Global Iv Equipment Market

Market Size in USD Billion

CAGR :

%

USD

16.92 Billion

USD

28.43 Billion

2025

2033

USD

16.92 Billion

USD

28.43 Billion

2025

2033

| 2026 –2033 | |

| USD 16.92 Billion | |

| USD 28.43 Billion | |

|

|

|

|

Intravenous (IV) Equipment Market Size

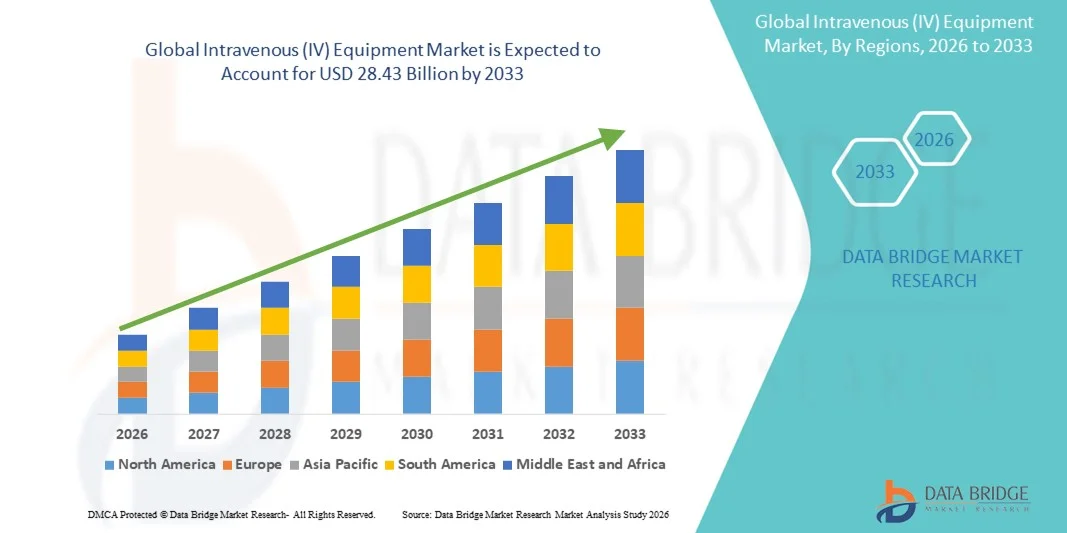

- The global Intravenous (IV) equipment market size was valued at USD 16.92 billion in 2025 and is expected to reach USD 28.43 billion by 2033, at a CAGR of 6.70 % during the forecast period

- The market growth is largely driven by the increasing prevalence of chronic diseases, rising hospitalization rates, and expanding use of IV therapy across healthcare settings, which is boosting the demand for advanced infusion systems and consumables

- Furthermore, the growing requirement for safe, efficient, and technologically enhanced IV delivery solutions is positioning IV equipment as an essential component of modern patient care. These converging factors are accelerating the adoption of IV devices, thereby significantly strengthening the market’s overall expansion

Intravenous (IV) Equipment Market Analysis

- Intravenous (IV) equipment, comprising catheters, infusion pumps, administration sets, and related consumables, is a crucial component of modern clinical care across hospitals, clinics, and emergency settings due to its essential role in safely and accurately delivering medications, fluids, and nutrients to patients

- The escalating demand for Intravenous (IV) equipment is primarily driven by the rising burden of chronic diseases, increasing hospitalization and surgical volumes, and a growing need for precise, contamination-free drug delivery supported by continuous advancements in infusion technologies

- North America dominated the Intravenous (IV) equipment market with the largest revenue share of 35.6% in 2025, driven by advanced healthcare infrastructure, high healthcare expenditure, and strong adoption of next-generation infusion solutions, with the U.S. experiencing substantial growth in IV therapy utilization across critical care, oncology, and home infusion settings, fueled by innovations in smart pumps and safety-engineered catheter systems

- Asia-Pacific is expected to be the fastest growing region in the Intravenous (IV) equipment market during the forecast period due to expanding healthcare investments, growing hospital capacities, and rising patient volumes associated with chronic and infectious diseases

- Intravenous (IV) Catheters segment dominated the Intravenous (IV) equipment market in 2025 with a market share of 41.7%, supported by their indispensable role in nearly all IV therapy applications and the ongoing shift toward advanced, infection-prevention catheter designs that enhance patient safety and clinical outcomes

Report Scope and Intravenous (IV) Equipment Market Segmentation

|

Attributes |

Intravenous (IV) Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Intravenous (IV) Equipment Market Trends

Enhanced Efficiency Through Smart Infusion and Digital Integration

- A significant and accelerating trend in the global intravenous (IV) equipment market is the expanding integration of digital health technologies, smart infusion capabilities, and connected monitoring systems, which is substantially enhancing accuracy, workflow efficiency, and patient safety across healthcare facilities

- For instance, Baxter’s Spectrum IQ infusion system integrates seamlessly with electronic medical records (EMRs), enabling automated data transmission for clinical decision-making and reducing manual entry errors. Similarly, B. Braun’s SpacePlus system supports centralized fleet management through hospital networks

- AI integration in IV equipment enables functionalities such as predictive maintenance of infusion pumps, early identification of flow irregularities, and more intelligent alarm management. For instance, ICU Medical’s IV systems are increasingly leveraging analytics to optimize infusion accuracy and detect anomalies in real time, thereby improving patient outcomes

- The seamless integration of IV equipment with clinical software platforms allows centralized control of infusion data, medication libraries, and device settings, enabling hospitals to manage infusions alongside other connected technologies for better operational coordination

- This trend toward more intelligent, automated, and interconnected infusion systems is reshaping expectations for hospital medication delivery standards. Consequently, companies such as Fresenius Kabi are developing advanced infusion technologies with enhanced digital connectivity and integrated safety features

- The demand for IV equipment offering smart monitoring, automated workflows, and EMR-linked capabilities is growing rapidly across hospitals and ambulatory centers, as healthcare providers increasingly prioritize precision, efficiency, and comprehensive digital health functionality

Intravenous (IV) Equipment Market Dynamics

Driver

Growing Need Due to Rising Chronic Disease Burden and Hospital Procedures

- The increasing prevalence of chronic illnesses, rising surgical volumes, and expanding hospital admissions are major drivers contributing to the growing demand for intravenous (IV) equipment across global healthcare systems

- For instance, in April 2025, Baxter International announced advancements in automated infusion safety technologies within its connected pump platforms, supporting improved medication administration and accelerating market growth during the forecast period

- As healthcare facilities focus on reducing medication errors and improving delivery precision, IV equipment provides features such as controlled infusion rates, real-time monitoring, and safety-engineered catheters, positioning it as an essential upgrade over older manual methods

- Furthermore, the widespread adoption of digital health tools and the increasing need for integrated medication delivery workflows are making IV equipment a critical component of modern clinical operations, offering improved accuracy, efficiency, and safety

- The convenience of automated infusion programming, remote monitoring of pump fleets, and the ability to streamline workflows through software-driven platforms are key factors driving adoption across hospitals, specialty clinics, and home infusion settings. The shift toward outpatient and home therapies, supported by portable and user-friendly infusion devices, further contributes to market growth

Restraint/Challenge

Infection Risks and Regulatory Compliance Hurdle

- Concerns regarding catheter-associated bloodstream infections (CLABSIs) and stringent regulatory requirements surrounding the safety of IV devices pose significant challenges for broader market adoption, particularly in high-volume clinical settings

- For instance, high-profile reports of contamination risks and device recalls have made some facilities cautious about adopting new infusion systems without extensive validation of long-term safety performance

- Addressing these concerns through antimicrobial catheter designs, improved sterilization standards, and enhanced device-tracking protocols is crucial for building institutional confidence. Companies such as ICU Medical and B. Braun emphasize infection-prevention engineering and rigorous testing to strengthen user trust. In addition, higher costs associated with advanced infusion pumps or specialized safety catheters can be a barrier for budget-constrained healthcare providers

- While cost-effective IV sets have become more accessible, premium solutions featuring integrated sensors, automated dose-error reduction software, or advanced connectivity often require significant investment, which may limit adoption in resource-restricted healthcare environments

- Overcoming these challenges through strengthened infection-control technologies, staff training, adherence to global regulatory standards, and the development of more affordable IV equipment options will be vital for sustained market expansion

Intravenous (IV) Equipment Market Scope

The market is segmented on the basis of product and end user.

- By Product

On the basis of product, the Intravenous (IV) equipment market is segmented into Intravenous (IV) catheters, peripheral catheters, administration sets, infusion pumps, securement devices, stopcocks and check valves, drip chambers, needleless connectors, and other intravenous (IV) equipment. The intravenous (IV) catheters segment dominated the market with the largest market revenue share of 41.7% in 2025, driven by their indispensable use across nearly every IV therapy procedure, from medication administration to fluid delivery. Hospitals and clinics rely heavily on IV catheters due to their essential function in both acute and chronic care settings. The segment also benefits from continuous advancements in safety-engineered designs aimed at reducing needlestick injuries and catheter-associated infections. The increasing global incidence of chronic diseases such as cancer, kidney disorders, and cardiovascular conditions further expands catheter usage. The high volume of surgical procedures worldwide and rising hospitalization rates strengthen its leadership position in the market. In addition, the rollout of antimicrobial and closed-system catheters by leading manufacturers further reinforces dominance in this category.

The infusion pumps segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of smart infusion technologies in hospitals and ambulatory care settings. Infusion pumps offer precise control over medication dosage, minimizing human error and improving patient safety an essential requirement in critical care units. Rising demand for connected and digitally integrated pumps that link with electronic medical records (EMRs) is accelerating their uptake. The shift toward home-based infusion therapy for chronic disease management also supports strong growth in portable and wearable pump systems. Manufacturers are introducing advanced pumps equipped with alarm reduction software, dose-error reduction systems (DERS), and remote monitoring features. The rising emphasis on automated infusion workflows and the need to standardize hospital medication delivery further contribute to the rapid adoption of next-generation infusion pump technologies.

- By End User

On the basis of end user, the Intravenous (IV) equipment market is segmented into hospitals and clinics, home care, ambulatory care centres, and others. The hospitals and clinics segment dominated the intravenous (IV) equipment market in 2025, supported by the extensive use of IV therapy across emergency care, surgeries, intensive care units, oncology wards, and inpatient treatments. Hospitals require high volumes of IV catheters, administration sets, and infusion pumps due to the large patient throughput and the complex nature of clinical procedures. The presence of advanced healthcare infrastructure enables rapid adoption of safety-enhanced and technology-integrated IV equipment. Rising rates of surgical interventions and chronic disease treatments drive consistent demand for IV accessories and consumables. Hospitals also play a key role in introducing innovative infusion technologies due to their strong purchasing power and structured procurement systems. Their need to maintain quality, infection control standards, and medication delivery accuracy further supports their dominant share in the market.

The home care segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing shift toward home-based treatment for chronic illnesses such as cancer, diabetes, and immune disorders. The rising availability of compact, user-friendly infusion pumps and portable IV administration devices is enabling patients to receive therapies safely outside hospital settings. Growing healthcare costs and patient preference for comfort-based treatment environments are accelerating the expansion of home infusion programs. Advancements in remote monitoring technologies allow clinicians to track infusion parameters, improving safety and reducing the need for frequent hospital visits. The expansion of home healthcare service providers and reimbursement support in several countries further strengthens the growth prospects. In addition, the global focus on reducing hospital congestion and enhancing continuity of care after discharge is fueling rapid adoption of home-based IV therapy solutions.

Intravenous (IV) Equipment Market Regional Analysis

- North America dominated the Intravenous (IV) equipment market with the largest revenue share of 35.6% in 2025, driven by advanced healthcare infrastructure, high healthcare expenditure, and strong adoption of next-generation infusion solutions

- Healthcare providers in the region place strong emphasis on equipment that offers precision, safety, and integration with digital platforms such as electronic medical records (EMRs), increasing adoption of technologically enhanced IV catheters, infusion pumps, and administration sets

- This widespread usage is further supported by robust healthcare infrastructure, high per-capita healthcare expenditure, and accelerating preference for smart, connected infusion solutions, establishing IV equipment as an essential component of both acute and long-term patient care in the region

U.S. Intravenous (IV) Equipment Market Insight

The U.S. intravenous (IV) equipment market captured the largest revenue share of 81% in 2025 within North America, fueled by the widespread adoption of advanced infusion technologies and digital healthcare solutions. Hospitals and clinics are increasingly prioritizing precision, safety, and connectivity in IV therapy systems. The growing trend of home-based infusion therapy, coupled with robust demand for smart infusion pumps, catheters, and administration sets, further propels market growth. Moreover, integration with electronic medical records (EMRs) and remote monitoring systems is significantly contributing to the market’s expansion.

Europe Intravenous (IV) Equipment Market Insight

The Europe intravenous (IV) equipment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising healthcare spending and the need for safe and accurate IV therapy in hospitals and clinics. The increase in surgical procedures, coupled with the demand for technologically advanced infusion systems, is fostering the adoption of IV equipment. European healthcare providers are also drawn to devices that enhance patient safety and reduce medication errors. The region is experiencing significant growth across hospitals, ambulatory care centers, and home infusion programs, with IV devices being incorporated into both new healthcare setups and upgrades to existing facilities.

U.K. Intravenous (IV) Equipment Market Insight

The U.K. intravenous (IV) equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating demand for home healthcare services and improved hospital infusion systems. In addition, the rising prevalence of chronic diseases and an aging population are encouraging both hospitals and home care providers to adopt advanced IV devices. The UK’s emphasis on healthcare digitization, alongside its strong healthcare infrastructure, is expected to continue to stimulate market growth. Integration of infusion pumps with electronic monitoring systems further supports safe and efficient medication administration.

Germany Intravenous (IV) Equipment Market Insight

The Germany intravenous (IV) equipment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of patient safety, technological advancements in infusion therapy, and strict regulatory standards. Germany’s well-developed healthcare infrastructure, combined with high adoption of smart infusion systems and safety-engineered catheters, promotes the uptake of IV equipment. Hospitals and clinics increasingly prefer devices that integrate with digital health platforms, ensuring precise dosing and reduced risk of complications. Demand for eco-friendly and sustainable IV consumables also supports market growth.

Asia-Pacific Intravenous (IV) Equipment Market Insight

The Asia-Pacific intravenous (IV) equipment market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing hospital expansions, rising patient volumes, and growing government initiatives promoting healthcare infrastructure in countries such as China, Japan, and India. The region’s growing inclination towards home infusion therapy and technologically advanced IV devices is accelerating adoption. Furthermore, as APAC emerges as a manufacturing hub for infusion pumps, catheters, and related consumables, affordability and accessibility are expanding across hospitals, clinics, and home care settings.

Japan Intravenous (IV) Equipment Market Insight

The Japan intravenous (IV) equipment market is gaining momentum due to the country’s high-tech healthcare systems, aging population, and focus on patient-centric care. Japanese hospitals and home care providers increasingly adopt smart infusion pumps and safety-engineered catheters to ensure accurate dosing and reduce complications. Integration with electronic medical records and connected monitoring systems is fueling growth. Moreover, the need for efficient outpatient and home-based therapy is driving demand for compact and easy-to-use IV devices across both residential and clinical settings.

India Intravenous (IV) Equipment Market Insight

The India intravenous (IV) equipment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, growing middle-class population, and high rates of chronic diseases. India is emerging as a key market for infusion pumps, IV catheters, and administration sets, particularly in hospitals, clinics, and home care applications. The push toward smart hospitals and home-based therapy, along with the availability of cost-effective IV devices, is a major factor propelling the market in India. Strong domestic manufacturers and increasing awareness of patient safety further support market growth.

Intravenous (IV) Equipment Market Share

The Intravenous (IV) Equipment industry is primarily led by well-established companies, including:

- B. Braun SE (Germany)

- Terumo Corporation (Japan)

- Abbott (U.S.)

- Teleflex Incorporated (U.S.)

- Henry Schein, Inc. (U.S.)

- BD (U.S.)

- 3M (U.S.)

- Smiths Medical (U.S.)

- Baxter. (U.S.)

- Ascor S.A. (Switzerland)

- Moog Inc. (U.S.)

- AngioDynamics. (U.S.)

- ICU Medical, Inc. (U.S.)

- Fresenius SE & Co. KGaA (Germany)

- Animas LLC (U.S.)

- arcomed ag (Switzerland)

- International WIN, LTD. (U.S.)

- The Metrix Company (U.S.)

What are the Recent Developments in Global Intravenous (IV) Equipment Market?

- In April 2025, ICU Medical received FDA 510(k) clearance for its Plum Solo™ single channel IV pump, along with updated versions of its Plum Duo™ dual channel pump and LifeShield™ infusion safety software, officially launching its new IV Performance Platform. These precision IV pumps are built on ICU Medical’s cassette technology (from the Plum 360) and promise ±3% accuracy in real-world conditions a big step up in reliable infusion delivery

- In June 2023, B. Braun launched its DoseTrac® Enterprise Infusion Management Software, a next generation platform that can link up to 40,000 infusion pumps across multiple facilities via a single central application. The software provides both real-time views and retrospective reporting, giving clinical and IT teams deep visibility into their entire pump fleet and medication usage

- In August 2023, ICU Medical was granted FDA 510(k) clearance for its Plum Duo infusion pump together with LifeShield infusion safety software. The dual channel design allows the pump to deliver up to four compatible IV lines, helping in high-acuity setups or when multiple drugs need to be infused simultaneously

- In January 2022, ICU Medical completed the acquisition of Smiths Medical, incorporating its syringe and ambulatory infusion devices, vascular access products, and vital care solutions to significantly broaden its IV therapy portfolio. The deal gave ICU Medical access to Smiths’ strong line of ambulatory and syringe pumps, complementing its large volume infusion systems and catheters

- In September 2021, ICU Medical announced its decision to acquire Smiths, proposing a USD 2.35 billion deal in cash and stock. This move was strategic combining ICU Medical’s existing infusion systems with Smiths’ syringe pumps, ambulatory infusion devices, and vascular access products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.