Global Insect Screen Market

Market Size in USD Million

CAGR :

%

USD

789.40 Million

USD

1,184.19 Million

2024

2032

USD

789.40 Million

USD

1,184.19 Million

2024

2032

| 2025 –2032 | |

| USD 789.40 Million | |

| USD 1,184.19 Million | |

|

|

|

|

Insect Screen Market Size

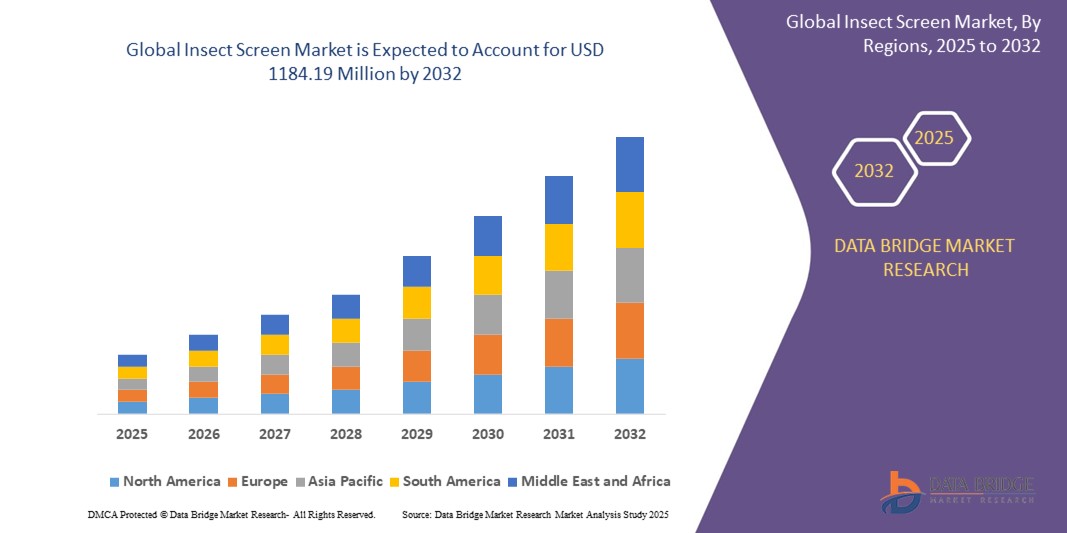

- The global ophthalmic operational microscope market was valued at USD 789.40 million in 2024 and is expected to reach USD 1184.19 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.2%, primarily driven by the increasing demand for pest control solutions

- This growth is driven by factors such as rising awareness of vector-borne diseases, growing preference for eco-friendly home solutions, and increasing adoption of insect screens in residential and commercial buildings

Insect Screen Market Analysis

- Insect screens are protective mesh systems installed on windows, doors, and ventilation areas to block insects while allowing airflow and visibility. They are widely used in residential, commercial, and industrial settings

- The demand for insect screens is significantly driven by growing awareness of vector-borne diseases such as malaria, dengue, and Zika virus. Increasing emphasis on health and hygiene, especially in tropical and subtropical regions, fuels market growth

- The North America region stands out as one of the dominant regions for insect screens, supported by strong construction activities, consumer preference for natural ventilation, and stringent regulations on pest control

- For instance, October 2023, Phantom Screens expanded its product offerings across the U.S. with innovative retractable insect screens tailored for both modern and traditional home designs, reinforcing market demand for customizable, aesthetic screening solutions

- Globally, insect screens are increasingly viewed as essential home and building components that improve indoor air quality, reduce reliance on chemical repellents, and promote sustainable living environments

Report Scope and Insect Screen Market Segmentation

|

Attributes |

Insect Screen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insect Screen Market Trends

“Integration of Smart and Retractable Screen Technologies”

- One prominent trend in the global insect screen market is the increased adoption of smart and retractable screen technologies, offering both functionality and aesthetic appeal for modern architectural designs

- These advanced screens provide flexibility by allowing users to deploy or retract the mesh as needed, enhancing convenience while maintaining insect protection and airflow

- For instance, In May 2023, Centor introduced its latest retractable insect screen system integrated with thermal insulation and smart home compatibility, responding to consumer demand for energy-efficient and multifunctional products

- Smart insect screens, embedded with motion sensors or remote-control systems, are also gaining traction in premium housing and commercial applications, especially in regions experiencing increased construction of luxury homes

- This trend is revolutionizing the way buildings incorporate insect protection, merging technology with user comfort, and driving demand for innovative insect screen solutions globally

Insect Screen Market Dynamics

Driver

“Increasing Demand for Protective and Energy-Efficient Home Solutions”

- The rising demand for effective insect control in residential and commercial spaces is significantly contributing to the growth of the insect screen market

- Consumers are increasingly opting for insect screens as a non-chemical, eco-friendly solution to prevent insect-borne diseases such as dengue, malaria, and Zika virus

- Insect screens are also being adopted for their secondary benefits, including improved ventilation, reduced use of air conditioning, and enhanced energy efficiency

- The growing awareness of vector-borne diseases and the importance of maintaining hygienic living environments has led to a surge in installations of insect screens in windows and doors, and ventilation systems

- Moreover, modern insect screens offer additional functionalities such as retractability, UV protection, and integration with smart home systems, making them more appealing to consumers

For instance,

- In March 2023, Phifer Incorporated reported a spike in demand for its insect screen products across North America due to increasing public health awareness and rising consumer preference for sustainable, non-toxic pest control solutions

- In September 2022, RETRACTASCREEN introduced a new range of retractable insect screens targeting urban housing in Southeast Asia, where there is heightened concern about mosquito-borne illnesses amid rising temperatures and humidity

- As a result of increasing awareness of disease prevention, eco-friendly living, and comfort, the global insect screen market is experiencing a strong and growing demand trajectory

Opportunity

“Smart Home Integration and Technological Advancements in Insect Screens”

- The integration of insect screens with smart home systems presents a significant opportunity for market growth, enabling users to control and monitor screens remotely for enhanced convenience and security

- Advanced insect screens are being developed with features such as automated opening and closing, sensor-triggered operation, and compatibility with voice assistants like Alexa and Google Assistant

- In addition, manufacturers are incorporating materials that offer multifunctionality—such as UV protection, air filtration, and heat insulation—appealing to environmentally conscious consumers

For instance,

- In December 2024, Centor Architectural launched an innovative retractable insect screen with smart sensor integration that automatically closes when insect activity is detected, gaining popularity in tech-forward households in Europe and North America

- In August 2023, Phantom Screens unveiled a smart insect screen system that syncs with home automation platforms, allowing for scheduled operation and remote control via mobile apps

- These technological advancements not only elevate user experience but also contribute to energy efficiency, enhanced air quality, and protection from pests—making insect screens a smart and health-conscious addition to modern homes

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of advanced insect screen systems, especially those with integrated technologies such as smart sensors and automated features, poses a significant barrier to market growth

- These high-end insect screens can often cost several times more than traditional manual or fixed insect screens, making them unaffordable for budget-conscious consumers or small-scale businesses

- The cost of installation, maintenance, and potential repairs for such sophisticated systems further adds to the financial challenge, particularly in developing regions where income levels and budgets are more constrained

For instance,

- In October 2024, Rollertech raised concerns about the cost of retractable insect screen systems, noting that the high price point for automated models is limiting their adoption in both residential and commercial sectors in emerging markets

- In June 2023, Luxscreen reported that their smart insect screen systems, which offer UV and heat protection, have a higher price tag that affects their accessibility for middle-income households, especially in regions where affordability is a key factor in purchasing decisions

- As a result, the demand for more affordable, manual, or basic models remains prevalent, potentially stalling the widespread adoption of technologically advanced insect screens

Insect Screen Market Scope

The market is segmented on the basis of type, material, application, sales channel, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material |

|

|

By Application |

|

|

By Sales Channel |

|

|

By End User |

|

Insect Screen Market Regional Analysis

“North America is the Dominant Region in the Insect Screen Market”

- North America holds a dominant share in the global insect screen market, driven by the region's high demand for quality and innovation in home and commercial solutions

- The U.S. is the key player, supported by a high standard of living, increasing awareness about health and safety, and a growing demand for products that offer both protection and aesthetic appeal

- Technological advancements in retractable, motorized, and automated insect screens have further strengthened market demand, particularly in residential buildings and commercial properties

- Well-established distribution channels, a robust construction industry, and the increasing adoption of energy-efficient building materials are fueling the market expansion across the region

- In addition, North America is witnessing an increasing trend of urbanization, with more households opting for high-quality insect screen solutions for better comfort and hygiene

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to witness the highest growth rate in the global insect screen market, driven by increasing urbanization, rising disposable incomes, and growing awareness of hygiene and protection against insects

- Countries such as China, India, and Japan are emerging as key markets due to rapid infrastructural development, especially in the residential and commercial sectors, alongside rising demand for quality insect protection solutions

- Japan remains a critical market due to its advanced technological landscape and preference for premium, energy-efficient insect screen solutions, further fueling market expansion

- China and India, with their large and growing populations, coupled with rapid urbanization and improving living standards, are witnessing increased demand for insect screens in both new construction and retrofit applications. Additionally, a surge in government initiatives promoting healthier and safer living environments contributes to the market's growth

Insect Screen Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Phifer Incorporated (U.S.)

- Saint-Gobain ADFORS (France)

- Andersen Corporation (U.S.)

- Marvin Windows and Doors (U.S.)

- Renson (Belgium)

- Smartex Screen Co., Ltd. (China)

- Anping County Zhuodi Wire Mesh Products Co., Ltd. (China)

- Wuqiang Huihuang Fiberglass Factory (China)

- Vestergaard (Switzerland)

- Magicseal (New Zealand)

- Freedom Retractable Screens (Australia)

- Progressive Screens (U.S.)

- Pronema (Italy)

- RajFilters (India)

- Shaoxing Naite Plastics Co., Ltd. (China)

Latest Developments in Global Insect Screen Market

- In May 2024, Phantom Screens introduced its Clearview Motorized Screens, a cutting-edge addition to its retractable screen lineup. Designed for extensive use in patios, multi-hinged doors, and wide windows, these screens offer enhanced visibility and incorporate advanced technology for smooth operation, quiet performance, and exceptional durability. Notably, the Clearview Motorized Screens feature eco-friendly components, catering to the growing demand for sustainable products. Phantom Screens showcased these innovations at the 2024 International Builders’ Show in Las Vegas, which highlighted smart home advancements. This launch underscores the company’s commitment to delivering high-quality, personalized insect screen solutions

- On January 31, 2025, Phifer unveiled its innovative 'Grip Fit' insect screen system, crafted to deliver stylish and durable protection for outdoor spaces. Featuring a minimalist design, it seamlessly integrates with existing architecture, enhancing the visual appeal of patios and verandahs while effectively keeping insects out. The 'Grip Fit' system is designed for year-round use, offering easy maintenance and long-lasting performance. This launch underscores Phifer's commitment to combining functionality with aesthetics, catering to the needs of modern outdoor living

- On January 31, 2025, the Europe insect screen market was valued at USD 285.4 million in 2024 and is projected to reach $480 million by 2035, growing at a CAGR of 5.0% from 2025 to 2035. This growth is fueled by rising health awareness, urbanization, and the increasing demand for eco-friendly solutions. Insect screens play a vital role in preventing pests like mosquitoes and flies from entering homes and businesses, enhancing comfort and hygiene. The market's expansion reflects the growing emphasis on sustainable and effective pest control solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.