Global Laboratory Microphysiological Systems Mps Consumables And Reagents Market

Market Size in USD Million

CAGR :

%

USD

411.64 Million

USD

983.37 Million

2025

2033

USD

411.64 Million

USD

983.37 Million

2025

2033

| 2026 –2033 | |

| USD 411.64 Million | |

| USD 983.37 Million | |

|

|

|

|

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Size

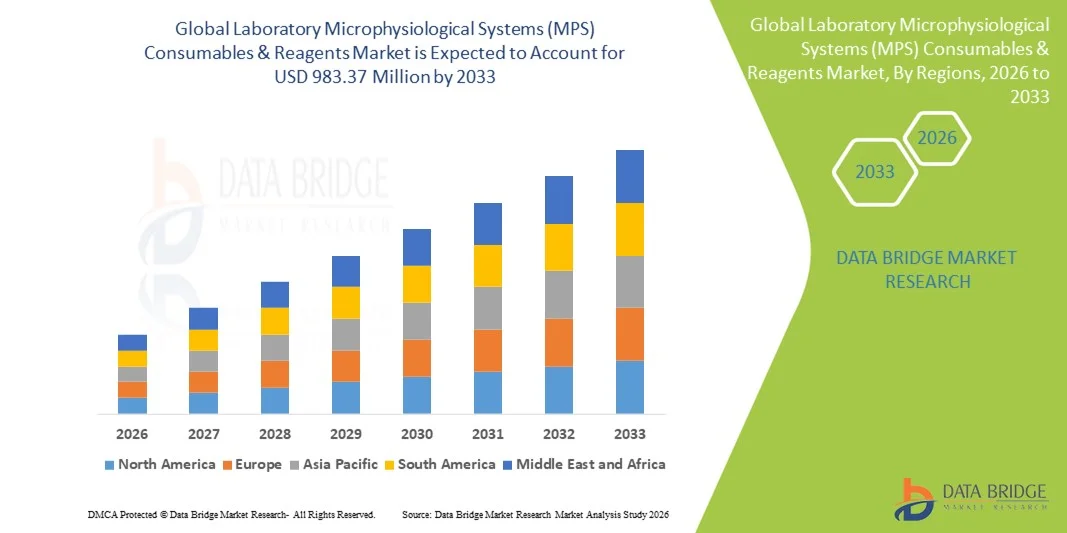

- The global Laboratory Microphysiological Systems (MPS) consumables & reagents market size was valued at USD 411.64 million in 2025 and is expected to reach USD 983.37 million by 2033, at a CAGR of 11.50% during the forecast period

- The market growth is largely driven by the increasing adoption of microphysiological systems in drug discovery, toxicity testing, and disease modeling, along with continuous advancements in organ-on-chip and microfluidics technologies that are expanding experimental capabilities in laboratory research settings

- Furthermore, rising demand for physiologically relevant in-vitro models, growing emphasis on reducing animal testing, and increasing investments by pharmaceutical, biotechnology, and research institutions are positioning MPS consumables and reagents as critical components of next-generation biomedical research, thereby significantly accelerating overall market growth

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Analysis

- Laboratory Microphysiological Systems (MPS) consumables & reagents, encompassing assay kits, cells, culture media, scaffolds, and specialized biochemical reagents used in organ-on-chip and microfluidic platforms, are increasingly essential to advanced in-vitro research workflows due to their ability to replicate human-relevant tissue functions for drug discovery, toxicity testing, and disease modeling

- The growing demand for Laboratory Microphysiological Systems (MPS) consumables & reagents is primarily driven by rising adoption of MPS technologies across pharmaceutical and biotechnology research, increasing emphasis on predictive and human-relevant preclinical models, and global initiatives aimed at reducing animal testing

- North America dominated the Laboratory Microphysiological Systems (MPS) consumables & reagents market with the largest revenue share of 42.6% in 2025, supported by robust pharmaceutical R&D investments, early commercialization of organ-on-chip platforms, and the strong presence of leading MPS technology developers and consumables suppliers, with the U.S. accounting for the majority of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the Laboratory Microphysiological Systems (MPS) consumables & reagents market during the forecast period driven by expanding life sciences research infrastructure, increasing government and private funding, and rapid growth of CRO and academic research activities

- Assay kits segment dominated the Laboratory Microphysiological Systems (MPS) consumables & reagents market with a market share of 38.9% in 2025, driven by their high recurring consumption, critical role in functional and toxicity assessments, and increasing demand for standardized, organ-specific consumables compatible with diverse MPS platforms

Report Scope and Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Segmentation

|

Attributes |

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Trends

Shift Toward Standardized, Organ-Specific and Human-Relevant Consumables

- A significant and accelerating trend in the global Laboratory Microphysiological Systems (MPS) consumables & reagents market is the growing shift toward standardized, organ-specific consumables and reagents that improve reproducibility, scalability, and cross-laboratory comparability of MPS-based experiments

- For instance, several MPS platform providers and reagent suppliers are introducing pre-validated liver-, heart-, and kidney-specific assay kits and culture media optimized for organ-on-chip systems to support consistent toxicity and efficacy studies

- Increasing emphasis on human-relevant in-vitro models is driving demand for advanced cell-based reagents, extracellular matrices, and physiologically relevant media formulations that more accurately mimic in-vivo conditions compared to traditional 2D cultures

- The integration of MPS consumables with high-content imaging, omics analysis, and automated microfluidic workflows is further shaping product development, encouraging suppliers to design reagents compatible with real-time monitoring and multiplexed assays

- This trend toward highly specialized, ready-to-use consumables is transforming procurement preferences among pharmaceutical companies and CROs, which increasingly favor standardized reagent solutions that reduce setup time and experimental variability

- Consequently, leading life sciences reagent manufacturers are expanding their MPS-focused portfolios to include application-specific consumables, reinforcing the shift toward more reliable, predictive, and scalable MPS research workflows

- Growing interest in multi-organ and body-on-chip systems is also influencing consumable innovation, with rising demand for reagents that support inter-organ communication and long-term co-culture stability

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Dynamics

Driver

Rising Adoption of MPS in Drug Discovery and Toxicology Testing

- The increasing adoption of microphysiological systems by pharmaceutical and biotechnology companies for drug discovery, safety assessment, and lead optimization is a major driver for the growing demand for MPS consumables and reagents

- For instance, in recent years, several global pharmaceutical companies have publicly highlighted the integration of organ-on-chip platforms into their preclinical pipelines to improve prediction of human toxicity and efficacy outcomes

- As drug developers seek to reduce late-stage clinical failures, MPS consumables such as assay kits, specialized media, and human-derived cells are gaining traction for their ability to generate more predictive preclinical data

- Furthermore, global regulatory and scientific initiatives encouraging the reduction of animal testing are accelerating the adoption of MPS technologies, directly increasing recurring demand for compatible consumables and reagents

- The growing reliance on MPS platforms for decision-making in early-stage research is positioning consumables and reagents as indispensable, high-frequency purchase components within modern pharmaceutical R&D environments

- Expanding investment in translational research and precision medicine is further driving demand for disease-specific and patient-derived MPS consumables

- In parallel, the rapid growth of CROs offering MPS-based testing services is boosting recurring consumption of reagents and assay kits across outsourced research workflows

Restraint/Challenge

High Cost, Technical Complexity, and Lack of Full Standardization

- The relatively high cost of specialized MPS consumables and reagents, including human primary cells, customized assay kits, and advanced biomaterials, presents a key challenge to broader market adoption, particularly among smaller laboratories and academic institutions

- For instance, advanced organ-specific reagent kits and long-term culture media required for MPS experiments are often significantly more expensive than conventional cell culture consumables

- Technical complexity associated with handling, integrating, and maintaining MPS consumables can also limit adoption, as successful implementation often requires skilled personnel and optimized laboratory infrastructure

- In addition, the lack of universal standardization across MPS platforms creates compatibility challenges, forcing end-users to source platform-specific consumables, which can increase operational costs and procurement complexity

- Overcoming these barriers through cost optimization, improved standardization, and simplified consumable workflows will be critical for expanding the adoption of Laboratory Microphysiological Systems (MPS) consumables & reagents across a broader range of end-users

- Limited long-term performance data for certain consumables can also create hesitation among conservative research organizations when transitioning from established in-vitro models

- Furthermore, supply chain constraints for high-quality human cells and specialized biomaterials may restrict scalability and consistent availability of critical MPS consumables in some regions

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Scope

The market is segmented on the basis of product, technology, application, and end user.

- By Product

On the basis of product, the Laboratory Microphysiological Systems (MPS) consumables & reagents market is segmented into assay kits, cells & biological reagents, culture media & supplements, scaffolds & ECM materials, buffers & detection reagents, and microplates, inserts & disposable microfluidic components. The assay kits segment dominated the market with the largest revenue share of 38.9% in 2025, driven by their critical role in enabling standardized and reproducible functional, toxicity, and biomarker analyses in MPS workflows. Assay kits are extensively used to measure cell viability, permeability, metabolic activity, inflammation, and organ-specific endpoints, making them indispensable in drug discovery and safety testing. Their ready-to-use nature reduces experimental complexity and variability, which is highly valued by pharmaceutical companies and CROs. Increasing adoption of high-throughput and automated MPS platforms further strengthens demand for compatible assay kits. In addition, growing regulatory interest in standardized in-vitro testing supports the widespread use of validated assay solutions. The recurring consumption of assay kits across experiments continues to reinforce their dominant market position.

The cells & biological reagents segment is expected to be the fastest growing during the forecast period, driven by rising demand for human-relevant and patient-derived models. These reagents, including primary cells, iPSC-derived cells, and co-culture systems, are essential for replicating physiological and pathological conditions within MPS platforms. Advances in stem cell technologies and differentiation protocols are expanding the availability and application scope of high-quality biological reagents. Increasing focus on disease modeling and precision medicine further accelerates adoption. Moreover, long-term and multi-organ MPS studies require continuous replenishment of biological reagents, contributing to strong growth momentum. This segment’s expansion reflects the industry’s shift toward more complex and predictive in-vitro systems.

- By Technology

On the basis of technology, the market is segmented into organ-on-chip consumables, microfluidics-specific reagents, organoid consumables, and 3D bioprinting consumables. The organ-on-chip consumables segment dominated the market in 2025, supported by widespread adoption of organ-on-chip platforms in pharmaceutical research and toxicology testing. These consumables include specialized chips, coatings, media, and reagents designed to maintain dynamic flow and tissue-specific functions. Organ-on-chip systems are increasingly preferred for their ability to replicate mechanical forces and physiological conditions, driving consistent demand for compatible consumables. The segment’s dominance is reinforced by growing validation of organ-on-chip data for decision-making in preclinical research. Strong investments by both industry and government institutions continue to support sustained consumption of organ-on-chip–specific reagents.

The organoid consumables segment is projected to grow at the fastest rate during the forecast period, driven by increasing interest in complex 3D tissue models and personalized medicine applications. Organoids offer higher structural and functional complexity, increasing demand for specialized matrices, growth factors, and differentiation reagents. Advances in stem cell research and disease modeling are accelerating adoption of organoid-based MPS workflows. In addition, the integration of organoids with microfluidic platforms is expanding their application scope. This convergence is creating strong growth momentum for organoid-focused consumables and reagents.

- By Application

On the basis of application, the market is segmented into drug discovery, toxicology testing, disease modeling, personalized, and other research applications. The drug discovery segment accounted for the largest market share in 2025, driven by the need for more predictive preclinical models to reduce late-stage clinical failures. MPS consumables are increasingly used in target validation, lead optimization, and mechanism-of-action studies. Pharmaceutical companies are adopting MPS platforms early in the development pipeline, resulting in high recurring consumption of assay kits, media, and biological reagents. The ability of MPS to generate human-relevant data supports broader adoption in drug screening workflows. Continuous R&D investment by large pharma further sustains this segment’s dominance.

The disease modeling segment is expected to register the fastest growth over the forecast period, fueled by rising focus on understanding complex disease mechanisms using human-relevant systems. MPS consumables enable modeling of chronic, rare, and multi-factorial diseases that are difficult to replicate using traditional models. Increasing academic and translational research funding is driving demand for disease-specific reagents and long-term culture consumables. The growth of patient-derived models and precision medicine initiatives further accelerates adoption. These factors collectively position disease modeling as a high-growth application area.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, contract research organizations, government & regulatory labs, and other industry labs. The pharmaceutical & biotechnology companies segment dominated the market in 2025, due to high R&D spending and early adoption of MPS technologies for preclinical testing. These organizations consume large volumes of consumables and reagents on a recurring basis as MPS platforms are integrated into routine workflows. The push to reduce attrition rates and improve safety assessment accuracy drives sustained demand. In addition, internal validation and scaling of MPS models within pharma pipelines further boosts consumable usage. This segment’s dominance is reinforced by strong financial capacity and long-term research commitments.

The contract research organizations (CROs) segment is anticipated to grow at the fastest rate during the forecast period, driven by increasing outsourcing of drug discovery and toxicology studies. CROs are expanding their MPS service offerings to meet growing demand from pharmaceutical and biotechnology clients. This trend leads to continuous, high-volume consumption of standardized consumables and assay kits. Growth in biotech startups and virtual pharma models further accelerates outsourcing to CROs. As CROs scale their MPS capabilities, demand for consumables and reagents is expected to rise rapidly.

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Regional Analysis

- North America dominated the Laboratory Microphysiological Systems (MPS) consumables & reagents market with the largest revenue share of 42.6% in 2025, supported by robust pharmaceutical R&D investments, early commercialization of organ-on-chip platforms, and the strong presence of leading MPS technology developers and consumables suppliers, with the U.S. accounting for the majority of regional demand

- Research organizations and drug developers in the region place high value on the predictive accuracy, human relevance, and reproducibility offered by MPS consumables and reagents, particularly for drug discovery, toxicology testing, and disease modeling applications

- This widespread adoption is further supported by robust research funding, the presence of leading MPS platform developers and life sciences reagent suppliers, and favorable regulatory and scientific initiatives promoting alternatives to animal testing, positioning MPS consumables & reagents as a preferred solution across both industrial and academic research settings

U.S. Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Insight

The U.S. Laboratory Microphysiological Systems (MPS) consumables & reagents market captured the largest revenue share within North America in 2025, driven by strong pharmaceutical and biotechnology R&D investments and early adoption of organ-on-chip technologies. Research institutions and drug developers in the U.S. are increasingly prioritizing human-relevant in-vitro models to improve preclinical predictability and reduce late-stage drug failures. The growing integration of MPS platforms into routine drug discovery and toxicology workflows is accelerating recurring demand for assay kits, cells, and specialized media. Moreover, robust funding from both private and government sources continues to support innovation and large-scale deployment of MPS consumables. The presence of leading MPS technology developers and life sciences reagent suppliers further reinforces the country’s dominant market position.

Europe Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Insight

The Europe Laboratory Microphysiological Systems (MPS) consumables & reagents market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulatory frameworks promoting alternatives to animal testing. Increasing focus on ethical research practices and human-relevant testing models is fostering the adoption of MPS technologies across the region. European pharmaceutical companies and academic institutions are actively investing in advanced in-vitro platforms to meet evolving regulatory and scientific requirements. In addition, rising funding for translational research and collaborative public–private initiatives is supporting market growth. The region is witnessing expanding adoption across drug discovery, toxicology, and disease modeling applications.

U.K. Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Insight

The U.K. Laboratory Microphysiological Systems (MPS) consumables & reagents market is anticipated to grow at a noteworthy CAGR over the forecast period, driven by strong government support for innovative life sciences research. The country’s emphasis on reducing animal testing and advancing human-relevant models is encouraging pharmaceutical and academic institutions to adopt MPS platforms. Increasing investments in biomedical research hubs and collaborative innovation ecosystems are further stimulating demand for consumables and reagents. The growing role of CROs and translational research organizations in the U.K. also contributes to recurring consumption of standardized MPS consumables. These factors collectively support sustained market expansion.

Germany Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Insight

The Germany Laboratory Microphysiological Systems (MPS) consumables & reagents market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong focus on scientific innovation and advanced research infrastructure. German research organizations are increasingly adopting MPS technologies to enhance drug safety evaluation and disease modeling accuracy. The emphasis on precision medicine and high-quality preclinical data is driving demand for specialized cells, assay kits, and biomaterials. In addition, strong collaboration between academia, industry, and regulatory bodies supports technology validation and adoption. Germany’s commitment to high research standards further promotes consistent consumable usage.

Asia-Pacific Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Insight

The Asia-Pacific Laboratory Microphysiological Systems (MPS) consumables & reagents market is poised to grow at the fastest CAGR during the forecast period, driven by expanding biotechnology sectors, rising research funding, and rapid growth of CRO activities in countries such as China, Japan, and India. Increasing adoption of advanced in-vitro models by pharmaceutical companies seeking cost-effective and predictive research solutions is accelerating market growth. Government initiatives supporting life sciences innovation and infrastructure development further boost adoption. As the region strengthens its role in global drug development and testing services, demand for MPS consumables and reagents is expected to rise significantly.

Japan Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Insight

The Japan Laboratory Microphysiological Systems (MPS) consumables & reagents market is gaining momentum due to the country’s strong emphasis on technological innovation and high-quality biomedical research. Japanese pharmaceutical companies are increasingly adopting MPS platforms to improve drug efficacy and safety assessment. The integration of MPS with advanced analytical technologies is supporting demand for high-performance consumables and reagents. In addition, Japan’s aging population is driving research into chronic and age-related diseases, increasing the use of disease-specific MPS models. These factors are collectively supporting steady market growth.

India Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Insight

The India Laboratory Microphysiological Systems (MPS) consumables & reagents market accounted for a significant share within Asia-Pacific in 2025, supported by rapid expansion of pharmaceutical manufacturing and contract research activities. India’s growing role as a global CRO hub is driving increased adoption of advanced in-vitro testing platforms, including MPS. Rising investments in biomedical research, coupled with government initiatives promoting innovation, are accelerating demand for consumables and reagents. Academic institutions and biotech startups are also increasingly integrating MPS technologies into research workflows. The availability of skilled talent and cost-effective research infrastructure further positions India as a key growth market.

Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market Share

The Laboratory Microphysiological Systems (MPS) Consumables & Reagents industry is primarily led by well-established companies, including:

- CN Bio Innovations Ltd (U.K.)

- Mimetas (Netherlands)

- AIM Biotech Pte. Ltd (Singapore)

- Emulate Inc. (U.S.)

- Hesperos Inc. (U.S.)

- Ascendance Biotechnology Inc. (U.S.)

- AxoSim Technologies LLC (U.S.)

- Hμrel Corporation (U.S.)

- Kirkstall Ltd (UK)

- InSphero AG (Switzerland)

- Nortis Bio (U.S.)

- SynVivo Inc. (U.S.)

- TissUse GmbH (Germany)

- Tara Biosystems (U.S.)

- AlveoliX AG (Switzerland)

- 4Design Biosciences (U.S.)

- BI/OND Solutions B.V. (Netherlands)

- BioIVT LLC (U.S.)

- Cherry Biotech SAS (France)

- Axol Bioscience Ltd (U.K.)

What are the Recent Developments in Global Laboratory Microphysiological Systems (MPS) Consumables & Reagents Market?

- In October 2025, CN Bio Innovations launched the PhysioMimix® Core system, an all-in-one organ-on-a-chip (MPS) platform that delivers validated performance across single-organ, multi-organ, and high-throughput configurations, providing researchers with greater flexibility and scalability for drug development workflows and supporting seamless use of existing consumables and reagents

- In September 2025, Emulate, Inc. and FUJIFILM Cellular Dynamics launched the Brain-Chip R1, a next-generation organ-on-a-chip model specifically designed to study drug transport across the blood-brain barrier and neuroinflammation, incorporating multiple isogenic iPSC-derived cell types and ready-to-use consumables that simplify workflows and improve reproducibility in CNS research

- In September 2024, Emulate, Inc. unveiled the Chip-R1™ Rigid Chip, a new organ-on-a-chip consumable designed with low-drug-absorbing plastics to enhance biological modeling and ADME/toxicology testing, improving accuracy and compatibility with high-content analysis in drug discovery labs

- In February 2023, CN Bio extended its microphysiological systems portfolio with the PhysioMimix™ Single-Organ Higher-Throughput (HT) System and new Liver-48 consumable plate, enabling 48 liver chip assays per plate within a standard lab footprint, significantly increasing throughput and capacity for predictive drug metabolism and toxicity studies

- In January 2023, the U.S. FDA expanded its collaboration with CN Bio to evaluate the PhysioMimix Multi-Organ MPS, marking one of the first formal regulatory initiatives to investigate multi-organ microphysiological systems for improved preclinical drug bioavailability estimation compared with traditional animal models, a partnership that also reinforces wider adoption of advanced MPS consumables and reagents

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.