Global Industrial Protective Clothing Market

Market Size in USD Billion

CAGR :

%

USD

5.20 Billion

USD

7.80 Billion

2024

2032

USD

5.20 Billion

USD

7.80 Billion

2024

2032

| 2025 –2032 | |

| USD 5.20 Billion | |

| USD 7.80 Billion | |

|

|

|

|

Industrial Protective Clothing Market Size

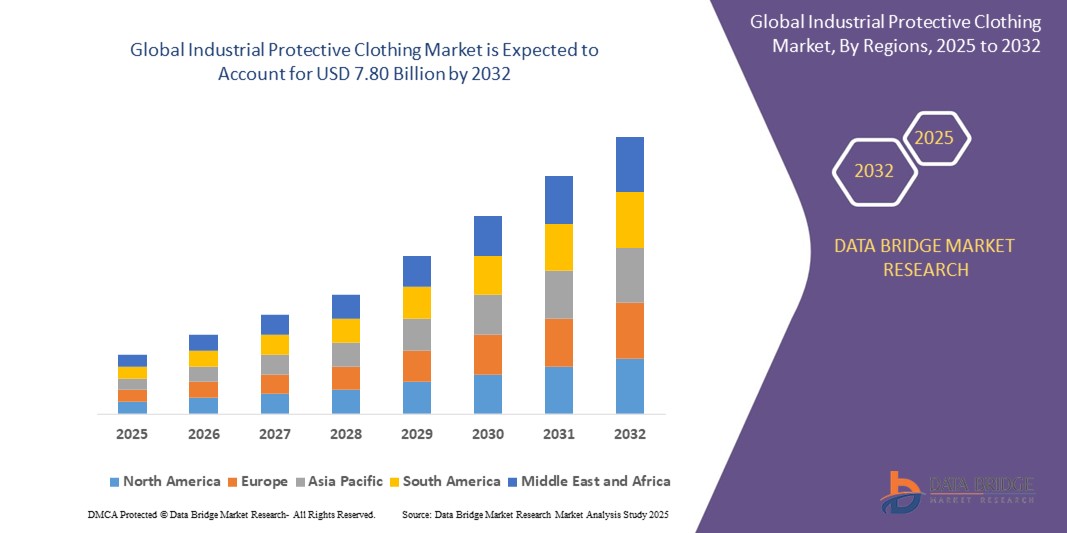

- The Global Industrial Protective Clothing Market size was valued at USD 5.20 Billion in 2024 and is expected to reach USD 7.80 Billion by 2032, at a CAGR of 5.10 % during the forecast period.

- The market growth is primarily driven by stringent workplace safety regulations, increasing awareness of occupational hazards, rising industrialization in emerging economies, and technological advancements in textile materials.

- Furthermore, growing demand from end-use industries—particularly oil & gas, construction, and mining—combined with the introduction of smart protective garments integrated with IoT sensors, eco-friendly fabric innovations, and expanding distribution through e-commerce platforms are accelerating market expansion worldwide.

Industrial Protective Clothing Market Analysis

- Industrial protective clothing comprises garments designed to safeguard workers against a variety of hazards such as flames, chemicals, cuts, high-visibility requirements, and electrical arc flashes. These garments are made from specialized materials—like Nomex, Kevlar, and high-performance polymers—to offer thermal resistance, chemical impermeability, and mechanical durability.

- The market is experiencing steady growth due to heightened regulatory enforcement by bodies such as OSHA (Occupational Safety and Health Administration) in the U.S., the European Agency for Safety and Health at Work (EU-OSHA), and equivalent agencies in Asia-Pacific, which mandate the use of certified protective apparel.

- Asia-Pacific is expected to dominate the Global Industrial Protective Clothing Market, driven by rapid industrialization, large workforce in hazardous sectors, and government initiatives to enforce safety standards in countries like China, India, and Southeast Asian nations. This region accounted for over 40 % of global consumption in 2024.

- North America is projected to be the second-largest region, supported by robust adoption of advanced protective solutions, significant R&D investments by key players, and well-established supply chains. The U.S. market, in particular, witnesses continuous innovations in smart textiles and wearable sensors to monitor worker vitals and environmental conditions.

- By product type, the Coveralls segment holds the largest market share due to its comprehensive protection coverage and widespread use in multiple end-use industries. Jackets and Gloves segments also constitute significant shares, especially in cold-temperature operations and chemical handling applications.

Report Scope and Industrial Protective Clothing Market Segmentation

|

Attributes |

Industrial Protective Clothing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Protective Clothing Market Trends

“Integration of Smart Textiles, Sustainability, and Ergonomic Design”

- A significant trend is the integration of smart textile technology—such as embedded temperature sensors, accelerometers, and gas detectors—into protective garments. These innovations enable real-time monitoring of worker vitals, exposure levels, and environmental hazards, thereby reducing accident response times and enhancing overall workplace safety.

- Sustainability is gaining traction, with manufacturers introducing protective clothing made from recycled and biodegradable materials, low-VOC (volatile organic compound) coatings, and recycled nylon or polyester fabrics. This addresses growing demand for environmentally responsible PPE solutions that also meet performance standards.

- Ergonomic and comfort-oriented designs are being prioritized, including lightweight composite fabrics, moisture-wicking linings, and stretchable reinforcements. Such features reduce heat stress, fatigue, and mobility constraints, thereby increasing wearer compliance and productivity.

- Digital platforms and Industry 4.0 initiatives are influencing procurement, with centralized PPE management systems that track inventory, usage rates, and predictive maintenance schedules. This shift is streamlining supply chains and reducing downtime associated with protective clothing replacements

Industrial Protective Clothing Market Dynamics

Driver

“Increasing Stringent Safety Regulations and Growing Industrialization in Emerging Economies”

- Regulatory bodies across North America, Europe, and Asia-Pacific are enforcing stricter workplace safety standards that mandate certified protective apparel—for example, NFPA 70E for arc flash protection, EN ISO 11612 for heat and flame resistance, and ANSI/ISEA 107 for high-visibility garments. This creates a sustained demand for compliant protective clothing.

- Rapid industrialization in China, India, and Southeast Asia is driving demand for protective apparel in core sectors such as oil & gas, construction, and mining. Government initiatives focused on infrastructure development and occupational health are further stimulating market expansion.

- Technological advancements in fiber materials—such as meta-aramid blends, para-aramid reinforcements, and inherently flame-resistant polymers—are broadening the application scope of protective clothing to more extreme operating conditions

Restraint/Challenge

“High Cost of Advanced Materials and Comfort-Performance Trade-Offs”

- The cost of raw materials—particularly high-performance aramid fibers and specialty coatings—remains high, leading to elevated selling prices for advanced protective garments. This can hinder adoption among small-to-medium enterprises (SMEs) with constrained budgets.

- Balancing protective performance with wearer comfort is challenging: garments designed for maximum chemical or thermal resistance often suffer from poor breathability and increased weight, contributing to heat stress and reduced mobility.

- Regional disparities in regulatory enforcement—where developing countries may lack consistent PPE mandates—limit market penetration for premium protective clothing in those markets.

Industrial Protective Clothing Market Scope

The market is segmented on the basis of material, product type, end-use, and distribution channel.

- By Material

On the basis of material it is segmented into Flame-Resistant, Chemical-Resistant, Cut-Resistant, High-Visibility, Arc Flash, and Others (e.g., Waterproof, Insulated fibers).

The Flame-Resistant segment dominates the market with over 30 % revenue share in 2024, owing to widespread use in oil & gas, utilities, and petrochemical industries. The Chemical-Resistant segment is expected to witness the highest growth rate during the forecast period, driven by stringent safety standards in the chemical processing and pharmaceutical sectors

- By Product Type

On the basis of product type the Industrial Protective Clothing Market is segmented into Coveralls, Jackets, Trousers, Gloves, Safety Vests, Others (e.g., Aprons, Lab Coats).

The Coveralls segment holds the largest revenue share in 2024 due to its versatility and comprehensive protection against multiple hazards. Gloves are also significant, particularly in manufacturing and healthcare industries where dexterity and barrier protection are critical.

- By End-Use

On the basis of end-use it is segmented into Oil & Gas, Construction, Manufacturing, Mining, Healthcare, Others (e.g., Food Processing, Utilities).

The Oil & Gas segment dominates the market with a 28 % share in 2024, driven by the high-risk environment that necessitates flame-resistant and chemical-resistant fabrics. The Construction segment is projected to grow steadily due to increased infrastructure projects and heightened focus on worker safety in developing regions

- By Distribution Channel

On the basis of distribution channel it is segmented into Direct Sales, Distributors, Online Retail.

Direct Sales account for the largest share in 2024, as major end-users prefer bulk procurement through long-term contracts with OEMs. The Online Retail segment is expected to register the highest CAGR during the forecast period, owing to rising e-commerce penetration and smaller businesses purchasing standardized protective clothing via digital platforms

Industrial Protective Clothing Market Regional Analysis

Asia-Pacific dominates the market with a revenue share of approximately 42 % in 2024, driven by rapid industrialization in China and India, large-scale infrastructure projects, and increasing enforcement of workplace safety regulations. China holds the largest share within Asia-Pacific, supported by its vast manufacturing base and government subsidies for safety equipment procurement. India is expected to witness the fastest CAGR of 6.5 % from 2025 to 2032, fueled by growing awareness of occupational hazards, expansion of the petrochemical and construction sectors, and rising disposable incomes.

North America holds the second-largest share at 25 % in 2024, led by the U.S. market. Demand is propelled by stringent OSHA regulations, widespread adoption of smart protective garments, and continuous product innovations by key players. Canada also shows steady growth due to similar regulatory frameworks and investments in mining and oil & gas operations in provinces like Alberta.

Europe accounts for 22 % of global revenue in 2024, with Germany, France, and the U.K. being major contributors. The market is driven by strict EU directives on worker safety (e.g., PPE Regulation EU 2016/425), high healthcare and industrial budgets, and a strong aftermarket for replacement PPE. Eastern European countries are witnessing gradual growth due to increased foreign direct investments in manufacturing facilities

Industrial Protective Clothing Market Share

The speciality starches is primarily led by well-established companies, including:

- DuPont (U.S.)

- Honeywell International Inc. (U.S.)

- 3M Company (U.S.)

- Ansell Limited (Australia)

- Lakeland Industries, Inc. (U.S.)

- Kimberly-Clark Corporation (U.S.)

- Mcr Safety (U.S.)

- Uvex Safety Group (Germany)

- Allegro Industries (U.S.)

- Carrington Textiles (U.K.)

Latest Developments in Global Industrial Protective Clothing Market

- In April 2025, DuPont introduced a next-generation flame-resistant coverall made from a novel Aramid-Blend fabric, offering 20 % greater thermal protection and a 15 % reduction in garment weight compared to previous models.

- In March 2025, Honeywell International Inc. launched a smart protective jacket embedded with Bluetooth-enabled sensors that monitor worker heart rate, ambient temperature, and toxic gas exposure, transmitting real-time alerts to central safety systems.

- In February 2025, 3M Company partnered with a leading textile manufacturer to develop a new line of reusable, biodegradable chemical-resistant suits certified under EN ISO 16602 standards, reducing environmental impact by 30 %.

- In January 2025, Ansell Limited acquired a European startup specializing in antimicrobial fabric treatments for protective garments, aiming to expand its portfolio in healthcare and pharmaceutical industries.

- In January 2025, Lakeland Industries, Inc. opened a new R&D facility in Texas, U.S., focused on developing high-visibility fabrics with integrated LED notice panels to enhance worker safety in low-light conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.