Global Laboratory Biological Reagents Market

Market Size in USD Billion

CAGR :

%

USD

5.14 Billion

USD

11.40 Billion

2025

2033

USD

5.14 Billion

USD

11.40 Billion

2025

2033

| 2026 –2033 | |

| USD 5.14 Billion | |

| USD 11.40 Billion | |

|

|

|

|

Laboratory Biological Reagents Market Size

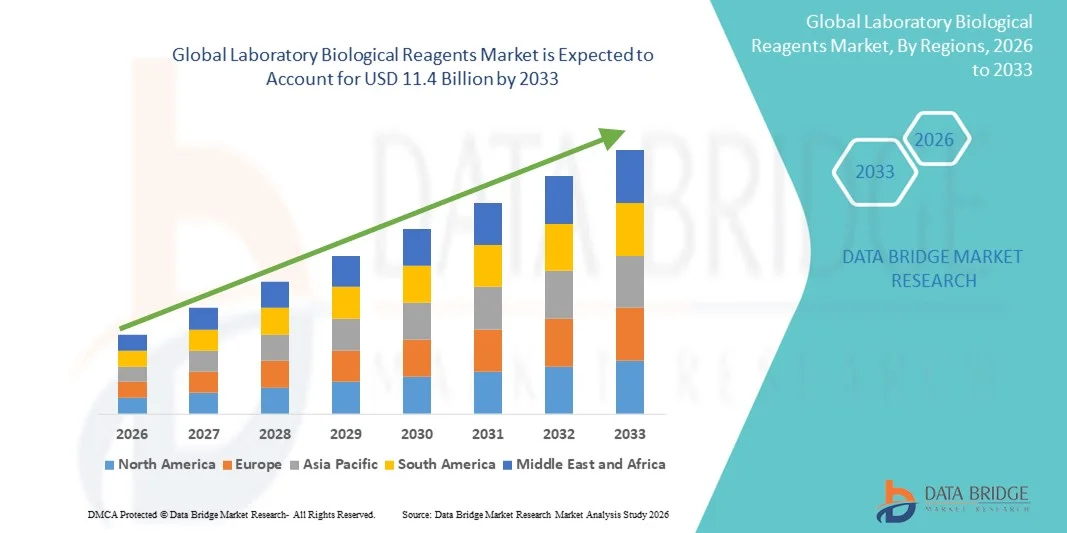

- The global laboratory biological reagents market size was valued at USD 5.14 billion in 2025 and is expected to reach USD 11.4 billion by 2033, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by the expanding use of molecular diagnostics, genomics, proteomics, and advanced life-science research, which continues to drive demand for high-performance reagents across academic, clinical, and industrial settings

- Furthermore, rising investment in biopharmaceutical R&D, increased adoption of precision medicine, and a growing need for reliable, high-quality reagents for drug discovery and disease analysis are strengthening the market foundation. These converging factors are accelerating the uptake of biological reagents, thereby significantly boosting the industry’s growth

Laboratory Biological Reagents Market Analysis

- Laboratory biological reagents, which include enzymes, antibodies, buffers, nucleic acids, and assay kits, are essential components across molecular biology, diagnostics, drug discovery, and biomanufacturing workflows, becoming increasingly vital to modern research and clinical processes due to their precision, reliability, and ability to support complex analytical techniques

- The escalating demand for biological reagents is primarily fueled by the rising adoption of molecular diagnostics, rapid expansion of genomics and proteomics research, and increasing emphasis on precision medicine, coupled with growing investments in pharmaceutical R&D and the widespread need for high-quality reagents across laboratories

- North America dominated the laboratory biological reagents market with the largest revenue share of 40.3% in 2025, supported by advanced research infrastructure, strong biopharmaceutical presence, and rapid adoption of innovative genomic and diagnostic technologies, with the U.S. showing substantial growth in reagent consumption driven by expanding clinical testing, biotech innovation, and increasing numbers of academic and commercial research programs

- Asia-Pacific is expected to be the fastest-growing region in the laboratory biological reagents market during the forecast period due to accelerating biotechnology investments, rising healthcare expenditure, growing academic research capacity, and increasing local manufacturing of molecular and diagnostic reagents

- The Molecular Biology Reagents segment dominated the market with a share of 32.9% in 2025, driven by the widespread use of PCR, qPCR, sequencing workflows, nucleic acid amplification, and other core molecular techniques that remain foundational to diagnostic testing, genetic analysis, and pharmaceutical research

Report Scope and Laboratory Biological Reagents Market Segmentation

|

Attributes |

Laboratory Biological Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Laboratory Biological Reagents Market Trends

Accelerated Adoption of High-Throughput and AI-Enhanced Research Workflow

- A significant and accelerating trend in the global laboratory biological reagents market is the rapid shift toward high-throughput, automation-enabled, and AI-supported research platforms that enhance analytical precision, data quality, and workflow speed across genomics, proteomics, and molecular diagnostics laboratories

- For instance, vendors are integrating automated liquid handling systems with specialized reagents designed for ultra-high-throughput PCR, sequencing, and immunoassay workflows, enabling laboratories to process larger sample volumes while reducing manual variability and turnaround time

- AI integration in reagent-based workflows supports predictive assay optimization, automated quality assessment, and intelligent troubleshooting, improving assay performance while reducing reagent waste; for instance, some sequencing platforms now use machine-learning algorithms to refine reagent mixing ratios and enhance read accuracy

- The rising use of connected laboratory ecosystems, cloud-linked instruments, and digital reagent tracking systems enables centralized control over assay setup, inventory management, and quality monitoring, creating unified and efficient research environments

- This movement toward more intelligent, automated, and data-driven workflows is fundamentally reshaping laboratory expectations for reagent performance, driving manufacturers to develop advanced formulations optimized for robotics, AI algorithms, and computational biology platforms

- The demand for reagents compatible with automated and AI-enhanced systems is rising rapidly across clinical, pharmaceutical, and academic sectors as laboratories increasingly prioritize scalability, reproducibility, and integrated digital functionality

Laboratory Biological Reagents Market Dynamics

Driver

Growing Demand Driven by Expansion of Molecular Diagnostics and Biopharmaceutical R&D

- The global rise in molecular diagnostics, infectious disease testing, and genomics-based screening, combined with the accelerating expansion of biopharmaceutical R&D, is a significant driver behind the increasing consumption of laboratory biological reagents

- For instance, in 2025 several biopharma companies expanded their molecular assay development initiatives, increasing demand for enzymes, nucleic acids, and high-performance immunoreagents used in advanced diagnostic and therapeutic research

- As laboratories intensify efforts to develop precision-medicine solutions, biological reagents offer essential capabilities such as high-sensitivity detection, robust amplification performance, and consistent assay reproducibility, providing a strong upgrade over legacy chemical-based methods

- Furthermore, the rapid adoption of sequencing technologies, PCR platforms, and cell-based analysis systems is making biological reagents indispensable for a wide range of research workflows, driving higher utilization across academic and industrial laboratories

- The rising preference for standardized assay kits, ready-to-use reagents, and workflow-specific formulations is further propelling market growth, supporting both clinical and research laboratories seeking greater efficiency and ease of use

Restraint/Challenge

Quality Variability, Cold-Chain Dependence, and Regulatory Compliance Hurdles

- Concerns surrounding reagent quality variability, supply-chain inconsistencies, and stringent regulatory requirements pose significant challenges to broader market expansion, particularly for laboratories operating in highly regulated diagnostic and biomanufacturing environments

- For instance, reports of batch-to-batch inconsistency, contamination risks, or suboptimal performance in certain reagent categories have made some laboratories cautious about switching suppliers or adopting new reagent formulations

- Addressing these concerns through enhanced manufacturing controls, validated GMP-grade production, and rigorous documentation is crucial for building confidence among clinical and pharmaceutical users who rely on high-integrity reagent performance

- In addition, the dependence on cold-chain logistics and temperature-sensitive storage increases operational costs and supply-chain risks, particularly in emerging markets where controlled shipping infrastructure is still developing

- Overcoming these challenges through improved quality assurance, strengthened regulatory compliance processes, and the development of more stable, cold-chain-resilient reagent formulations will be vital for sustaining long-term market growth

Laboratory Biological Reagents Market Scope

The market is segmented on the basis of product type, technology, application, and end user.

- By Product Type

On the basis of product type, the laboratory biological reagents market is segmented into antibodies & immunoreagents, enzymes, kits & assay reagents, culture media & cell reagents, buffers, salts & general laboratory reagents, recombinant proteins & peptides, and nucleic acids & oligonucleotides. The Kits & Assay Reagents segment dominated the market with the largest revenue share in 2025, driven by their widespread adoption in clinical diagnostics, pharmaceutical R&D, and academic research. These ready-to-use formulations reduce laboratory workload, minimize protocol variability, and offer standardized performance across a broad range of analytical workflows. Their convenience and reliability make them indispensable for applications such as PCR, ELISA, immunoassays, and pathogen detection. The expansion of point-of-care testing and rapid diagnostic solutions has further increased demand for assay kits that offer high sensitivity with minimal processing time. In addition, their compatibility with automated laboratory systems is enhancing adoption across high-throughput environments. The growing need for quick, accurate, and reproducible results continues to reinforce the leadership of this product category.

The Nucleic Acids & Oligonucleotides segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising global investment in genomics, next-generation sequencing, and precision medicine initiatives. These reagents are essential for applications such as gene expression profiling, CRISPR gene editing, synthetic biology, and molecular diagnostics. Growing demand for customized oligos, including probes, primers, and synthetic DNA/RNA constructs, is accelerating market expansion as personalized therapeutic approaches become more widespread. For instance, the increased use of mRNA-based technologies in vaccines and therapeutics has significantly boosted consumption of high-purity nucleic acid reagents. Their critical role in both research and clinical workflows ensures sustained growth as laboratories worldwide prioritize cutting-edge genetic analysis capabilities. Continued advancements in sequencing and synthetic biology will further make this the fastest-expanding segment.

- By Technology

On the basis of technology, the market is segmented into molecular biology reagents, immunoassay reagents, cell & tissue assay reagents, protein analysis reagents, and sequencing & genomic reagents. The Molecular Biology Reagents segment held the largest market share of 32.9% in 2025, driven by its central role in PCR, qPCR, cloning, gene expression analysis, and nucleic acid amplification workflows. These reagents form the foundation of modern diagnostics and life-science research, particularly in infectious disease testing, genetic screening, and oncology. Increasing adoption of molecular assays in clinical laboratories, supported by automation and high-throughput instrumentation, has strengthened demand for advanced DNA/RNA reagents. For instance, laboratories worldwide continue to expand molecular testing capabilities, requiring high-performance enzymes, primers, and master mixes. Growing emphasis on understanding genetic markers and disease pathways further contributes to the dominance of this segment. Its wide applicability across both research and clinical settings ensures its continued leadership.

The Sequencing & Genomic Reagents segment is expected to register the fastest CAGR from 2026 to 2033, driven by rapid advances in NGS technologies and falling sequencing costs. These reagents support whole-genome, targeted, and transcriptomic sequencing, which are increasingly used in cancer diagnostics, rare disease investigation, and population-scale genomic programs. For instance, national initiatives in precision medicine are accelerating the adoption of sequencing assays that require highly specialized, ultra-pure reagents. Growth in single-cell sequencing and long-read sequencing workflows is further expanding reagent demand. As biopharmaceutical companies intensify genomic biomarker discovery, this category benefits from rising commercial and research investments. The growing push toward personalized healthcare ensures that sequencing reagents remain the fastest-growing technology group.

- By Application

On the basis of application, the market is segmented into clinical diagnostics, drug discovery & pharmaceutical r&d, academic research, biomanufacturing, and environmental & food testing. The Clinical Diagnostics segment dominated the market in 2025 due to widespread use of biological reagents in infectious disease detection, oncology testing, genetic screening, and routine laboratory assays. The expanding demand for molecular and immunological tests, supported by the growth of centralized labs and point-of-care diagnostics, continues to drive reagent consumption. For instance, increased adoption of PCR-based respiratory panels and oncology biomarkers has substantially boosted reagent requirements across clinical settings. High accuracy, reliability, and regulatory compliance make biological reagents essential for diagnostic workflows. Furthermore, the push for early disease detection and personalized treatment strategies has strengthened the segment’s leadership. As healthcare systems increase diagnostic capacity, this segment remains the largest revenue contributor.

The Drug Discovery & Pharmaceutical R&D segment is projected to be the fastest growing from 2026 to 2033, driven by increased biopharmaceutical innovation and rising investment in therapeutic development. Reagents are crucial for cell-based assays, high-throughput screening, biomarker discovery, and molecular mechanism studies used in preclinical and clinical research. For instance, the expansion of biologics, gene therapies, and mRNA-based therapeutics is fueling demand for enzymes, proteins, and assay kits tailored to advanced R&D needs. Pharmaceutical companies are increasingly adopting automation and AI-driven platforms, requiring high-quality reagents compatible with sophisticated workflows. The need for reproducible, scalable, and regulatory-ready reagents further supports rapid market growth. This segment’s acceleration is also supported by global collaborations between CROs, biotech firms, and research institutions.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biotechnology companies, hospital & clinical laboratories, academic & research institutes, contract research organizations (CROs), and biomanufacturers. The Pharmaceutical & Biotechnology Companies segment dominated the market with the largest share in 2025, driven by extensive use of reagents in drug development, biological manufacturing, genetic engineering, and analytical testing. These companies rely on high-purity enzymes, proteins, kits, and cell-based reagents to support research pipelines across therapeutic areas. For instance, increased biopharma investment in monoclonal antibodies, vaccines, and cell and gene therapies has significantly boosted reagent demand. The need for consistent performance, regulatory compliance, and large-scale production drives higher consumption compared to other end users. In addition, growth in bioprocessing, quality control, and formulation studies contributes to segment leadership. As innovation accelerates within biologics and precision medicine, this user group will remain the dominant consumer of biological reagents.

The Biomanufacturers segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the rising global demand for biologics, biosimilars, vaccines, and advanced therapies. These manufacturers require large volumes of GMP-grade reagents for cell culture, upstream processing, downstream purification, and quality assurance workflows. For instance, the rapid expansion of facilities producing viral vectors, mRNA platforms, and cell-based therapies has significantly increased the need for specialized, compliant reagents. Stringent regulatory expectations around purity, consistency, and traceability further strengthen reagent demand in this segment. The shift toward continuous bioprocessing and automated manufacturing technologies is accelerating adoption of optimized reagent formulations. With biopharmaceutical capacity expanding across Asia, Europe, and the U.S., this segment represents the fastest-growing end-user group.

Laboratory Biological Reagents Market Regional Analysis

- North America dominated the laboratory biological reagents market with the largest revenue share of 40.3% in 2025, supported by advanced research infrastructure, strong biopharmaceutical presence, and rapid adoption of innovative genomic and diagnostic technologies

- The region benefits from a well-established research ecosystem supported by major academic institutions, federal funding agencies, and clinical laboratories that continuously require high-quality reagents for diagnostics, therapeutics development, and genomic research

- In addition, continuous rise in biologics, cell therapies, and precision medicine initiatives has significantly increased reagent consumption across drug discovery, biomanufacturing, and diagnostic segments, maintaining North America’s leadership position

U.S. Laboratory Biological Reagents Market Insight

The U.S. laboratory biological reagents market accounted for the largest revenue share of 82% in North America in 2025, driven by significant federal funding for biomedical research, strong pharmaceutical pipelines, and extensive adoption of advanced molecular and cellular analysis technologies. High usage of reagents in genomic medicine, biomanufacturing, and clinical diagnostics continues to propel demand across leading research institutions and biotech hubs. The nation’s rapidly expanding biologics and cell-therapy development ecosystem also fuels the consumption of high-purity reagents. In addition, the presence of major reagent manufacturers and innovation-focused biotech startups strengthens the U.S. market leadership.

Europe Laboratory Biological Reagents Market Insight

The Europe laboratory biological reagents market is projected to grow at a substantial CAGR through the forecast period, supported by strong regulatory emphasis on quality diagnostics, rising investments in life sciences research, and growing demand for precision medicine tools. Increasing adoption of advanced sequencing and proteomics platforms in academic and clinical settings is enhancing reagent utilization across the region. Europe’s push toward sustainable bioprocessing and innovation in biomanufacturing is also accelerating demand for specialized and GMP-grade reagents. The market is witnessing notable uptake across both established R&D hubs and emerging biotechnology clusters.

U.K. Laboratory Biological Reagents Market Insight

The U.K. laboratory biological reagents market is expected to record notable growth, driven by the country’s well-established biomedical research ecosystem and its leading role in genomics initiatives such as large-scale sequencing programs. Rising focus on early disease detection, cancer research, and biologics development is increasing the need for high-quality reagents in clinical and academic laboratories. Strong government support for innovation, coupled with expanding collaborations between biotech firms and universities, continues to accelerate reagent adoption. The U.K.’s advanced healthcare infrastructure further strengthens market demand for diagnostic and molecular biology reagents.

Germany Laboratory Biological Reagents Market Insight

The Germany laboratory biological reagents market is forecast to expand at a significant CAGR, supported by the country’s strong emphasis on scientific innovation, high R&D expenditure, and growing adoption of advanced laboratory technologies. Germany’s leadership in biomanufacturing, biotechnology, and pharmaceutical engineering drives robust consumption of reagents used in cell culture, protein analysis, and molecular assays. A strong preference for high-precision, quality-certified laboratory products aligns with rising demand in both industrial and academic research environments. In addition, increasing investment in translational medicine and digital laboratories supports sustained market growth.

Asia-Pacific Laboratory Biological Reagents Market Insight

The Asia-Pacific laboratory biological reagents market is set to grow at the fastest CAGR of 23% from 2026 to 2033, driven by rapid expansion of biotechnology industries, growing investments in healthcare infrastructure, and rising adoption of molecular diagnostics in countries such as China, Japan, and India. Government-led programs promoting genomic research, clinical testing, and biopharmaceutical manufacturing are accelerating reagent usage. The emergence of APAC as a global hub for cost-effective biomanufacturing and R&D further drives market expansion. Increasing private-sector funding and expanding diagnostic laboratory networks amplify growth prospects across the region.

Japan Laboratory Biological Reagents Market Insight

The Japan laboratory biological reagents market is gaining strong momentum, supported by the country’s advanced technological ecosystem, rapid integration of automation in laboratories, and increasing demand for high-precision molecular and cell-based assays. A strong focus on regenerative medicine, stem-cell research, and aging-related disease studies significantly increases the use of specialized reagents. Japan’s commitment to innovation in diagnostic testing and bioprocessing continues to drive reagent consumption across both academic and industrial sectors. The rise in smart and automated laboratories also supports steady market expansion.

India Laboratory Biological Reagents Market Insight

The India laboratory biological reagents market captured the largest revenue share in Asia-Pacific in 2025, propelled by rapid growth in clinical diagnostics, expanding biotech manufacturing capabilities, and increasing adoption of molecular testing across hospitals and research institutes. India’s strong government support for biotechnology, rising investments in pharma R&D, and a growing network of private diagnostic labs are major demand drivers. The surge in genomic testing, vaccine research, and biologics manufacturing has accelerated the need for high-quality, affordable reagents. Local production capabilities and competitive pricing further boost market penetration across the country.

Laboratory Biological Reagents Market Share

The Laboratory Biological Reagents industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Merck KGaA (Germany)

- QIAGEN (Netherlands)

- Agilent Technologies, Inc. (U.S.)

- Danaher (U.S.)

- Beckman Coulter, Inc. (U.S.)

- PerkinElmer (U.S.)

- Illumina, Inc. (U.S.)

- Promega Corporation (U.S.)

- New England Biolabs, Inc. (U.S.)

- Bio-Techne Corporation (U.S.)

- Lonza Group Ltd. (Switzerland)

- Waters Corporation (U.S.)

- BD (U.S.)

- Siemens Healthcare AG (Germany)

- BIOMÉRIEUX (France)

- GenScript Biotech Corporation (China)

- Vazyme Biotech Co., Ltd. (China)

- TransGen Biotech Co., Ltd. (China)

What are the Recent Developments in Global Laboratory Biological Reagents Market?

- In July 2025, NIBSC made available a Reference Reagent for Mpox NAT assays, a lyophilized inactivated-virus standard to help labs worldwide calibrate and harmonize nucleic-acid amplification tests for Monkeypox detection, strengthening readiness for emerging infectious diseases

- In October 2023, NIBSC updated its catalogue with a new panel of SARS-CoV-2 variant-specific antibodies and reference materials, supporting global efforts in vaccine development, serology testing, and variant-specific immune response research

- In September 2023, Takara Bio Europe (TBE) launched High-Quality (HQ) grade mRNA-production enzymes (T7 RNA polymerase, Pyrophosphatase), designed for pre-clinical and process development in mRNA vaccine and therapeutic manufacturing bridging research- to manufacturing-grade reagent needs

- In December 2021, Thermo Fisher Scientific introduced Invitrogen TrueCut HiFi Cas9 Protein, a highly-accurate CRISPR-Cas9 reagent that reduces off-target effects in genome editing compared to wild-type Cas9, advancing precision gene editing for research and therapeutic development

- In April 2021, The Native Antigen Company launched a SARS-CoV-2 Neutralisation Assay Development Kit, providing researchers with reagents (Spike RBD, labelled ACE2, controls) to assess neutralizing antibody activity critical for vaccine and variant-impact studies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.