Global Intravascular Microaxial Lvad Devices Market

Market Size in USD Million

CAGR :

%

USD

594.00 Million

USD

2,071.58 Million

2024

2032

USD

594.00 Million

USD

2,071.58 Million

2024

2032

| 2025 –2032 | |

| USD 594.00 Million | |

| USD 2,071.58 Million | |

|

|

|

|

Intravascular Microaxial LVAD Devices Market Size

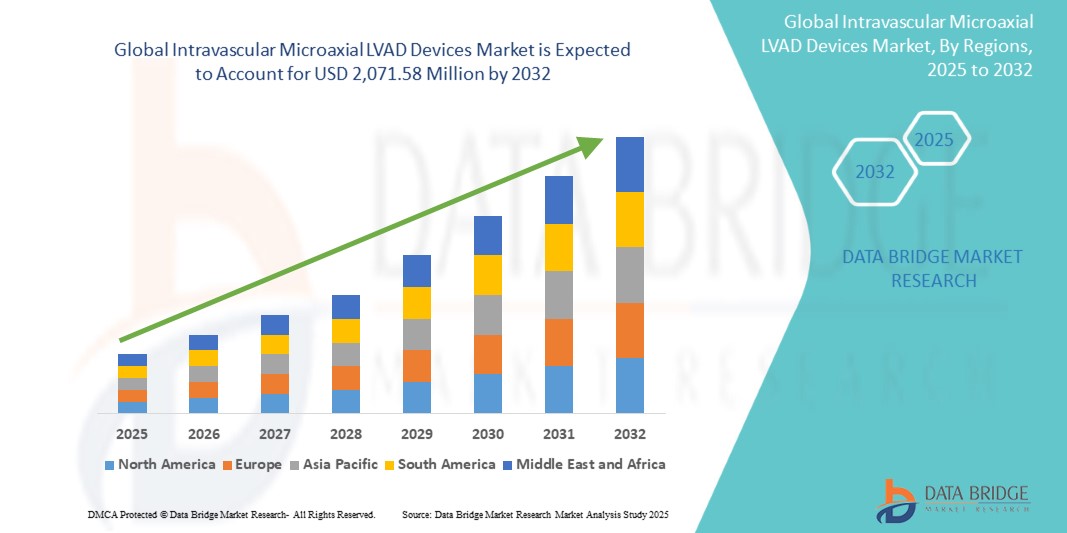

- The global intravascular microaxial LVAD devices market size was valued at USD 594.00 million in 2024 and is expected to reach USD 2,071.58 million by 2032, at a CAGR of 16.90% during the forecast period

- The market expansion is driven by the rising prevalence of acute myocardial infarction, cardiogenic shock, and high-risk percutaneous coronary interventions, where these devices provide critical short-term hemodynamic support

- In addition, growing clinical adoption of minimally invasive, percutaneous circulatory assist solutions supported by advancements in device technology and increasing availability in tertiary cardiac centers is fueling demand

Intravascular Microaxial LVAD Devices Market Analysis

- Intravascular microaxial LVAD devices, designed to provide temporary mechanical circulatory support by unloading the left ventricle and maintaining systemic circulation, are increasingly critical in advanced cardiac care, particularly in the management of acute myocardial infarction with cardiogenic shock, high-risk PCI, and post-cardiotomy shock cases

- The growing demand for these devices is primarily fueled by the rising global burden of cardiovascular diseases, increasing adoption of minimally invasive hemodynamic support solutions, and expanding use in bridge-to-recovery or bridge-to-decision strategies for critically ill patients

- North America dominated the intravascular microaxial LVAD devices market with the largest revenue share of 62.8% in 2024, supported by favorable reimbursement frameworks, early adoption in tertiary cardiac centers, and the strong presence of leading manufacturers, with the U.S. witnessing significant utilization in both AMI-related cardiogenic shock and complex PCI procedures

- Asia-Pacific is expected to be the fastest growing region in the intravascular microaxial LVAD devices market during the forecast period, driven by the rising incidence of heart failure and myocardial infarction, expanding interventional cardiology programs, and increasing healthcare infrastructure investments

- The mid-flow device segment (3–4 L/min) dominated the intravascular microaxial LVAD devices market with a share of 48.3% in 2024, largely due to its balance of support effectiveness and procedural safety, making it the most widely adopted option in both high-risk PCI and cardiogenic shock interventions

Report Scope and Intravascular Microaxial LVAD Devices Market Segmentation

|

Attributes |

Intravascular Microaxial LVAD Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Intravascular Microaxial LVAD Devices Market Trends

Increasing Adoption in High-Risk PCI and Cardiogenic Shock Management

- A significant and accelerating trend in the global intravascular microaxial LVAD devices market is the growing utilization of these devices in high-risk percutaneous coronary interventions (PCI) and acute myocardial infarction (AMI) with cardiogenic shock. Their ability to provide rapid, minimally invasive hemodynamic support is reshaping treatment pathways in interventional cardiology

- For instance, devices such as the Impella CP and Impella 5.5 are increasingly used in tertiary cardiac centers to stabilize critically ill patients undergoing complex PCI procedures or recovering from AMI-related shock, offering clinicians more control over patient outcomes

- Clinical studies and registry data continue to demonstrate improved survival rates when microaxial LVADs are deployed early in shock management, which is driving hospital protocols and physician adoption globally

- Furthermore, advances in device engineering are enabling longer duration of support, smaller insertion profiles, and reduced vascular complications, making these devices more accessible to a broader patient population

- The trend towards integrating LVAD therapy as a bridge-to-recovery, bridge-to-decision, or bridge-to-transplant is creating new treatment paradigms in advanced heart failure and cardiology practices

- This shift toward early adoption and expanded indications is fundamentally reshaping expectations for temporary circulatory support, with leading companies investing in next-generation designs to strengthen their market position

Intravascular Microaxial LVAD Devices Market Dynamics

Driver

Rising Cardiovascular Disease Burden and Need for Advanced Hemodynamic Support

- The increasing global prevalence of acute myocardial infarction, cardiogenic shock, and advanced heart failure is a primary driver fueling the adoption of intravascular microaxial LVAD devices. These conditions require rapid, effective, and minimally invasive solutions to maintain circulation and improve patient survival

- For instance, clinical adoption of Impella devices has surged in the U.S. as tertiary cardiac centers integrate them into protocols for managing AMI-related shock and high-risk PCI, supported by favorable reimbursement frameworks

- As hospitals strive to improve outcomes and reduce mortality in critical cardiac events, the ability of microaxial LVADs to unload the ventricle, stabilize hemodynamics, and provide time for myocardial recovery makes them a compelling clinical choice

- Growing investments in advanced interventional cardiology infrastructure, coupled with physician training programs, are accelerating global adoption

- The expanding role of these devices in bridge-to-recovery and bridge-to-decision therapies is further reinforcing their position as an essential component of modern cardiac care

Restraint/Challenge

High Device Cost and Limited Trained Operator Base

- The high cost of intravascular microaxial LVAD devices, coupled with the expenses associated with hospitalization, cath lab procedures, and intensive care, presents a major barrier to widespread adoption, especially in cost-sensitive healthcare systems

- For instance, in emerging markets, limited reimbursement coverage and constrained healthcare budgets have slowed penetration of advanced LVAD therapy despite rising cardiac disease burden

- Another key challenge is the need for specialized training and experienced operators to safely implant and manage these devices. The learning curve and procedural complexity can limit adoption in smaller hospitals and developing regions

- Concerns related to device-related complications, such as bleeding, hemolysis, and vascular access issues, also contribute to cautious uptake among physicians

- Overcoming these challenges requires cost-optimization strategies, wider reimbursement support, and structured physician training programs, alongside continued technological innovation aimed at reducing complications

- Addressing affordability and accessibility gaps will be critical to sustaining long-term growth and expanding the reach of intravascular microaxial LVAD devices beyond highly specialized cardiac centers

Intravascular Microaxial LVAD Devices Market Scope

The market is segmented on the basis of product type, duration of support, clinical indication, and end user.

- By Product Type

On the basis of product type, the intravascular microaxial LVAD devices market is segmented into low-flow devices (<3 L/min), mid-flow devices (3–4 L/min), and high-flow devices (≥4 L/min). Mid-flow devices (3–4 L/min) dominated the market in 2024 with the largest revenue share of 48.3%. Their clinical adoption is strong because they provide an optimal balance between circulatory support and procedural safety, particularly in high-risk PCI and cardiogenic shock cases. Devices such as Impella CP are widely used across tertiary care hospitals in North America and Europe, making them the preferred choice for interventional cardiologists. Their ability to deliver sufficient hemodynamic support while minimizing insertion risks has made them the most popular category. Increasing physician familiarity and favorable reimbursement policies further consolidate their leadership.

High-flow devices (≥4 L/min) are anticipated to witness the fastest growth from 2025 to 2032. This segment is gaining traction due to rising demand for more robust support in severe cardiogenic shock, post-cardiotomy shock, and advanced heart failure cases. Devices such as Impella 5.0/5.5 enable longer support durations and are increasingly considered in bridge-to-decision and bridge-to-transplant therapies. The shift toward managing critically ill patients with more aggressive support strategies, combined with technological improvements to reduce vascular complications, is accelerating growth in this segment.

- By Duration of Support

On the basis of duration, the intravascular microaxial LVAD devices market is segmented into ultra-short term (<24 hours), short-term (1–3 days), and prolonged (>3 days up to 14 days). Short-term support (1–3 days) dominated the market in 2024 with the highest share. This segment is widely adopted because the majority of cases involving AMI with cardiogenic shock and high-risk PCI require stabilization for a limited time window. Hospitals prefer these devices as they are cost-effective for acute interventions, and clinical guidelines often recommend short-duration use to minimize complications. The balance of clinical effectiveness, cost management, and hospital resource optimization has made this the leading segment.

Prolonged support (>3 days up to 14 days) is projected to be the fastest-growing segment during the forecast period. As cardiology practices evolve, there is a rising preference for extended LVAD use in patients with refractory cardiogenic shock or as a bridge-to-recovery when myocardial function takes longer to stabilize. Advancements in device durability, improved patient monitoring, and growing experience among cardiac specialists are boosting the adoption of prolonged support strategies. In addition, the role of these devices in bridging patients to heart transplantation or durable LVAD therapy is contributing to their accelerated growth.

- By Clinical Indication

On the basis of clinical indication, the intravascular microaxial LVAD devices market is segmented into AMI with cardiogenic shock, high-risk PCI, post-cardiotomy shock (PCS), acute decompensated heart failure, and other indications. Acute Myocardial Infarction (AMI) with Cardiogenic Shock dominated the market in 2024 with the largest revenue share. This indication is the most common and clinically urgent use case, as patients experiencing AMI-related shock often face high mortality risk. Intravascular microaxial LVADs provide immediate hemodynamic support, allowing myocardial recovery and improving survival outcomes. Their proven benefit in stabilizing circulation during acute emergencies has made this the cornerstone application for these devices. Widespread guideline inclusion and clinical data supporting early intervention further reinforce dominance in this segment.

High-risk PCI is expected to be the fastest-growing clinical indication segment through 2032. The increasing number of patients undergoing complex coronary interventions with multiple comorbidities, coupled with the aging population, is driving demand for hemodynamic support during PCI procedures. Interventional cardiologists are increasingly using microaxial LVADs prophylactically to reduce peri-procedural complications and improve patient safety. Favorable reimbursement for PCI-related support and expanding use in elective but high-risk interventions are fueling this segment’s rapid growth.

- By End User

On the basis of end user, the intravascular microaxial LVAD devices market is segmented into tertiary care hospitals, specialized heart & vascular centers, and academic & research hospitals. Tertiary care hospitals dominated the market in 2024 with the largest share. These hospitals are equipped with advanced catheterization labs, critical care units, and highly trained interventional cardiologists, making them the primary users of microaxial LVAD devices. Favorable reimbursement policies in developed regions and the concentration of complex cardiovascular cases in tertiary settings ensure their leadership. Their ability to handle both emergency cases such as AMI shock and elective high-risk PCI procedures sustains their dominance.

Specialized heart & vascular centers are projected to witness the fastest growth from 2025 to 2032. With the increasing burden of cardiovascular disease, more specialized cardiac centers are being established globally, particularly in Asia-Pacific and Latin America. These centers focus exclusively on cardiovascular procedures, leading to higher procedural volumes and adoption of advanced support devices. The expansion of private-sector cardiac hospitals, combined with targeted investments in cardiovascular infrastructure, is accelerating adoption in this segment.

Intravascular Microaxial LVAD Devices Market Regional Analysis

- North America dominated the intravascular microaxial LVAD devices market with the largest revenue share of 62.8% in 2024, supported by favorable reimbursement frameworks, early adoption in tertiary cardiac centers, and the strong presence of leading manufacturers

- Hospitals and cardiac centers in the region emphasize early use of these devices due to their proven ability to stabilize critically ill patients, reduce mortality, and improve procedural outcomes

- This widespread adoption is further supported by favorable reimbursement frameworks, advanced interventional cardiology infrastructure, and a highly trained physician base, making North America the global leader in utilization

U.S. Intravascular Microaxial LVAD Devices Market Insight

The U.S. intravascular microaxial LVAD devices market captured the largest revenue share of 79% in 2024 within North America, fueled by the high prevalence of acute myocardial infarction and cardiogenic shock cases. The swift adoption of mechanical circulatory support devices in high-risk PCI procedures reflects a strong clinical preference for short-term stabilization. Favorable reimbursement policies, extensive availability of advanced cath labs, and the presence of leading device manufacturers further accelerate growth. Moreover, the rising awareness among physicians regarding early intervention with LVADs is significantly contributing to the U.S. market’s expansion.

Europe Intravascular Microaxial LVAD Devices Market Insight

The Europe intravascular microaxial LVAD devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing burden of cardiovascular diseases and supportive healthcare policies. Countries in the region are emphasizing the adoption of innovative cardiac assist devices for critically ill patients, ensuring improved survival outcomes. Rising healthcare expenditure and widespread adoption in tertiary care hospitals are fueling utilization. The market is witnessing steady uptake across Germany, the U.K., France, and Italy, supported by a robust research environment and training programs for interventional cardiologists.

U.K. Intravascular Microaxial LVAD Devices Market Insight

The U.K. intravascular microaxial LVAD devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for advanced cardiac support therapies and an expanding network of specialized heart centers. Concerns over the rising incidence of heart failure and cardiogenic shock are encouraging hospitals to adopt microaxial LVADs for acute interventions. The U.K.’s emphasis on innovative healthcare solutions, coupled with NHS-driven support for advanced interventions, is expected to further stimulate market growth.

Germany Intravascular Microaxial LVAD Devices Market Insight

The Germany intravascular microaxial LVAD devices market is expected to expand at a considerable CAGR during the forecast period, fueled by its strong healthcare infrastructure and advanced interventional cardiology practices. The country’s well-established tertiary care hospitals and cardiovascular research centers are early adopters of innovative circulatory support systems. Growing physician awareness, combined with a focus on patient-centric care and cutting-edge technologies, is supporting strong uptake. Germany also benefits from being a leading hub for clinical trials and collaborations in mechanical circulatory support.

Asia-Pacific Intravascular Microaxial LVAD Devices Market Insight

The Asia-Pacific intravascular microaxial LVAD devices market is poised to grow at the fastest CAGR of 23.4% during 2025–2032, driven by rising cardiovascular disease incidence, improving healthcare infrastructure, and growing accessibility of advanced interventions in China, Japan, and India. Rapid urbanization, higher healthcare investments, and government-led initiatives to strengthen tertiary cardiac care are accelerating adoption. In addition, growing physician training programs and the entry of global manufacturers are increasing device availability. This is positioning APAC as a rapidly expanding hub for LVAD adoption across both developed and emerging markets.

Japan Intravascular Microaxial LVAD Devices Market Insight

The Japan intravascular microaxial LVAD devices market is gaining momentum due to the country’s tech-savvy medical culture and strong focus on advanced cardiovascular therapies. Hospitals are integrating these devices into acute care protocols for AMI with cardiogenic shock and post-cardiotomy interventions. The high emphasis on clinical outcomes, combined with Japan’s aging population, is driving adoption of minimally invasive circulatory support devices. Integration with broader cardiovascular treatment pathways and government support for medical innovation further strengthen growth prospects.

India Intravascular Microaxial LVAD Devices Market Insight

The India intravascular microaxial LVAD devices market accounted for the largest market revenue share within Asia-Pacific in 2024, attributed to the country’s growing burden of heart failure and ischemic heart disease, coupled with rapid expansion of advanced cardiac centers. Increasing affordability, greater awareness among cardiologists, and the rise of private tertiary hospitals are fueling adoption. The government’s focus on modernizing healthcare through smart city and health infrastructure projects, alongside the presence of emerging domestic suppliers and partnerships with global firms, are key drivers propelling the Indian market.

Intravascular Microaxial LVAD Devices Market Share

The Intravascular Microaxial LVAD Devices industry is primarily led by well-established companies, including:

- ABIOMED (U.S.)

- Procyrion, Inc. (U.S.)

- Magenta Medical Ltd. (Israel)

- PulseCath B.V. (Netherlands)

- Jarvik Heart, Inc. (U.S.)

- Abbott (U.S.)

- Medtronic (Ireland)

- Berlin Heart GmbH (Germany)

- SynCardia Systems (U.S.)

- CARMAT (France)

- BiVACOR (U.S.)

- ReliantHeart Inc. (U.S.)

- CorWave (France)

- Calon Cardio-Technology Ltd. (U.K.)

- Lepu Medical Technology Co., Ltd. (China)

- CH Biomedical Inc. (China)

- Windmill Cardiovascular Systems (U.S.)

- Sun Medical Technology Research Corp. (Japan)

- Evaheart Inc. (South Korea)

- CardiacAssist, Inc. (U.S.)

What are the Recent Developments in Global Intravascular Microaxial LVAD Devices Market?

- In July 2025, the FDA issued an early alert regarding an issue with Automated Impella Controllers (AICs) failing to detect connected Impella pumps (such as Impella CP/5.5). Three deaths were reported as of mid-June, although no serious injuries. Healthcare professionals were advised to have backup consoles and follow specific protocols if detection fails

- In May 2025, a multicenter clinical trial began to evaluate the BrioVAD System, a new durable left ventricular assist device (LVAD) designed as an alternative to the HeartMate 3. The BrioVAD features a fully magnetically levitated pump technology and is being developed with the goal of reducing complications and improving the patient experience

- In April 2025, a multicenter European retrospective study was published comparing microaxial devices including Impella CP and high-flow models (Impella 5.0/5.5) used as a bridge to durable LVAD implantation. High-flow devices showed better hemodynamic support, reduced need for ECLS/RVAD, and improved organ function and mobilization pre-surgery

- In October 2024, Johnson & Johnson MedTech announced results from the pivotal IDE trial of Impella ECP, a novel transvalvular microaxial pump designed for high-risk PCI. Presented at TCT 2024, the study (256 patients across 18 U.S. sites) showed low 30-day MACCE rates—below the performance goal—and 92% success in closure with 8Fr Angio-Seal—highlighting its safety and efficacy

- In June 2024, the U.S. Food and Drug Administration released updated Urgent Medical Device Correction instructions for the Impella RP with SmartAssist and Impella RP Flex with SmartAssist. The update addressed a safety risk where guidewire tips or other medical devices might contact the pump during insertion or removal, potentially causing pump stoppage or sensor damage without involving product removal

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.