Global Islamic Clothing Market

Market Size in USD Billion

CAGR :

%

USD

88.00 Billion

USD

137.12 Billion

2024

2032

USD

88.00 Billion

USD

137.12 Billion

2024

2032

| 2025 –2032 | |

| USD 88.00 Billion | |

| USD 137.12 Billion | |

|

|

|

|

Islamic Clothing Market Size

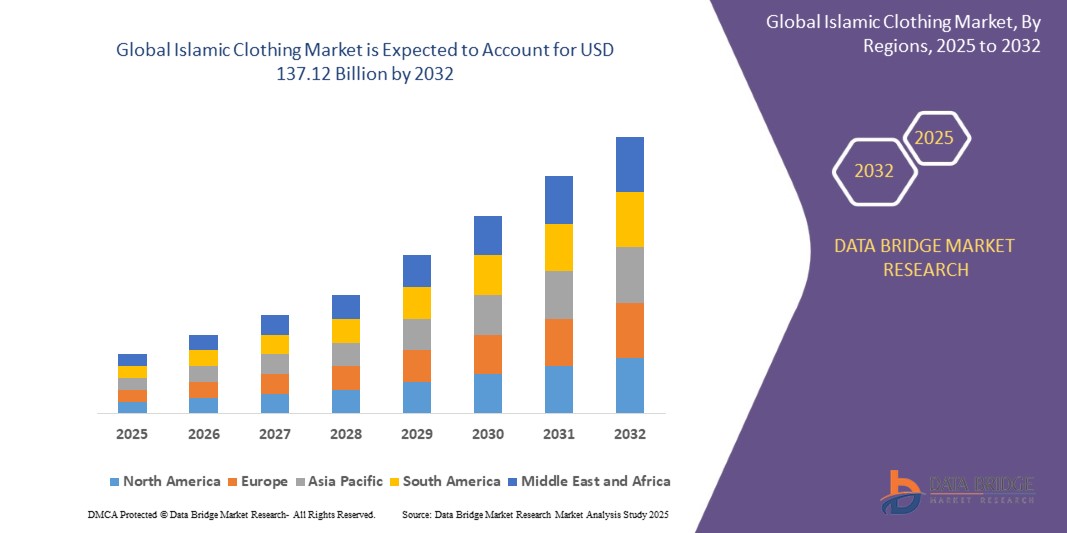

- The global islamic clothing market was valued at USD 88.00 billion in 2024 and is expected to reach USD 137.12 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.70%, primarily driven by rapidly growing muslim population worldwide

- This growth is driven by increasing disposable incomes and a rising demand for modest yet fashionable attire

Islamic Clothing Market Analysis

- The islamic clothing market is witnessing steady growth, driven by rising fashion consciousness among Muslim consumers, increasing spending on modest and culturally significant attire, and the growing popularity of stylish, functional, and innovative Islamic fashion collections. Advancements in sustainable fabrics, modern designs, and aesthetic appeal are also playing a pivotal role in market expansion

- Demand is primarily fueled by the influence of social media trends, celebrity endorsements, and the increasing number of young, fashion-forward Muslims seeking to express their identity through modest yet trendy clothing. The availability of a wide range of products catering to men, women, and children further supports the market’s growth across global regions

- North America dominates the islamic clothing market, supported by a rapidly growing young Muslim population, rising immigration rates, and the presence of numerous multinational apparel manufacturing companies offering diverse and premium modest fashion collections. E-commerce growth and frequent product innovations also reinforce the region’s market leadership

- For instance, in the U.S., the demand for trendy and sustainable Islamic clothing has increased, with brands introducing eco-friendly materials such as organic cotton and recycled fabrics to cater to environmentally conscious consumers

- Globally, the islamic clothing market is experiencing continuous expansion, with trends such as fusion wear, eco-conscious materials, and luxury modest fashion shaping the future of the industry and driving innovation in both functionality and cultural relevance

Report Scope and Islamic Clothing Market Segmentation

|

Attributes |

Islamic Clothing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Islamic Clothing Market Trends

“Integration of Technology and Smart Textiles in Islamic Fashion”

- The islamic clothing market is witnessing a growing integration of technology and smart textiles, driven by consumer demand for enhanced functionality, comfort, and personalization in modest fashion apparel

- Brands are experimenting with smart fabrics that offer features such as UV protection, temperature regulation, moisture-wicking, and anti-bacterial properties, making islamic clothing more versatile and suitable for different climates and active lifestyles

- For instance, Veil Garments introduced a collection of hijabs and abayas made with performance fabrics offering UV protection and cooling technology, catering to consumers seeking comfort and functionality in their daily wear

- The emergence of tech-enhanced modest wear, including garments embedded with fitness trackers or designed with app-controlled elements such as adjustable ventilation, is also gaining attention among younger, tech-savvy Muslim consumers

- This trend is transforming the islamic clothing market by encouraging brands to invest in research and development, collaborate with textile innovation companies, and offer high-performance, stylish solutions that meet both cultural expectations and modern lifestyle needs, setting the stage for the next evolution of Islamic fashion

Islamic Clothing Market Dynamics

Driver

“Rising Muslim Population and Growing Middle-Class Income Levels”

- The expanding global Muslim population, coupled with rising middle-class income levels, is significantly boosting the demand for islamic clothing, as consumers seek stylish, modest, and high-quality apparel that reflects both their faith and fashion preferences

- Brands are increasingly focusing on launching affordable yet fashionable islamic clothing lines to cater to the growing number of middle-income Muslim consumers, especially in emerging markets across Asia-Pacific, the Middle East, and Africa

- Countries such as Indonesia, Pakistan, India, and Malaysia are witnessing a surge in demand for modern abayas, hijabs, tunics, and kaftans, driven by increased purchasing power, urbanization, and a greater emphasis on personal style among younger Muslim populations

- For instance, in September 2024, Indonesian brand Zoya announced plans to expand its affordable modest fashion collections across Southeast Asia, aiming to capture the rapidly growing demand among middle-class Muslim consumers

- As demographic shifts and income growth continue to reshape consumer behavior, the islamic clothing market is expected to achieve sustained expansion, with brands adapting to evolving consumer needs and offering a diverse range of stylish and accessible modest fashion solutions globally

Opportunity

“Growing Demand for Sustainable and Ethical Islamic Fashion”

- The increasing consumer preference for sustainable and ethically produced clothing is creating new growth avenues for the islamic clothing market, as buyers seek products that align with their values of modesty, environmental responsibility, and social consciousness

- Brands are responding by introducing eco-friendly Islamic apparel made from organic cotton, recycled fabrics, and sustainable dyes, while also emphasizing fair labor practices and transparent supply chains in their marketing strategies

- Certifications such as GOTS (Global Organic Textile Standard) and partnerships with ethical fashion initiatives are gaining importance, helping brands build trust and appeal to environmentally and socially conscious Muslim consumers worldwide

For instance,

- In March 2024, Modanisa launched its first eco-conscious collection featuring abayas and hijabs made from sustainable fabrics, aiming to meet the growing demand for ethical fashion among young Muslim consumers

- In October 2023, Aab Collection introduced a "Green Modesty" campaign, highlighting its efforts to source eco-friendly materials and promote responsible production processes

- In June 2023, Inayah committed to carbon-neutral operations by 2026, reinforcing its brand positioning as a leader in sustainable modest fashion

- As sustainability becomes a mainstream consideration, the islamic clothing market is poised to capture new customer segments, strengthen brand loyalty, and achieve competitive advantage by embracing green innovations and ethical practices across the value chain

Restraint/Challenge

“Cultural Sensitivities and Regulatory Barriers across Regions”

- The islamic clothing market faces challenges stemming from diverse cultural norms, religious interpretations, and regulatory restrictions, making it difficult for brands to design one-size-fits-all products and marketing strategies across different Muslim-majority and minority regions

- Variations in modesty requirements, fabric preferences, and acceptable styles across countries such as Saudi Arabia, Indonesia, and Turkey require brands to adopt highly localized product lines and messaging to avoid backlash and ensure cultural appropriateness

- In addition, regulatory hurdles such as import restrictions, certification requirements (such as halal certification for textiles), and advertising limitations in conservative markets can delay product launches and complicate international expansion plans for Islamic fashion brands

For instance,

- In January 2024, Turkey implemented stricter textile import regulations, affecting several international Islamic fashion brands trying to expand in the country

- In July 2023, Indonesia’s Ministry of Religious Affairs announced new halal certification standards for clothing, impacting brands targeting the growing Muslim fashion market there

- In December 2022, Malaysia introduced new guidelines on modest fashion advertising to ensure alignment with Islamic values, requiring brands to adjust their marketing campaigns accordingly

- As cultural sensitivities and regulatory barriers intensify, islamic clothing brands must invest in regional research, build local partnerships, and tailor their product offerings and marketing communications to meet specific market expectations while ensuring global brand consistency

Islamic Clothing Market Scope

The market is segmented on the basis of product, type, and applications.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Applications |

|

Islamic Clothing Market Regional Analysis

“North America is the Dominant Region in the Islamic Clothing Market”

- Rapidly growing young Muslim population is driving strong demand for culturally relevant fashion across North America

- Rising trend in ethnic fashion is encouraging brands to launch diverse and inclusive clothing lines

- Increasing immigration of Muslim populations and the presence of numerous multinational apparel companies are further accelerating market expansion

- These combined factors position North America as the dominant region in the market, with continued growth expected in the coming years

“Asia-Pacific is projected to register the Highest Growth Rate”

- Increasing adoption of designer clothing in countries such as Malaysia, Indonesia, and India is fueling market growth in the Asia-Pacific region

- Expanding middle-class population is boosting spending power, leading to higher demand for premium and fashionable Islamic clothing

- Growing preference for fashionable and culturally significant attire is shaping consumer choices and encouraging innovation in the market

- With these factors in play, the Asia-Pacific region is set to witness rapid growth and emerge as a key player in the global islamic clothing market

Islamic Clothing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- UNIQLO CO. LTD. (Japan)

- H&M (Sweden)

- MANGO (Spain)

- Tommy Hilfiger Licensing, LLC. (U.S.)

- Lu’an Jiaodian Clothing Co., Ltd (China)

- Shukr Clothing (Jordan)

- Inayah (U.K.)

- Aab Collection (U.K.)

- Modanisa (Turkey)

- EastEssence (U.S.)

- Niswa Fashion (U.S.)

- Al-Farah (U.A.E.)

- Hijab House (Australia)

- Al-Humaira Contemporary (Malaysia)

- The Sahara Collection (Egypt)

Latest Developments in Global Islamic Clothing Market

- In August 2024, Alhaya Fashion, a leading online retailer of traditional Emirati clothing, launched its new Women's Abaya Collection featuring elegant and modest designs suitable for all occasions. This launch is expected to further solidify Alhaya Fashion’s influence in the growing modest fashion market

- In February 2023, Noon, a U.A.E.-based e-commerce company, acquired Namshi for an undisclosed amount, aiming to enhance its digital ecosystem by expanding its fashion and lifestyle offerings. This strategic move strengthens Noon's position as a dominant player in the Middle East’s online fashion sector

- In March 2021, Marshmallowscarf and Airaz Technologies competed to take over operations of the Innersejuk modest fashion brand. This competition reflects the rising importance and value of the modest fashion industry in Southeast Asia

- In February 2021, Malaysia’s Aidijuma acquired Haute Elan, a U.K.-based online marketplace for modest fashion. This acquisition helped Aidijuma expand its global footprint and cater to a wider international audience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.