Global Immunoassay Gamma Counters Market

Market Size in USD Billion

CAGR :

%

USD

2.40 Billion

USD

3.94 Billion

2024

2032

USD

2.40 Billion

USD

3.94 Billion

2024

2032

| 2025 –2032 | |

| USD 2.40 Billion | |

| USD 3.94 Billion | |

|

|

|

|

Immunoassay-Gamma Counters Market Size

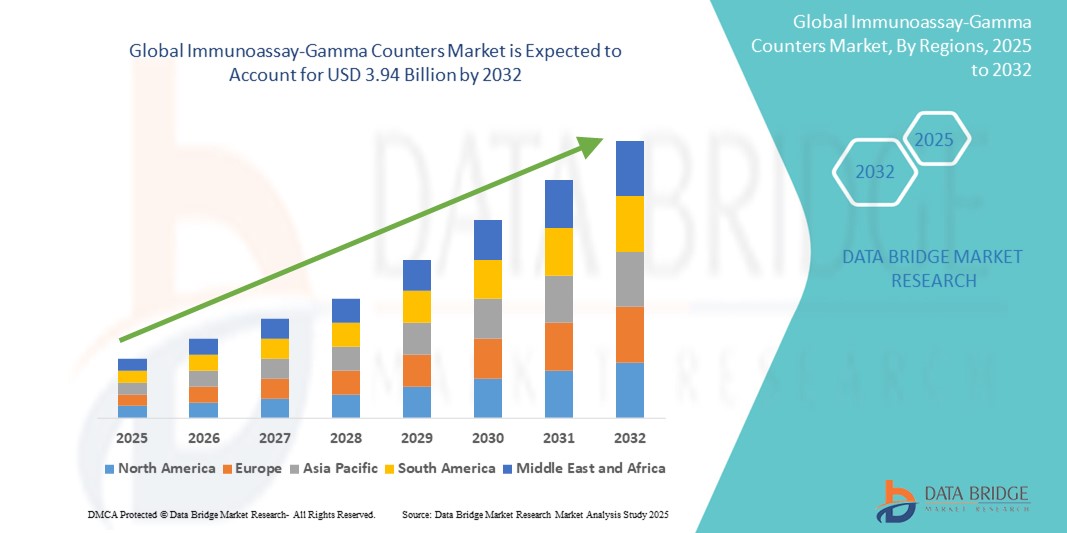

- The global immunoassay-gamma counters market size was valued at USD 2.40 billion in 2024 and is expected to reach USD 3.94 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely driven by the increasing prevalence of chronic diseases and the expanding application of radioimmunoassay techniques in clinical diagnostics and research laboratories

- Furthermore, growing demand for highly sensitive, accurate, and automated diagnostic tools is positioning immunoassay-gamma counters as a vital component in nuclear medicine and endocrine testing. These combined factors are propelling the adoption of gamma counters worldwide, significantly accelerating the industry's overall growth

Immunoassay-Gamma Counters Market Analysis

- Immunoassay-gamma counters, essential for detecting and quantifying radioisotopes in biological samples, are increasingly critical in clinical diagnostics, pharmaceutical research, and endocrinology due to their precision, sensitivity, and automation capabilities

- The rising demand for immunoassay-gamma counters is primarily driven by the growing prevalence of chronic diseases, increased use of radioimmunoassays in hormone and cancer marker detection, and advancements in nuclear medicine technologies

- North America dominated the immunoassay-gamma counters market with the largest revenue share of 41.8% in 2024, attributed to its advanced healthcare infrastructure, high research funding, and a strong presence of key manufacturers, with the U.S. showing significant uptake in academic and diagnostic laboratories driven by increasing investments in life sciences

- Asia-Pacific is expected to be the fastest growing region in the immunoassay-gamma counters market during the forecast period due to expanding healthcare systems, rising diagnostic awareness, and increased investments in laboratory infrastructure

- The automated gamma counters segment dominated the market with a market share of 46.1% in 2024, owing to their time efficiency, reduced human error, and enhanced throughput in clinical and research environments

Report Scope and Immunoassay-Gamma Counters Market Segmentation

|

Attributes |

Immunoassay-Gamma Counters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Immunoassay-Gamma Counters Market Trends

“Automation and Digital Advancements Driving Efficiency”

- A significant and accelerating trend in the global immunoassay-gamma counters market is the rapid integration of automation and digital technologies aimed at enhancing workflow efficiency, accuracy, and throughput in clinical and research laboratories

- For instance, advanced systems such as the Hidex AMG and PerkinElmer Wizard2 series offer automated sample processing, touchscreen interfaces, and connectivity with laboratory information systems (LIS), allowing for seamless data transfer and efficient lab operations

- Automation enables high-throughput testing and minimizes human error, while integrated software provides real-time data analysis, customizable protocols, and comprehensive result reporting. These features are especially beneficial in hormone assays, oncology diagnostics, and pharmaceutical applications

- The digitalization of gamma counters also enhances compliance with regulatory standards by supporting electronic record-keeping and secure data storage. Beckman Coulter’s solutions, for instance, emphasize 21 CFR Part 11 compliance and improved audit trails for clinical use

- In addition, compact and user-friendly designs are making gamma counters more accessible for smaller laboratories without compromising performance. Manufacturers are focusing on ease of installation, minimal maintenance, and intuitive operation to meet growing demand

- This trend toward automated, digitally enhanced, and precision-driven gamma counters is redefining laboratory efficiency and reliability, driving increased adoption across diagnostic centers, research institutions, and hospital laboratories

Immunoassay-Gamma Counters Market Dynamics

Driver

“Rising Diagnostic Demand and Chronic Disease Burden”

- The increasing global burden of chronic diseases such as cancer, thyroid disorders, and infectious conditions is a major driver for the expanding adoption of immunoassay-gamma counters

- For instance, radioimmunoassays remain a gold standard for detecting specific biomarkers and hormones, and the demand for precise, sensitive, and high-throughput tools has made gamma counters indispensable in endocrinology and oncology labs

- As healthcare providers prioritize early diagnosis and effective disease monitoring, gamma counters offer unmatched accuracy in quantifying radioactive tracers, enabling timely clinical decisions

- Furthermore, expanding investments in nuclear medicine infrastructure, especially in developed countries, are strengthening the role of immunoassay-gamma counters in advanced diagnostics. These systems support a broad range of applications, including tumor marker testing, metabolic studies, and pharmacokinetics

- Growing emphasis on personalized medicine and advanced laboratory automation is also fueling the demand for automated gamma counters, especially in research-driven healthcare systems and academic medical centers

- The trend toward integrating gamma counters with AI-enabled lab systems and digital diagnostics is further accelerating their adoption, making them essential for comprehensive laboratory diagnostics

Restraint/Challenge

“Radioisotope Handling Regulations and Cost Constraints”

- Strict regulatory requirements related to the use, transport, and disposal of radioactive materials present a key challenge to the broader adoption of immunoassay-gamma counters

- For instance, compliance with guidelines from the International Atomic Energy Agency (IAEA) and national nuclear regulatory bodies necessitates significant investments in infrastructure, safety training, and radiation protection protocols

- These regulatory complexities can delay procurement and implementation, particularly in low- and middle-income countries with limited nuclear medicine capabilities

- In addition, the high cost of advanced automated gamma counters, along with maintenance and isotope supply expenses, can act as a barrier for small diagnostic labs and institutions operating under budget constraints

- While cost-effective and compact models are entering the market, affordability remains a concern in resource-limited settings. Moreover, a lack of trained personnel for handling radioisotopes and maintaining the equipment can further limit adoption

- Addressing these challenges will require coordinated efforts from manufacturers, healthcare policymakers, and training institutions to ensure regulatory compliance, cost optimization, and improved accessibility for global diagnostic needs

Immunoassay-Gamma Counters Market Scope

The market is segmented on the basis of product type, well type, application, disease condition, purchase mode, end user, and distribution channel.

- Product Type

On the basis of product type, the immunoassay-gamma counters market is segmented into automated and manual/semi-automated. The automated segment dominated the market with the largest market revenue share of 46.1% in 2024, driven by the increasing demand for high-throughput, reliable, and user-friendly systems in diagnostic laboratories. Automated gamma counters reduce human error, enhance reproducibility, and improve lab efficiency, making them an essential tool in high-volume testing environments.

The manual/semi-automated segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its continued use in academic and research institutions. These systems offer flexibility and affordability, particularly in settings with lower testing volumes or specific assay requirements.

- By Well Type

On the basis of well type, the immunoassay-gamma counters market is segmented into multi-well and single-well. The multi-well segment dominated the market with the largest market share in 2024, driven by its ability to process multiple samples simultaneously, thus improving efficiency in clinical diagnostics and large-scale testing. Multi-well systems are preferred in hospitals and laboratories where high throughput and time-sensitive diagnostics are essential.

The single-well segment is expected to witness fastest growth during forecast period, particularly in specialized research settings where precision and individual sample handling are prioritized. Its simplicity and accuracy make it suitable for small labs and low-volume test scenarios.

- By Application

On the basis of application, the immunoassay-gamma counters market is segmented into radio immunoassays, nuclear medicine assays, and others. The radio immunoassays segment dominated the market in 2024 due to its widespread use in detecting hormones, cancer markers, and other biological analytes. Its high sensitivity and specificity make it a gold standard for many clinical and research applications.

The nuclear medicine assays segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising adoption of nuclear imaging techniques and radiopharmaceuticals. This growth is further driven by increased focus on precision medicine and targeted diagnostics in oncology and cardiology.

- By Disease Condition

On the basis of disease condition, the immunoassay-gamma counters market is segmented into cancer biomarkers, infectious diseases, therapeutic drug monitoring, endocrine hormones, allergy, neonatal screening, cardiac markers, auto-immune disease, and others. The cancer biomarkers segment held the largest revenue share in 2024 due to growing demand for early detection, monitoring of treatment effectiveness, and rising cancer incidence globally.

The endocrine hormones segment is expected to witness fastest growth during forecast period, as gamma counters are frequently used for diagnosing and monitoring thyroid, adrenal, and other hormone-related disorders. The infectious disease and neonatal screening segments are expected to grow rapidly, driven by increasing global focus on early and accurate diagnostics.

- By Purchase Mode

On the basis of purchase mode, the immunoassay-gamma counters market is divided into outright purchase and rental purchase. The outright purchase segment dominated the market in 2024, as healthcare facilities and laboratories prioritize long-term cost efficiency and complete control over their diagnostic systems.

The rental purchase segment is expected to witness fastest growth during forecast period, particularly among start-ups and academic institutions with limited capital expenditure capacity. This model allows greater accessibility to advanced equipment without the burden of full ownership costs.

- By End User

On the basis of end user, the immunoassay-gamma counters market is segmented into laboratories, hospitals, research & academic institutes, pharmaceutical & biotechnology companies, blood banks, and others. Laboratories dominated the market with the largest share in 2024 due to their central role in diagnostic testing and high testing volume.

Hospitals is expected to witness fastest growth during forecast period, driven by growing patient loads and increasing adoption of in-house diagnostic capabilities. Research & academic institutes and pharmaceutical companies are also significant segments due to their ongoing involvement in biomarker research and drug development, requiring high-performance gamma counters.

- By Distribution Channel

On the basis of distribution channel, the immunoassay-gamma counters market is segmented into direct tender and third-party distributors. The direct tender segment accounted for the largest revenue share in 2024, driven by bulk procurement by hospitals, government institutions, and diagnostic chains seeking competitive pricing, service agreements, and regulatory compliance.

The third-party distributor segment is expected to witness the fastest CAGR from 2025 to 2032, especially in emerging markets, where local distributors offer accessibility, training, and after-sales support for small and mid-sized healthcare providers.

Immunoassay-Gamma Counters Market Regional Analysis

- North America dominated the immunoassay-gamma counters market with the largest revenue share of 41.8% in 2024, attributed to its advanced healthcare infrastructure, high research funding, and a strong presence of key manufacturers

- The region’s healthcare providers and research institutions highly value the accuracy, automation, and data integration capabilities offered by modern gamma counters, particularly for radioimmunoassay-based testing of hormones, cancer biomarkers, and infectious diseases

- This strong market presence is further supported by the availability of skilled professionals, ongoing funding for biomedical research, and robust regulatory standards that encourage adoption of advanced diagnostic equipment across hospitals, labs, and academic institutions

U.S. Immunoassay-Gamma Counters Market Insight

The U.S. immunoassay-gamma counters market captured the largest revenue share of 75.6% in 2024 within North America, driven by advanced healthcare systems, high diagnostic volumes, and increased funding for clinical research. The growing reliance on radioimmunoassays for hormone analysis, cancer marker detection, and therapeutic drug monitoring fuels the demand for automated gamma counters. In addition, the strong presence of leading diagnostic equipment manufacturers, along with a focus on laboratory automation and compliance with regulatory standards, continues to support market growth.

Europe Immunoassay-Gamma Counters Market Insight

The Europe immunoassay-gamma counters market is projected to grow at a steady CAGR during the forecast period, driven by a strong healthcare infrastructure, aging population, and rising prevalence of chronic diseases. European nations are increasingly adopting advanced diagnostic tools such as gamma counters in hospitals and academic institutions to ensure early disease detection and improved patient outcomes. The region’s emphasis on quality assurance, lab standardization, and the implementation of EU-wide diagnostic regulations further strengthens market expansion across applications such as endocrinology, oncology, and infectious disease testing.

U.K. Immunoassay-Gamma Counters Market Insight

The U.K. immunoassay-gamma counters market is expected to grow at a noteworthy CAGR during the forecast period, supported by a well-established public healthcare system and a strong academic research landscape. The growing focus on biomarker-based diagnostics and hormone analysis, along with government investment in life sciences and personalized medicine, is contributing to the adoption of gamma counters in both clinical and research settings. Moreover, the shift towards automated laboratory solutions to improve efficiency and reduce human error is expected to further drive market demand.

Germany Immunoassay-Gamma Counters Market Insight

The Germany immunoassay-gamma counters market is anticipated to expand at a considerable CAGR during the forecast period, fueled by strong diagnostic capabilities, high research intensity, and rising demand for nuclear medicine applications. Germany’s emphasis on innovation, precision diagnostics, and healthcare digitization supports the deployment of advanced gamma counters in medical centers and research facilities. The country’s leadership in healthcare technologies, along with increased testing for cancer and metabolic disorders, continues to enhance the market landscape.

Asia-Pacific Immunoassay-Gamma Counters Market Insight

The Asia-Pacific immunoassay-gamma counters market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by healthcare infrastructure development, expanding patient populations, and growing demand for advanced diagnostics in countries such as China, Japan, and India. The increasing prevalence of chronic diseases and rising government initiatives supporting diagnostic accessibility are key growth drivers. In addition, local manufacturing capabilities and the availability of cost-effective gamma counters are making these systems more accessible to a broader range of healthcare providers in the region.

Japan Immunoassay-Gamma Counters Market Insight

The Japan immunoassay-gamma counters market is gaining momentum due to its advanced medical technology landscape, aging population, and strong focus on early disease detection. Japanese laboratories and hospitals are adopting automated gamma counters for their accuracy, efficiency, and compatibility with integrated diagnostic workflows. The country's proactive approach to personalized medicine and its investment in biomarker research and nuclear medicine are expected to significantly contribute to market expansion.

India Immunoassay-Gamma Counters Market Insight

The India immunoassay-gamma counters market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by growing healthcare investments, expanding diagnostic infrastructure, and increasing awareness of precision diagnostics. The rising burden of endocrine and infectious diseases, along with government-led initiatives to modernize healthcare facilities, is promoting the adoption of gamma counters. Furthermore, domestic manufacturing, a growing number of clinical laboratories, and the push toward cost-effective healthcare solutions are accelerating the market’s growth trajectory in the country.

Immunoassay-Gamma Counters Market Share

The immunoassay-gamma counters industry is primarily led by well-established companies, including:

- PerkinElmer (U.S.)

- Hidex Oy (Finland)

- Capintec, Inc. (U.S.)

- Berthold Technologies GmbH & Co. KG (Germany)

- LabLogic Systems Ltd. (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Stratec SE (Germany)

- ORTEC (AMETEK Inc.) (U.S.)

- ZECOTEK Photonics Inc. (Canada)

- Comecer S.p.A. (Italy)

- Mirion Technologies, Inc. (U.S.)

- Ludlum Measurements, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Mirion Technologies Subsidiary (U.S.)

- Kromek Group plc (U.K.)

- Scintacor Ltd. (U.K.)

- EuroProbe Ltd. (U.K.)

- Mediso Ltd. (Hungary)

- Shanghai Hualian Pharmaceutical Machinery Co., Ltd. (China)

- Elysia-raytest GmbH (Germany)

What are the Recent Developments in Global Immunoassay-Gamma Counters Market?

- In April 2023, Hidex Oy, a Finland-based manufacturer of laboratory instrumentation, introduced an upgraded version of its automated gamma counter, featuring enhanced software integration and multi-detector configurations. Designed for high-throughput environments, the system supports improved assay flexibility and data accuracy, reinforcing Hidex’s position as a key innovator in radioactivity-based diagnostic instrumentation and supporting laboratories in achieving streamlined, efficient diagnostic workflows

- In March 2023, PerkinElmer Inc. launched a next-generation gamma counter system tailored for advanced clinical diagnostics and life sciences research. This newly developed platform incorporates faster sample processing, reduced background interference, and broader compatibility with radioisotope-based assays. The release underscores PerkinElmer’s strategic commitment to developing precision diagnostic tools aligned with the growing demand for accurate biomarker detection across global healthcare systems

- In March 2023, Beckman Coulter Life Sciences announced the expansion of its gamma counting solutions into emerging markets through localized partnerships in Southeast Asia and Latin America. This move is aimed at increasing accessibility to high-performance gamma counters in underserved regions by offering affordable, compact models along with localized support and training. The initiative highlights the company’s focus on global health equity and infrastructure development in diagnostic testing

- In February 2023, Capintec, Inc., a leading supplier of nuclear medicine instrumentation, revealed a collaboration with several U.S.-based healthcare institutions to implement its latest gamma counter systems in nuclear endocrinology testing. The partnership focuses on improving workflow efficiency and diagnostic accuracy in hormone analysis, demonstrating Capintec’s efforts to integrate its systems into clinical practice and support disease management through radioimmunoassay technology

- In January 2023, LabLogic Systems Ltd. launched a new version of its Wizard3 gamma counter, featuring enhanced user interface design, cloud data storage compatibility, and automated quality control routines. Introduced at a major European life sciences trade event, the product aims to improve data security and remote accessibility for laboratory teams, reflecting the rising demand for digitized and compliant diagnostic technologies in both academic and clinical research settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.