Global It Operations Analytics Market

Market Size in USD Million

CAGR :

%

USD

33.54 Million

USD

361.37 Million

2024

2032

USD

33.54 Million

USD

361.37 Million

2024

2032

| 2025 –2032 | |

| USD 33.54 Million | |

| USD 361.37 Million | |

|

|

|

|

Information Technology (IT) Operations Analytics Market Size

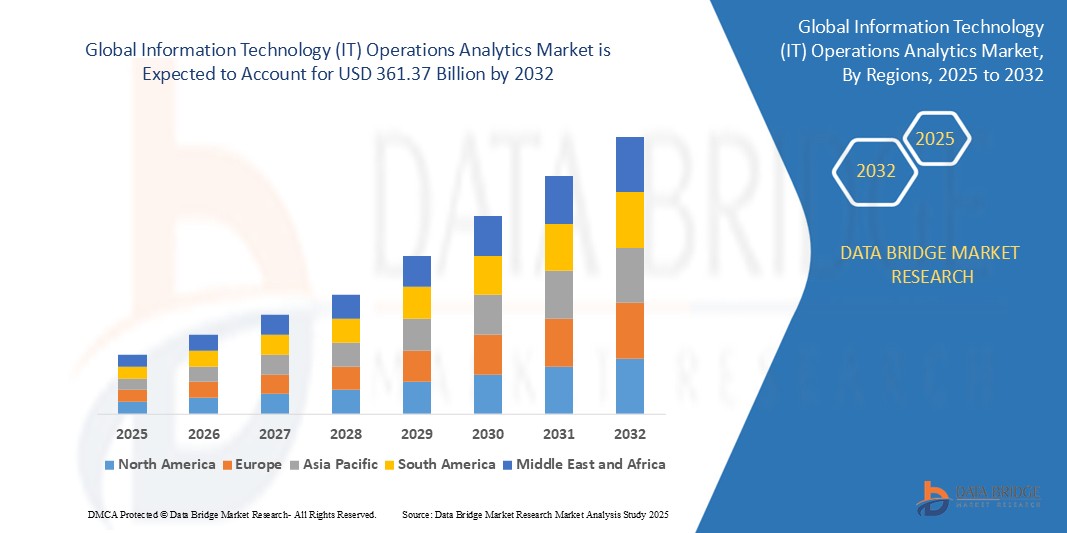

- The global information technology (IT) operations analytics market size was valued at USD 33.54 billion in 2024 and is expected to reach USD 361.37 billion by 2032, at a CAGR of 34.60% during the forecast period

- This growth is driven by factors such as the increasing adoption of cloud computing and the need for real-time insights in IT operations

Information Technology (IT) Operations Analytics Market Analysis

- The market refers to the industry encompassing tools and solutions designed to monitor, analyze, and optimize IT operations. It includes software platforms, services and technologies that facilitate real-time monitoring, predictive analytics, and automation for enhanced IT performance and efficiency

- This market caters to various sectors such as finance, healthcare, telecommunications, and manufacturing, addressing the growing need for proactive IT management and decision-making

- North America is expected to dominate the Information Technology (IT) Operations Analytics market with 39.1% due to its advanced technological infrastructure and early adoption of IT analytics solutions

- Asia-Pacific is expected to be the fastest growing region in the Information Technology (IT) Operations Analytics market during the forecast period due to rapid digital transformation and increasing adoption of cloud technologies

- Cloud segment is expected to dominate the market with a market share of 64.7% due to its scalability, cost-effectiveness, and flexibility, making them attractive to organizations of all sizes

Report Scope and Information Technology (IT) Operations Analytics Market Segmentation

|

Attributes |

Information Technology (IT) Operations Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Information Technology (IT) Operations Analytics Market Trends

“Proliferation of Predictive Analytics”

- The IT operations analytics (ITOA) market is witnessing a significant shift towards predictive analytics. This trend is driven by the increasing volume and complexity of IT data, necessitating advanced analytics to foresee potential issues before they impact operations

- Predictive analytics enables organizations to identify patterns and anomalies in real-time, allowing for proactive resolution of issues, thereby minimizing downtime and enhancing system reliability

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) with predictive analytics is further enhancing the accuracy and efficiency of IT operations, leading to smarter decision-making processes

- Industries such as telecommunications, healthcare, and finance are increasingly adopting predictive analytics to optimize their IT operations and improve service delivery.

Information Technology (IT) Operations Analytics Market Dynamics

Driver

“Surge in Cloud Computing Adoption”

- The rapid adoption of cloud computing is a primary driver for the IT Operations Analytics market. As organizations migrate their infrastructure to the cloud, the need for advanced analytics to monitor and optimize these environments becomes critical

- Cloud platforms offer scalability and flexibility, enabling businesses to handle large volumes of data and complex IT operations efficiently

- Cloud-based IT operations analytics solutions reduce the need for extensive on-premises infrastructure, leading to cost savings and improved resource allocation

- Cloud environments facilitate better collaboration across teams, allowing for more effective management of IT operations and quicker resolution of issues

- The increasing adoption of cloud computing is expected to propel the IT Operations Analytics market's growth, as organizations seek solutions to manage and optimize their cloud-based infrastructures

Opportunity

“Integration of AIOps for Automation”

- The integration of Artificial Intelligence for IT Operations (AIOps) presents a significant opportunity for the IT Operations Analytics market. AIOps utilizes AI and ML to automate and enhance IT operations processes, improving efficiency and reducing manual intervention

- AIOps platforms provide real-time insights into IT operations, enabling organizations to detect and resolve issues swiftly, thereby minimizing downtime and enhancing system performance

- By leveraging historical data and machine learning algorithms, AIOps can predict potential issues before they occur, allowing for proactive measures to be taken

- AIOps helps in optimizing resource utilization by identifying inefficiencies and recommending improvements, leading to cost savings and better performance

- Organizations adopting AIOps can gain a competitive edge by enhancing their IT operations' agility and responsiveness, aligning with the growing demand for intelligent automation in the industry

Restraint/Challenge

“Data Quality and Integration Issues”

- One of the significant challenges in the IT operations analytics market is ensuring data quality. Inaccurate, incomplete, or inconsistent data can undermine the effectiveness of analytics solutions, leading to misguided decisions

- Integrating data from diverse sources and systems poses a challenge, as disparate formats and structures can complicate the analytics process, resulting in siloed information and inefficiencies

- Establishing robust data governance practices is essential to maintain data integrity and compliance with regulations, adding complexity to the implementation of IT operations analytics solutions.

- Organizations may face resource constraints in terms of skilled personnel and technological infrastructure to address data quality and integration issues effectively.

- These challenges can hinder the adoption and effectiveness of IT operations analytics solutions, potentially delaying the realization of their benefits and affecting overall market growth

Information Technology (IT) Operations Analytics Market Scope

The market is segmented on the basis of component, deployment mode, organization size, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment |

|

|

By Organization Size |

|

|

By End-User |

|

In 2025, the cloud segment is projected to dominate the market with a largest share in deployment segment

The cloud segment is expected to dominate the information technology (IT) operations analytics market with the largest share of 64.7% in 2025 due to its high scalability, cost-effectiveness, and flexibility, making them attractive to organizations of all sizes.

The large enterprises is expected to account for the largest share during the forecast period in organization size market

In 2025, the large enterprises segment is expected to dominate the market with the largest market share of 31.6% due to These organizations have the resources to invest in comprehensive ITOA solutions to manage complex IT infrastructures. For large enterprises, optimizing IT operations is crucial for maintaining competitive advantage and operational efficiency.

Information Technology (IT) Operations Analytics Market Regional Analysis

“North America Holds the Largest Share in the Information Technology (IT) Operations Analytics Market”

- North America is anticipated to lead the global IT operations analytics market with 39.1% due to its advanced technological infrastructure and early adoption of IT analytics solutions

- The region benefits from a strong IT ecosystem, fostering innovation and creating a favorable environment for the widespread implementation of IT operations analytics

- A high concentration of key market players and a proactive approach towards digital transformation contribute to North America's leadership in this market

- Significant investments in cloud computing and data analytics technologies further bolster the region's dominance in the IT operations analytics sector

- Industries such as healthcare, finance, and manufacturing are increasingly adopting IT operations analytics to optimize operations, reduce costs, and improve performance

“Asia-Pacific is Projected to Register the Highest CAGR in the Information Technology (IT) Operations Analytics Market”

- Asia-Pacific is expected to be the fastest-growing region in the IT operations analytics market due to its rapid digital transformation and increasing adoption of cloud technologies

- The region is witnessing a rise in investments in IT infrastructure, including data centers and cloud services, driving the demand for advanced analytics tools

- A rising demand for advanced analytics tools to optimize IT operations across diverse industries is contributing to the market's growth in Asia-Pacific

- Government initiatives promoting digitalization and smart city projects are further accelerating the adoption of IT operations analytics solutions in the region

- Countries such as China, India, and Japan are at the forefront of this growth, with substantial investments in IT infrastructure and a burgeoning technology sector

Information Technology (IT) Operations Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Splunk Inc. (U.S.)

- Microsoft (U.S.)

- Broadcom (U.S.)

- IBM Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Oracle (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Sumo Logic (U.S.)

- BMC Software, Inc. (U.S.)

- Hitachi Vantara LLC (U.S.)

- ExtraHop Networks (U.S.)

- ScienceLogic (U.S.)

- SAP SE (Germany)

- SolarWinds Worldwide, LLC (U.S.)

- Nexthink (Switzerland)

- Paessler AG (Germany)

- Fortra, LLC (U.S.)

- Evolven Software (U.S.)

- BigPanda (U.S.)

- Zenoss Inc. (U.S.)

Latest Developments in Global Information Technology (IT) Operations Analytics Market

- In July 2024, IBM Consulting announced a partnership with Microsoft to enhance security operations for clients, particularly in managing cloud identity threats. This partnership leverages IBM's cybersecurity services with Microsoft's security technologies, including Microsoft Sentinel and Defender, to modernize security operations and offer real-time threat detection

- In April 2024, OpenText, an information technology company, announced Cloud Editions CE 24.2. OpenText IT Operations Aviator, a private-gen AI virtual assistant that is unified into OpenText SMAX. This advanced service management solution is now supporting service desk agents, which was previously exclusive to technology users

- In January 2024, ExtraHop Networks, a company specializing in IT Ops analytics and cloud-native network detection, announced that it had raised USD 100 million in growth capital from existing investors. This funding added cybersecurity veterans to the executive team to support the company’s continued growth

- In November 2023, Hewlett Packard Enterprise (HPE) announced a partnership with NVIDIA to launch a new enterprise-grade solution for generative AI (GenAI). This full-stack offering integrates HPE’s computing capabilities and AI software with NVIDIA’s advanced AI technologies. The collaboration aims to help businesses quickly and efficiently customize AI models using their data, facilitating smoother deployment across diverse environments, from edge to cloud

- In March 2023, Splunk Inc., a player in cyber security and observability, announced innovations in its unified platform of safety and observability to help build safer and more resilient digital enterprises. The latest innovations from Splunk included improvements to mission control and monitoring cloud, and the general availability of the Splunk Edge Processor. Organizations can unify, simplify, and modernize their processes and operations with the Splunk platform

- In January 2023, Microsoft launched a showcase of a cloud service called Smart Store Analytics in partnership with AiFi. This startup aims to make it cost-effective for retailers to deploy autonomous shopping technology. Smart Store Analytics is part of the Microsoft Cloud for Retail product suite, which provides retailers with AiFi’s technology and operational analytics for their Smart Store fleets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.