Global Industrial Coating Market

Market Size in USD Billion

CAGR :

%

USD

112.80 Billion

USD

147.96 Billion

2024

2032

USD

112.80 Billion

USD

147.96 Billion

2024

2032

| 2025 –2032 | |

| USD 112.80 Billion | |

| USD 147.96 Billion | |

|

|

|

|

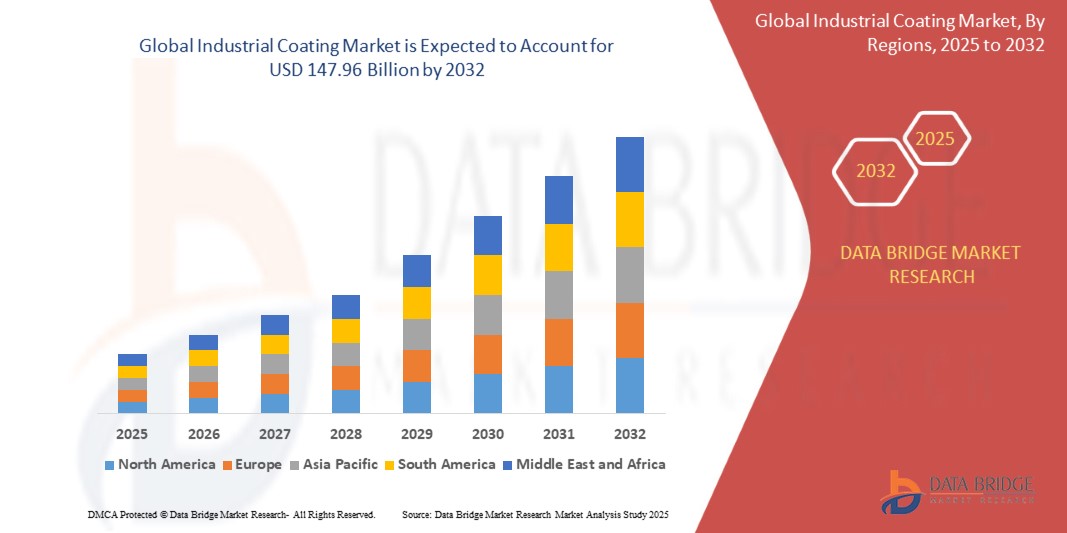

What is the Global Industrial Coating Market Size and Growth Rate?

- The global industrial coating market size was valued at USD 112.80 billion in 2024 and is expected to reach USD 147.96 billion by 2032, at a CAGR of 3.45% during the forecast period

- The industrial coating market is experiencing robust growth, driven by increasing demand across various sectors, including automotive, aerospace, and construction. As industries prioritize durability and performance, innovations in coating technologies, such as eco-friendly formulations and advanced application methods, are emerging as key trends

- Recent developments include the introduction of high-performance coatings with enhanced resistance to chemicals, UV exposure, and corrosion, which are essential for extending the lifespan of industrial components

- Companies are also focusing on sustainable practices, leading to the development of bio-based coatings and waterborne solutions that minimize environmental impact. The integration of digital technologies in coating applications is another noteworthy trend, improving efficiency and precision in the application process

- Overall, the industrial coating market is poised for significant expansion as it adapts to changing consumer demands and regulatory pressures, positioning itself at the forefront of innovation and sustainability in industrial applications

What are the Major Takeaways of Industrial Coating Market?

- The automotive and aerospace industries are experiencing a robust growth, significantly boosting the demand for high-performance coatings

- In the automotive sector, by 2026, passenger vehicles are such asly to increase between 9.4–13.4 million units, commercial vehicles between 2.0–3.9 million units. Such surge necessitates coatings that enhance durability and aesthetics and provide resistance to extreme conditions, such as UV exposure and corrosion

- Asia-Pacific dominated the industrial coating market with the largest revenue share of 39.82% in 2024, driven by robust manufacturing output across automotive, electronics, and heavy industries, along with increasing adoption of advanced surface engineering technologies

- North America is projected to grow at the fastest CAGR of 8.1% during the forecast period from 2025 to 2032, supported by increased demand for high-performance coatings in aerospace, defense, and energy sectors

- The Acrylic segment dominated the market with the largest market revenue share of 28.5% in 2024, owing to its excellent weatherability, color retention, and cost-effectiveness across diverse industrial applications

Report Scope and Industrial Coating Market Segmentation

|

Attributes |

Industrial Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Industrial Coating Market?

“Adoption of Cold Gas Spray in Additive Manufacturing and Repair Applications”

- A prominent trend in the industrial coating market is the integration of cold gas spray technology in additive manufacturing and high-precision component repair, particularly across aerospace, defense, and heavy engineering industries. This solid-state process allows coatings to be applied without melting the feedstock, preserving base material properties

- For instance, OC Oerlikon is actively investing in cold spray systems for turbine blade and engine part repairs, significantly reducing turnaround time. Such aswise, Praxair Surface Technologies provides turnkey cold spray systems for large-scale industrial use

- Cold spray's advantages such as minimal thermal distortion, reduced oxidation, and high adhesion strength make it ideal for lightweight alloys such as aluminum, titanium, and magnesium

- The process also aligns with sustainability goals by lowering energy usage and material waste, offering a green alternative to conventional welding and thermal spray techniques

- Companies such as Wall Colmonoy are utilizing cold spray for tailored coating solutions in aviation, energy, and power generation applications, pushing the technology into mainstream manufacturing

- This trend is expected to accelerate the global shift toward high-performance, eco-friendly, and repair-centric surface coating solutions over the next decade

What are the Key Drivers of Industrial Coating Market?

- Rising demand for corrosion- and wear-resistant coatings in automotive, marine, and heavy industries is driving the market forward. Industrial coatings enhance longevity and performance of equipment exposed to harsh environments

- For instance, in February 2024, Saint-Gobain expanded its wear-resistant product line using cold spray, targeting growing demand in transport and heavy machinery sectors

- Cold gas spray is particularly favored for temperature-sensitive substrates, such as electronics housings and lightweight structural parts, allowing application without compromising integrity

- OEMs are increasingly adopting cold spray for cost-saving life cycle maintenance, reducing component replacements and downtime

- The ability to deposit dense, thick coatings with high bond strength also makes cold spray suitable for thermal management in electronics and biomedical applications

- In addition, government incentives and rising R&D spending in advanced coating technologies are accelerating the deployment of cold spray in defense, aerospace, and high-performance industrial systems

Which Factor is challenging the Growth of the Industrial Coating Market?

- A significant hurdle for the industrial coating market is the high capital investment and technical know-how required for cold spray setup, including high-pressure gas systems, robotics, and precision nozzles

- For instance, smaller firms in emerging markets often struggle with the infrastructure and skilled workforce needed to operate these systems effectively

- In addition, material limitations and geometrical application constraints restrict the coating of certain complex or high-hardness surfaces compared to plasma or HVOF spraying methods

- The absence of standardized protocols in certification-sensitive industries such as aerospace and medical devices hampers wider adoption, as consistency and repeatability are crucial

- Companies such as GTV Wear Protection GmbH are addressing this challenge by developing modular cold spray platforms and application-specific solutions to broaden the technology’s appeal

- Market growth depends on the ability to scale down system complexity, improve training, and standardize quality assurance processes, making cold spray a viable option across broader industrial applications

How is the Industrial Coating Market Segmented?

The market is segmented on the basis of resin, technology, and end use.

• By Resin

On the basis of resin, the industrial coating market is segmented into Alkyd, Acrylic, Polyurethane, Epoxy, Polyester, and Fluoropolymers. The Acrylic segment dominated the market with the largest market revenue share of 28.5% in 2024, owing to its excellent weatherability, color retention, and cost-effectiveness across diverse industrial applications. Acrylic coatings are widely used for metal structures, machinery, and equipment, offering fast-drying characteristics and UV resistance.

The Epoxy segment is projected to witness the fastest growth rate from 2025 to 2032, supported by its superior adhesion, chemical resistance, and durability, especially in harsh industrial environments. Epoxy coatings are extensively utilized in protective marine, oil & gas, and chemical processing applications due to their long-lasting corrosion protection.

• By Technology

On the basis of technology, the market is segmented into Solvent-Based, Water-Based, and Powder coatings. The Solvent-Based segment held the largest market revenue share of 41.2% in 2024, driven by its strong adhesion properties, rapid curing, and proven performance in high-humidity or adverse weather conditions. Solvent-based coatings are preferred in heavy-duty applications including transportation, infrastructure, and construction.

The Powder Coating segment is anticipated to witness the fastest CAGR during the forecast period, driven by its environmental benefits, such as low VOC emissions, high material utilization, and superior finish quality. This segment is gaining strong traction across furniture, appliance, and automotive component coatings.

• By End Use

On the basis of end use, the industrial coating market is segmented into General Industrial, Automotive & Transportation, Marine Protective, Industrial Wood, and Packaging. The General Industrial segment dominated the market with the largest revenue share of 33.6% in 2024, due to the broad application of coatings in equipment, tools, construction materials, and machinery used in industrial production.

The Automotive & Transportation segment is expected to register the fastest CAGR from 2025 to 2032, fueled by the increasing demand for lightweight vehicle materials, corrosion protection, and high-performance aesthetics. Industrial coatings play a crucial role in extending vehicle durability and enhancing fuel efficiency through advanced material finishes.

Which Region Holds the Largest Share of the Industrial Coating Market?

- Asia-Pacific dominated the industrial coating market with the largest revenue share of 39.82% in 2024, driven by robust manufacturing output across automotive, electronics, and heavy industries, along with increasing adoption of advanced surface engineering technologies

- Countries such as China, Japan, India, and South Korea are accelerating investment in aerospace, renewable energy, and public infrastructure maintenance, which fuels demand for high-performance, eco-friendly coatings such as cold gas spray

- The rise of localized production, combined with regional initiatives promoting sustainable manufacturing and lifecycle extension of industrial components, positions Asia-Pacific as a global leader in industrial coating innovation and adoption

China Industrial Coating Market Insight

China held the largest market share in Asia-Pacific in 2024, attributed to its massive industrial output, strong presence in OEM and MRO markets, and government support for smart manufacturing and green technologies. The country's growing export of value-added coated products and rising focus on military and aviation applications are key factors boosting cold spray technology penetration across various industries.

Japan Industrial Coating Market Insight

Japan is experiencing rapid growth in the industrial coating sector, backed by its precision engineering expertise, high demand for lightweight protective coatings, and increasing usage in robotics, electronics, and medical devices. The country’s emphasis on non-invasive repair methods and environmentally responsible solutions is propelling adoption of cold spray technologies, particularly for aging infrastructure and high-tech applications.

Which Region is the Fastest Growing Region in the Industrial Coating Market?

North America is projected to grow at the fastest CAGR of 8.1% during the forecast period from 2025 to 2032, supported by increased demand for high-performance coatings in aerospace, defense, and energy sectors. The region’s rising focus on refurbishing aging assets, corrosion control, and additive manufacturing is driving growth. Furthermore, the presence of top-tier companies and advanced R&D capabilities fosters innovation in thermal and cold spray technologies across key industries.

U.S. Industrial Coating Market Insight

The U.S. market leads North America in 2024, fueled by strong investment in aerospace, military modernization, and sustainable manufacturing practices. The demand for advanced coatings in sectors such as oil & gas, infrastructure, and electronics is rising, with government initiatives supporting cold spray innovation for component repair and lifecycle extension.

Canada Industrial Coating Market Insight

Canada is witnessing growing adoption of industrial coatings due to its emphasis on resource industries, infrastructure renewal, and environmental compliance. Cold spray applications are expanding in mining equipment, transportation components, and clean energy systems, backed by national efforts to develop sustainable and low-emission manufacturing technologies.

Which are the Top Companies in Industrial Coating Market?

The industrial coating industry is primarily led by well-established companies, including:

- PPG Industries, Inc. (U.S.)

- NIPSEA Group (Singapore)

- Axalta Coating Systems, LLC (U.S.)

- The Sherwin-Williams Company (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Asian Paints (India)

- Jotun (Norway)

- Beckers Group (Sweden)

- RPM International Inc. (U.S.)

- Kansai Paint Co., Ltd. (Japan)

- Hempel A/S (Denmark)

- KCC CORPORATION (South Korea)

- Sika AG (Switzerland)

- NOROO Paint & Coatings Co., Ltd. (South Korea)

- Wacker Chemie AG (Germany)

What are the Recent Developments in Global Industrial Coating Market?

- In September 2024, Evonik Coating Additives has introduced groundbreaking biosurfactants tailored for coating and ink formulations. The two new products, TEGO Wet 570 Terra and TEGO Wet 580 Terra, are poised to revolutionize the paints, coatings, and inks industry by delivering high performance while offering outstanding sustainability

- In September 2024, Crawford United Corporation announced the acquisition of Advanced Industrial Coatings, based in Stockton, California. Advanced Industrial Coatings specializes in providing high-performance coating solutions for the aerospace, semiconductor, medical, energy, and other industrial sectors. The company offers custom solutions, including non-stick, heat-resistant, chemical-resistant, and anti-corrosion applications, for industries requiring fluoropolymers and other advanced coatings

- In August 2020, Sherwin-Williams Protective & Marine has introduced a rapid curing technology aimed at significantly reducing application time and labor costs for structural steel protection. The Envirolastic 2500 system, which provides comparable color and gloss retention to polyurethane topcoats, can be applied as a single or multi-coat solution. This allows for quicker shop processing compared to conventional two-pack coating systems

- In July 2020, PPG has launched its newly formulated PPG SURFACE SEAL Hydrophobic Coating for aerospace transparencies. Designed specifically for glass and anti-static coated glass windshields, Surface Seal is a top-tier rain and water-repellent coating system. It enhances pilot visibility in wet conditions and, when used as a replacement for traditional windshield-wiping systems, can contribute to improved fuel efficiency by reducing weight and enhancing aerodynamics

- In January 2020, Royal DSM, a global leader in science-driven solutions for Nutrition, Health, and Sustainable Living, announced that its innovative bio-based self-matting resin, Decovery® SP-2022 XP, has been successfully incorporated by coating formulators Ciranova and Arboritec AB into products showcased at Domotex 2020

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.