Global Lab Accessories Market

Market Size in USD Billion

CAGR :

%

USD

7.44 Billion

USD

13.03 Billion

2024

2032

USD

7.44 Billion

USD

13.03 Billion

2024

2032

| 2025 –2032 | |

| USD 7.44 Billion | |

| USD 13.03 Billion | |

|

|

|

|

Lab Accessories Market Size

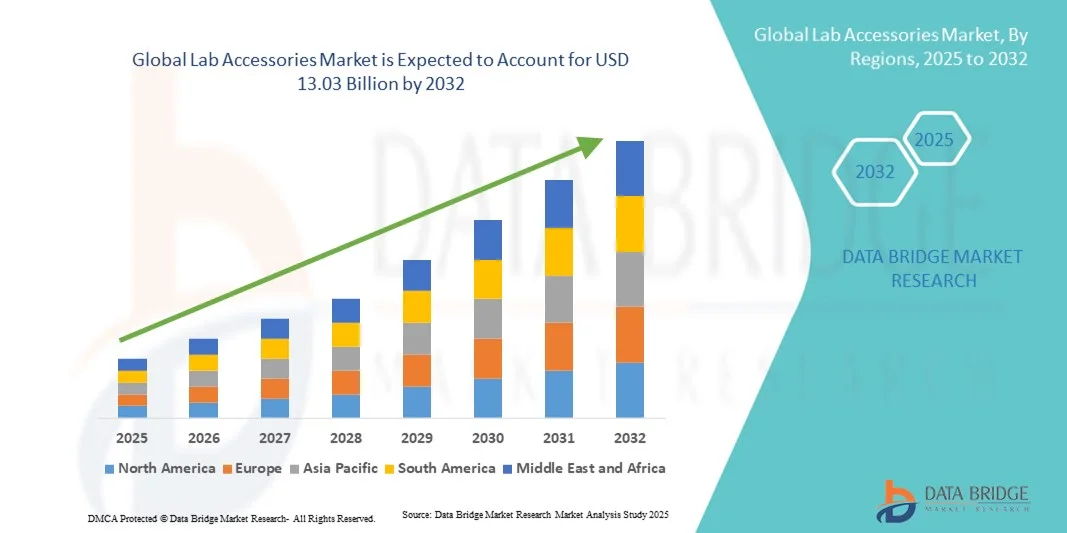

- The global lab accessories market size was valued at USD 7.44 billion in 2024 and is expected to reach USD 13.03 billion by 2032, at a CAGR of 7.25% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced laboratory equipment and the expansion of research and development activities across pharmaceuticals, biotechnology, and chemical industries

- Furthermore, rising demand for high-quality, durable, and specialized lab accessories to ensure accuracy, safety, and efficiency in laboratory operations is positioning these products as essential tools in modern laboratories. These factors collectively are accelerating the uptake of lab accessories, thereby significantly boosting the industry's growth

Lab Accessories Market Analysis

- Lab accessories, including essential tools such as microplates, pipettes, reagent reservoirs, and wash stations, are increasingly critical for ensuring precision, efficiency, and safety in laboratory workflows across research, clinical, and industrial settings

- The rising demand for lab accessories is primarily driven by the growth of biotechnology and pharmaceutical research, increasing government and private investments in R&D, and the need for standardized, high-quality equipment to improve laboratory accuracy and productivity

- North America dominated the lab accessories market with the largest revenue share of 38.2% in 2024, supported by advanced research infrastructure, high adoption of cutting-edge laboratory technologies, and the presence of major market players, with the U.S. driving demand across pharmaceutical companies, private laboratories, and academic institutions

- Asia-Pacific is expected to be the fastest-growing region in the lab accessories market during the forecast period, fueled by rising biotechnology research, expansion of academic and research institutes, and increasing healthcare infrastructure investments in emerging economies

- Pipettes segment dominated the lab accessories market with a market share of 42.8% in 2024, driven by their indispensable role in laboratory experiments, high usage across multiple end users, and the growing preference for automated and precision pipetting systems

Report Scope and Lab Accessories Market Segmentation

|

Attributes |

Lab Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lab Accessories Market Trends

Automation and Digitization in Laboratory Workflows

- A significant and accelerating trend in the global lab accessories market is the increasing integration of automated and digital laboratory systems, enhancing efficiency, accuracy, and data traceability in research and clinical environments

- For instance, automated pipetting workstations integrated with inventory management software enable precise liquid handling while minimizing human error and improving workflow standardization

- Digitally connected lab accessories, such as smart microplate readers and automated wash stations, allow real-time monitoring and data logging, enabling laboratories to optimize experimental outcomes and maintain compliance with regulatory standards

- The adoption of connected laboratory ecosystems facilitates centralized management of multiple instruments, reagents, and consumables, reducing manual interventions and streamlining experimental protocols

- This trend toward automation and digital integration is reshaping expectations for laboratory efficiency and reproducibility, driving companies such as Eppendorf to develop smart pipettes and automated consumable management systems compatible with broader laboratory software platforms

- The demand for lab accessories that seamlessly integrate into automated and digital workflows is rapidly growing across pharmaceutical, biotechnology, and academic research sectors as laboratories prioritize precision, throughput, and regulatory compliance

Lab Accessories Market Dynamics

Driver

Increasing R&D Investments and Expansion of Biotechnology and Pharmaceutical Research

- The growing global investment in research and development, particularly in biotechnology and pharmaceutical sectors, is a significant driver for the heightened demand for high-quality and specialized lab accessories

- For instance, in June 2024, Thermo Fisher Scientific reported expanding its lab solutions portfolio to support high-throughput drug discovery and biopharmaceutical research workflows

- As research intensity increases, laboratories require durable, accurate, and standardized accessories to maintain reproducibility and efficiency across experiments, driving consistent demand for pipettes, microplates, reagent reservoirs, and wash stations

- Furthermore, the expansion of clinical, academic, and private research laboratories globally is creating a broader end-user base for lab accessories, from routine consumables to specialized instruments integrated with laboratory automation systems

- The increasing focus on laboratory safety, accuracy, and compliance, coupled with the adoption of advanced laboratory technologies, is fueling the demand for high-quality lab accessories across all major end users

Restraint/Challenge

High Cost and Standardization Challenges Across Laboratories

- The relatively high cost of premium and specialized lab accessories poses a significant challenge to adoption, particularly for small-scale or budget-constrained laboratories in emerging regions

- For instance, advanced automated pipetting systems or smart microplate readers often require significant capital investment, limiting their accessibility for smaller research setups

- In addition, the lack of universal standardization across different laboratory instruments and accessories can create compatibility issues, reducing operational efficiency and discouraging adoption of integrated systems

- While some affordable alternatives exist, laboratories often face trade-offs in terms of precision, durability, or compatibility with automated workflows, impacting overall productivity

- Overcoming these challenges through cost-effective innovations, improved standardization, and compatibility with existing laboratory systems will be crucial for sustained growth in the global lab accessories market

Lab Accessories Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the lab accessories market is segmented into microplates, label printers, pipettes, pumps, reagent reservoirs, valves, tubings, and wash stations. The pipettes segment dominated the market with the largest revenue share of 42.8% in 2024, driven by their essential role in precise liquid handling across research, clinical, and industrial laboratories. Pipettes are widely used in drug discovery, diagnostic testing, and biotechnology experiments due to their accuracy, reliability, and versatility. The market sees strong demand for pipettes because of the rising focus on laboratory automation, reproducibility of results, and stringent quality standards. In addition, both manual and automated pipetting systems are being adopted across academic and industrial labs, further cementing pipettes’ dominance. The growing preference for adjustable and electronic pipettes that reduce human error is also supporting the segment's sustained leadership.

The microplates segment is anticipated to witness the fastest growth rate of 20.5% from 2025 to 2032, fueled by increasing high-throughput screening and drug discovery activities. Microplates are integral for assays, sample storage, and biochemical testing, making them indispensable in biotechnology and pharmaceutical R&D. The rising adoption of automation-compatible microplates, multi-well formats, and specialized coatings enhances efficiency and experimental accuracy. Furthermore, their compatibility with robotic systems and lab automation platforms accelerates adoption, particularly in research institutes and private laboratories. The segment benefits from continuous innovations, including low-binding, UV-transparent, and temperature-controlled microplates, meeting evolving laboratory demands.

- By End User

On the basis of end user, the lab accessories market is segmented into OEMs, biotechnology and pharmaceutical companies, hospitals, private laboratories, academic institutes, and research institutes. The biotechnology and pharmaceutical companies segment dominated the market with the largest revenue share of 39.8% in 2024, driven by their intensive R&D activities and need for high-quality, standardized lab accessories. These companies rely on pipettes, microplates, and reagent reservoirs for drug discovery, formulation, and testing processes. The segment benefits from large-scale laboratory setups, regulatory compliance requirements, and the adoption of automation to enhance throughput and reproducibility. Furthermore, the focus on precision, safety, and contamination-free operations makes these end users major contributors to market growth.

The academic institutes segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, fueled by increasing investment in research facilities and STEM education programs globally. Academic laboratories are increasingly adopting advanced lab accessories such as automated pipettes, microplates, and wash stations to improve efficiency and experimental accuracy. The rising number of research grants, collaborations with industry, and establishment of advanced teaching labs drive this growth. In addition, the shift toward digital learning and laboratory simulations enhances demand for durable, versatile, and user-friendly lab accessories. Academic institutes also contribute to innovation and training, ensuring continuous adoption of cutting-edge lab equipment.

Lab Accessories Market Regional Analysis

- North America dominated the lab accessories market with the largest revenue share of 38.2% in 2024, supported by advanced research infrastructure, high adoption of cutting-edge laboratory technologies, and the presence of major market players

- Laboratories in the region prioritize high-quality, standardized, and automation-compatible accessories such as pipettes, microplates, and wash stations to ensure precision, efficiency, and compliance with regulatory standards

- This widespread adoption is further supported by the presence of leading market players, advanced laboratory technologies, and increasing collaborations between academic institutes and private research organizations, establishing lab accessories as essential tools across various end users

U.S. Lab Accessories Market Insight

The U.S. lab accessories market captured the largest revenue share of 42% in 2024 within North America, fueled by extensive R&D activities in biotechnology, pharmaceutical, and academic sectors. Laboratories are increasingly prioritizing high-precision, automation-compatible accessories such as pipettes, microplates, and wash stations to improve experimental accuracy and efficiency. The adoption of advanced laboratory equipment, coupled with stringent regulatory compliance requirements, further propels market growth. Moreover, the integration of lab accessories with laboratory information management systems (LIMS) is enhancing workflow standardization and data traceability, driving continued demand across research and clinical laboratories.

Europe Lab Accessories Market Insight

The Europe lab accessories market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in pharmaceutical and biotechnology research. Stringent quality standards and regulatory compliance requirements are fostering demand for high-quality, durable, and precise lab accessories. The region is witnessing growth across academic institutes, research centers, and private laboratories, with an emphasis on workflow efficiency and reproducibility. European laboratories are also adopting automation-compatible accessories and digital solutions, enhancing productivity and reducing human error.

U.K. Lab Accessories Market Insight

The U.K. lab accessories market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expanding focus on life sciences research and the adoption of automation in academic and industrial laboratories. Concerns regarding experimental accuracy and safety are encouraging institutions to invest in standardized and high-quality lab accessories. In addition, the U.K.’s strong research infrastructure, combined with government funding for biotechnology and pharmaceutical projects, is expected to stimulate market growth. The integration of lab accessories with smart lab systems and digital monitoring tools further supports adoption.

Germany Lab Accessories Market Insight

The Germany lab accessories market is expected to expand at a considerable CAGR during the forecast period, fueled by growing R&D investment, high-quality laboratory infrastructure, and a focus on sustainable laboratory practices. Laboratories in Germany emphasize precision, safety, and compatibility with automation systems, driving demand for pipettes, microplates, reagent reservoirs, and wash stations. The country’s strong innovation ecosystem and emphasis on compliance with regulatory standards promote the adoption of technologically advanced accessories in both academic and commercial laboratories. Integration with laboratory digitalization initiatives is also supporting growth.

Asia-Pacific Lab Accessories Market Insight

The Asia-Pacific lab accessories market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by increasing government funding for research, rapid expansion of biotechnology and pharmaceutical sectors, and growing adoption of laboratory automation in countries such as China, Japan, and India. The region’s expanding healthcare infrastructure, rising number of academic and research institutes, and focus on quality and safety are driving the demand for reliable lab accessories. In addition, local manufacturing of laboratory equipment and consumables is improving affordability and accessibility, accelerating market adoption across both research and clinical applications.

Japan Lab Accessories Market Insight

The Japan lab accessories market is gaining momentum due to advanced research infrastructure, high technology adoption, and a strong focus on automation in laboratories. The market emphasizes high-precision instruments and accessories, with growing demand for microplates, pipettes, and automated wash stations. Integration with digital laboratory management systems enhances data accuracy and operational efficiency. Moreover, Japan’s aging population and healthcare focus are increasing demand for laboratory diagnostics and research, further driving adoption of lab accessories across academic, clinical, and industrial laboratories.

India Lab Accessories Market Insight

The India lab accessories market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing R&D activities, and the expansion of academic and clinical laboratories. India’s rising biotechnology and pharmaceutical sectors, coupled with government initiatives promoting research infrastructure, are driving demand for high-quality and affordable lab accessories. Local manufacturing, cost-effective solutions, and the increasing adoption of laboratory automation are key factors supporting growth in both residential research labs and commercial laboratory applications.

Lab Accessories Market Share

The Lab Accessories industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Danaher U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- PerkinElmer (U.S.)

- Sartorius AG (Germany)

- Eppendorf AG (Germany)

- Merck & Co., Inc. (U.S.)

- Corning Incorporated (U.S.)

- Greiner Bio-One International GmbH (Austria)

- Abbott (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Waters Corporation (U.S.)

- Shimadzu Corporation (Japan)

- Illumina, Inc. (U.S.)

- Mettler-Toledo International Inc. (U.S.)

- 3M (U.S.)

- GE Healthcare (U.S.)

- Lonza Group (Switzerland)

What are the Recent Developments in Global Lab Accessories Market?

- In April 2025, QIAGEN announced plans to launch three new sample preparation instruments QIAmini, QIAsprint, and QIAcube Connect—by 2026. These instruments aim to enhance lab automation and streamline workflows in clinical and research laboratories

- In January 2024, At SLAS 2024, Tecan unveiled the Next-Gen Introspect, a digital tool designed to improve lab productivity. Slated for commercial release in Q2 2024, this platform aims to optimize laboratory processes through advanced digital solutions

- In November 2023, The Lab Innovations 2023 event in Birmingham highlighted the latest advancements in laboratory technology, focusing on smart and sustainable solutions. The event featured innovations aimed at improving efficiency and reducing environmental impact in laboratory settings

- In January 2023, At SLAS 2023, Synthace introduced the Experiment Platform, a software tool designed to enhance high-throughput experimentation and the design of experiments. This platform aims to provide researchers with powerful tools to navigate the complexity of biological system

- In November 2022, Agilent unveiled its next-generation InfinityLab LC Series, featuring advanced automation with InfinityLab Assist Technology. This series aims to improve sample tracking and enhance sustainability in laboratory workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.