Global Post Acute Myocardial Infarction Market

Market Size in USD Billion

CAGR :

%

USD

2.18 Billion

USD

3.58 Billion

2024

2032

USD

2.18 Billion

USD

3.58 Billion

2024

2032

| 2025 –2032 | |

| USD 2.18 Billion | |

| USD 3.58 Billion | |

|

|

|

|

Post Acute Myocardial Infarction Market Size

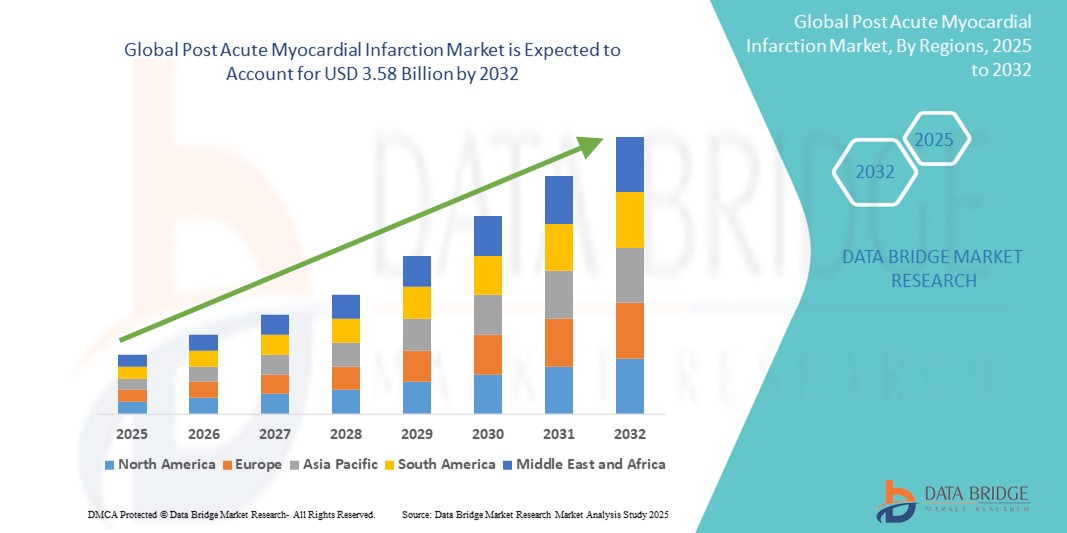

- The global post acute myocardial infarction market size was valued at USD 2.18 billion in 2024 and is expected to reach USD 3.58 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, rising geriatric population, and advancements in post-MI therapeutic approaches such as antiplatelet agents, beta-blockers, ACE inhibitors, and lifestyle management programs, which are critical in reducing recurrent cardiac events

- Furthermore, growing awareness among patients regarding early cardiac rehabilitation, the expansion of telehealth services, and strategic investments in R&D by pharmaceutical companies are reinforcing the market's growth trajectory. These converging factors are driving the demand for effective post-MI care, thereby significantly boosting the industry's expansion.

Post Acute Myocardial Infarction Market Analysis

- Post acute myocardial infarction (AMI) care, involving therapeutic and rehabilitative strategies following a heart attack, is becoming an essential component of cardiovascular healthcare systems worldwide due to its role in reducing recurrence, improving survival rates, and enhancing quality of life among patients

- The increasing demand for post-AMI interventions is primarily fueled by the rising global incidence of myocardial infarctions, expanding aging populations, and growing awareness of the importance of structured post-MI care—including pharmacological therapy, cardiac rehabilitation, and lifestyle modifications

- North America dominated the post acute myocardial infarction market with the largest revenue share of 42% in 2024, attributed to high healthcare expenditure, robust reimbursement frameworks, widespread access to advanced therapies, and the presence of key pharmaceutical and medical device players

- Asia-Pacific is expected to be the fastest growing region in the post acute myocardial infarction market during the forecast period, due to increasing cardiovascular disease burden, improving healthcare infrastructure, and greater governmental focus on non-communicable disease management

- The beta-blockers segment dominated the post acute myocardial infarction therapeutics market with a market share of 37.2% in 2024, driven by its long-standing clinical efficacy in reducing mortality and preventing reinfarction post-event

Report Scope and Post Acute Myocardial Infarction Market Segmentation

|

Attributes |

Post Acute Myocardial Infarction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Post Acute Myocardial Infarction Market Trends

“Rising Integration of Digital Health and Remote Monitoring Technologies”

- A significant and accelerating trend in the global post acute myocardial infarction (AMI) market is the integration of digital health platforms and remote monitoring technologies into post-MI care programs. These technologies are enhancing patient adherence, improving long-term outcomes, and facilitating more efficient management of post-MI recovery

- For instance, apps such as WellDoc’s BlueStar and platforms such as Livongo provide remote coaching and real-time data sharing for cardiovascular patients, enabling clinicians to monitor vital signs, medication adherence, and rehabilitation progress outside clinical settings

- Remote cardiac monitoring devices, including wearable ECG monitors and implantable loop recorders, enable continuous tracking of heart rhythms and early detection of arrhythmias, which are common post-MI complications. This proactive monitoring helps in timely intervention and reduces hospital readmissions

- The incorporation of artificial intelligence in these platforms further enables predictive analytics, allowing clinicians to assess risk levels and tailor follow-up care accordingly. AI can detect subtle changes in heart rate variability or other biometric indicators, alerting providers to potential adverse events before they become critical

- This shift toward digital and decentralized care models is particularly valuable in regions with limited access to cardiologists or rehabilitation facilities. The flexibility and convenience offered by remote health monitoring are driving greater patient engagement and improving adherence to rehabilitation protocols

- Consequently, healthcare providers, insurers, and tech companies are increasingly investing in scalable, patient-centric digital solutions that can augment traditional care. This trend is poised to transform the landscape of post-MI management, aligning it with broader telehealth and personalized medicine initiatives across the healthcare industry

Post Acute Myocardial Infarction Market Dynamics

Driver

“Growing Need Due to Increasing Cardiovascular Disease Burden and Focus on Secondary Prevention”

- The rising global burden of cardiovascular diseases, especially myocardial infarctions, is a key driver for the demand for post-AMI care solutions. Secondary prevention, which focuses on preventing recurrent cardiac events, has become a clinical and public health priority worldwide

- For instance, in January 2024, Novartis expanded access to its post-MI therapy Leqvio® (inclisiran) across several European markets, offering long-term LDL cholesterol management in combination with statins. Such advancements highlight the growing emphasis on integrated pharmacological approaches in post-AMI care

- The growing awareness among patients and providers about the long-term consequences of poor post-MI management—such as heart failure, stroke, or reinfarction—is driving the adoption of comprehensive care models. These include medication adherence programs, lifestyle interventions, and structured cardiac rehabilitation services

- In addition, increased governmental and institutional support for preventive cardiology programs, along with improved reimbursement for post-MI therapies and rehabilitation services, is contributing to sustained market growth

- The integration of smart pill technology, remote medication reminders, and mobile health coaching is further empowering patients to take a proactive role in their recovery, leading to better health outcomes and reduced healthcare costs

Restraint/Challenge

“Low Adherence to Post-MI Therapy and Access Barriers in Developing Regions”

- One of the major challenges in the global post acute myocardial infarction market is low adherence to post-MI therapy and rehabilitation, particularly in low- and middle-income countries. Despite clinical evidence supporting the efficacy of post-MI secondary prevention measures, patient engagement and long-term compliance remain suboptimal

- For instance, studies published in The Lancet have highlighted that only a fraction of eligible patients in developing nations complete cardiac rehabilitation programs or consistently adhere to prescribed medications such as antiplatelets or beta-blockers

- Barriers such as limited awareness, socioeconomic constraints, lack of access to cardiology specialists, and insufficient health insurance coverage hinder widespread implementation of post-MI care, especially in rural and underserved populations

- Furthermore, logistical issues such as distance from rehabilitation centers, language barriers, and inadequate digital literacy can limit the effectiveness of tele-rehabilitation programs

- While new mobile-based and AI-assisted interventions offer promise, the digital divide and infrastructure limitations in some regions pose significant challenges

- Addressing these challenges through public-private partnerships, community outreach programs, and scalable digital care platforms tailored to resource-limited settings will be essential for unlocking the full potential of post acute myocardial infarction therapies and ensuring equitable access to life-saving secondary prevention strategies

Post Acute Myocardial Infarction Market Scope

The market is segmented on the basis of drug class, end-user, and distribution channel.

- By Drug Class

On the basis of drug class, the post acute myocardial infarction market is segmented into antiplatelet therapy, beta blockers, renin-angiotensin-aldosterone system (RAAS) inhibitors, statin therapy, and others. The beta-blockers segment dominated the post acute myocardial infarction therapeutics market in 2024, with a market share of 37.2%, making it one of the key contributors. Their wide clinical use post-MI stems from their effectiveness in preventing arrhythmias, lowering heart rate, and reducing reinfarction risk.

The RAAS inhibitors segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by growing clinical evidence supporting their use in reducing mortality and improving left ventricular function post-infarction. RAAS inhibitors, including ACE inhibitors and angiotensin receptor blockers, are increasingly being prescribed as part of comprehensive post-MI care, especially for patients with heart failure or diabetes comorbidities. Advancements in combination therapies and patient-tailored treatment regimens are also contributing to the segment's momentum.

- By End User

On the basis of end-user, the post acute myocardial infarction market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment held the largest market share in 2024, driven by the high volume of post-MI patient admissions, immediate access to multidisciplinary cardiac care, and the presence of specialized cardiac rehabilitation units. Hospitals play a central role in initiating secondary prevention strategies and coordinating follow-up care, including pharmacotherapy and monitoring.

The homecare segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by the increasing shift toward remote patient monitoring, telehealth consultations, and at-home cardiac rehabilitation programs. The aging population, along with a preference for recovery in familiar environments, is encouraging the adoption of home-based post-MI care models, particularly supported by wearable technology and app-based medication adherence tools.

- By Distribution Channel

On the basis of distribution channel, the post acute myocardial infarction market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment accounted for the largest revenue share in 2024, owing to the immediate need for post-MI medications upon discharge and the centralized nature of medication dispensing within healthcare facilities. Hospital pharmacies also often offer bundled care packages and ensure continuity of care during the transition from inpatient to outpatient settings.

The online pharmacy segment is anticipated to register the fastest growth during the forecast period, driven by rising e-commerce penetration, patient preference for convenience, and expanding digital health ecosystems. Online platforms are enabling timely access to chronic cardiac medications, with automated refill reminders, teleconsultations, and home delivery services improving patient compliance and satisfaction, especially in urban and semi-urban areas.

Post Acute Myocardial Infarction Market Regional Analysis

- North America dominated the post acute myocardial infarction market with the largest revenue share of 42% in 2024, attributed to high healthcare expenditure, robust reimbursement frameworks, widespread access to advanced therapies, and the presence of key pharmaceutical and medical device players

- The region's strong emphasis on evidence-based post-MI care, including comprehensive cardiac rehabilitation programs and guideline-directed pharmacological therapies, has resulted in improved patient outcomes and greater uptake of long-term treatment regimens such as beta-blockers, antiplatelet agents, and statins

- Furthermore, increasing awareness of heart disease prevention, favorable reimbursement policies, and the presence of major pharmaceutical companies and research institutions continue to support regional market growth. The growing geriatric population, combined with rising lifestyle-related risk factors such as obesity and hypertension, further accentuates the demand for post-MI therapies across the region

U.S. Post Acute Myocardial Infarction Market Insight

The U.S. post acute myocardial infarction market captured the largest revenue share of 79% in 2024 within North America, driven by the widespread availability of advanced healthcare infrastructure, strong reimbursement policies, and increasing awareness of cardiovascular disease (CVD) prevention. The growing prevalence of sedentary lifestyles and rising incidence of heart attacks are prompting greater adoption of beta-blockers, antiplatelet agents, and statin therapies. Furthermore, the rise of cardiac rehabilitation programs, telehealth-based monitoring systems, and precision medicine initiatives are enhancing the quality and outcomes of post-AMI care. The presence of leading pharmaceutical companies such as Pfizer and Merck further supports innovation and treatment accessibility in the region.

Europe Post Acute Myocardial Infarction Market Insight

The Europe post acute myocardial infarction market is projected to expand at a significant CAGR throughout the forecast period, owing to increased adoption of guideline-based care and early intervention strategies. Public health campaigns focusing on secondary prevention, combined with access to universal healthcare in countries such as Germany, France, and the U.K., contribute to market stability. Digital health integration and widespread use of RAAS inhibitors and antiplatelet therapy in post-AMI patients are key trends. Moreover, government funding toward tele-rehabilitation and e-health platforms is supporting consistent patient follow-up and medication adherence, driving the post-AMI treatment landscape across the continent.

U.K. Post Acute Myocardial Infarction Market Insight

The U.K. post acute myocardial infarction market is expected to grow steadily over the forecast period, driven by the National Health Service (NHS)’s proactive stance on reducing cardiovascular mortality through standardized treatment protocols and secondary prevention strategies. Heightened awareness of cardiac health, improvements in emergency response systems, and initiatives such as the NHS Long Term Plan contribute to robust treatment rates. The integration of digital therapeutics, mobile health apps, and cardiac rehab programs in the primary care setting are further supporting patient outcomes, leading to a strong foundation for sustained market growth.

Germany Post Acute Myocardial Infarction Market Insight

The Germany post acute myocardial infarction market is anticipated to grow at a considerable CAGR, bolstered by high healthcare spending, strong clinical adherence to ESC (European Society of Cardiology) guidelines, and widespread insurance coverage. A significant focus on structured discharge plans, patient education, and pharmacological adherence for beta blockers, RAAS inhibitors, and lipid-lowering drugs are enhancing post-AMI care. Germany's innovation in digital health tools and its early adoption of real-world data to inform treatment regimens are fostering advanced, patient-centric cardiac recovery models, driving market growth in both urban and rural healthcare settings.

Asia-Pacific Post Acute Myocardial Infarction Market Insight

The Asia-Pacific post acute myocardial infarction market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by a rising incidence of cardiovascular disease, rapid urbanization, and improving access to healthcare. Countries such as China, India, and Japan are investing heavily in cardiac care infrastructure, screening programs, and medication accessibility. Government-led initiatives promoting early diagnosis and treatment of heart diseases, along with growing penetration of generics and telemedicine platforms, are enabling broader access to post-AMI care. The region is also witnessing a surge in clinical trials and research activity focused on novel cardiovascular therapies.

Japan Post Acute Myocardial Infarction Market Insight

The Japan post acute myocardial infarction market is advancing steadily, propelled by the country’s aging population and its emphasis on chronic disease management. High-tech healthcare systems, adherence to evidence-based medicine, and the availability of advanced medications are key market drivers. Japanese guidelines emphasize personalized medicine and combination therapy, contributing to increased use of statins and beta blockers post-AMI. In addition, the growing demand for digital health solutions and remote cardiac rehabilitation programs tailored to elderly patients is supporting sustained market expansion across the nation.

India Post Acute Myocardial Infarction Market Insight

The India post acute myocardial infarction market accounted for the largest revenue share in the Asia-Pacific region in 2024, fueled by the country’s high cardiovascular disease burden, improving healthcare access, and increased focus on preventive care. Rising awareness, widespread use of generic cardiac medications, and the rollout of national heart health campaigns are enabling better post-AMI outcomes. Government-backed schemes such as Ayushman Bharat and digital health platforms are expanding the availability of critical therapies such as antiplatelets and RAAS inhibitors. The growing availability of affordable treatment options and tele-cardiology services are further bolstering market growth in both metropolitan and rural settings.

Post Acute Myocardial Infarction Market Share

The Post Acute Myocardial Infarction industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- Sanofi (France)

- Johnson & Johnson Services, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Amgen Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Lupin (India)

- Daiichi Sankyo Company, Limited (Japan)

- Bristol-Myers Squibb Company (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Zydus Group (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Limited (India)

What are the Recent Developments in Global Post Acute Myocardial Infarction Market?

- In May 2024, AstraZeneca plc expanded access to its next-generation oral antiplatelet therapy, Brilinta (ticagrelor), in emerging markets including Southeast Asia and Latin America. This strategic move aims to reduce secondary cardiovascular events in post-AMI patients, aligning with global healthcare objectives focused on improving outcomes in high-risk populations. The initiative showcases AstraZeneca’s commitment to equitable access to life-saving therapies and its continued leadership in cardiovascular innovation

- In April 2024, Novartis AG announced positive real-world outcomes from its ENTRESTO (sacubitril/valsartan) therapy used in post-AMI patients with reduced ejection fraction. The data, presented at the American College of Cardiology Annual Scientific Session, demonstrated significant reductions in hospital readmission rates and cardiovascular mortality. This advancement reinforces Novartis’ focus on data-backed, guideline-driven care and its position at the forefront of RAAS inhibition in cardiac recovery

- In February 2024, Pfizer Inc. partnered with health systems in the U.S. and Canada to pilot a digital patient engagement platform tailored for post-AMI patients. The platform integrates medication reminders, tele-rehabilitation, and real-time health tracking to enhance patient adherence and recovery. This initiative reflects the growing importance of digital therapeutics in cardiac care and Pfizer’s ongoing investment in patient-centered innovation

- In January 2024, Bayer AG launched a new initiative across Europe promoting dual antiplatelet therapy (DAPT) best practices in early-stage myocardial infarction recovery. The campaign includes physician education, digital health tools, and updated prescribing guidelines for its widely used antiplatelet agent, Xarelto. This development aligns with Bayer’s broader cardiovascular strategy to reduce complications and mortality in the immediate post-AMI period

- In December 2023, Abbott Laboratories unveiled the expansion of its Remote Cardiac Monitoring Solutions to include post-AMI management tools, integrating wearables and AI-driven alerts for early identification of complications such as arrhythmias or reinfarction risk. This technological advancement empowers clinicians with real-time decision support, enhancing both acute and long-term post-infarction care. The move underscores Abbott’s leadership in connected health ecosystems and precision cardiac monitoring

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEOMOLOGY MODELLING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR POST-ACUTE MYOCARDIAL INFARCTION MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR POST-ACUTE MYOCARDIAL INFARCTION MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FOR POST-ACUTE MYOCARDIAL INFARCTION MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR POST-ACUTE MYOCARDIAL INFARCTION MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR POST-ACUTE MYOCARDIAL INFARCTION MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 OPPUTUNITY MAP ANALYSIS

16 VALUE CHAIN ANALYSIS

17 HEALTHCARE ECONOMY

17.1 HEALTHCARE EXPENDITURE

17.2 CAPITAL EXPENDITURE

17.3 CAPEX TRENDS

17.4 CAPEX ALLOCATION

17.5 FUNDING SOURCES

17.6 INDUSTRY BENCHMARKS

17.7 GDP RATION IN OVERALL GDP

17.8 HEALTHCARE SYSTEM STRUCTURE

17.9 GOVERNMENT POLICIES

17.1 ECONOMIC DEVELOPMENT

18 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, BY DIAGNOSIS AND TREATMENT

18.1 OVERVIEW

18.2 DIAGNOSIS

18.2.1 ELECTROCARDIOGRAM (ECG)

18.2.2 BLOOD TESTS

18.2.2.1. TROPONIN

18.2.2.2. CK-MB

18.2.2.3. OTHERS

18.2.3 IMAGING TEST

18.2.3.1. ECHOCARDIOGRAPHY

18.2.3.2. CORONARY ANGIOGRAPHY

18.2.3.3. OTHERS

18.2.4 OTHERS

18.3 TREATMENT

18.3.1 MEDICATIONS

18.3.1.1. BY TYPE

18.3.1.1.1. MARKETED MEDICATION

18.3.1.1.1.1 BY DRUG CLASS

18.3.1.1.1.1.1. ANTIPLATELET AGENTS

A. ASPIRIN

I. BY DRUGS

II. ASCRIPTIN

III. BAYER ASPIRIN

IV. ASPIRTAB

V. ECOTRIN

VI. DURLAZA

VII. BY STRENGTH

VIII. 81MG

IX. 325MG

X. 500MG

XI. OTHERS

B. CLOPIDOGREL

I. BY DRUGS

II. PLAVIX

III. OTHERS

IV. BY STRENGTH

V. 75MG

VI. 300MG

C. TICAGRELOR

I. BY DRUG

II. BRILINTA

III. OTHERS

IV. BY STRENGTH

V. 60MG

VI. 90MG

D. PRASUGREL

I. BY DRUGS

II. EFFIENT

III. OTHERS

IV. BY STRENGTH

V. 5MG

VI. 10MG

E. VORAPAXAR

I. BY DRUGS

II. ZONTIVITY

III. OTHERS

18.3.1.1.1.1.2. ANTITHROMBOTIC AGENTS

A. BIVALIRUDIN

I. BY DRUGS

II. ANGIOMAX

III. ANGIOMAX RTU

IV. OTHERS

V. BY STRENGTH

VI. 5MG/ML

VII. 250MG/VIAL

B. HEPARIN

I. BY DRUGS

II. LOCK SOLUTION

III. INJECTIBLE SOLUTION

IV. BY STRENGTH

V. 1UNIT/ML

VI. 2UNITS/ML

VII. 10UNITS/ML

VIII. 100UNITS/ML

IX. OTHERS

C. ENOXAPARIN

I. BY DRUGS

II. LOVENOX

III. OTHERS

IV. BY STRENGTH

V. 30MG/0.3ML

VI. 40MG/0.4ML

VII. 60MG/0.6ML

VIII. BY DOSAGE

IX. MULTIDOSE VIAL

X. PREFILLED SYRINGES

D. DALTEPARIN

I. BY DRUGS

II. FRAGMIN

III. OTHERS

IV. BY STRENGTH

V. 2,500 IU/0.2 ML

VI. 5,000 IU/0.2 ML

VII. 7,500 IU/0.3 ML

VIII. OTHERS

18.3.1.1.1.1.3. GLYCOPROTEIN IIB/IIIA INHIBITORS

A. ABCIXIMAB

I. BY DRUGS

II. REOPRO

III. OTHERS

B. TIROFIBAN

I. BY DRUGS

II. AGGRASTAT

III. OTHERS

IV. BY STRENGTH

V. 5MG/100ML

VI. 12.5MG/250ML

C. EPTIFIBATIDE

I. BY DRUGS

II. INTEGRILIN

III. OTHERS

IV. BY STRENGTH

V. 2MG/ML

VI. 0.75MG/ML

18.3.1.1.1.1.4. VASODILATORS

A. NITROGLYCERIN IV

I. BY DRUG

II. GLYCERYL TRINITRATE IV

III. IV NITROGLYCERIN

IV. BY STRENGTH

V. 25MG/250ML

VI. 50MG/250ML

VII. OTHERS

B. OTHERS

18.3.1.1.1.1.5. BETA-ADRENERGIC BLOCKERS

A. METOPROLOL

I. BY DRUGS

II. LOPRESSOR

III. TOPROL XL

IV. BY STRENGTH

V. 25 MG

VI. 50 MG

VII. OTHERS

B. ESMOLOL

I. BY DRUGS

II. BREVIBLOC

III. OTHERS

IV. BY STRENGTH

V. 2G/100ML

VI. 2.5G/250ML

C. ATENOLOL

I. BY DRUGS

II. TENORMIN

III. OTHERS

IV. BY STRENGTH

V. 25MG

VI. 50MG

VII. 100MG

18.3.1.1.1.1.6. ANGIOTENSIN-CONVERTING ENZYME INHIBITORS

A. BY DRUG

I. CAPTOPRIL

II. ENALAPRIL

III. QUINAPRIL

IV. LISINOPRIL

B. BY STRENGTH

I. 25MG

II. 50MG

III. OTHERS

18.3.1.1.1.1.7. ANGIOTENSIN-RECEPTOR BLOCKERS

A. BY DRUGS

I. IRBESARTAN

II. CANDESARTAN

III. VALSARTAN

IV. AZILSARTAN

V. EPROSARTAN MESYLATE

VI. LOSARTAN

B. BY STRENGTH

I. 75MG

II. 150MG

III. OTHERS

18.3.1.1.1.1.8. THROMBOLYTICS

A. BY DRUGS

I. ALTEPLASE, T-PA

II. TENECTEPLASE

III. OTHERS

B. BY STRENGTH

I. 2MG

II. 50MG

18.3.1.1.1.1.9. ANALGESICS

A. BY DRUGS

I. MORPHINE SULFATE

II. OTHERS

B. BY STRENGTH

I. 15 MG

II. 30MG

III. OTHERS

18.3.1.1.1.1.10. PCSK9 INHIBITORS

A. BY DRUGS

I. EVOLOCUMAB

II. ALIROCUMAB

III. OTHERS

B. BY STRENGTH

I. 75MG/ML

II. 150MG/ML

III. OTHERS

18.3.1.1.1.1.11. STATIN THERAPY

A. BY DRUGS

I. ATORVASTATIN

II. STATIX

III. ATOREC

IV. LIPVAS

V. XTOR

VI. FLUVASTATIN

VII. LESCOL

VIII. LESCOL XL

IX. OTHERS

X. LOVASTATIN

XI. AZTATIN

XII. FAVOLIP

XIII. LESTRIC

XIV. LIPISTAT

XV. OTHERS

XVI. ROSUVASTATIN

XVII. CRESTOR

XVIII. EZALLOR SPRINKLE

XIX. OTHERS

XX. SIMVASTATIN

XXI. ZOCOR

XXII. FLILIPID

XXIII. VYTORIN

XXIV. PITAVASTATIN

XXV. LIVALO

XXVI. ZYPITAMAG

XXVII. OTHERS

B. BY STRENGTH

I. 10 MG

II. 20 MG

III. 40 MG

18.3.1.1.1.1.12. OTHERS

18.3.1.1.2. PIPELINE MEDICATION

18.3.1.1.2.1 RH001

18.3.1.1.2.2 SELATOGREL

18.3.1.1.2.3 KAND567

18.3.1.1.2.4 TBPCB201

18.3.1.1.2.5 MPC-25-IC

18.3.1.1.2.6 FDY-5301

18.3.1.1.2.7 RTP-026

18.3.1.1.2.8 ZALUNFIBAN

18.3.1.1.2.9 OTHERS

18.3.1.2. BY DRUG TYPE

18.3.1.2.1. BRANDED

18.3.1.2.1.1 DURLAZA

18.3.1.2.1.2 PLAVIX

18.3.1.2.1.3 BRILINTA

18.3.1.2.1.4 EFFIENT

18.3.1.2.1.5 OTHERS

18.3.1.2.2. GENERICS

18.3.1.3. BY ROUTE OF ADMINISTRATION

18.3.1.3.1. ORAL

18.3.1.3.1.1 TABLET

18.3.1.3.1.2 CAPSULE

18.3.1.3.1.3 OTHERS

18.3.1.3.2. PARENTERAL

18.3.1.3.2.1 INTRAVENEOUS

18.3.1.3.2.2 SUBCUTANEOUS

18.3.1.3.2.3 OTHERS

18.3.1.3.3. OTHERS

18.3.1.4. BY DISTRIBUTION CHANNEL

18.3.1.4.1. DIRECT TENDER

18.3.1.4.2. RETAIL SALES

18.3.1.4.2.1 ONLINE

18.3.1.4.2.1.1. COMPANY WEBSITE

18.3.1.4.2.1.2. E-STORES

18.3.1.4.2.1.3. OTHERS

18.3.1.4.2.2 OFFLINE

18.3.1.4.2.2.1. HOSPITAL PHARMACY

18.3.1.4.2.2.2. MEDICINE STORES

18.3.1.4.2.2.3. OTHERS

18.3.1.4.3. OTHERS

18.3.2 SURGICAL TREATMENT

18.3.2.1. CORONARY ARTERY BYPASS GRAFTING (CABG)

18.3.2.2. ANGIOPLASTY & STENTING

18.4 OTHERS

19 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, BY AGE GROUP

19.1 OVERVIEW

19.2 BELOW 30 YEARS

19.3 30 TO 50 YEARS

19.4 ABOVE 50 YEARS

20 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, BY GENDER

20.1 OVERVIEW

20.2 MALE

20.2.1 BELOW 30 YEARS

20.2.2 30 TO 50 YEARS

20.2.3 ABOVE 50 YEARS

20.3 FEMALE

20.3.1 BELOW 30 YEARS

20.3.2 30 TO 50 YEARS

20.3.3 ABOVE 50 YEARS

21 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS

21.2.1 BY TYPE

21.2.1.1. PUBLIC

21.2.1.2. PRIVATE

21.2.2 BY LEVEL

21.2.2.1. TIER 1

21.2.2.2. TIER 2

21.2.2.3. TIER 3

21.3 SPECIALTY CLINICS

21.3.1 PUBLIC

21.3.2 PRIVATE

21.4 HOME HEALTHCARE

21.5 CARDIAC RESEARCH INSTITUTES

21.6 AMBULATORY SURGICAL CENTRE

21.7 OTHERS

22 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, BY GEOGRAPHY

GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 IRELAND

22.2.5 ITALY

22.2.6 SPAIN

22.2.7 RUSSIA

22.2.8 TURKEY

22.2.9 NETHERLANDS

22.2.10 SWITZERLAND

22.2.11 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 TAIWAN

22.3.4 SOUTH KOREA

22.3.5 INDIA

22.3.6 AUSTRALIA

22.3.7 SINGAPORE

22.3.8 THAILAND

22.3.9 MALAYSIA

22.3.10 INDONESIA

22.3.11 PHILIPPINES

22.3.12 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 SAUDI ARABIA

22.5.3 UAE

22.5.4 EGYPT

22.5.5 ISRAEL

22.5.6 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

23.6 MERGERS & ACQUISITIONS

23.7 NEW PRODUCT DEVELOPMENT & APPROVALS

23.8 EXPANSIONS

23.9 REGULATORY CHANGES

23.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL POST-ACUTE MYOCARDIAL INFARCTION MARKET, COMPANY PROFILE

24.1 MARKETED MANUFACTURE

24.1.1 PFIZER INC.

24.1.1.1. COMPANY OVERVIEW

24.1.1.2. REVENUE ANALYSIS

24.1.1.3. GEOGRAPHIC PRESENCE

24.1.1.4. PRODUCT PORTFOLIO

24.1.1.5. RECENT DEVELOPMENTS

24.1.2 SUN PHARMACEUTICAL INDUSTRIES LTD.

24.1.2.1. COMPANY OVERVIEW

24.1.2.2. REVENUE ANALYSIS

24.1.2.3. GEOGRAPHIC PRESENCE

24.1.2.4. PRODUCT PORTFOLIO

24.1.2.5. RECENT DEVELOPMENTS

24.1.3 SANDOZ GMBH (MARKETING AUTHORISATION HOLDER -NOVARTIS AG)

24.1.3.1. COMPANY OVERVIEW

24.1.3.2. REVENUE ANALYSIS

24.1.3.3. GEOGRAPHIC PRESENCE

24.1.3.4. PRODUCT PORTFOLIO

24.1.3.5. RECENT DEVELOPMENTS

24.1.4 ORGANON GROUP OF COMPANIES

24.1.4.1. COMPANY OVERVIEW

24.1.4.2. REVENUE ANALYSIS

24.1.4.3. GEOGRAPHIC PRESENCE

24.1.4.4. PRODUCT PORTFOLIO

24.1.4.5. RECENT DEVELOPEMENTS

24.1.5 MERCK SHARP & DOHME CORP (A SUBSIDIARY OF MERCK & CO., INC.)

24.1.5.1. COMPANY OVERVIEW

24.1.5.2. REVENUE ANALYSIS

24.1.5.3. GEOGRAPHIC PRESENCE

24.1.5.4. PRODUCT PORTFOLIO

24.1.5.5. RECENT DEVELOPEMENTS

24.1.6 VIATRIS INC.

24.1.6.1. COMPANY OVERVIEW

24.1.6.2. REVENUE ANALYSIS

24.1.6.3. GEOGRAPHIC PRESENCE

24.1.6.4. PRODUCT PORTFOLIO

24.1.6.5. RECENT DEVELOPEMENTS

24.1.7 NOVADOZ PHARMACEUTICALS

24.1.7.1. COMPANY OVERVIEW

24.1.7.2. REVENUE ANALYSIS

24.1.7.3. GEOGRAPHIC PRESENCE

24.1.7.4. PRODUCT PORTFOLIO

24.1.7.5. RECENT DEVELOPEMENTS

24.1.8 ASTRAZENECA

24.1.8.1. COMPANY OVERVIEW

24.1.8.2. REVENUE ANALYSIS

24.1.8.3. GEOGRAPHIC PRESENCE

24.1.8.4. PRODUCT PORTFOLIO

24.1.8.5. RECENT DEVELOPEMENTS

24.1.9 KOWA COMPANY, LTD.

24.1.9.1. COMPANY OVERVIEW

24.1.9.2. REVENUE ANALYSIS

24.1.9.3. GEOGRAPHIC PRESENCE

24.1.9.4. PRODUCT PORTFOLIO

24.1.9.5. RECENT DEVELOPMENTS

24.1.10 DR. REDDY'S LABORATORIES LIMITED

24.1.10.1. COMPANY OVERVIEW

24.1.10.2. REVENUE ANALYSIS

24.1.10.3. GEOGRAPHIC PRESENCE

24.1.10.4. PRODUCT PORTFOLIO

24.1.10.5. RECENT DEVELOPMENTS

24.1.11 GLENMARK PHARMACEUTICALS LTD .

24.1.11.1. COMPANY OVERVIEW

24.1.11.2. REVENUE ANALYSIS

24.1.11.3. GEOGRAPHIC PRESENCE

24.1.11.4. PRODUCT PORTFOLIO

24.1.11.5. RECENT DEVELOPMENTS

24.1.12 LUPIN

24.1.12.1. COMPANY OVERVIEW

24.1.12.2. REVENUE ANALYSIS

24.1.12.3. GEOGRAPHIC PRESENCE

24.1.12.4. PRODUCT PORTFOLIO

24.1.12.5. RECENT DEVELOPMENTS

24.1.13 ABBOTT

24.1.13.1. COMPANY OVERVIEW

24.1.13.2. REVENUE ANALYSIS

24.1.13.3. GEOGRAPHIC PRESENCE

24.1.13.4. PRODUCT PORTFOLIO

24.1.13.5. RECENT DEVELOPMENTS

24.1.14 BAYERS AG

24.1.14.1. COMPANY OVERVIEW

24.1.14.2. REVENUE ANALYSIS

24.1.14.3. GEOGRAPHIC PRESENCE

24.1.14.4. PRODUCT PORTFOLIO

24.1.14.5. RECENT DEVELOPMENTS

24.1.15 ZYDUS LIFESCIENCES LTD.

24.1.15.1. COMPANY OVERVIEW

24.1.15.2. REVENUE ANALYSIS

24.1.15.3. GEOGRAPHIC PRESENCE

24.1.15.4. PRODUCT PORTFOLIO

24.1.15.5. RECENT DEVELOPMENTS

24.1.16 TEVA PHARMACEUTICALS INDUSTRIES LTD.

24.1.16.1. COMPANY OVERVIEW

24.1.16.2. REVENUE ANALYSIS

24.1.16.3. GEOGRAPHIC PRESENCE

24.1.16.4. PRODUCT PORTFOLIO

24.1.16.5. RECENT DEVELOPMENTS

24.1.17 AUROBINDO PHARMA USA

24.1.17.1. COMPANY OVERVIEW

24.1.17.2. REVENUE ANALYSIS

24.1.17.3. GEOGRAPHIC PRESENCE

24.1.17.4. PRODUCT PORTFOLIO

24.1.17.5. RECENT DEVELOPMENTS

24.2 PIPELINE MANUFACTURE

24.2.1 REGENINNOPHARM INC.

24.2.1.1. COMPANY OVERVIEW

24.2.1.2. REVENUE ANALYSIS

24.2.1.3. GEOGRAPHIC PRESENCE

24.2.1.4. PRODUCT PORTFOLIO

24.2.1.5. RECENT DEVELOPMENTS

24.2.2 CELECOR THERAPEUTICS

24.2.2.1. COMPANY OVERVIEW

24.2.2.2. REVENUE ANALYSIS

24.2.2.3. GEOGRAPHIC PRESENCE

24.2.2.4. PRODUCT PORTFOLIO

24.2.2.5. RECENT DEVELOPMENTS

24.2.3 IDORSIA PHARMACEUTICALS LTD

24.2.3.1. COMPANY OVERVIEW

24.2.3.2. REVENUE ANALYSIS

24.2.3.3. GEOGRAPHIC PRESENCE

24.2.3.4. PRODUCT PORTFOLIO

24.2.3.5. RECENT DEVELOPMENTS

24.2.4 KANCERA AB.

24.2.4.1. COMPANY OVERVIEW

24.2.4.2. REVENUE ANALYSIS

24.2.4.3. GEOGRAPHIC PRESENCE

24.2.4.4. PRODUCT PORTFOLIO

24.2.4.5. RECENT DEVELOPMENTS

24.2.5 TWBIO-THERA.COM

24.2.5.1. COMPANY OVERVIEW

24.2.5.2. REVENUE ANALYSIS

24.2.5.3. GEOGRAPHIC PRESENCE

24.2.5.4. PRODUCT PORTFOLIO

24.2.5.5. RECENT DEVELOPMENTS

24.2.6 MESOBLAST LTD

24.2.6.1. COMPANY OVERVIEW

24.2.6.2. REVENUE ANALYSIS

24.2.6.3. GEOGRAPHIC PRESENCE

24.2.6.4. PRODUCT PORTFOLIO

24.2.6.5. RECENT DEVELOPMENTS

24.2.7 FARADAY PHARMACEUTICALS

24.2.7.1. COMPANY OVERVIEW

24.2.7.2. REVENUE ANALYSIS

24.2.7.3. GEOGRAPHIC PRESENCE

24.2.7.4. PRODUCT PORTFOLIO

24.2.7.5. RECENT DEVELOPMENTS

24.2.8 RESOTHER PHARMA

24.2.8.1. COMPANY OVERVIEW

24.2.8.2. REVENUE ANALYSIS

24.2.8.3. GEOGRAPHIC PRESENCE

24.2.8.4. PRODUCT PORTFOLIO

24.2.8.5. RECENT DEVELOPMENTS

24.2.9 ACTICOR BIOTECH SA

24.2.9.1. COMPANY OVERVIEW

24.2.9.2. REVENUE ANALYSIS

24.2.9.3. GEOGRAPHIC PRESENCE

24.2.9.4. PRODUCT PORTFOLIO

24.2.9.5. RECENT DEVELOPMENTS

24.2.10 NOVO NORDISK

24.2.10.1. COMPANY OVERVIEW

24.2.10.2. REVENUE ANALYSIS

24.2.10.3. GEOGRAPHIC PRESENCE

24.2.10.4. PRODUCT PORTFOLIO

24.2.10.5. RECENT DEVELOPMENTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.