Global Late Stage Oncology Drug Pipeline Market

Market Size in USD Billion

CAGR :

%

USD

10.85 Billion

USD

26.67 Billion

2025

2033

USD

10.85 Billion

USD

26.67 Billion

2025

2033

| 2026 –2033 | |

| USD 10.85 Billion | |

| USD 26.67 Billion | |

|

|

|

|

Late-Stage Oncology Drug Pipeline Market Size

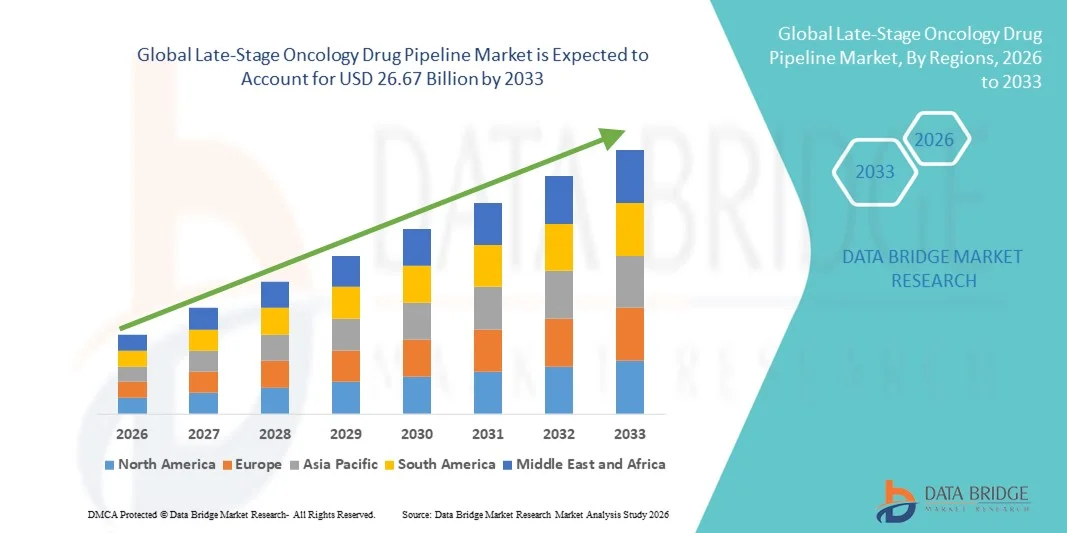

- The global late-stage oncology drug pipeline market size was valued at USD 10.85 billion in 2025 and is expected to reach USD 26.67 billion by 2033, at a CAGR of 11.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cancer worldwide and the rising focus of pharmaceutical companies on developing targeted, immunotherapy, and precision oncology treatments in advanced clinical stages

- Furthermore, advancements in clinical research, supportive regulatory frameworks, and growing investments in innovative therapies are enabling faster development and commercialization of late-stage oncology drugs. These converging factors are accelerating the progression of pipeline candidates, thereby significantly boosting the industry's growth

Late-Stage Oncology Drug Pipeline Market Analysis

- Late-stage oncology drugs, comprising candidates in Phase II, Phase III, and regulatory submission stages, represent advanced investigational therapies targeting various cancer indications and are critical components of the global pharmaceutical innovation landscape due to their potential to address high unmet medical needs and improve survival outcomes

- The escalating development of late-stage oncology drugs is primarily fueled by the rising global cancer burden, increasing investment in research and development, and strong momentum in precision medicine, immunotherapy, and targeted treatment approaches

- North America dominated the late-stage oncology drug pipeline market with the largest revenue share of 41.3% in 2025, characterized by a robust clinical trial ecosystem, significant R&D expenditure, favorable regulatory pathways, and the strong presence of leading biopharmaceutical companies, with the U.S. accounting for a substantial number of Phase III oncology trials and regulatory submissions

- Asia-Pacific is expected to be the fastest growing region in the late-stage oncology drug pipeline market during the forecast period due to expanding clinical research infrastructure, increasing patient pool availability, supportive government initiatives, and growing participation of regional biotech firms in global oncology trials

- Immunotherapy segment dominated the late-stage oncology drug pipeline market with a market share of 44.6% in 2025, driven by the growing success of immune checkpoint inhibitors, CAR-T therapies, and combination regimens demonstrating improved efficacy and durable responses across multiple cancer types

Report Scope and Late-Stage Oncology Drug Pipeline Market Segmentation

|

Attributes |

Late-Stage Oncology Drug Pipeline Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Late-Stage Oncology Drug Pipeline Market Trends

Rising Dominance of Precision Oncology and Immunotherapy Innovation

- A significant and accelerating trend in the global late-stage oncology drug pipeline market is the increasing focus on precision medicine and immunotherapy platforms, including checkpoint inhibitors, CAR-T therapies, and antibody-drug conjugates. This scientific evolution is significantly enhancing treatment specificity and long-term survival outcomes across multiple cancer types

- For instance, multiple Phase III oncology trials are currently evaluating next-generation PD-1/PD-L1 inhibitors and bispecific antibodies designed to improve response rates in resistant tumors. Similarly, several biotech firms are advancing personalized cancer vaccines into late-stage clinical development targeting specific genetic mutations

- The integration of biomarker-driven strategies in late-stage trials enables improved patient stratification and higher clinical success probabilities. For instance, targeted therapies developed for HER2-low breast cancer and KRAS-mutated lung cancer are demonstrating enhanced efficacy in genetically defined populations. Furthermore, combination regimens are increasingly being evaluated to overcome treatment resistance and extend progression-free survival

- The growing collaboration between pharmaceutical companies, research institutions, and biotechnology firms facilitates accelerated innovation and shared clinical expertise. Through strategic partnerships and licensing agreements, companies can expand oncology portfolios, optimize late-stage trial design, and strengthen global regulatory positioning

- This trend toward more targeted, data-driven, and biologically precise oncology therapies is fundamentally reshaping drug development priorities in advanced clinical stages. Consequently, companies are increasingly investing in next-generation cell therapies, radioligand treatments, and immune-oncology combinations to strengthen their late-stage pipelines

- The demand for highly effective and personalized oncology therapies is growing rapidly across both developed and emerging markets, as healthcare systems increasingly prioritize innovative treatments that improve survival rates and quality of life for cancer patients

- Increasing utilization of artificial intelligence and data analytics in oncology research is streamlining trial design, accelerating patient recruitment, and enhancing predictive modeling for therapeutic outcomes

Late-Stage Oncology Drug Pipeline Market Dynamics

Driver

Rising Global Cancer Burden and Expanding Oncology R&D Investments

- The increasing global prevalence of cancer, coupled with expanding investments in oncology research and development, is a significant driver for the accelerated advancement of late-stage oncology drug pipelines

- For instance, in recent years, major pharmaceutical companies have announced multi-billion-dollar oncology R&D expansions and strategic acquisitions of biotech firms specializing in advanced cancer therapies. Such initiatives by key industry participants are expected to drive late-stage pipeline growth during the forecast period

- As cancer incidence continues to rise worldwide, healthcare providers and policymakers are prioritizing early diagnosis and advanced treatment options, creating strong demand for innovative therapies progressing through Phase II and Phase III trials

- Furthermore, supportive regulatory frameworks such as breakthrough therapy designations and accelerated approval pathways are enabling faster progression of promising oncology candidates toward commercialization

- The growing focus on targeted therapies, immunotherapies, and rare cancer indications is encouraging pharmaceutical companies to diversify and strengthen their late-stage portfolios. The increasing availability of genomic testing and biomarker identification tools further supports precision-driven drug development and higher clinical trial success rates

- Increasing public and private funding for oncology innovation, including government grants and venture capital investments, is further accelerating the development of promising late-stage candidates

- Expanding global clinical trial networks and contract research organization support are improving trial execution efficiency and enabling broader patient enrollment across multiple geographic region

Restraint/Challenge

High Clinical Trial Failure Rates and Regulatory Complexity

- Concerns surrounding high attrition rates in oncology clinical trials pose a significant challenge to late-stage pipeline sustainability. As oncology drugs undergo complex and lengthy Phase II and Phase III studies, failure at advanced stages can result in substantial financial losses and delayed innovation

- For instance, several late-stage oncology candidates have been discontinued due to insufficient efficacy or unexpected safety concerns, leading to setbacks in commercialization timelines

- Addressing these development risks through adaptive trial designs, improved biomarker validation, and enhanced patient selection strategies is crucial for increasing late-stage success rates. Companies are increasingly leveraging real-world evidence and artificial intelligence-driven analytics to optimize trial outcomes. In addition, stringent regulatory requirements across different regions can complicate global approval strategies and prolong market entry timelines

- While regulatory agencies offer expedited pathways for breakthrough therapies, the need for comprehensive safety and efficacy data remains stringent, often increasing development costs and operational complexity

- Overcoming these challenges through collaborative research models, diversified pipeline strategies, and continuous innovation in clinical trial methodologies will be vital for sustained growth in the global late-stage oncology drug pipeline market

- High development costs associated with biologics, cell therapies, and combination regimens can strain financial resources, particularly for smaller biotechnology firms with limited funding capacity

- Pricing pressures, reimbursement uncertainties, and health technology assessment requirements in major markets may impact the commercial viability of newly approved oncology therapies

Late-Stage Oncology Drug Pipeline Market Scope

The market is segmented on the basis of therapy type, drug class, indication, and clinical stage.

- By Therapy Type

On the basis of therapy type, the global late-stage oncology drug pipeline market is segmented into chemotherapy, targeted therapy, immunotherapy, hormonal therapy, and others. The immunotherapy segment dominated the market with the largest revenue share of 44.6% in 2025, driven by the strong clinical success of immune checkpoint inhibitors, CAR-T therapies, and combination immuno-oncology regimens. Pharmaceutical companies continue to prioritize immunotherapy candidates in Phase III trials due to their durable response rates and broad applicability across multiple tumor types. The growing number of regulatory approvals for PD-1/PD-L1 inhibitors has further strengthened confidence in this segment. In addition, immunotherapies are increasingly being tested in earlier lines of treatment and in combination with targeted agents. The segment also benefits from strong investment inflows and strategic collaborations. As a result, immunotherapy maintains leadership in late-stage oncology development activity.

The targeted therapy segment is anticipated to witness the fastest growth during the forecast period, fueled by advancements in precision medicine and biomarker-driven drug development. Increasing identification of actionable genetic mutations such as KRAS, BRAF, and HER2-low is expanding the scope of targeted treatments in Phase II and Phase III pipelines. These therapies offer improved efficacy with reduced systemic toxicity compared to traditional chemotherapy. Growing adoption of genomic testing is accelerating patient stratification in clinical trials. Pharmaceutical companies are increasingly focusing on niche and rare mutations, creating new late-stage opportunities. This precision-focused approach is expected to significantly drive segment growth.

- By Drug Class

On the basis of drug class, the market is segmented into small molecule drugs, biologics, cell & gene therapies, RNA-based therapeutics, and antibody-drug conjugates. The biologics segment dominated the market in 2025 due to the widespread development of monoclonal antibodies and immune-modulating therapies in late-stage clinical trials. Biologics have demonstrated high specificity and improved survival benefits across various cancer indications. The strong commercial success of previously approved biologic oncology drugs has encouraged companies to expand their biologics pipelines. In addition, advancements in recombinant technology and protein engineering are enhancing therapeutic performance. Biologics also play a central role in combination regimens under Phase III evaluation. This sustained innovation has positioned biologics as the leading drug class in late-stage oncology pipelines.

The cell & gene therapies segment is projected to be the fastest growing during the forecast period, driven by breakthroughs in CAR-T, TCR therapies, and gene-editing technologies. Increasing clinical validation of personalized cellular therapies in hematologic malignancies is expanding late-stage development programs. Improvements in manufacturing scalability and safety management are supporting broader trial expansion. Pharmaceutical companies are investing heavily in next-generation allogeneic and off-the-shelf cell therapies. Regulatory agencies are also offering supportive pathways for transformative gene-based treatments. These factors collectively contribute to rapid growth in this advanced therapeutic segment.

- By Indication

On the basis of indication, the market is segmented into breast cancer, lung cancer, colorectal cancer, prostate cancer, blood cancers, gynecologic cancers, other solid tumors, and critical indications. The lung cancer segment dominated the late-stage oncology drug pipeline market in 2025 due to its high global incidence and mortality rates. A substantial number of Phase III trials are focused on non-small cell lung cancer (NSCLC), particularly targeting EGFR, ALK, and KRAS mutations. The rapid evolution of immunotherapy combinations has further strengthened development activity in this indication. Pharmaceutical companies prioritize lung cancer due to its large patient pool and significant unmet medical need. In addition, regulatory agencies frequently grant accelerated designations for innovative lung cancer therapies. This high level of research concentration supports its dominant position.

The critical indications segment is expected to witness the fastest growth during the forecast period, driven by increasing attention toward rare and aggressive cancers such as glioblastoma and pancreatic cancer. Advances in molecular profiling are enabling targeted approaches in previously difficult-to-treat malignancies. Pharmaceutical companies are focusing on orphan drug opportunities with potential regulatory incentives and market exclusivity benefits. Rising awareness of unmet therapeutic needs in rare cancers is encouraging late-stage investment. Strategic collaborations between biotech firms and research institutions are accelerating development timelines. These factors are collectively fueling rapid expansion in this segment.

- By Clinical Stage

On the basis of clinical stage, the market is segmented into Phase II, Phase III, and regulatory submission. The Phase III segment dominated the market with the largest share in 2025, as these pivotal trials represent the final and most resource-intensive step before regulatory approval. Pharmaceutical companies allocate significant investment toward Phase III programs due to their proximity to commercialization. Success at this stage can rapidly translate into market entry and revenue generation. Many late-stage oncology assets are currently undergoing global multicenter Phase III trials. In addition, positive interim data from these studies often influences stock valuations and partnership opportunities. This concentration of high-value assets drives the segment’s leadership.

The regulatory submission segment is anticipated to witness the fastest growth during the forecast period, driven by the increasing number of oncology candidates reaching filing stages due to improved clinical success rates. Accelerated approval pathways and breakthrough therapy designations are facilitating faster review timelines. Growing reliance on real-world evidence and adaptive trial designs is supporting smoother regulatory transitions. Companies are strategically prioritizing high-potential candidates for rapid submission in major markets such as the U.S. and Europe. Rising global cancer burden continues to push innovation toward commercialization. Consequently, regulatory-stage assets are expanding at a notable pace.

Late-Stage Oncology Drug Pipeline Market Regional Analysis

- North America dominated the late-stage oncology drug pipeline market with the largest revenue share of 41.3% in 2025, characterized by a robust clinical trial ecosystem, significant R&D expenditure, favorable regulatory pathways

- Companies in the region highly prioritize innovation in immunotherapy, targeted therapy, and cell-based treatments, supported by advanced regulatory pathways such as breakthrough therapy and accelerated approval designations

- This leadership position is further reinforced by the presence of major biopharmaceutical companies, well-established clinical trial networks, favorable reimbursement frameworks, and a large patient pool, establishing North America as the primary hub for late-stage oncology drug development and commercialization

The U.S. Late-Stage Oncology Drug Pipeline Market Insight

The U.S. late-stage oncology drug pipeline market captured the largest development share in 2025 within North America, fueled by robust biopharmaceutical innovation and extensive Phase II and Phase III clinical trial activity. Companies are increasingly prioritizing breakthrough cancer therapies, including immunotherapies, targeted agents, and cell-based treatments. The strong presence of leading pharmaceutical firms, advanced research institutions, and well-established oncology trial networks further propels pipeline expansion. Moreover, supportive regulatory frameworks such as fast track and breakthrough therapy designations are significantly accelerating drug development and submission timelines.

Europe Late-Stage Oncology Drug Pipeline Market Insight

The Europe late-stage oncology drug pipeline market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing oncology research funding and strong collaboration between biotech firms and academic institutions. The rising cancer burden, coupled with emphasis on precision medicine, is fostering the development of advanced oncology candidates. European regulatory support mechanisms and cross-border clinical trial initiatives are further enhancing pipeline progression. The region is experiencing notable growth in immunotherapy and biologics development, with numerous candidates advancing toward regulatory submission.

U.K. Late-Stage Oncology Drug Pipeline Market Insight

The U.K. late-stage oncology drug pipeline market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding oncology research programs and strong government-backed life sciences initiatives. In addition, partnerships between universities, biotech startups, and global pharmaceutical companies are accelerating late-stage clinical development. The U.K.’s well-structured clinical trial environment and regulatory adaptability are expected to continue stimulating pipeline advancement. Increasing focus on innovative cancer therapies and rare oncology indications further supports growth in the country.

Germany Late-Stage Oncology Drug Pipeline Market Insight

The Germany late-stage oncology drug pipeline market is expected to expand at a considerable CAGR during the forecast period, fueled by strong investment in biomedical research and a growing emphasis on targeted cancer therapies. Germany’s advanced healthcare infrastructure and clinical research capabilities promote high participation in multinational oncology trials. The country’s focus on precision medicine and biomarker-driven studies is also becoming increasingly prevalent. A strong pharmaceutical manufacturing base and innovation-driven ecosystem further align with expanding oncology pipeline activities.

Asia-Pacific Late-Stage Oncology Drug Pipeline Market Insight

The Asia-Pacific late-stage oncology drug pipeline market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by expanding clinical trial capabilities, large patient populations, and increasing R&D investments in countries such as China, Japan, and India. The region's growing focus on biotechnology innovation, supported by favorable government initiatives, is accelerating oncology drug development. Furthermore, as Asia-Pacific emerges as a major clinical trial hub, global pharmaceutical companies are increasingly conducting late-stage studies in the region, enhancing its strategic importance.

Japan Late-Stage Oncology Drug Pipeline Market Insight

The Japan late-stage oncology drug pipeline market is gaining momentum due to the country’s advanced research ecosystem, aging population, and rising cancer incidence. The Japanese market places significant emphasis on innovative oncology treatments, and the adoption of targeted and immunotherapy candidates is steadily increasing. Integration of advanced diagnostics with late-stage drug development is fueling precision oncology initiatives. Moreover, supportive regulatory pathways and collaboration between domestic and international firms are contributing to steady pipeline growth.

India Late-Stage Oncology Drug Pipeline Market Insight

The India late-stage oncology drug pipeline market accounted for a significant share in Asia-Pacific in 2025, attributed to the country’s expanding clinical trial infrastructure and cost-efficient research capabilities. India stands as a key destination for multinational oncology trials due to its large and diverse patient pool. The push toward biotechnology innovation, combined with supportive regulatory reforms, is strengthening late-stage development activities. Increasing participation of domestic pharmaceutical companies in global oncology collaborations is further propelling pipeline expansion in India.

Late-Stage Oncology Drug Pipeline Market Share

The Late-Stage Oncology Drug Pipeline industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc., (U.S.)

- AstraZeneca (U.K.)

- AbbVie Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Sanofi (France)

- Amgen Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Gilead Sciences, Inc. (U.S.)

- Incyte Corporation (U.S.)

- Eli Lilly and Company (U.S.)

- Astellas Pharma Inc. (Japan)

- BeiGene, Ltd. (China)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Exelixis, Inc. (U.S.)

- Blueprint Medicines Corporation (U.S.)

- Argenx SE (Netherlands)

- BioNTech SE (Germany)

What are the Recent Developments in Global Late-Stage Oncology Drug Pipeline Market?

- In November 2025, the U.S. FDA approved ziftomenib (Komzifti), a menin inhibitor for relapsed or refractory acute myeloid leukemia with an NPM1 mutation, representing an important new late-stage targeted therapy for hematologic malignancy

- In July 2025, Nuvalent announced completion of its rolling NDA submission for zidesamtinib, an investigational ROS1-selective inhibitor for TKI-pretreated advanced ROS1-positive NSCLC, with engagement in the FDA Real-Time Oncology Review program a critical regulatory milestone toward potential approval

- In June 2025, the U.S. FDA granted accelerated approval to telisotuzumab vedotin-tllv (Emrelis) for adults with locally advanced or metastatic non-squamous non-small cell lung cancer with high c-Met overexpression, marking a significant late-stage success for this targeted oncology ADC therapy

- In May 2025, the U.S. FDA approved retifanlimab-dlwr (Zynyz) in combination with carboplatin and paclitaxel as a first-line treatment for adults with inoperable, locally recurrent or metastatic squamous cell carcinoma of the anal canal, expanding options for a rare cancer indication based on late-stage clinical outcomes

- In January 2025, the U.S. FDA approved datopotamab deruxtecan-dlnk (Datroway), a Trop-2-directed antibody-drug conjugate, for unresectable or metastatic hormone receptor-positive, HER2-negative breast cancer, reinforcing the therapeutic impact of late-stage ADC development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.