Global In Plant Logistics Market

Market Size in USD Billion

CAGR :

%

USD

13.53 Billion

USD

29.86 Billion

2024

2032

USD

13.53 Billion

USD

29.86 Billion

2024

2032

| 2025 –2032 | |

| USD 13.53 Billion | |

| USD 29.86 Billion | |

|

|

|

|

What is the Global In-Plant Logistics Market Size and Growth Rate?

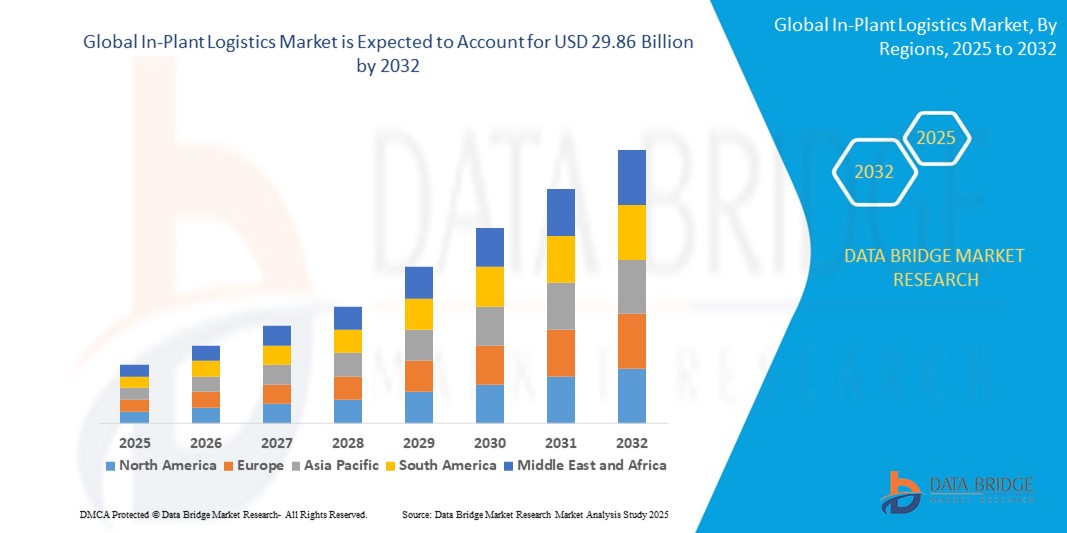

- The global in-plant logistics market size was valued at USD 13.53 billion in 2024 and is expected to reach USD 29.86 billion by 2032, at a CAGR of 10.40% during the forecast period

- The in-plant logistics market refers to the comprehensive set of processes and activities involved in the movement, storage, and management of materials within a manufacturing facility or plant. It encompasses the efficient handling of raw materials, components, and finished goods from one point to another within the production environment

- In-plant logistics aims to optimize internal supply chain operations, minimize downtime, enhance production efficiency, and reduce overall costs by employing advanced technologies, automation, and streamlined processes

What are the Major Takeaways of In-Plant Logistics Market?

- The growing demand for efficient supply chain management stands as a pivotal driver for the market. As supply chains become increasingly intricate, businesses are recognizing the imperative of optimizing in-plant logistics to enhance overall supply chain efficiency. In-plant logistics solutions play a crucial role in minimizing lead times, streamlining material flow within manufacturing facilities, and ensuring seamless coordination between various operational components

- North America dominated the in-plant logistics market with the largest revenue share of 36.46% in 2024, driven by strong adoption of automation, robotics, and advanced material handling systems across manufacturing, automotive, food & beverages, and e-commerce sectors

- Asia-Pacific is poised to grow at the fastest CAGR of 5.4% from 2025 to 2032, driven by rapid industrialization, booming e-commerce, and rising automation investments in manufacturing and warehousing

- The assembly/production lines segment dominated the in-plant logistics market with the largest market revenue share of 46.8% in 2024, driven by the rising integration of automated guided vehicles (AGVs), conveyors, and robotic arms to streamline component movement and optimize just-in-time (JIT) manufacturing

Report Scope and In-Plant Logistics Market Segmentation

|

Attributes |

In-Plant Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the In-Plant Logistics Market?

Automation Acceleration through AI-Driven and Robotics-Enabled Operations

- A leading and fast-growing trend in the global in-plant logistics market is the integration of advanced artificial intelligence (AI) with autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and smart conveyor systems, enabling higher efficiency, precision, and adaptability in material handling processes

- For instance, Daifuku’s intelligent conveyor systems use AI-based predictive analytics to optimize routing and reduce downtime, while Honeywell Intelligrated deploys machine-learning-powered sortation to improve throughput in complex manufacturing environments. Similarly, AutoStore’s cube storage systems leverage AI algorithms to dynamically adjust picking sequences, enhancing warehouse productivity

- AI capabilities in in-plant logistics can forecast demand, adjust workflows in real time, and enable predictive maintenance, while robotics integration streamlines repetitive or labor-intensive tasks. For instance, Geek+ deploys vision-guided robots with AI pathfinding to minimize congestion, and SSI Schaefer combines robotics with AI for intelligent order consolidation

- The convergence of AI-powered robotics with IoT-connected platforms supports unified monitoring, control, and optimization across the entire plant floor, integrating seamlessly with ERP, MES, and WMS systems

- This shift toward smarter, self-learning, and highly automated intralogistics systems is redefining operational benchmarks for manufacturing and distribution facilities. Companies such as Vanderlande are developing robotics and AI-powered control software that can adapt to fluctuating production demands, reducing human intervention

- The growing demand for in-plant logistics solutions that merge AI adaptability with robotics-enabled automation is surging across automotive, food & beverage, pharmaceuticals, and electronics industries, driven by the push for faster, safer, and more cost-efficient operations

What are the Key Drivers of In-Plant Logistics Market?

- The rising need for operational efficiency, reduced downtime, and improved safety standards is a core driver of growth in the in-plant logistics market

- For instance, in January 2025, Toyota Material Handling introduced its AI-enabled autonomous forklifts with advanced safety sensors and fleet management integration, targeting automotive, retail, and heavy manufacturing sectors

- As production volumes increase and supply chains become more complex, manufacturers are seeking systems with higher automation, real-time data visibility, and seamless integration with existing digital infrastructure. In-plant logistics offers a significant advantage over manual handling by enabling automated goods movement, inventory tracking, and just-in-time delivery capabilities

- In addition, the expansion of e-commerce-driven manufacturing and the shift toward lean production are fueling adoption, with automated in-plant logistics becoming essential for synchronized production lines, assembly areas, and outbound logistics

- The demand for modular, scalable, and energy-efficient solutions combined with reduced labor dependency is further accelerating uptake. Easy integration with existing facilities and compatibility with Industry 4.0 frameworks are enabling wider market penetration

Which Factor is challenging the Growth of the In-Plant Logistics Market?

- High upfront investment costs and integration complexity present significant challenges for the In-Plant Logistics market, particularly for small and medium-sized enterprises (SMEs) with limited capital expenditure budgets

- For instance, advanced robotics systems or high-density automated storage solutions can require millions in initial investment, along with substantial downtime for installation and integration with legacy systems

- In addition, cybersecurity concerns related to connected equipment such as the risk of system breaches, operational sabotage, or data theft pose challenges for facilities adopting IoT-linked logistics automation. Industrial cyberattacks in recent years have increased caution among manufacturers

- Addressing these issues requires modular deployment strategies, subscription-based robotics-as-a-service (RaaS) models, and strong cybersecurity protocols including network segmentation and encrypted communications

- Furthermore, workforce resistance to automation stemming from fears of job displacement—can slow implementation timelines, especially in regions with strong labor unions

- To overcome these barriers, industry leaders must prioritize affordable, secure, and interoperable automation solutions while offering clear ROI demonstrations and upskilling programs to support workforce transition

How is the In-Plant Logistics Market Segmented?

The market is segmented on the basis of location, product, and application.

- By Location

On the basis of location, the in-plant logistics market is segmented into assembly/production lines, storage facilities, packaging workstations, and others. The assembly/production lines segment dominated the in-plant logistics market with the largest market revenue share of 46.8% in 2024, driven by the rising integration of automated guided vehicles (AGVs), conveyors, and robotic arms to streamline component movement and optimize just-in-time (JIT) manufacturing. The demand for automation in high-volume production environments, particularly in automotive and electronics sectors, continues to push this segment forward.

The storage facilities segment is anticipated to register the fastest growth rate of 18.6% from 2025 to 2032, supported by the adoption of high-density automated storage and retrieval systems (AS/RS) and AI-powered warehouse management solutions to maximize space utilization and reduce operational costs.

- By Product

On the basis of product, the in-plant logistics market is segmented into cranes, conveyors & sortation systems, automated storage & retrieval systems (AS/RS), warehouse management systems (WMS), automated guided vehicles (AGVs), robots, and others. The conveyors & sortation systems segment held the largest market revenue share in 2024 at 28.5%, owing to their widespread deployment for continuous, high-throughput material flow in manufacturing and packaging operations. Technological advancements such as AI-driven routing, IoT-enabled monitoring, and energy-efficient drives have further strengthened their adoption.

The automated guided vehicles (AGVs) segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising need for flexible, scalable, and labor-efficient solutions in material transport across industrial floors. The ability of AGVs to integrate seamlessly with WMS and MES platforms makes them highly attractive for Industry 4.0 facilities.

- By Application

On the basis of application, the in-plant logistics market is segmented into automotive, aviation, food & beverages, metals & heavy machinery, semiconductor & electronics, healthcare, and others. The automotive segment dominated the in-plant logistics market with a market revenue share of 31.7% in 2024, driven by the sector’s high reliance on synchronized material flow, component traceability, and robotics-enabled assembly line operations. Increasing investment in electric vehicle (EV) production facilities and modular manufacturing plants is further supporting demand.

The semiconductor & electronics segment is projected to grow at the fastest CAGR from 2025 to 2032, backed by the industry’s stringent requirements for precision handling, contamination control, and automated cleanroom logistics. Growing chip production capacities in Asia-Pacific and North America are accelerating adoption of advanced in-plant logistics solutions in this segment.

Which Region Holds the Largest Share of the In-Plant Logistics Market?

- North America dominated the in-plant logistics market with the largest revenue share of 36.46% in 2024, driven by strong adoption of automation, robotics, and advanced material handling systems across manufacturing, automotive, food & beverages, and e-commerce sectors

- The region benefits from the presence of leading in-plant logistics solution providers, advanced R&D capabilities, and a highly developed industrial base committed to operational efficiency

- Companies value solutions that integrate seamlessly with warehouse management systems, IoT platforms, and AI-powered analytics, while high labor costs and stringent safety standards further accelerate automation adoption. Mature supply chain networks, advanced infrastructure, and significant investment in Industry 4.0 technologies continue to reinforce North America’s leadership in the market

U.S. In-Plant Logistics Market Insight

The U.S. in-plant logistics market captured the largest revenue share in 2024 within North America, supported by strong demand in automotive assembly plants, large-scale distribution centers, and high-tech manufacturing facilities. Enterprises are increasingly deploying automated guided vehicles (AGVs), robotic picking systems, and high-speed conveyors to meet growing e-commerce fulfillment needs and optimize production workflows. Rising labor shortages, coupled with the need for faster order cycles, are pushing companies toward fully integrated automated solutions.

Europe In-Plant Logistics Market Insight

The Europe in-plant logistics market is projected to expand at a steady CAGR throughout the forecast period, driven by industrial modernization, high-speed connectivity, and government-backed automation programs under Industry 4.0. Adoption is fueled by applications in precision manufacturing, packaging, and cold chain logistics, with an emphasis on sustainability and energy-efficient systems. Both greenfield and brownfield projects in automotive, aerospace, and heavy machinery sectors are contributing to market growth.

U.K. In-Plant Logistics Market Insight

The U.K. in-plant logistics market is anticipated to grow at a robust CAGR during the forecast period, driven by the need for agile and flexible supply chain operations across food processing, pharmaceuticals, and retail distribution. Strong investment in warehouse automation, robotics integration, and digital twin technologies is boosting efficiency. The rapid growth of e-commerce, combined with nationwide 5G rollout and warehouse infrastructure upgrades, is further accelerating adoption.

Germany In-Plant Logistics Market Insight

The Germany in-plant logistics market is expected to expand considerably, supported by its advanced manufacturing base, strong automotive industry, and engineering expertise. Demand is growing for AGVs, automated storage and retrieval systems (AS/RS), and AI-driven predictive maintenance tools in industrial environments. Sustainability, precision, and high-quality engineering remain central priorities, driving adoption of durable, efficient, and modular logistics systems.

Which Region is the Fastest Growing Region in the In-Plant Logistics Market?

Asia-Pacific is poised to grow at the fastest CAGR of 5.4% from 2025 to 2032, driven by rapid industrialization, booming e-commerce, and rising automation investments in manufacturing and warehousing. Countries such as China, Japan, South Korea, and India are increasingly adopting cost-efficient yet advanced logistics solutions, supported by government initiatives for smart manufacturing and industrial digitalization. The region’s strong position as a global manufacturing hub ensures competitive equipment pricing and rapid deployment of advanced systems.

Japan In-Plant Logistics Market Insight

The Japan in-plant logistics market is gaining momentum due to the country’s world-class manufacturing sector, robotics expertise, and focus on operational precision. Adoption is strong in automotive, electronics, and healthcare manufacturing, with significant interest in collaborative robots and compact AS/RS systems to maximize space efficiency. Japan’s culture of innovation and quality manufacturing supports the demand for high-performance, reliable logistics automation solutions.

China In-Plant Logistics Market Insight

The China in-plant logistics market accounted for the largest share in Asia-Pacific in 2024, driven by rapid automation in e-commerce fulfillment centers, electronics manufacturing, and food processing plants. Government-led smart manufacturing programs and strong investment in AI-powered logistics technologies are accelerating adoption. A large domestic production base, competitive pricing, and the expansion of local automation brands are solidifying China’s leading role in the region.

Which are the Top Companies in In-Plant Logistics Market?

The in-plant logistics industry is primarily led by well-established companies, including:

- Honeywell Intelligrated (U.S.)

- Daifuku Co., Ltd. (Japan)

- SSI Schaefer (Germany)

- Toyota Material Handling Group (Japan)

- Vanderlande Industries Holding B.V. (Netherlands)

- Dematic (Germany)

- Swisslog (KUKA AG) (Switzerland)

- TGW Logistics Group (Austria)

- Knapp AG (Austria)

- Bastian Solutions (U.S.)

- Muratec Machinery Ltd. (Japan)

- CIMCORP (Finland)

- SSI SCHAEFER (Germany)

- BEUMER Group (Germany)

- Interroll Group (Switzerland)

- AutoStore AS (Norway)

- Magazino GmbH (Germany)

- Geek+ Technology Co., Ltd. (China)

- GreyOrange Pte Ltd (Singapore)

- Fetch Robotics, Inc. (U.S.)

What are the Recent Developments in Global In-Plant Logistics Market?

- In October 2023, Honeywell Intelligrated launched the Honeywell Genesis R60 AMR, a next-generation autonomous mobile robot designed to deliver efficient and flexible material handling operations in warehouses and distribution centers. In introducing this innovation, the company reinforced its leadership in automation solutions for the in-plant logistics market, further enhancing productivity and operational flexibility for its customers

- In September 2023, Swisslog and GreyOrange announced a strategic partnership, combining Swisslog’s proven expertise in automated storage and retrieval systems (ASRS) with GreyOrange’s advanced robotic picking and sorting technologies to elevate e-commerce fulfillment capabilities. In joining forces, both companies aim to revolutionize warehouse efficiency and provide faster, more accurate order processing for clients worldwide

- In June 2023, BEUMER Group GmbH & Co. KG acquired The Hendrik Group Inc., expanding its product portfolio in bulk material transport solutions within manufacturing facilities. In integrating air-supported belt conveyor expertise, BEUMER can now offer manufacturers more efficient and environmentally friendly transport systems, strengthening its competitive position in sustainable logistics solutions

- In May 2023, SSI Schaefer partnered with Brands for Less to implement a state-of-the-art automated storage system featuring robotic shuttles and vertical lifts for bin delivery to designated pick-up points. In executing this collaboration, the companies improved storage and retrieval efficiency, reduced operational costs, and established a foundation for scalable future growth

- In January 2023, KUKA AG upgraded its KMP 600-S diffDrive platform, a high-speed automated guided vehicle (AGV) designed for durability and optimal performance in demanding industrial environments. In enhancing its IP 54-rated design, KUKA ensured the AGV’s reliable operation under challenging conditions, reinforcing its commitment to delivering resilient and high-performing automation solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global In Plant Logistics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global In Plant Logistics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global In Plant Logistics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.