Global Laxative Market

Market Size in USD Billion

CAGR :

%

USD

7.35 Billion

USD

11.98 Billion

2024

2032

USD

7.35 Billion

USD

11.98 Billion

2024

2032

| 2025 –2032 | |

| USD 7.35 Billion | |

| USD 11.98 Billion | |

|

|

|

|

Laxative Market Analysis

The laxative market is seeing significant growth driven by new methods and technological advancements. One notable innovation is the development of more targeted and effective formulations that reduce side effects while improving patient outcomes. Recent advancements include the creation of non-stimulant laxatives that provide smoother and more natural relief, often combining prebiotics and probiotics for enhanced gut health.

Technologically, there has been a rise in digital health tools, such as mobile apps and smart devices, that help individuals track their digestive health, reminding users to take medications and providing guidance on diet and hydration. These tools are boosting market demand by increasing awareness and improving compliance among users.

In terms of growth, the demand for natural and herbal laxatives is on the rise, as consumers prefer plant-based solutions with fewer chemicals. The aging population and an increasing focus on digestive health are also key factors contributing to the expanding market. Furthermore, innovations in the development of personalized treatment options are expected to drive the market's continued expansion.

Laxative Market Size

The global laxative market size was valued at USD 7.35 billion in 2024 and is projected to reach USD 11.98 billion by 2032, with a CAGR of 6.3% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Laxative Market Trends

“Rising Demand for Natural and Plant-Based Laxatives”

One specific trend driving growth in the laxative market is the increasing consumer preference for natural and plant-based alternatives. As consumers become more health-conscious and aware of the potential side effects of synthetic ingredients, they are opting for laxatives made from herbal or natural ingredients. Products such as psyllium husk, aloe vera, and senna have gained popularity due to their gentle and effective nature. For instance, brands such as Metamucil and Natural Vitality’s Calm are tapping into this demand by offering plant-based solutions that promote digestive health without harsh chemicals. This shift toward natural products is expected to continue fueling market expansion in the coming years.

Report Scope and Laxative Market Segmentation

|

Attributes |

Laxative Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

F. Hoffmann-La Roche Ltd. (Switzerland), Mylan N.V. (U.S.), Teva Pharmaceutical Industries Ltd. (Ireland), Sanofi (France), Pfizer Inc. (U.S.), GSK plc (U.K.), Novartis AG (Switzerland), Merck & Co., Inc. (U.S.), AstraZeneca (U.K.), Johnson & Johnson Services, Inc. (U.S.), Hikma Pharmaceuticals PLC (U.K.), Dr. Reddy's Laboratories Ltd. (India), Lupin (India), Fresenius Kabi AG (Germany), Aurobindo Pharma (India), Cipla Inc. (U.S.), Bausch Health Companies Inc. (Canada), Amneal Pharmaceuticals LLC. (U.S.), Apotex Inc. (Canada), and Eli Lilly and Company (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laxative Market Definition

A laxative is a substance that helps stimulate or facilitate bowel movements, often used to relieve constipation. Laxatives work by softening stool, increasing stool volume, or stimulating the muscles in the intestines to promote bowel movement. They come in various forms, including oral pills, liquids, suppositories, and enemas. Common types include bulk-forming, stimulant, osmotic, and lubricant laxatives. While laxatives can provide relief, they should be used cautiously to avoid dependence or overuse, which can lead to weakened bowel function. It's recommended to consult a healthcare professional before using laxatives, especially for chronic issues.

Laxative Market Dynamics

Drivers

- Increasing Prevalence of Gastrointestinal Disorders

The laxative market is propelled by the increasing prevalence of gastrointestinal disorders such as constipation and irritable bowel syndrome (IBS). For instance, as more individuals adopt sedentary lifestyles and consume processed foods low in fiber, constipation rates rise. Consequently, a heightened demand for laxatives is needed to manage these symptoms effectively. This trend underscores the necessity for accessible and effective treatment options to address the growing burden of gastrointestinal issues.

- Expanding Geriatric Population

The growing elderly population in developed nations fuels laxative demand, given age-related bowel function changes. Elderly individuals face increased susceptibility to constipation and gastrointestinal issues, prompting the need for laxative usage. This demographic shift underscores the necessity for effective bowel health management strategies to address the unique needs of aging populations in maintaining digestive wellness.

Opportunities

- Increasing Healthcare Expenditure

Rising healthcare expenditure, especially in emerging economies, boosts access to healthcare services and medications such as laxatives. This facilitates greater affordability and availability of laxative products, driving market growth. As investment in healthcare infrastructure and services increases, individuals in these regions can access essential medications more readily, addressing gastrointestinal issues and contributing to market expansion.

- Changing Dietary Habits and Sedentary Lifestyles

Modern lifestyles marked by poor diets, low fiber intake, insufficient hydration, and sedentary habits contribute to constipation. Consequently, there's an increased demand for laxatives to address associated symptoms. For instance, diets lacking in fruits, vegetables, whole grains, and prolonged sitting can slow bowel movements. This leads individuals to seek relief through laxatives, highlighting the market's reliance on lifestyle-induced digestive issues for growth.

Restraints/Challenges

- Side Effects and Tolerance

Laxatives carry side effects such as abdominal cramps, diarrhea, and dehydration. Prolonged use often results in tolerance, demanding higher doses for effectiveness. These adverse effects, coupled with the demand for escalating doses, may deter consumers from prolonged usage, impacting the market negatively. As a result, there is a growing interest in alternative solutions with fewer side effects within the laxatives market.

- Competition from Natural Remedies

The laxative market faces stiff competition from the growing popularity of natural remedies and alternative therapies for digestive health. Consumers are increasingly drawn to gentler, non-pharmacological solutions, leading to a shift in demand away from traditional laxatives. This trend reflects a broader preference for holistic approaches to wellness, challenging the market's reliance on conventional pharmaceutical products.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Laxative Market Scope

The market is segmented on the basis of type, flavors, source, indication, mode of purchase, dosage form, route of administration, population type, sales channel, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Osmotic Laxatives

- Stimulant Laxatives

- Bulk Laxatives

- Lubricant and Emollient Laxatives

Flavors

- With Flavor

- Without Flavor

Source

- Natural

- Synthetic

- Others

Indication

- Chronic Constipation

- Irritable Bowel Syndrome with Constipation

- Opioid-Induced Constipation

- Acute Constipation

- Others

Mode of Purchase

- Prescription

- Over-the-Counter

Dosage Form

- Tablets

- Capsules

- Powder

- Liquid

- Gels

- Suppositories

- Others

Route of Administration

- Oral

- Rectal

Population Type

- Children

- Adults

Sales Channel

- Hospitals

- Elderly Care Centers

- Laxative

- Pharmacy Stores

- Health and Beauty Stores

- Others

Distribution channel

- Direct Sales

- Wholesalers

- Others

Laxative Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, flavors, source, indication, mode of purchase, dosage form, route of administration, population type, sales channel, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

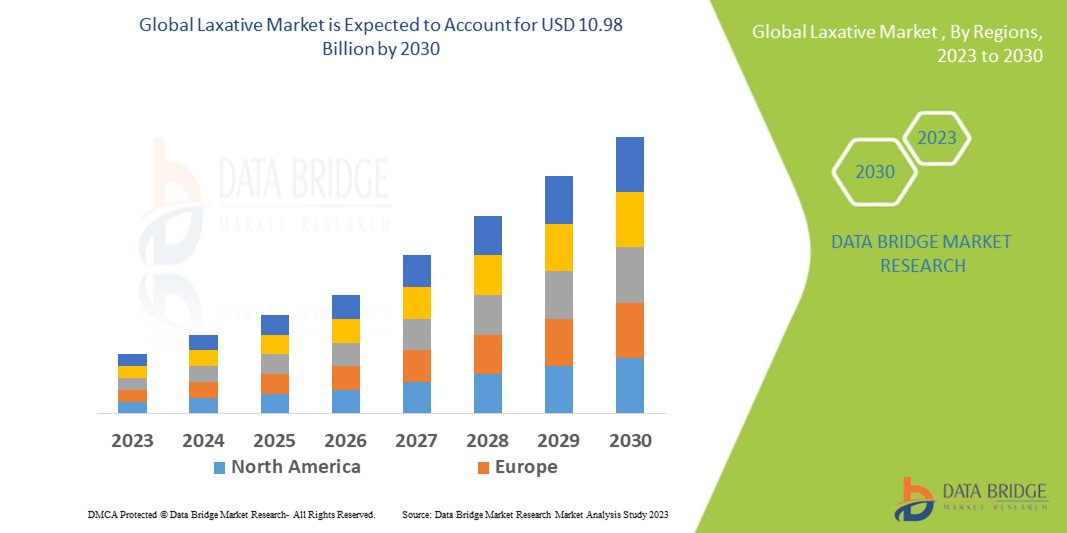

North America is expected to dominate the global laxative market in terms of both market share and revenue, fueled by rising usage and healthcare spending. The region's growth is driven by major players and the adoption of advanced technologies, ensuring continued dominance in the forecast period.

Asia-Pacific is expected to be the fastest-growing region in the global laxative market, driven by increasing investment in innovative research and development for novel drug products. In addition, developing healthcare infrastructure and the rising number of generic drug manufacturers will further propel growth in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Laxative Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Laxative Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Mylan N.V. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Dr. Reddy's Laboratories Ltd. (India)

- Lupin (India)

- Fresenius Kabi AG (Germany)

- Aurobindo Pharma (India)

- Cipla Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Amneal Pharmaceuticals LLC. (U.S.)

- Apotex Inc. (Canada)

- Eli Lilly and Company (U.S.)

Latest Developments in Laxative Market

- In 2022, Roivant Sciences, in collaboration with Pfizer, launched RVT-3101 to tackle ulcerative colitis. Roivant retains commercial rights in the U.S. and Japan, while Pfizer oversees commercialization elsewhere. This partnership aims to combat the global impact of ulcerative colitis through joint commercial efforts

- In 2022, JB Pharma unveiled Ranraft, a novel treatment for gastroesophageal reflux disease (GERD), bolstering its position in gastroenterology. This strategic launch expands JB Pharma's product portfolio and underscores its dedication to innovative digestive health solutions, catering to the needs of GERD sufferers

- In 2021, Purdue Pharma L.P. introduced two Senokot Dietary Supplement Products. Senokot Laxative Gummies, in blueberry pomegranate flavor, offer gentle overnight relief for constipation with natural senna extract. Senokot Laxative Tea, infused with cinnamon and floral notes, diversifies their digestive health offerings

- In 2020, FDA approved lactitol for chronic idiopathic constipation treatment in adults. As a powder, lactitol offers flexibility in administration and is easily mixed with water or juice for enhanced patient convenience. This approval broadens treatment options, providing a versatile solution for chronic constipation sufferers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.