Global Iot In Chemical Industry Market

Market Size in USD Billion

CAGR :

%

USD

78.79 Billion

USD

176.78 Billion

2024

2032

USD

78.79 Billion

USD

176.78 Billion

2024

2032

| 2025 –2032 | |

| USD 78.79 Billion | |

| USD 176.78 Billion | |

|

|

|

|

What is the Global IoT in Chemical industry Market Size and Growth Rate?

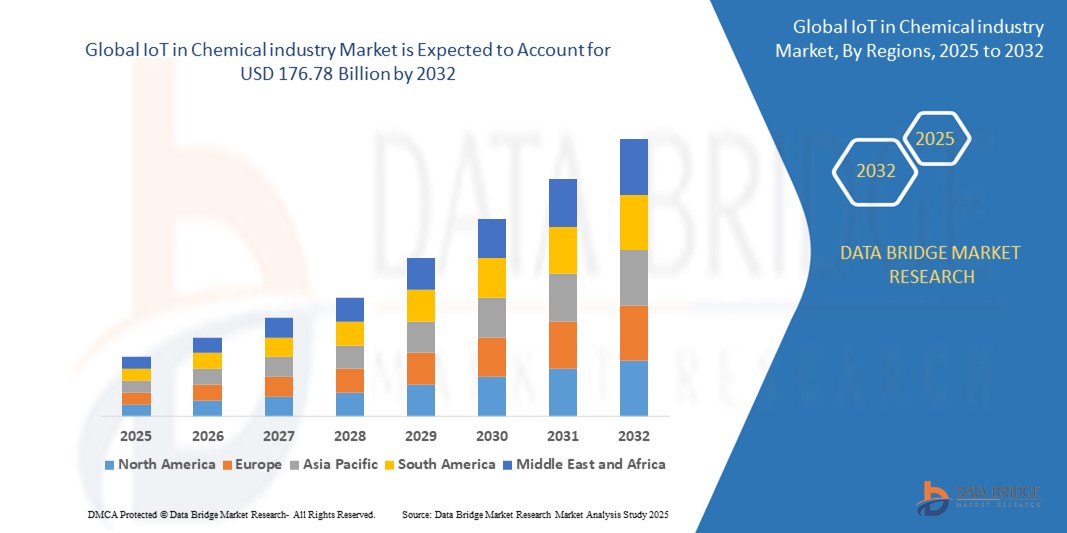

- The global IoT in chemical industry market size was valued at USD 78.79 billion in 2024 and is expected to reach USD 176.78 billion by 2032, at a CAGR of 10.63% during the forecast period

- This robust growth is driven by the increasing integration of connected devices, sensor technologies, and data analytics in chemical manufacturing and processing environments to improve operational efficiency and safety

- Furthermore, the growing emphasis on predictive maintenance, remote monitoring, and real-time process optimization is pushing chemical companies to adopt IoT-enabled solutions, accelerating digital transformation across the sector

What are the Major Takeaways of IoT in Chemical industry Market?

- IoT in the chemical industry enables automation, monitoring, and data-driven decision-making through smart sensors, control systems, and cloud-based analytics, significantly improving plant reliability and reducing downtime

- Major drivers include stringent safety regulations, sustainability goals, and the need for real-time visibility into chemical processes, which are encouraging investments in IoT infrastructure across the globe

- The shift toward Industry 4.0, combined with the demand for energy efficiency and waste reduction, is positioning IoT as a critical enabler in the future of chemical production and supply chain management

- North America dominated the IoT in chemical industry market with the largest revenue share of 38.45% in 2024, driven by strong digital infrastructure, early adoption of Industry 4.0 technologies, and the presence of major chemical manufacturers integrating IoT for process optimization and predictive maintenance

- Asia-Pacific is expected to register the fastest CAGR of 6.89% during the forecast period (2025–2032), propelled by growing chemical production, industrial expansion, and government initiatives for smart manufacturing in China, India, Japan, and South Korea

- The Plant Asset Management segment dominated the IoT in chemical industry market with the largest market revenue share of 26.4% in 2024, driven by the rising demand for predictive maintenance and real-time equipment monitoring

Report Scope and IoT in Chemical industry Market Segmentation

|

Attributes |

IoT in Chemical industry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the IoT in Chemical industry Market?

“Digital Transformation through Predictive Maintenance and Smart Monitoring”

- A key emerging trend in the global IoT in chemical industry market is the growing deployment of predictive maintenance solutions and real-time asset monitoring across chemical manufacturing plants. IoT sensors and cloud-connected platforms are transforming traditional operations into data-driven, proactive ecosystems

- For instance, BASF and SAP partnered to implement IoT-driven asset health systems that predict equipment failures before they occur, reducing unplanned downtime and improving process safety. These systems continuously monitor critical parameters such as temperature, pressure, and vibration

- The integration of AI algorithms and digital twins in IoT infrastructure further enhances visibility and control. Companies can simulate chemical plant performance in real time, enabling rapid decision-making, optimizing resource use, and ensuring compliance with environmental regulations

- These advancements are streamlining process automation, reducing maintenance costs, and improving energy efficiency. By enabling remote diagnostics and control, IoT is helping chemical companies stay resilient amid labor shortages and regulatory complexity

- Industry leaders such as Honeywell, Emerson, and ABB are driving this trend by offering comprehensive IoT platforms tailored to chemical production needs, including hazardous environment compatibility and secure connectivity

- As digitalization accelerates, the shift toward predictive, intelligent operations will remain a cornerstone of competitiveness and sustainability in the chemical industry

What are the Key Drivers of IoT in Chemical industry Market?

- The increasing need for operational efficiency, worker safety, and regulatory compliance in chemical manufacturing is a primary driver for the growing adoption of IoT technologies

- For instance, in June 2023, ABB launched its “Ability Smart Sensor” solution suite for chemical plants, which enables wireless monitoring of pumps and motors, thereby optimizing energy use and improving safety

- Rising environmental awareness and strict emissions regulations are pushing companies to monitor air and water quality in real time. IoT-enabled solutions allow for early leak detection, automated compliance reporting, and sustainable resource management

- In addition, the demand for remote operations and monitoring, especially in geographically distributed or hazardous production environments, is accelerating IoT implementation. This is especially relevant post-pandemic, where digital transformation gained significant momentum

- The growing trend of Industry 4.0 and investments in smart factory infrastructure are expanding the scope of IoT integration across the entire chemical value chain—from raw material sourcing to product delivery

Which Factor is challenging the Growth of the IoT in Chemical industry Market?

- One of the major challenges hindering the growth of the IoT in chemical industry market is the complexity of integrating IoT technologies with legacy infrastructure and fragmented data systems

- For instance, many chemical plants still rely on aging analog equipment that lacks digital connectivity, making it difficult to implement seamless IoT solutions without costly upgrades

- Cybersecurity remains a critical concern, particularly as chemical companies handle sensitive data and operate in high-risk environments. A breach can lead to production halts, safety risks, or environmental incidents

- To address this, vendors such as Cisco and Siemens are focusing on secure-by-design architectures, offering industrial-grade firewalls and encrypted communication protocols. However, ensuring compliance with diverse global cybersecurity regulations remains a hurdle

- Moreover, the initial cost of deploying enterprise-scale IoT systems, including sensors, software, and integration services, can be prohibitive for small and mid-sized chemical enterprises. The ROI may not be immediately apparent, especially in markets with thin margins or regulatory uncertainty

- Overcoming these challenges will require collaborative industry efforts, standardized frameworks, and government incentives to encourage digital innovation across the chemical sector

How is the IoT in Chemical industry Market Segmented?

The market is segmented on the basis of technology and chemical verticals.

- By Technology

On the basis of technology, the IoT in chemical industry market is segmented into Machine Vision, 3D Printing, Digital Twin, Plant Asset Management, Manufacturing Execution System, Distributed Control Systems, Industrial Robotics, Big Data, Artificial Intelligence, AR and VR, and Others. The Plant Asset Management segment dominated the IoT in chemical industry market with the largest market revenue share of 26.4% in 2024, driven by the rising demand for predictive maintenance and real-time equipment monitoring. This technology helps chemical manufacturers reduce operational downtime, optimize energy usage, and improve asset longevity by providing early fault detection and data-driven maintenance schedules.

The Digital Twin segment is expected to witness the fastest growth rate of 20.3% from 2025 to 2032, as it enables virtual modeling of chemical processes and equipment. With real-time simulation and analytics, digital twins support better decision-making, risk mitigation, and enhanced process optimization. Their increasing adoption in smart chemical plants is revolutionizing how operations are visualized and managed remotely.

- By Chemical Verticals

On the basis of chemical verticals, the IoT in chemical industry market is segmented into Mining and Metals, Food and Beverages, Chemicals, Pharmaceuticals, and Paper and Pulp. The Chemicals segment held the largest market revenue share of 39.1% in 2024, attributed to the broad application of IoT technologies in monitoring hazardous materials, ensuring safety compliance, and optimizing batch production processes. The sector is rapidly adopting IoT to enhance automation, traceability, and plant-wide integration, especially in petrochemical and specialty chemical manufacturing.

The Pharmaceuticals segment is anticipated to register the fastest CAGR during the forecast period, driven by stringent regulatory requirements for quality control, data integrity, and real-time monitoring of sensitive materials. IoT enables pharmaceutical manufacturers to achieve high operational efficiency, minimize contamination risks, and meet GMP standards through integrated sensor-based systems and advanced process control.

Which Region Holds the Largest Share of the IoT in Chemical industry Market?

- North America dominated the IoT in chemical industry market with the largest revenue share of 38.45% in 2024, driven by strong digital infrastructure, early adoption of Industry 4.0 technologies, and the presence of major chemical manufacturers integrating IoT for process optimization and predictive maintenance

- Companies in the region increasingly deploy IoT-enabled solutions to improve operational efficiency, reduce downtime, and ensure regulatory compliance in chemical production environments

- Robust investments in smart factory initiatives, advanced analytics, and cloud-based platforms further boost the region’s leadership in IoT implementation across the chemical value chain

U.S. IoT in Chemical Industry Market Insight

The U.S. IoT in chemical industry market held the largest revenue share in North America, driven by widespread digitization in industrial operations and the growing use of IoT for asset monitoring, remote diagnostics, and real-time data analytics. With increasing environmental regulations and labor cost pressures, chemical manufacturers in the U.S. are rapidly adopting intelligent systems to streamline operations, enhance safety, and cut costs. Moreover, partnerships between chemical giants and IoT solution providers such as IBM, Honeywell, and GE Digital are accelerating market growth through customized automation strategies.

Europe IoT in Chemical Industry Market Insight

The Europe IoT in chemical industry market is expected to grow at a healthy pace, supported by the region’s focus on sustainable manufacturing and carbon reduction. The EU’s regulatory emphasis on energy efficiency and safety compliance is driving the adoption of IoT sensors, predictive analytics, and emissions tracking solutions in chemical facilities. Countries such as Germany, France, and the U.K. are investing in Industry 4.0 integration, with strong support from public-private initiatives aiming to modernize the industrial base through digital technologies.

Germany IoT in Chemical Industry Market Insight

Germany, being the hub of Europe’s chemical industry, is witnessing significant adoption of IoT for condition monitoring, digital twin applications, and quality control automation. German manufacturers are focused on creating highly automated, efficient plants leveraging IoT and AI, with a preference for customized software platforms and real-time visualization tools. The demand is further fueled by the country’s strategic focus on smart factories and data-centric production in line with the Industrie 4.0 framework.

U.K. IoT in Chemical Industry Market Insight

The U.K. IoT in chemical industry market is projected to grow steadily as the country accelerates its transition toward digital manufacturing. British chemical firms are increasingly integrating IoT in supply chain transparency, remote process control, and waste reduction strategies. Government incentives for industrial digitization and strong demand for safe, sustainable operations are key growth enablers in the U.K. market.

Which Region is the Fastest Growing Region in the IoT in Chemical Industry Market?

Asia-Pacific is expected to register the fastest CAGR of 6.89% during the forecast period (2025–2032), propelled by growing chemical production, industrial expansion, and government initiatives for smart manufacturing in China, India, Japan, and South Korea. The increasing demand for automation, along with rising safety and compliance needs, is pushing chemical companies to adopt IoT-based monitoring, maintenance, and control systems across their facilities. The region’s cost-competitive production, skilled labor, and emerging startup ecosystems in IoT hardware and analytics further reinforce its position as the fastest-growing IoT in Chemical Industry market globally.

China IoT in Chemical Industry Market Insight

China led the Asia-Pacific region in revenue share for IoT in the chemical industry in 2024, supported by its dominance in global chemical exports, heavy investments in industrial automation, and extensive use of real-time tracking and energy management systems. The rollout of smart industrial parks and government-backed digital transformation policies have made China a key hub for IoT deployment in chemical production.

Japan IoT in Chemical Industry Market Insight

The Japan IoT in chemical Industry market is growing rapidly due to its advanced technological ecosystem and strong focus on precision manufacturing. Japanese chemical firms are leveraging IoT for asset reliability, environmental monitoring, and quality assurance, especially in high-value specialty chemical segments. With the government’s push for Society 5.0, IoT integration across industrial sectors, including chemicals, continues to gain strong momentum.

Which are the Top Companies in IoT in Chemical industry Market?

The IoT in chemical industry industry is primarily led by well-established companies, including:

- Siemens AG (Germany)

- General Electric Company (U.S.)

- Honeywell International Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Intel Corporation (U.S.)

- SAP SE (Germany)

- IBM Corporation (U.S.)

- Schneider Electric SE (France)

- Rockwell Automation, Inc. (U.S.)

- Yokogawa Electric Corporation (Japan)

- ABB Ltd. (Switzerland)

- GE Digital (U.S.)

- PTC Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Accenture plc (Ireland)

- Bosch Group (Germany)

- Emerson Electric Co. (U.S.)

- Oracle Corporation (U.S.)

What are the Recent Developments in Global IoT in Chemical industry Market?

- In October 2022, Siemens, a global technology leader, introduced a suite of IoT solutions tailored for the chemical industry, including its Digital Enterprise Suite for Chemicals, which supports end-to-end digitalization from production planning to maintenance and service. This launch underscores Siemens’ commitment to driving digital transformation across the chemical value chain

- In March 2021, BASF, one of the world’s leading chemical companies, partnered with Litmus Automation, a prominent IoT platform provider, to co-develop a digitalization solution aimed at enhancing real-time monitoring and operational efficiency in chemical production processes. The collaboration reflects the growing trend of strategic partnerships to accelerate industrial IoT adoption

- In February 2021, Honeywell, a global conglomerate, unveiled its Sentience Industrial Internet of Things (IIoT) platform specifically designed for the chemical industry, offering real-time insights and predictive analytics to improve productivity and minimize equipment downtime. The platform represents Honeywell’s continued innovation in smart manufacturing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.