Global Kombucha Market

Market Size in USD Billion

CAGR :

%

USD

24.17 Billion

USD

121.40 Billion

2024

2032

USD

24.17 Billion

USD

121.40 Billion

2024

2032

| 2025 –2032 | |

| USD 24.17 Billion | |

| USD 121.40 Billion | |

|

|

|

|

Kombucha Market Size

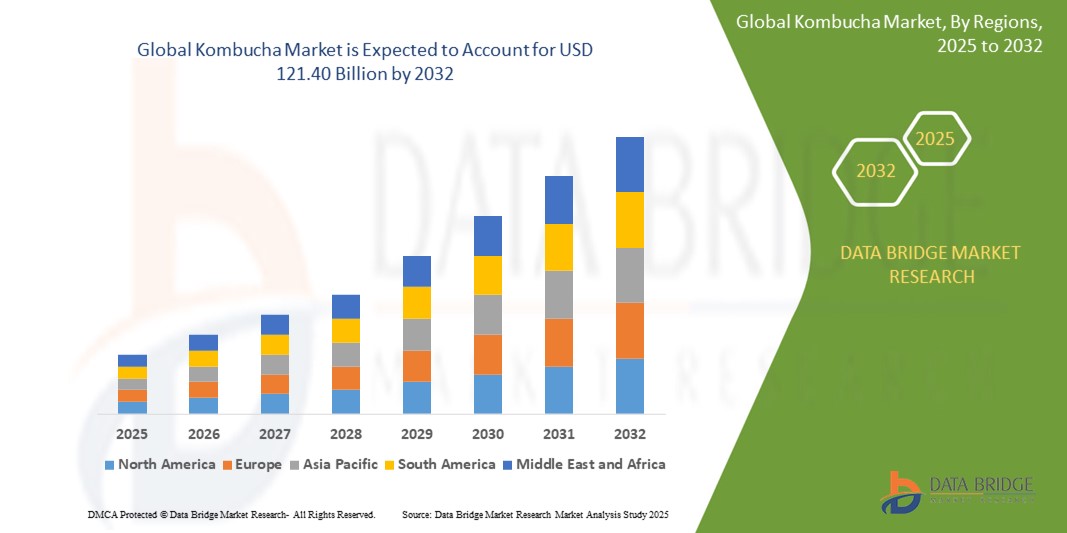

- The global kombucha market size was valued at USD 24.17 billion in 2024 and is expected to reach USD 121.40 billion by 2032, at a CAGR of 22.35% during the forecast period

- The market growth is largely fuelled by the increasing consumer preference for healthy and natural beverages, driven by rising awareness of gut health and wellness benefits

- Growing innovation in kombucha flavors and packaging formats is expanding its appeal across different age groups and markets, further driving market growth

Kombucha Market Analysis

- The kombucha market is expanding as consumers increasingly prefer natural and functional beverages, leading manufacturers to focus on improving product quality and variety to meet diverse tastes

- Innovation in fermentation processes and sustainable packaging is helping companies enhance product shelf life and appeal, supporting steady market growth and consumer trust

- North America dominates the kombucha market with the largest revenue share of 41.3% in 2024, driven by increasing health awareness and the rising demand for functional beverages

- The Asia-Pacific region is expected to witness the highest growth rate in the global kombucha market, driven by increasing health consciousness, growing disposable incomes, and the rising popularity of functional beverages across emerging economies such as China and India.

- The yeast segment holds the largest market revenue share in 2024, driven by its vital role in the fermentation process, which produces the characteristic tangy flavor and carbonation of kombucha. Yeast contributes significantly to the beverage's probiotic content, enhancing its digestive and health benefits, thereby driving demand among health-conscious consumers

Report Scope and Kombucha Market Segmentation

|

Attributes |

Kombucha Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Kombucha Market Trends

“Rise of Functional and Health-Focused Kombucha Beverages”

- There is a growing consumer preference for beverages that offer health benefits beyond basic nutrition, driving demand for kombucha known for its probiotic content and digestive health support

- Manufacturers are increasingly incorporating functional ingredients such as adaptogens, vitamins, and antioxidants into kombucha to enhance wellness appeal and target specific health needs

- This trend is supported by rising awareness of gut health and immune system benefits, motivating consumers to choose kombucha over sugary or artificial drinks

- Brands such as GT’s Kombucha and Health-Ade have capitalized on this trend by launching product lines with added functional ingredients, expanding their market share

- The trend encourages continuous product innovation and diversification, as companies seek to attract health-conscious consumers and maintain competitive advantage in the beverage sector

Kombucha Market Dynamics

Driver

“Rising Demand for Natural and Functional Beverages”

- The kombucha market is experiencing strong growth due to increasing consumer preference for natural and functional beverages that promote overall health and wellness

- Consumers are shifting away from sugary soft drinks in favor of kombucha, which is known for its probiotic benefits that support gut health and immunity

- The beverage’s compatibility with trending diets such as vegan, organic, and gluten-free is broadening its appeal among health-conscious individuals

- Companies are introducing a diverse range of formulations, including low-sugar and caffeine-free options, to meet varied consumer needs

- For instance, brands such as Remedy and Humm have expanded their product lines with functional blends that emphasize wellness and digestive health

Restraint/Challenge

“Limited Shelf Life and Complex Storage Requirements”

- A key challenge in the kombucha market is its short shelf life and the need for precise storage conditions to maintain product quality

- As a live, fermenting beverage, kombucha can experience shifts in taste, carbonation, and alcohol content if not stored properly

- Ensuring cold chain logistics throughout distribution increases operational costs, which can be burdensome for small or emerging brands

- Inconsistent fermentation during transport may affect flavor, leading to potential customer dissatisfaction or returns

- For instance, if temperature fluctuations occur during shipping, the beverage’s taste may change noticeably, impacting consumer experience and brand perception

Kombucha Market Scope

The market is segmented on the basis of ingredient type, product, type, flavor, packaging type, and distribution channel.

- By Ingredient Type

On the basis of ingredient type, the kombucha market is segmented into yeast, bacteria, mold, and others. The yeast segment holds the largest market revenue share in 2024, driven by its vital role in the fermentation process, which produces the characteristic tangy flavor and carbonation of kombucha. Yeast contributes significantly to the beverage's probiotic content, enhancing its digestive and health benefits, thereby driving demand among health-conscious consumers.

The bacteria segment is expected to witness the fastest growth rate from 2025 to 2032, as awareness increases regarding the gut health benefits offered by probiotics. The growing demand for functional beverages that support immunity and digestion is further boosting the adoption of bacterial strains in kombucha production.

- By Product

On the basis of product, the kombucha market is segmented into organic and non-organic. The organic segment dominated the market in 2024, owing to the rising preference for clean-label beverages free from artificial additives, pesticides, and GMOs. Consumers are increasingly opting for organic kombucha due to its perceived health benefits and natural ingredients.

The non-organic segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its affordability and widespread availability. As kombucha gains popularity among a broader demographic, non-organic variants offer an accessible entry point for new consumers seeking cost-effective options.

- By Type

On the basis of type, the kombucha market is segmented into original and flavored. The flavored segment held the largest revenue share in 2024, driven by consumers' growing interest in diverse taste profiles and innovative blends. Flavored kombucha caters to both health and taste preferences, boosting its appeal among younger and urban populations.

The original segment is expected to witness the fastest growth rate from 2025 to 2032, favored by traditionalists and health-conscious consumers seeking minimal ingredients and authentic fermentation processes.

- By Flavor

On the basis of flavor, the kombucha market is segmented into herbs and spices, citrus, berries, apple, coconut & mangoes, and flowers. The berries segment led the market in 2024, supported by consumer preference for antioxidant-rich ingredients and the popularity of fruity flavor profiles.

The herbs and spices segment is expected to witness the fastest growth rate from 2025 to 2032, driven by a rising trend of functional flavors offering added health benefits, such as anti-inflammatory and digestive properties.

- By Packaging Type

On the basis of packaging type, the kombucha market is segmented into glass bottles and cans. The glass bottles segment held the largest market share in 2024, attributed to their eco-friendly appeal and association with premium products. Glass is also perceived as a better option for preserving taste and quality.

The cans segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their portability, convenience, and increasing use by brands to cater to on-the-go consumption trends.

- By Distribution Channel

On the basis of distribution channel, the kombucha market is segmented into supermarkets/hypermarkets, convenience stores, health stores, online retailers, and others. The supermarkets/hypermarkets segment captured the largest market revenue share in 2024, owing to high consumer footfall and the availability of a wide variety of kombucha products under one roof.

The online retailer’s segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rapid expansion of e-commerce platforms, convenience of home delivery, and rising preference for health products purchased through digital channels.

Kombucha Market Regional Analysis

- North America dominates the kombucha market with the largest revenue share of 41.3% in 2024, driven by increasing health awareness and the rising demand for functional beverages

- Consumers in the region are highly focused on digestive health and immune support, propelling the demand for probiotic-rich drinks such as kombucha

- The presence of well-established health food retail channels and early adoption of natural beverages further supports market growth

U.S. Kombucha Market Insight

The U.S. kombucha market captured the largest revenue share of 84% in 2024 within North America, fueled by consumer inclination towards organic, non-GMO, and low-sugar beverages. The growing popularity of clean-label and gut-friendly drinks, along with robust product innovation from both large and small beverage companies, drives the market. Expanding distribution in mainstream supermarkets and online retail platforms is further enhancing accessibility and adoption.

Europe Kombucha Market Insight

The Europe kombucha market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for plant-based, fermented beverages and rising health consciousness. European consumers are becoming more proactive about gut health, which supports the growth of kombucha across the region. Sustainability, eco-friendly packaging, and locally sourced ingredients are also becoming influential purchase drivers, particularly in countries emphasizing wellness and environmental responsibility.

U.K. Kombucha Market Insight

The U.K. kombucha market is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing interest in non-alcoholic, functional beverages among millennials and health-conscious individuals. The trend toward reducing sugar consumption is pushing demand for fermented drinks such as kombucha. Increasing availability through health food stores and cafes, along with the rising popularity of vegan lifestyles, is helping to accelerate market growth.

Germany Kombucha Market Insight

The Germany kombucha market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by strong consumer demand for probiotic-rich products and natural beverages. Germany's health-driven culture and affinity for functional foods are supporting kombucha adoption, particularly among urban and younger consumers. Local producers are also expanding product lines with regionally inspired flavors, aligning with demand for authenticity and clean-label beverages.

Asia-Pacific Kombucha Market Insight

The Asia-Pacific kombucha market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of digestive health and a shift toward healthier dietary habits in emerging markets. Increasing disposable incomes, expanding urban populations, and growing access to international health trends are fuelling market expansion in countries such as China, Japan, and India. The region is also witnessing growing investment in health-focused beverage startups, supporting kombucha’s wider reach.

Japan Kombucha Market Insight

The Japan kombucha market is expected to witness the fastest growth rate from 2025 to 2032, due to the country's long-standing familiarity with fermented products and its increasing focus on wellness and longevity. While kombucha is still emerging in mainstream retail, health-conscious consumers are showing growing interest in probiotic beverages. Local innovations and the appeal of functional drinks are contributing to a gradual but steady rise in demand.

China Kombucha Market Insight

The China kombucha market held the largest revenue share within Asia-Pacific in 2024, driven by urbanization, rising middle-class health awareness, and the strong appeal of international wellness trends. China's rapidly expanding e-commerce sector and growing network of health-focused retail outlets are facilitating access to kombucha. The market is also benefiting from domestic producers offering localized flavors and value-based pricing to appeal to a broader consumer base.

Kombucha Market Share

The Kombucha industry is primarily led by well-established companies, including:

- KeVita (U.S.)

- FedUp Foods (U.S.)

- Humm Kombucha (U.S.)

- Hain Celestial (U.S.)

- Revive Drinks (U.K.)

- Kosmic Kombucha (U.S.)

- Drink Live (Australia)

- Wonder Drink (U.S.)

- Australian Organics (Australia)

- GT's Living Foods (U.S.)

- The Coca-Cola Company (U.S.)

- NessAlla Kombucha (U.S.)

- Brew Dr. (U.S.)

- Health-Ade, LLC (U.S.)

- Cell-Nique Corporation (U.S.)

- Remedy Drinks (Australia)

- The Local Drinks Co (Australia)

Latest Developments in Global Kombucha Market

- In February 2022, Superfoods Company introduced an instant kombucha formula designed for convenient at-home preparation. Infused with black tea and rich in polyphenols, flavonoids, and prebiotics, this product aims to support digestive and metabolic health. With each package making up to thirty servings, the launch offers consumers a functional and economical wellness drink. This innovation enhances accessibility in the kombucha market and caters to the demand for gut-friendly beverages

- In February 2022, Remedy Drinks launched a new wild berry kombucha flavor in the U.K., initially available at Tesco. The company also announced plans to expand its product line with mango passion flavor and increase the availability of existing options. This move strengthens its presence in the U.K. market and aligns with the growing consumer interest in healthier drink alternatives

- In July 2021, Nova Easy Kombucha unveiled a high-performance product range, including a POWER blend with natural caffeine and a RECOVERY blend with probiotics. These non-alcoholic kombucha options target fitness and wellness consumers seeking functional drinks. The launch supports the brand's positioning as a provider of performance-oriented kombucha beverages and helps attract a broader health-conscious audience

- In July 2021, Remedy Drinks partnered with RooLife Group Ltd. to market and distribute its kombucha products in China. The collaboration aims to tap into the growing interest in functional beverages among Chinese consumers. This expansion supports Remedy's international growth strategy and increases awareness of kombucha in the Asian market

- In March 2021, Health-Ade Kombucha introduced a line of kombucha-based cocktail mixers called Health-Ade Mixers, sold exclusively at Whole Foods Market. These mixers combine kombucha with ingredients such as bitters, juice, and syrup to create ready-to-use cocktail bases. The launch merges the health benefits of kombucha with lifestyle-oriented products, appealing to consumers seeking unique, better-for-you beverage experiences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Kombucha Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Kombucha Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Kombucha Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.