demand for immuno-oncology assays in both clinical and research settings. Companion diagnostics for lung cancer patients are increasingly being developed alongside immunotherapies. Clinical trials targeting lung cancer utilize multiple assay platforms, including NGS and flow cytometry, further boosting market adoption. Pharmaceutical companies focus heavily on lung cancer immunotherapy, increasing assay usage. The growing need for personalized treatment strategies and early response monitoring continues to drive lung cancer assay demand.

The Melanoma segment is anticipated to witness the fastest growth rate of 19.2% CAGR from 2026 to 2033, driven by rising melanoma incidence and advancements in immunotherapy treatments such as checkpoint inhibitors and personalized vaccines. Melanoma research requires detailed immune profiling to identify responsive patient populations, making immuno-oncology assays critical. Multiplex immunoassays, flow cytometry, and NGS are increasingly applied for monitoring therapy efficacy in melanoma. The expansion of clinical trials and adoption of companion diagnostics further accelerates growth. The increasing focus on targeted immunotherapies and early detection strategies is boosting melanoma assay adoption. Rising awareness and investments in melanoma research in North America, Europe, and Asia-Pacific are contributing to strong growth prospects.

Immuno Oncology Assays Market Regional Analysis

- North America dominated the immuno-oncology assays market with the largest revenue share of 40.9% in 2025, supported by advanced healthcare infrastructure, high R&D investments, and a strong presence of key market players

- Healthcare providers and research institutions in the region highly value the accuracy, sensitivity, and high-throughput capabilities offered by immuno-oncology assays, which enable precise immune profiling, biomarker detection, and monitoring of treatment response in cancer patients

- This widespread adoption is further supported by robust R&D investments, the presence of leading assay developers, and favorable regulatory frameworks, establishing immuno-oncology assays as essential tools in both clinical diagnostics and oncology research

U.S. Immuno Oncology Assays Market Insight

The U.S. immuno-oncology assays market captured the largest revenue share of 81% in North America in 2025, fueled by the rapid adoption of advanced immunotherapies and growing cancer prevalence. Healthcare providers and research institutions are increasingly prioritizing high-throughput, precise assays for immune profiling, biomarker detection, and monitoring therapy response. The growing preference for companion diagnostics, along with integration with bioinformatics and AI-driven analysis tools, further propels the market. Moreover, the presence of key assay developers, robust clinical trial activity, and favorable regulatory support significantly contribute to market expansion.

Europe Immuno Oncology Assays Market Insight

The Europe immuno-oncology assays market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cancer incidence and increasing adoption of immunotherapies. Strong healthcare infrastructure, growing investments in clinical trials, and government initiatives supporting precision medicine are fostering market growth. European institutions are also drawn to the accuracy, high-throughput capabilities, and data integration features offered by immuno-oncology assays. The market is witnessing significant growth across research laboratories, hospitals, and diagnostic centers, with assays being incorporated into both new clinical trials and translational research programs.

U.K. Immuno Oncology Assays Market Insight

The U.K. immuno-oncology assays market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of biomarker-driven therapies and demand for personalized cancer treatment. In addition, increasing cancer prevalence and adoption of immune checkpoint inhibitors are encouraging both research organizations and hospitals to utilize advanced assays. The U.K.’s strong research infrastructure, availability of funding for oncology studies, and digital health integration are expected to continue to stimulate market growth.

Germany Immuno Oncology Assays Market Insight

The Germany immuno-oncology assays market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing focus on precision oncology and adoption of advanced diagnostic solutions. Germany’s well-developed healthcare and research infrastructure, combined with emphasis on innovation and clinical trial activity, promotes the adoption of immuno-oncology assays. Integration with bioinformatics platforms and AI-based predictive tools is becoming increasingly prevalent, with strong demand for reliable, high-quality assays in both hospitals and research laboratories.

Asia-Pacific Immuno Oncology Assays Market Insight

The Asia-Pacific immuno-oncology assays market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by increasing cancer incidence, rising healthcare expenditure, and rapid expansion of clinical research infrastructure in countries such as China, Japan, and India. The region’s growing focus on precision medicine and immunotherapy, supported by government initiatives promoting digital health and cancer research, is driving assay adoption. Furthermore, as APAC emerges as a hub for assay manufacturing and R&D, accessibility and affordability are improving, enabling wider clinical and research use.

Japan Immuno Oncology Assays Market Insight

The Japan immuno-oncology assays market is gaining momentum due to the country’s advanced healthcare infrastructure, high adoption of precision medicine, and focus on innovative cancer therapies. The market emphasizes accurate immune profiling and biomarker detection, with integration into hospital laboratories and clinical trial programs fueling growth. Moreover, Japan’s aging population and increasing number of clinical studies are expected to drive demand for reliable and user-friendly assay platforms in both clinical and research applications.

India Immuno Oncology Assays Market Insight

The India immuno-oncology assays market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rising cancer incidence, expanding healthcare infrastructure, and growing clinical research activity. India stands as an emerging market for advanced diagnostic solutions, and immuno-oncology assays are increasingly adopted in hospitals, research institutions, and clinical trial programs. Government initiatives for cancer care, expansion of precision medicine programs, and availability of cost-effective assay options are key factors propelling the market in India.

Immuno Oncology Assays Market Share

The Immuno Oncology Assays industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann La Roche Ltd. (Switzerland)

- Agilent Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- QIAGEN (Netherlands)

- NanoString Technologies, Inc. (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- PerkinElmer (U.S.)

- Guardant Health, Inc. (U.S.)

- Abbott (U.S.)

- BD (U.S.)

- Charles River Laboratories (U.S.)

- Sartorius AG (Germany)

- Adaptive Biotechnologies Corp. (U.S.)

- Foundation Medicine, Inc. (U.S.)

- HTG Molecular Diagnostics, Inc. (U.S.)

- Bio Techne Corporation (U.S.)

- Danaher (U.S.)

- Oxford Nanopore Technologies Ltd (U.K.)

- Caris Life Sciences (U.S.)

What are the Recent Developments in Global Immuno Oncology Assays Market?

- In July 2025, Guardant Health and collaborators announced they will present over 19 studies demonstrating the role of liquid biopsy in advancing precision oncology at the 2025 ASCO Annual Meeting, highlighting the use of assays such as Guardant360 CDx and Reveal for therapy selection, mutation detection, and molecular residual disease (MRD) monitoring reinforcing the clinical relevance of immuno‑oncology assays

- In July 2025, a new clinical study (RADIOHEAD) reported that Guardant Reveal’s tissue‑free monitoring assay could detect immunotherapy responses and identify non‑responders several months earlier than standard methods across multiple advanced cancers, showcasing improved predictive utility in immunotherapy monitoring

- In May 2025, Guardant Health introduced a comprehensive immunohistochemistry (IHC) testing suite for solid tumors that expands the assay capabilities for key biomarkers across lung, breast, gastric, and ovarian cancers enhancing diagnostic precision in immuno‑oncology applications

- In April 2025, Guardant Health launched Guardant360 Tissue, the first tissue molecular profiling test with comprehensive multi‑omic analysis that provides researchers and cancer care teams a more complete view of tumor biology to support immuno‑oncology decision‑making and treatment selection strategies

- In April 2023, Guardant Health and the Parker Institute for Cancer Immunotherapy (PICI) launched a major research collaboration to study the connection between cancer biomarkers and immunotherapy treatment response using multi‑dimensional biomarker analysis from blood samples, advancing real‑world immuno‑oncology research and translational insights.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.