Global Integrase Inhibitors Market

Market Size in USD Billion

CAGR :

%

USD

15.37 Billion

USD

24.32 Billion

2024

2032

USD

15.37 Billion

USD

24.32 Billion

2024

2032

| 2025 –2032 | |

| USD 15.37 Billion | |

| USD 24.32 Billion | |

|

|

|

|

Integrase Inhibitors Market Size

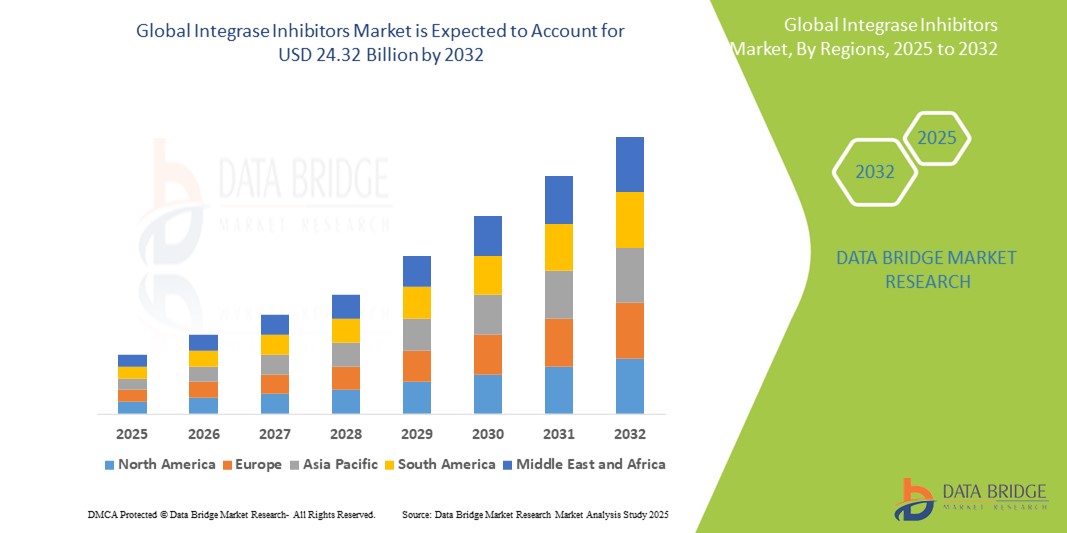

- The global integrase inhibitors market size was valued at USD 15.37 billion in 2024 and is expected to reach USD 24.32 billion by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely fueled by the increasing global prevalence of HIV/AIDS and the growing preference for highly effective antiretroviral therapies that offer fewer side effects and better patient compliance

- Furthermore, rising investments in R&D and the introduction of advanced integrase strand transfer inhibitors (INSTIs) are positioning these drugs as a cornerstone of modern HIV treatment regimens. These converging factors are accelerating the uptake of integrase inhibitors, thereby significantly boosting the industry's growth

Integrase Inhibitors Market Analysis

- Integrase inhibitors, a class of antiretroviral drugs targeting the integrase enzyme essential for HIV replication, are increasingly recognized as vital components of modern HIV treatment regimens in both developed and developing regions due to their potent antiviral activity, high barrier to resistance, and favorable safety profiles

- The escalating demand for integrase inhibitors is primarily fueled by rising HIV prevalence, the shift toward first-line treatment regimens including integrase strand transfer inhibitors (INSTIs), and growing global awareness and screening efforts

- North America dominated the integrase inhibitors market with the largest revenue share of 39.2% in 2024, characterized by strong healthcare infrastructure, favorable reimbursement policies, and the widespread adoption of newer-generation HIV therapies, with the U.S. leading due to high diagnosis rates and robust drug development pipelines from key pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the integrase inhibitors market during the forecast period due to expanding healthcare access, rising government initiatives, and increasing availability of generic antiretrovirals

- Dolutegravir segment dominated the integrase inhibitors market with a market share of 46.4% in 2024, driven by its proven efficacy, low resistance profile, and endorsement as a preferred option in international HIV treatment guidelines

Report Scope and Integrase Inhibitors Market Segmentation

|

Attributes |

Integrase Inhibitors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Integrase Inhibitors Market Trends

“Advancements in Long-Acting Formulations and Treatment Simplification”

- A significant and accelerating trend in the global integrase inhibitors market is the development of long-acting injectable formulations and simplified treatment regimens aimed at improving patient adherence and reducing pill burden for individuals living with HIV

- For instance, ViiV Healthcare's Cabenuva, a long-acting combination of cabotegravir and rilpivirine, allows for monthly or bi-monthly dosing, providing an alternative to daily oral therapy and addressing challenges related to treatment fatigue and adherence. Similarly, other long-acting pipeline candidates are being explored for less frequent administration and enhanced convenience

- Long-acting integrase inhibitors offer the potential to improve clinical outcomes by ensuring consistent drug levels, minimizing missed doses, and reducing the risk of resistance development. In addition, treatment simplification strategies are focusing on dual therapy regimens, such as dolutegravir plus lamivudine, which maintain efficacy while decreasing the number of drugs and potential side effects

- The growing interest in treatment personalization and lifestyle-compatible therapies is driving pharmaceutical innovation in this space. Companies are prioritizing extended-release and injectable versions of existing integrase inhibitors to meet evolving patient needs

- Furthermore, ongoing collaborations between global health organizations and pharmaceutical firms are accelerating the development and distribution of these advanced therapies, particularly in resource-limited settings. Efforts include simplifying distribution logistics, enhancing cold chain capabilities, and ensuring affordability and access

- This trend toward long-acting, simplified HIV therapies is reshaping treatment paradigms, with integrase inhibitors at the forefront. As demand for more convenient and patient-centric options grows, integrase inhibitors with improved delivery mechanisms are expected to gain widespread adoption across both high-income and low- to middle-income countries

Integrase Inhibitors Market Dynamics

Driver

“Rising HIV Prevalence and Preference for Potent, Well-Tolerated Therapies”

- The increasing global burden of HIV infections, particularly in low- and middle-income countries, coupled with a growing preference for effective and well-tolerated antiretroviral therapies, is a significant driver for the rising demand for integrase inhibitors

- For instance, in March 2024, Gilead Sciences announced advancements in integrase inhibitor-based combination therapies as part of their long-acting HIV treatment pipeline, aiming to address adherence challenges and improve patient quality of life. Such developments by major pharmaceutical companies are expected to drive the integrase inhibitors market growth during the forecast period

- As health systems and patients seek optimized regimens with fewer side effects and a lower risk of resistance, integrase inhibitors have emerged as the preferred component in first-line and switch HIV therapies due to their potent antiviral efficacy and safety profile

- Furthermore, the global push toward achieving UNAIDS 95-95-95 targets is promoting early diagnosis, treatment initiation, and viral suppression, thus increasing the adoption of effective integrase-based treatments across regions

- The availability of single-tablet regimens, fixed-dose combinations, and long-acting formulations enhances patient convenience and adherence, supporting their widespread use. As treatment strategies become more personalized and patient-centered, integrase inhibitors are increasingly viewed as essential to modern HIV care strategies across diverse healthcare settings

Restraint/Challenge

“Side Effects, Drug Resistance, and Regulatory Hurdles”

- Concerns surrounding the side effects and long-term safety of integrase inhibitors, along with the challenges of regulatory compliance across global markets, pose significant restraints to broader adoption. While generally well-tolerated, some integrase inhibitors have been linked to neuropsychiatric side effects or weight gain, raising concerns among clinicians and patients

- For instance, post-marketing reports and observational studies have noted increased risks of insomnia, anxiety, and weight-related issues with certain integrase inhibitors such as dolutegravir, prompting closer regulatory scrutiny and demand for more comprehensive safety data

- Addressing these concerns requires ongoing pharmacovigilance, transparent data reporting, and tailored prescribing practices, particularly for populations with comorbidities or those vulnerable to adverse effects. Regulatory bodies across regions demand rigorous clinical data to approve or expand indications for integrase inhibitors, which can slow market access, especially for new or long-acting formulations

- In addition, the emergence of drug-resistant HIV strains, though less common with newer integrase inhibitors, still presents a threat to sustained efficacy. This challenge underscores the need for continued research and surveillance to ensure treatment durability

- High development costs, coupled with strict pricing and reimbursement frameworks in several regions, may limit patient access, particularly in resource-limited settings. While initiatives to expand access are ongoing, inconsistent regulatory and pricing environments remain a significant challenge for manufacturers

- Overcoming these obstacles through innovation in drug development, regulatory alignment, and global access initiatives will be critical to maintaining the growth momentum of the integrase inhibitors market

Integrase Inhibitors Market Scope

The market is segmented on the basis of drug, drug type, dosage, route of administration, end-user, and distribution channel.

- By Drug

On the basis of drug, the integrase inhibitors market is segmented into raltegravir, dolutegravir, elvitegravir, and bictegravir. Dolutegravir dominated the market with the largest market revenue share in 2024 due to its high efficacy, low resistance profile, and endorsement as a first-line treatment option in global HIV treatment guidelines. Its widespread availability as both branded and generic formulations has further boosted accessibility, especially in low- and middle-income countries.

Bictegravir is anticipated to witness the fastest growth rate from 2025 to 2032, supported by its inclusion in once-daily fixed-dose combination therapies and superior tolerability. Its limited drug-drug interactions and high genetic barrier to resistance make it an increasingly preferred option among newly diagnosed patients.

- By Drug Type

On the basis of drug type, the market is segmented into branded and generics. The branded segment led the market in 2024, driven by the dominance of innovator drugs such as Tivicay (dolutegravir) and Biktarvy (bictegravir-based regimen), which offer high efficacy and are supported by strong clinical data.

However, the generics segment is expected to register the fastest CAGR through 2032, owing to patent expirations and global health programs prioritizing cost-effective treatments to expand HIV care coverage in resource-limited settings.

- By Dosage

On the basis of dosage, the integrase inhibitors market is segmented into tablets and others. Tablets held the largest revenue share in 2024, owing to patient convenience, ease of storage, and dominance of oral daily regimens in HIV treatment.

The others category, which includes long-acting injectable formulations and future delivery innovations, is projected to grow rapidly during forecast period, fueled by demand for less frequent dosing and improved patient adherence

- By Route Of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, and others. Oral administration remained the dominant route in 2024 due to the established use of oral integrase inhibitor tablets across global HIV treatment protocols.

Intravenous and other routes, particularly injectable long-acting therapies, are gaining traction and expected to see rapid adoption during forecast period, as part of efforts to reduce pill burden and improve quality of life.

- By End User

On the basis of end-user, the market is segmented into clinic, hospital, and others. Hospitals led the market in 2024, supported by high patient volume, availability of specialist care, and integration with national HIV treatment programs.

Clinics, particularly community health centers and outpatient care facilities, are expected to grow steadily during forecast period, due to decentralization of HIV care and greater accessibility in urban and semi-urban regions.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacies held the largest share in 2024 owing to their central role in dispensing ARVs through institutional care settings.

Online pharmacies are expected to witness the fastest growth during the forecast period, driven by increased digital health adoption, especially post-pandemic, and efforts to improve treatment access and convenience for patients managing chronic HIV care.

Integrase Inhibitors Market Regional Analysis

- North America dominated the integrase inhibitors market with the largest revenue share of 39.2% in 2024, driven by strong healthcare infrastructure, favorable reimbursement policies, and the widespread adoption of newer-generation HIV therapies

- Patients in the region benefit from access to innovative HIV treatment options, including branded and long-acting integrase inhibitors, supported by strong reimbursement systems and clinical adherence to global treatment guidelines

- This robust market position is further reinforced by the presence of major pharmaceutical companies, ongoing clinical research, and public health initiatives aimed at early testing and viral suppression, positioning integrase inhibitors as a preferred therapeutic option across diverse healthcare settings

U.S. Integrase Inhibitors Market Insight

The U.S. integrase inhibitors market captured the largest revenue share of 85% in 2024 within North America, driven by widespread awareness, early HIV diagnosis, and access to advanced treatment regimens. The presence of major pharmaceutical companies, favorable reimbursement policies, and a strong focus on long-acting therapies contribute significantly to market dominance. The U.S. is also a hub for clinical trials and innovation in HIV drug development, supporting continual adoption of newer integrase inhibitors and combination therapies across healthcare settings.

Europe Integrase Inhibitors Market Insight

The Europe integrase inhibitors market is projected to expand at a substantial CAGR throughout the forecast period, supported by national HIV prevention programs and access to high-quality healthcare infrastructure. Strong regulatory support for generic HIV drugs and increased focus on viral suppression goals are driving treatment uptake. European countries are seeing growing demand for once-daily and simplified therapy regimens, with market expansion across both public health systems and private healthcare providers.

U.K. Integrase Inhibitors Market Insight

The U.K. integrase inhibitors market is anticipated to grow at a noteworthy CAGR during the forecast period, bolstered by NHS-led HIV care programs and national targets for early diagnosis and sustained viral suppression. The shift toward patient-friendly regimens, including two-drug therapies and long-acting options, is accelerating adoption. Government-backed initiatives to reduce new infections and improve access to treatment are such asly to sustain growth.

Germany Integrase Inhibitors Market Insight

The Germany integrase inhibitors market is expected to expand at a considerable CAGR during the forecast period, propelled by the country’s robust healthcare coverage, patient education, and proactive HIV testing strategies. Germany’s emphasis on clinical efficacy and data-backed treatment outcomes aligns with the uptake of integrase inhibitors in standard-of-care regimens. The demand for simplified, well-tolerated therapies supports increasing prescriptions of dolutegravir- and bictegravir-based combinations.

Asia-Pacific Integrase Inhibitors Market Insight

The Asia-Pacific integrase inhibitors market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by rising HIV prevalence, expanding healthcare infrastructure, and increasing affordability of antiretroviral therapies. Countries such as China, India, and Thailand are investing in national HIV programs, improving treatment access and supply of generics. Regional efforts to achieve UNAIDS 95-95-95 goals are contributing to expanded use of effective integrase-based regimens.

Japan Integrase Inhibitors Market Insight

The Japan integrase inhibitors market is gaining momentum due to strong governmental support for HIV treatment, high awareness, and early adoption of innovative therapies. Japan’s integrated healthcare system and preference for advanced drug delivery options are supporting the uptake of branded integrase inhibitors. Growing demand for reduced-pill regimens and enhanced safety profiles makes integrase inhibitors a preferred component in therapy.

India Integrase Inhibitors Market Insight

The India integrase inhibitors market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by widespread use of generic antiretrovirals, support from government and non-government programs, and high HIV burden. India benefits from domestic pharmaceutical manufacturing, making integrase inhibitors widely accessible. Public health initiatives such as free ART distribution and awareness campaigns are propelling growth, particularly in urban and semi-urban regions

Integrase Inhibitors Market Share

The integrase inhibitors industry is primarily led by well-established companies, including:

- ViiV Healthcare (U.K.)

- Gilead Sciences, Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Cipla Ltd. (India)

- Aurobindo Pharma Ltd. (India)

- Mylan Pharmaceuticals Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Hetero Labs Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Lupin Ltd. (India)

- Viatris Inc. (U.S.)

- Apotex Inc. (Canada)

- Strides Pharma Science Ltd. (India)

- Zydus Lifesciences Ltd. (India)

- Sandoz International GmbH (Germany)

- AbbVie Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Alkem Laboratories Ltd. (India)

What are the Recent Developments in Global Integrase Inhibitors Market?

- In April 2024, ViiV Healthcare, a global leader in HIV treatment, announced the expansion of its Cabenuva (cabotegravir + rilpivirine) long-acting injectable therapy into additional markets, following regulatory approvals in Latin America and Southeast Asia. This move marks a significant step toward increasing global access to long-acting HIV treatment solutions and reflects ViiV’s commitment to patient-centric care and innovation in antiretroviral therapy delivery

- In March 2024, Gilead Sciences, Inc. initiated a Phase III clinical trial to evaluate a novel bictegravir-based dual therapy regimen aimed at reducing long-term side effects while maintaining high viral suppression. This trial underscores Gilead’s strategic focus on treatment simplification and innovation, targeting improved outcomes for treatment-experienced patients and those with comorbidities

- In March 2024, the World Health Organization (WHO) included dolutegravir in updated HIV treatment guidelines for broader use in pediatric populations, following positive safety and efficacy data. This endorsement significantly boosts global confidence in dolutegravir’s utility and supports its expanded use in public health programs, especially in low- and middle-income countries

- In February 2024, Mylan Pharmaceuticals, a subsidiary of Viatris, launched a generic fixed-dose combination of dolutegravir, lamivudine, and tenofovir disoproxil fumarate in sub-Saharan Africa. This launch aims to improve affordability and accessibility in high-burden regions, contributing to global HIV management goals by making quality therapies more widely available

- In January 2024, Janssen Pharmaceuticals announced early development of a next-generation integrase inhibitor targeting HIV strains with resistance to existing drugs. The research is part of Janssen’s broader pipeline expansion strategy focused on novel mechanisms of action and long-acting formulations, reflecting the industry’s ongoing efforts to address drug resistance and improve treatment adherence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.