Global Inductive Sensors Market

Market Size in USD Million

CAGR :

%

USD

742.98 Million

USD

1,295.80 Million

2024

2032

USD

742.98 Million

USD

1,295.80 Million

2024

2032

| 2025 –2032 | |

| USD 742.98 Million | |

| USD 1,295.80 Million | |

|

|

|

|

Inductive Sensors Market Analysis

The inductive sensors market has seen significant growth driven by advancements in sensor technology, such as the integration of smart features, improved accuracy, and enhanced durability. Modern inductive sensors are now equipped with advanced signal processing techniques, which enable them to detect the position, proximity, and motion of metallic objects with greater precision. One key development is the use of High-Frequency (HF) and Radio-Frequency (RF) inductive sensors, which provide faster response times and the ability to detect objects at longer distances.

Furthermore, the rise of Industry 4.0 has led to the widespread use of inductive sensors in automation systems, machine monitoring, and robotics. These sensors are now compatible with IoT devices, enabling real-time data analysis and predictive maintenance, which reduces downtime and improves operational efficiency.

The growth of the inductive sensors market is also attributed to their use in automotive, aerospace, and consumer electronics. As industries increasingly demand more reliable and efficient solutions, the inductive sensors market is expected to continue expanding, driven by innovation in sensor design and the growing adoption of smart technologies.

Inductive Sensors Market Size

The global inductive sensors market size was valued at USD 742.98 million in 2024 and is projected to reach USD 1,295.80 million by 2032, with a CAGR of 7.20% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Inductive Sensors Market Trends

“Increased Adoption of IoT Integration”

One specific trend in the inductive sensors market is the growing integration with the Internet of Things (IoT). As industries such as manufacturing, automotive, and robotics embrace smart technology, the demand for sensors that can communicate and exchange data in real time is increasing. Inductive sensors, which detect metal objects without physical contact, are becoming crucial for IoT-based applications due to their robustness and reliability in harsh environments. For instance, companies such as Siemens and Schneider Electric are incorporating inductive sensors in their IoT-enabled systems for predictive maintenance, improving operational efficiency and minimizing downtime. This trend is enhancing automation and driving the market for smart, connected sensors.

Report Scope and Inductive Sensors Market Segmentation

|

Attributes |

Inductive Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Sick AG (Germany), OMRON Corporation (Japan), ifm electronic GmbH (Germany), Schneider Electric (France), Pepperl+Fuchs (Germany), Panasonic Corporation (Japan), Rockwell Automation, Inc. (U.S.), Honeywell International Inc. (U.S.), Broadcom (U.S.), Hans Turck GmbH & Co. KG (Germany), Balluff Automation India Pvt. Ltd. (India), Fargo Controls Inc. (U.S.), Kaman Precision Products (U.S.), KEYENCE CORPORATION (Japan), Lion Precision (U.S.), Micron Optics, Inc. (U.S.), Standex Electronics, Inc. (U.S.), RiKO OPTO-ELECTRONICS TECHNOLOGY CO., LTD. (China), STMicroelectronics (Switzerland), Delta Electronics, Inc. (Taiwan), and Autonics Corporation (South Korea) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Inductive Sensors Market Definition

Inductive sensors are devices used to detect the presence of metallic objects without physical contact. They work on the principle of electromagnetic induction, where an alternating current creates a magnetic field. When a metal object enters this field, it alters the inductance, triggering a signal. These sensors are commonly used in industrial automation, robotics, and automotive applications for proximity detection, position sensing, and counting tasks. Known for their durability and resistance to harsh environments, inductive sensors are highly reliable in detecting ferrous and non-ferrous metals and are widely used in factories and assembly lines for automation and safety.

Inductive Sensors Market Dynamics

Drivers

- Growing Demand for Precision in Robotics

As robotics technology advances in industries such as automotive, electronics, and healthcare, there is a heightened demand for precise and reliable sensing solutions. Inductive sensors play a key role in this transformation due to their ability to detect the position and movement of robotic parts without physical contact. For instance, in automotive manufacturing, robots equipped with inductive sensors are used for assembly tasks, ensuring accurate positioning of parts. Similarly, in the healthcare sector, precision robotics for surgeries rely on inductive sensors for movement detection, ensuring optimal performance. The growing reliance on robotics for high-precision applications in these sectors significantly drives the demand for inductive sensors, fueling market growth.

- Miniaturization of Electronic Devices

The trend toward smaller and more compact electronic devices creates significant opportunities for the inductive sensors market. As devices become more compact, the need for miniaturized sensors that can fit into limited spaces while maintaining high accuracy is increasing. For instance, in October 2023, Maxic launched the MT3102, a cutting-edge miniature proximity sensor designed for low power consumption. This sensor incorporates integrated skin recognition technology, making it perfect for wearable devices. It provides precise and energy-efficient proximity detection, significantly enhancing user experience. With its compact design and advanced capabilities, the MT3102 sets a new standard in proximity sensing, solidifying Maxic’s leadership in the sensor market. The growing demand for miniaturized components in consumer electronics, automotive sensor applications, and medical devices is thus expanding the market potential for small, high-performance inductive sensors.

Opportunities

- Advancements in Sensing Technology

Advancements in Sensing Technology have created significant opportunities in the inductive sensors market. Innovations in sensor sensitivity, faster response times, and seamless integration with other systems are expanding the applications of inductive sensors. For instance, in aerospace, these sensors are increasingly used for precise position sensing in landing gear and flight control systems. In food processing, they are crucial for detecting metal contamination in production lines, ensuring safety and quality. In addition, in robotics, enhanced inductive sensors are being used for more accurate motion control and positioning, especially in automated warehouses and manufacturing. These advancements offer new growth avenues, particularly in sectors demanding high precision and reliability in harsh environments.

- Need for Non-Contact Sensing

The non-contact sensing capability of inductive sensors creates significant opportunities in markets where physical contact would lead to wear, damage, or contamination. In industries such as automotive, where precision is key, inductive sensors are used to detect the position of metal parts without touching them, thus preventing any mechanical wear. In industrial automation, these sensors are crucial for applications such as monitoring the movement of conveyors or detecting proximity in robotic arms. For instance, in the automotive sector, inductive sensors are used in braking systems and engine management, ensuring accuracy and longevity while reducing maintenance costs. This demand for non-contact sensing is driving growth in the market.

Restraints/Challenges

- High Initial Cost

High initial costs are a significant restraint for the inductive sensors market. These sensors, particularly those designed for industrial use, often involve advanced technology and high-quality materials, making them expensive. The high upfront investment required for purchasing and integrating inductive sensors can be prohibitive for small and medium-sized businesses, particularly in cost-sensitive industries. This cost barrier limits the adoption of inductive sensors in sectors where budget constraints are a primary concern, slowing down market growth. Consequently, many companies may opt for more affordable alternatives, thereby reducing the potential market for inductive sensors and hindering their widespread application across various industries.

- Limited Detection Range

One of the significant challenges for the inductive sensors market is their limited detection range. These sensors are specifically designed to detect metallic objects, which restricts their application to industries or environments where such materials are prevalent. Compared to other sensor types, such as capacitive or optical sensors, which offer broader detection capabilities, inductive sensors become less versatile. This limitation makes them unsuitable for applications where non-metallic objects need to be detected or where longer detection distances are required. As a result, the restricted functionality can hinder the adoption of inductive sensors across various sectors, particularly those requiring more flexible and versatile solutions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Inductive Sensors Market Scope

The market is segmented on the basis of end-user industry and type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

End-User Industry

- Consumer Electronics

- Industrial Automation

- Automotive

- Aerospace and Defense

- Pharmaceutical

- Packaging

- Others

Type

- Self-Contained

- Amplifier-In-Cable

- Separate Amplifier

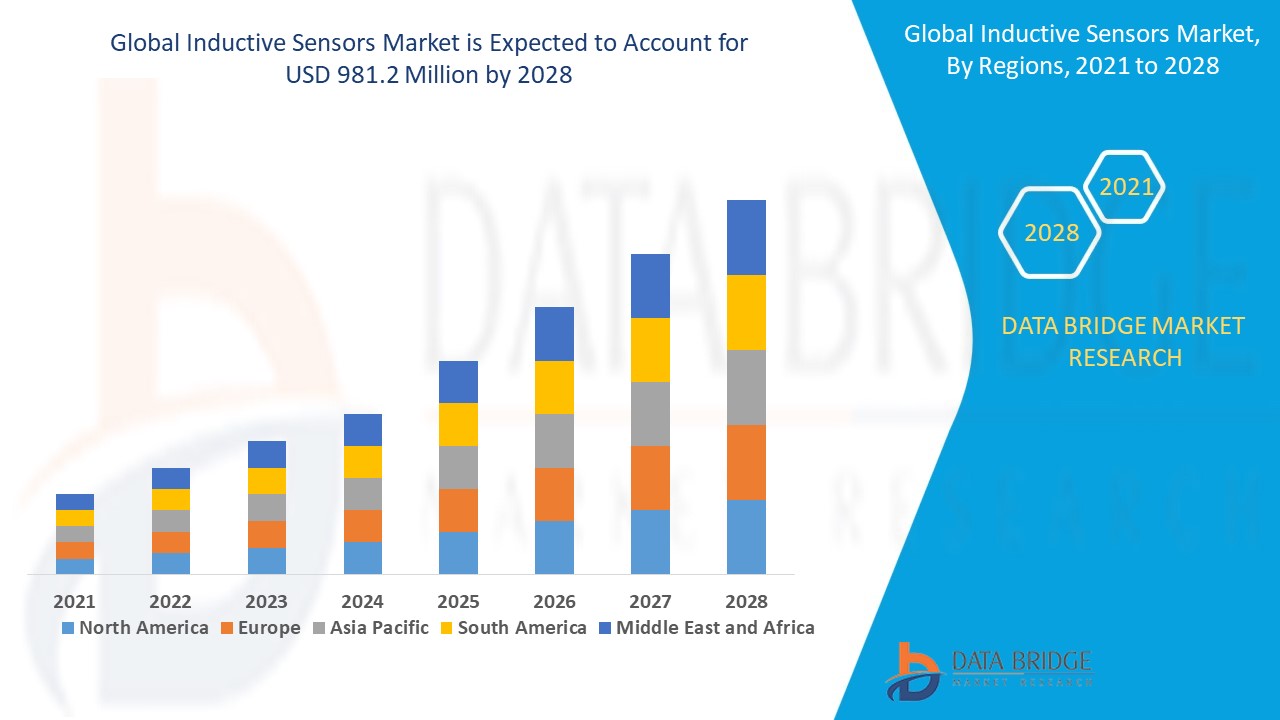

Inductive Sensors Market Regional Analysis

The market is analyzed and market size insights and trends are provided by end-user industry and type as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the inductive sensors market due to the growing demand for inductive sensors in automobiles, increased adoption in automation, and the rising preference for non-contact sensing technologies. These factors are driving significant market growth in the region.

Asia-Pacific is expected to show lucrative growth in the inductive sensors market due to increasing demand for automation technologies and the rising adoption of inductive sensors in the automotive industry. This growth is driven by industrial expansion and technological advancements in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Inductive Sensors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Inductive Sensors Market Leaders Operating in the Market Are:

- Sick AG (Germany)

- OMRON Corporation (Japan)

- ifm electronic GmbH (Germany)

- Schneider Electric (France)

- Pepperl+Fuchs (Germany)

- Panasonic Corporation (Japan)

- Rockwell Automation, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Broadcom (U.S.)

- Hans Turck GmbH & Co. KG (Germany)

- Balluff Automation India Pvt. Ltd. (India)

- Fargo Controls Inc. (U.S.)

- Kaman Precision Products (U.S.)

- KEYENCE CORPORATION (Japan)

- Lion Precision (U.S.)

- Micron Optics, Inc. (U.S.)

- Standex Electronics, Inc. (U.S.)

- RiKO OPTO-ELECTRONICS TECHNOLOGY CO., LTD. (China)

- STMicroelectronics (Switzerland)

- Delta Electronics, Inc. (Taiwan)

- Autonics Corporation (South Korea)

Latest Developments in Inductive Sensors Market

- In October 2023, Maxic launched the MT3102, a cutting-edge miniature proximity sensor designed for low power consumption. This sensor incorporates integrated skin recognition technology, making it perfect for wearable devices. It provides precise and energy-efficient proximity detection, significantly enhancing user experience. With its compact design and advanced capabilities, the MT3102 sets a new standard in proximity sensing, solidifying Maxic’s leadership in the sensor market

- In March 2023, Carlo Gavazzi introduced a new family of full-metal inductive sensors, featuring an IP69K rating and standard IO-Link capabilities. These sensors are designed to withstand harsh environmental conditions, making them ideal for demanding industrial applications. Their rugged performance ensures reliability in automation systems, while the IO-Link integration offers seamless communication for enhanced operational efficiency, further establishing Carlo Gavazzi’s strong presence in advanced sensor solutions

- In March 2022, Datalogic, a leader in automatic data capture and factory automation, showcased Visual Supply Chain Intelligence, focusing on supply chain traceability. The solution integrates barcodes, visual systems, artificial intelligence, and machine learning to enable efficient tracking and tracing across modern supply networks. This innovative technology delivers genuine intelligence to enhance supply chain management, positioning Datalogic at the forefront of automation and logistics solutions

- In February 2022, STMicroelectronics unveiled a new series of high-resolution Time-of-Flight (ToF) sensors, advancing 3D depth mapping capabilities. These sensors enable smartphones and other devices to capture more precise and detailed spatial data, enhancing applications such as augmented reality (AR), robotics, and facial recognition. With improved accuracy and range, these ToF sensors represent a significant leap in sensor technology, paving the way for smarter, more intuitive devices

- In March 2021, Autonics Corporation inaugurated a state-of-the-art R&D center in Seoul, South Korea. The nine-story facility, covering 22,633 square meters, is designed to enhance the company’s research and development capabilities. The new center will support the creation of innovative automation solutions and services, reinforcing Autonics’ global position as a trusted leader in automation technology. It’s a strategic investment to meet growing market demands and drive future growth

- In September 2020, Balluff GmbH introduced a new line of inductive sensors designed for explosion-protected areas, receiving CSA approval for use in the USA and Canada. These sensors are perfect for object detection and positioning in environments with explosive dust or gas atmospheres. Available in M12, M18, and M30 sizes, they offer robust, reliable performance and ensure safety in hazardous areas, reinforcing Balluff’s position in the industrial sensor market

- In August 2020, Hans Turck GmbH & Co. Kg launched a new series of inductive safety sensors with two OSSD (output switching signal device) outputs. These sensors enable wear-free position and range monitoring for safety applications, such as presses, cranes, and machinery covers. With flush-mountable M12, M18, and M30 devices, the sensors offer robust metal housing, a wide temperature range from -25 to 70 °C, and reliable safety in critical industrial settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Inductive Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Inductive Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Inductive Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.